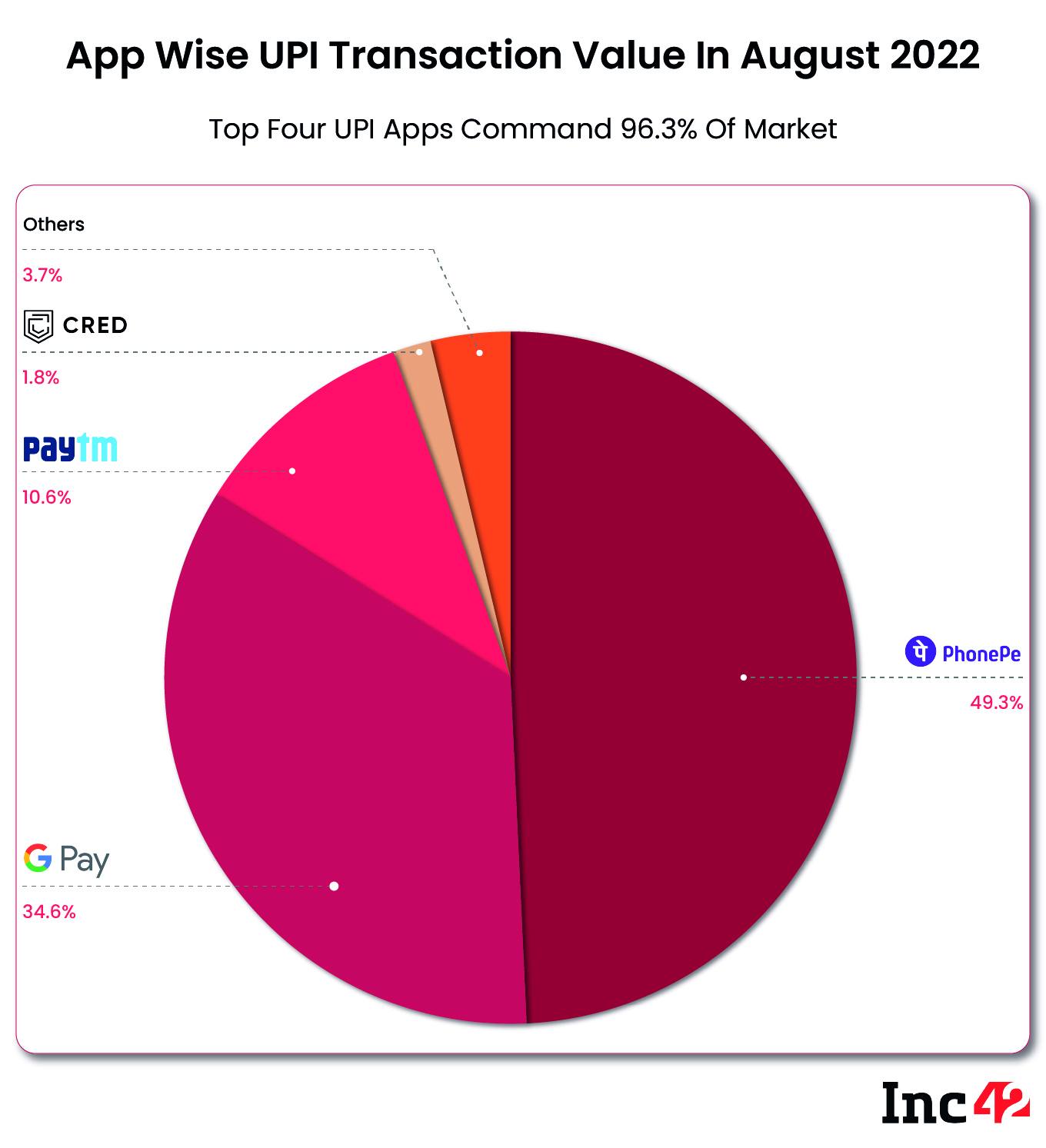

PhonePe (49.25%), Google Pay (34.6%), Paytm (10.65%) and CRED (1.8%) together processed 636 Cr UPI transactions worth INR 10.32 Lakh Cr

CRED processed nearly 1.5 Cr transactions and took the fourth spot in transaction volume processing payments worth INR 19,084.30 Cr

The deadline to comply with NPCI’s market cap guideline looms, but possibility of adherence by PhonePe, Google Pay is quite far

Albeit a little later than usual, the National Payments Corporation of India (NPCI) has released the app-wise break up of UPI numbers for August 2022.

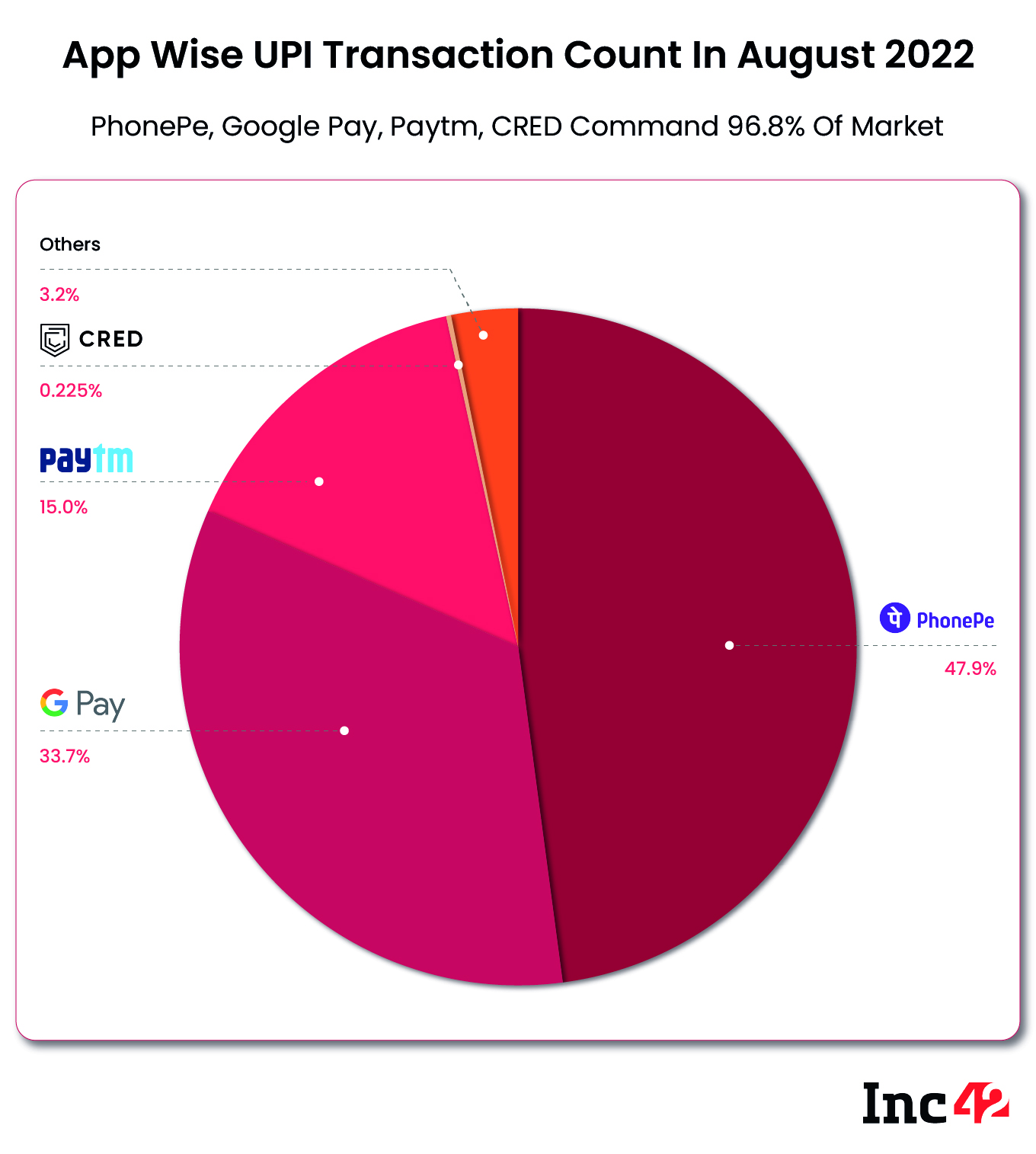

According to the data, Walmart-backed PhonePe has maintained its market share of nearly 50%, being an undisputed leader in customer transactions in count as well as value. PhonePe led the market with 47.9% of share by count and 49.25% by value of transactions, processing 314 Cr UPI transactions worth INR 5.28 Cr during the month.

Google Pay ranked second with a market share of 33.76% in the number of transactions and 34.5% in the value of transactions. The Indian fintech entity of the US-based giant processed 221 Cr UPI transactions worth INR 3.72 Cr during the month. Paytm was a distant third, commanding nearly 15% of the market in transactions count (98.6 Cr) and 11% share in transaction value (INR 1.14 Lakh Cr).

CRED processed nearly 1.5 Cr UPI transactions and took the fourth spot in transaction volume processing payments worth INR 19,084.30 Cr.

A simple look at the above trend shows that while CRED’s contribution to the number of transactions remains low, it is quite high in volume. This showcases that the company has been consistently recording a higher average payment volume (this month, it is INR 12,886). On a flip note, Paytm has recorded small ticket payments with the average payment being merely INR 1157.93.

In August 2022, NPCI recorded 657 Cr transactions – a 5% month-on-month (MoM) growth. The transaction volume also rose slightly to INR 10.72 Lakh Cr ($135.10 Bn) and grew nearly 76% year-on-year (YoY) from August 2021’s INR 6.07 Lakh Cr.

Due Date To Adhere To UPI Market Cap Guidelines Loom

In November 2020, UPI’s governing body NPCI introduced market cap guidelines asking the apps to restrict their market share to 30%. With PhonePe and Google Pay’s ever-increasing numbers and the constant 50% and 30% (respectively) market cap, the NPCI has been looking to avoid market concentration.

The deadline for the same is January 2023 and as the date approaches, the duo have made no strides in correcting their numbers.

Reports suggest that the deadline will likely be further pushed as there is a heavy consumer dependence on the two platforms. Even previously, UPI benefitted from the increased usage of contactless digital payments and the apps have made clear their plans of not slowing down. Thus, NPCI can only look at homegrown apps Paytm, CRED, BHIM and the likes to beat the Google Pay-PhonePe duopoly.