Many traders were left furious on Monday morning after one of the country’s largest stock broking platforms, , suffered a technical glitch, the second in the last week.

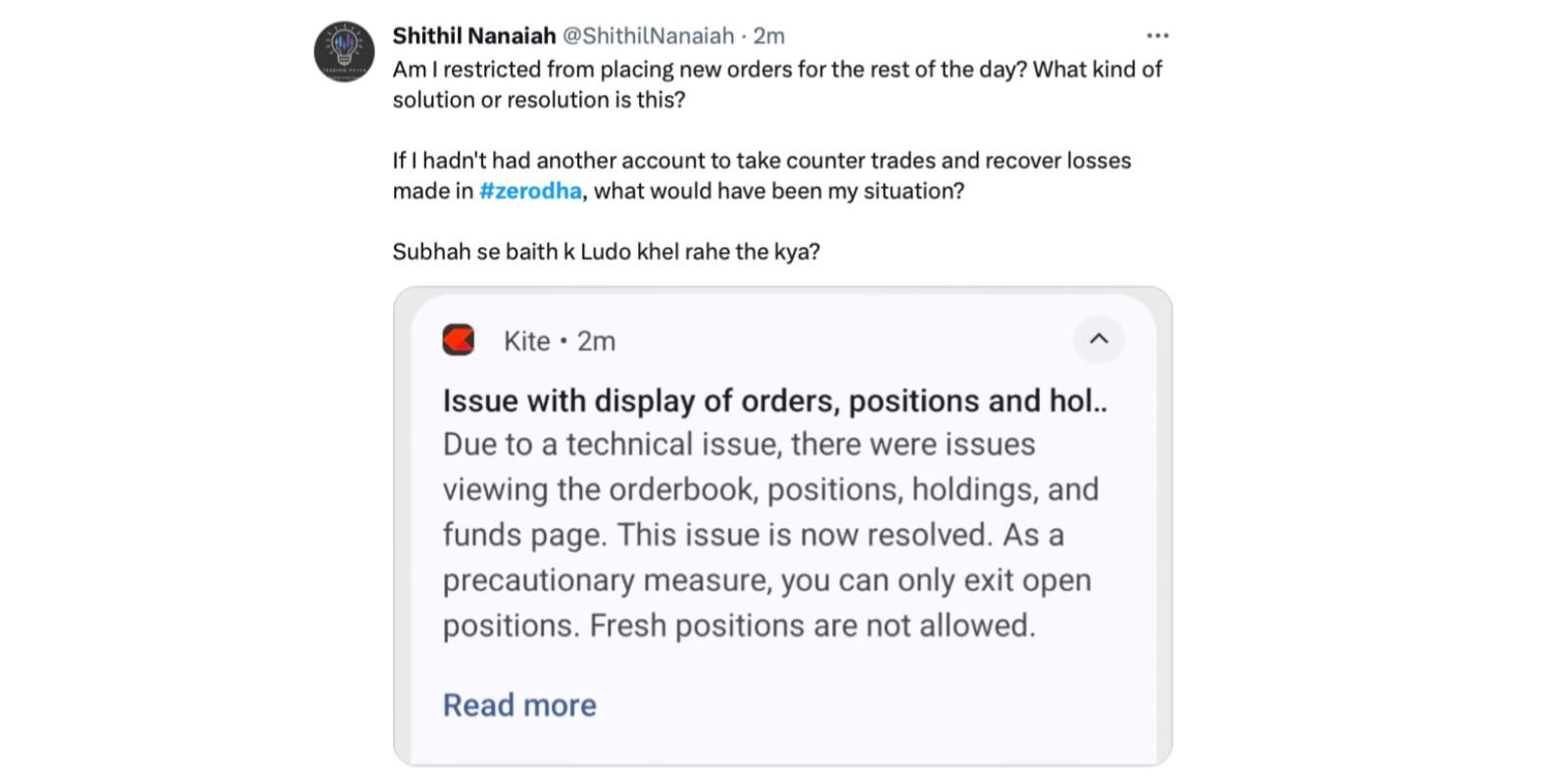

Traders were unable to view orderbook, positions, holdings, and funds page, or execute orders on the trading platform Kite.

The issue was later resolved after almost two hours.

“This issue is now resolved. As a precautionary measure, affected clients can only exit positions. Trading activity remains unaffected for the rest of our users,” the company informed on a social media platform.

This is the second such incident on Zerodha’s trading platform in one week. A few days ago, the broking platform reported a similar outage related to order placement on the trading platform Kite.

Many took to social media to lash out at the platform for constant technical snags.

“Pathetic services @zerodhaonline. These issues are happening on a daily basis. Small retailers are losing money because of these technical issues at the service provider end,” wrote a user on X.

Another user compared the services to rival , which recently took over Zerodha to become India’s largest stock broking platform in terms of active clients.

“There is a reason @_groww has taken over the number of users over @zerodhaonline even though the revenue of Zerodha is much more Zerodha is often having some technical glitches, due to which users are losing their important time. Time to introspect @nikhilkamathcio,” he said.

“I can’t exit our positions. Don’t know the status if it’s actually executed or rejected. I am losing money realtime since I can’t be sure what’s happening right now!!! What’s the point of paying such brokerage charges and taxes when broker and authorities can’t fix this!!” another user added.

In FY23, Zerodha reported a 38.5% jump in its revenue to Rs 6,875 crore. The company registered a rise of 38.8% in net profits—up from Rs 2,094 crore earned in the previous fiscal to Rs 2,907 crore.

Edited by Saheli Sen Gupta