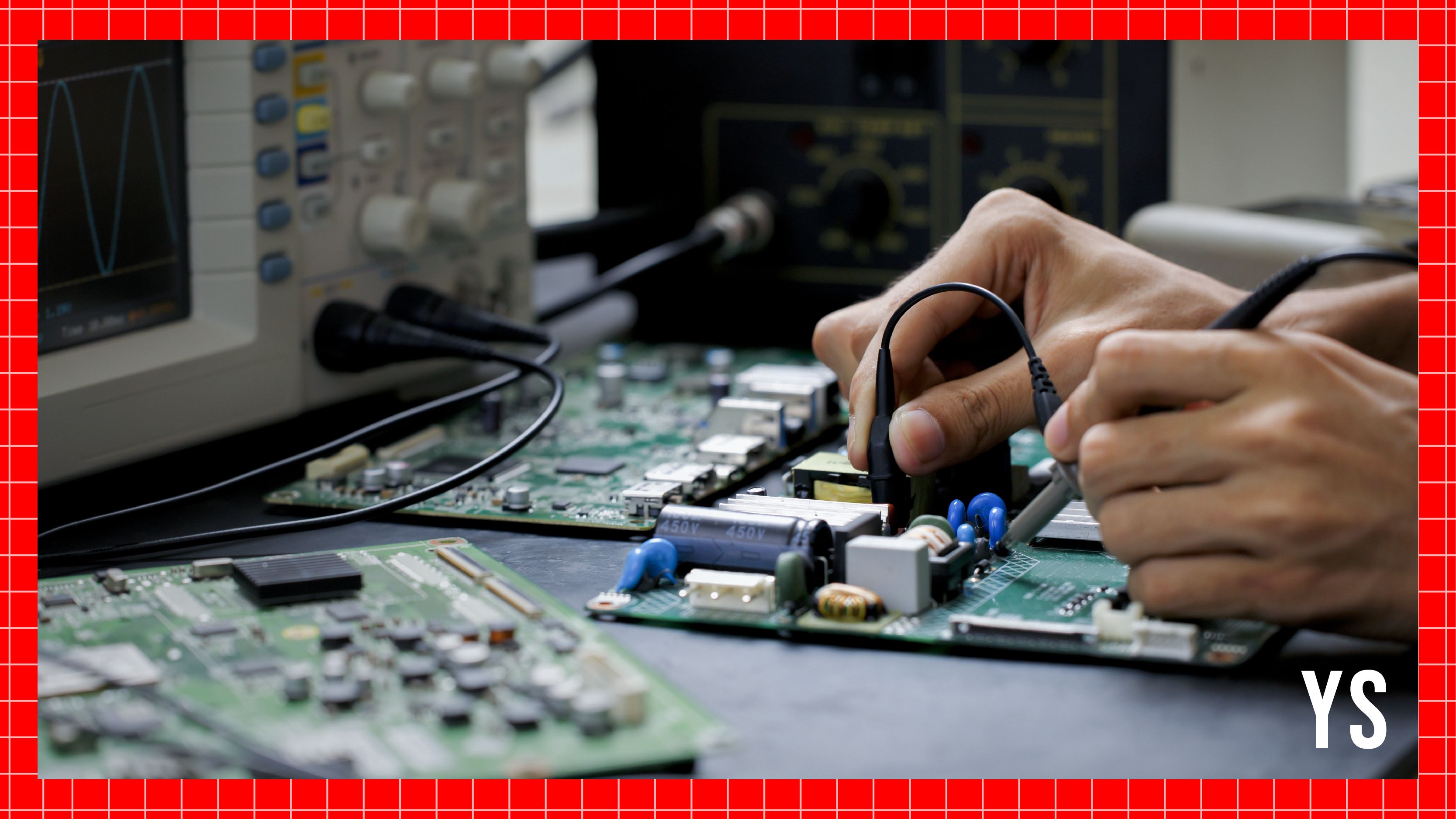

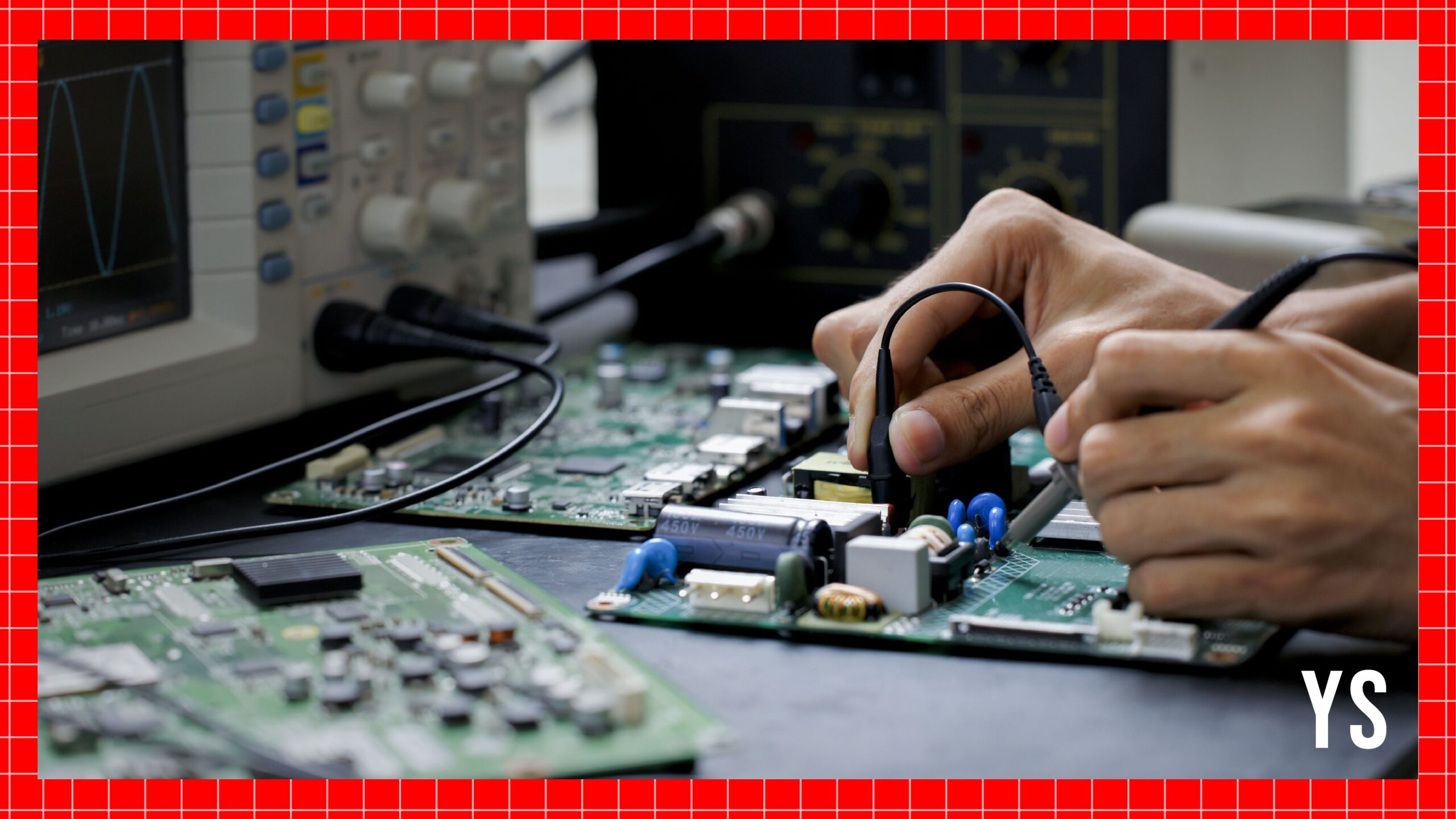

Hardware is hitting a sweet spot in today’s tech landscape. Costs have dipped with the China+1 strategy and manufacturing advancements, allowing for rapid iteration and growth.

At the same time, the cost has not declined to a point where there are zero barriers to entry or an influx of investor capital.

Over the past decade, the expenses associated with designing, prototyping, manufacturing, and expanding hardware have plummeted—thanks to streamlined processes from design to deployment.

Think of it like the diverse software stacks (JAM, LAMP, MEAN) that fuel software development. Now, there’s a similar stack for hardware, making innovation more accessible than ever.

.thumbnailWrapper{

width:6.62rem !important;

}

.alsoReadTitleImage{

min-width: 81px !important;

min-height: 81px !important;

}

.alsoReadMainTitleText{

font-size: 14px !important;

line-height: 20px !important;

}

.alsoReadHeadText{

font-size: 24px !important;

line-height: 20px !important;

}

}

Importance of hardware

We are witnessing a shift from “bits” to “atoms.” Software and data are everywhere, sure, but hardware?

The ubiquity of software, data, and artificial intelligence (AI) in global business processes has made these digital assets increasingly commoditised. In contrast, hardware has emerged as the new frontier of innovation, offering a tangible complement to the digital explosion.

That’s where the real action is. NVIDIA is a great example that has grown by 126% in FY24 and is now valued at $1.97 trillion. The company’s astronomical growth is a reflection of the growing demand for cutting-edge hardware for computing requirements.

India’s focus on startups in semiconductor, quantum and high-performance computing, AI, and cybersecurity through Startup India Phase II is a welcome sign. Such policies will make it easier to set up business and reduce compliance to support capital raising. This is, of course, music to our ears.

The plan includes setting up technology-specific scientific infrastructure, facilities for product prototyping and validation, tailor-made for hardware-based deep tech startups. It’s like a playground for innovation.

Challenges in hardware investment

However, here’s the kicker—the VC world has been snoozing on hardware; they see it as slow and pricey. Add in a sprinkle of lack of tech expertise and patience to thoroughly evaluate hardware innovations, and you have a recipe for continued software-centric investments such as SaaS, ecommerce, and digital marketplaces.

To thrive in the dynamic and complex landscape of hardware innovation, founders need more than just technical chops. They need supply chain savvy, financial finesse, killer product design skills, and a finger on the pulse of tech trends. It’s a whole package deal.

.thumbnailWrapper{

width:6.62rem !important;

}

.alsoReadTitleImage{

min-width: 81px !important;

min-height: 81px !important;

}

.alsoReadMainTitleText{

font-size: 14px !important;

line-height: 20px !important;

}

.alsoReadHeadText{

font-size: 24px !important;

line-height: 20px !important;

}

}

Addressing counter-arguments

Hardware ventures may involve more upfront capital and longer timelines for product development and market entry. However, advancements in manufacturing technologies—coupled with streamlined prototyping processes—have significantly reduced these barriers.

Moreover, the tangible nature of hardware often leads to more predictable revenue streams once products hit the market, offering a level of stability that software models sometimes lack.

As for the notion of longer development cycles, it’s worth noting that these timelines are often a by-product of ensuring quality and reliability in hardware products. While it may take longer to perfect a hardware prototype, the result is often a robust, durable product with longer-lasting value—a stark contrast to the rapid iterations common in the software world.

Data further demonstrates the distinct dynamics of hardware investment, contradicting the commonly held belief that hardware companies require more capital investment compared to software companies.

Let’s bust this myth. Hardware startups don’t always bleed cash. In fact, they often clock in comparable—if not lower—expenses than software counterparts, with exit valuations to match.

.thumbnailWrapper{

width:6.62rem !important;

}

.alsoReadTitleImage{

min-width: 81px !important;

min-height: 81px !important;

}

.alsoReadMainTitleText{

font-size: 14px !important;

line-height: 20px !important;

}

.alsoReadHeadText{

font-size: 24px !important;

line-height: 20px !important;

}

}

Potential for future development

For example, India is home to over three thousand hardware startups, but only a handful have seen VC green. It’s time for a strategic rethink, as this will only happen by building expertise in select areas and continuously expanding its domain knowledge.

Emphasising execution risk over market risk reflects venture capitalists’ dedication to founders committed to addressing complex challenges. This approach acknowledges that achieving hardware success is more akin to a marathon than a sprint.

Challenges, including global supply chain dependencies and geopolitical issues, are present, yet they serve as disguised opportunities. They offer the chance to build national champions and develop a more resilient, locally-focused supply ecosystem.

The future of tech demands a bold move—flipping the investment script. Hardware startups need to step into the spotlight. It’s more than funding; it’s about cultivating knowledge, connections, and champions.

These startups are at the forefront of driving innovation, fuelling economic growth, and building our infrastructure. Supporting them lays the foundation for revolutionary solutions across a multitude of industries.

It’s time to level the playing field between hardware and software, igniting a tech revolution where innovation knows no limits. Let’s make it happen.

Sheetal Bahl is a Partner at Merak Ventures.

Edited by Suman Singh

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)

![Read more about the article [Funding alert] Shiprocket raises $41.3M in Series D1 from PayPal Ventures, Bertelsmann India Investments, others](https://blog.digitalsevaa.com/wp-content/uploads/2021/07/Imagemt8q-1589180042829-300x150.jpg)