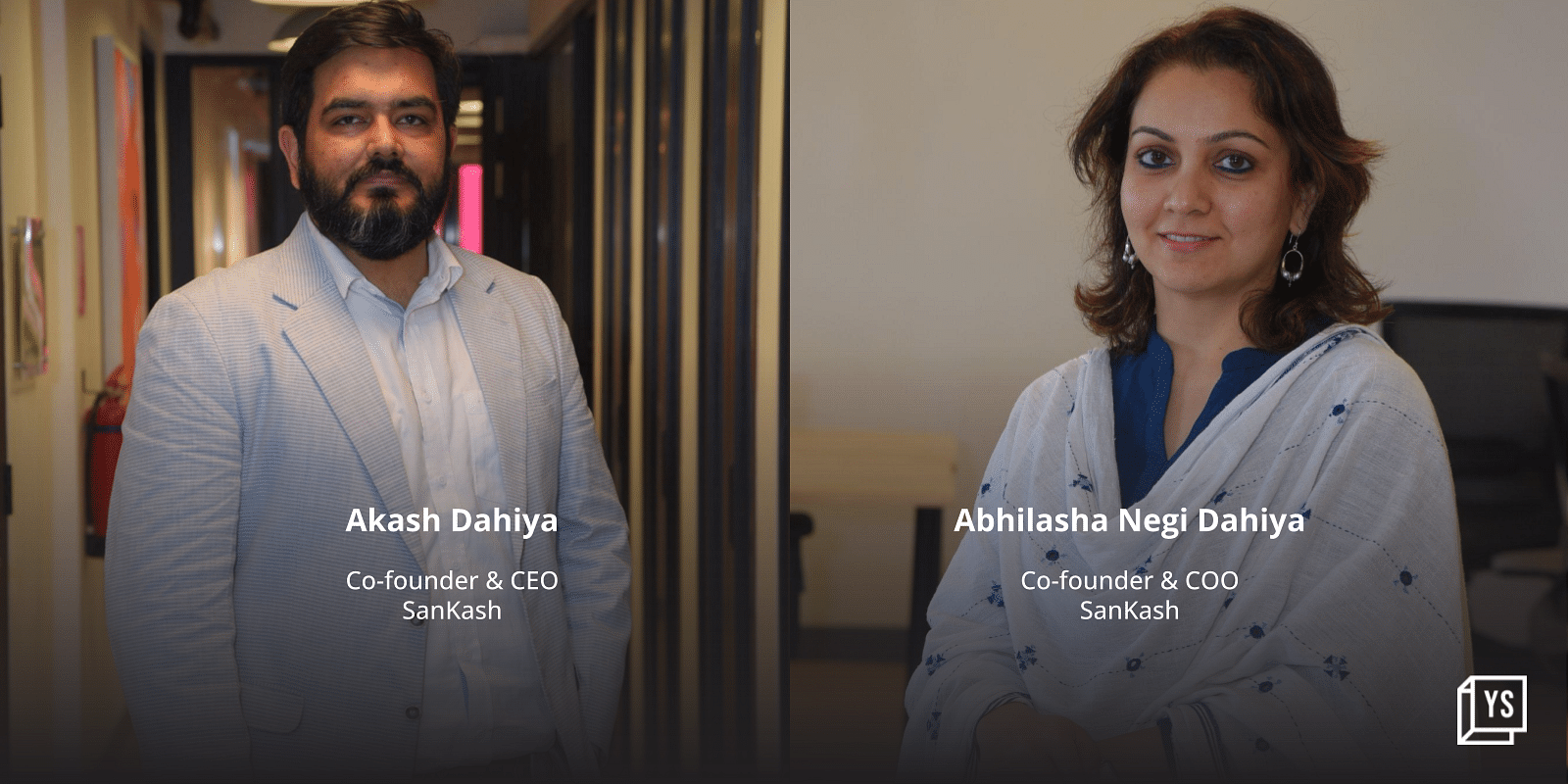

Akash Dahiya and Abhilasha Negi Dahiya found themselves stumped when trying to plan a vacation in 2016. Despite all planning and forethought—they realised that their ideal vacation was out of budget.

The Dahiyas aren’t the only ones. A self-commissioned study by Grant Thorton found that regularly in India, about 40% of travellers halt vacation plans due to a lack of funds. Further, among the group tested, about 70% wanted better travel options.

As the two begin to dig deep into the subject matter, they found that while a customer has several financing options to buy, say an iPhone, the same point-of-service financing options aren’t available when they enter a travelling agent’s store.

This only gets more complicated when you factor in credit-card penetration in the country, with the average credit-card holder having about Rs 45,000 in credit limit, while their budget is about Rs 60,000 for a good vacation.

The Dahiyas felt a need to double down on the problem. This is when they set up SanKash—sans in latin meaning without and kash standing for money—in 2018. Till date, the company offers travel now pay later (TNPL) options to travellers, besides a one-stop shop for all travel merchants’ financing needs.

SanKash clocks in an annual loan disbursement run rate of Rs 74 crore, as per the founders.

“SanKash has over 6000 travel merchants registered with it, including Thomas Cook, SOTC, Veena World, Balmer Lawrie etc on one front and has seven banks and NBFC partners (like Flexmoney, Bajaj Finance, Early Salary etc) associated with it on the other end for fulfillment of the loan need,” says Co-founder and CEO Akash Dahiya.

Starting off as a bootstrapped company, the startup raised Rs 4.5 crore in a seed round and a pre-Series A round of Rs 3 crore in the last quarter of 2022.

Solving for a complex market

While the self-sponsored travel market in India is valued somewhere between $42 billion, as per Grant Thorton’s study, it continues to be fragmented. About 90% of this still is done offline, with no immediate financing options. “This market is catered by 300,000 travel merchants spread across multiple cities. It is difficult to find a travel agent in a town as they don’t have a storefront,” Dahiya explains.

SanKash does away with some of these issues. It provides an integrated solution with multiple lenders to the travel merchant, thereby reducing the time it would use to find its own financiers. Through this process, a travel merchant could also take control of the data belonging to travellers.

“Our completely online journey for borrowers, real-time approval and disbursals, no servicing of loans, and API-first approach enables us to leverage our product quickly to launch online partnerships with the likes of IndiGo, Radisson hotels, Cordelia cruises etc,” says Dahiya.

In the current market, SanKash considers TripMoney by MakemyTrip a competitor. “Though TripMoney caters to ETB (Existing to Bank) portfolio not to NTB (New to Bank), whereas SanKash caters to all,” says Dahiya.

How it works

It can be pretty simple to use SanKash. All a traveller needs to do is choose a package or any other related travel service. Once they receive an application link for SanKash from the merchant, they need to fill in basic know-your-customer information and upload their income documents.

SanKash’s inhouse logic engine curates the travel information, underwriting information and determines the best non-banking financial company (NBFC) as per the company profile. From here Sankash will forward the customers’ profile to the respective NBFC for underwriting.

“A traveller can take upto Rs 10 lakh of a TNPL loan through SanKash. The entire process happens online. The customer need not visit any office, neither is any physical verification required,” Co-founder and COO Abhilasha Negi Dahiya says.

Sankash regularly reaches out to about 30 million travellers every year, says Dahiya. “Our contribution is currently to 5% of this traveller base and it is growing by 10% every month. Most travellers today are seeking experience-based travel rather than asset-based travel,” she adds.

The startup charges a processing fee from a traveller ranging from 1%-2% of the loan amount and an MDR (Merchant Discount Rate) of 3% from the merchant. It also takes loan origination commission from the NBFC of 1%-2%.

Sankash also has an offline network through its partnership with Travel Boutique Online (TBO), a travel aggregator in India and its in-house sales team. It also employs 60 people till date.

What lies ahead for SanKash

SanKash operates in 338 cities in India through its travel merchants. Its target group is all the merchants in the travel, aviation and hospitality industry. It also has plans to expand its merchant base to 15,000 by the end of 2025. The startup’s current revenue run rate is $2.1 million and plans to take it to $29 million in next two years.

For now, it has set its eyes on integrating new online partnerships beginning with the aviation sector, where it is going to go live with Indigo. “Similarly, we are going after the service providers and OTAs. We are in advanced talks to capture the OTA market as well, with 2-3 large OTAs integrating with SanKash and other service providers like Radisson Hotels too,” adds Dahiya.

![Read more about the article [Funding alert] EV infra startup RACEnergy raises $1.3M led by Micelio Fund, growX ventures](https://blog.digitalsevaa.com/wp-content/uploads/2021/08/funding-1625115361141-1629269868300-300x150.png)