WhatsApp Pay recorded 2.3 Cr UPI transactions worth INR 429.06 Cr

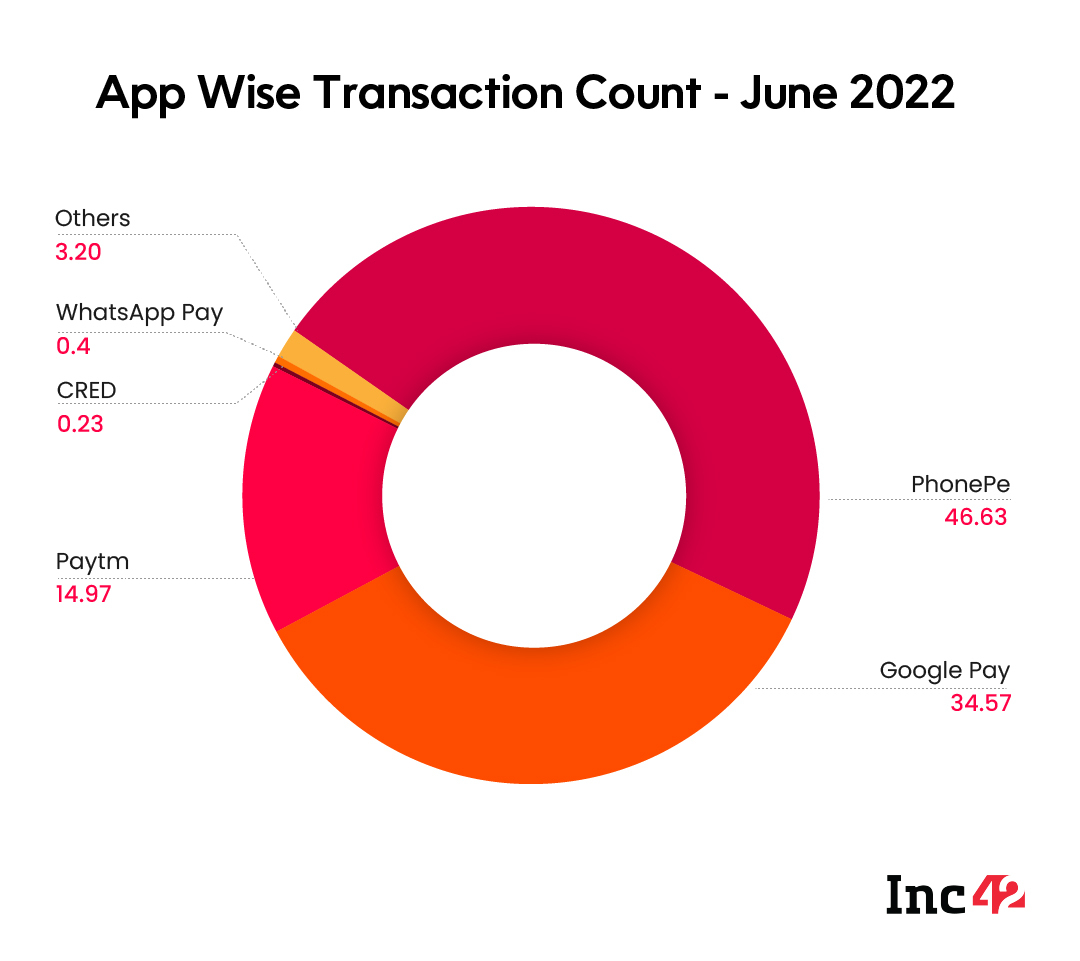

Despite its unprecedented growth, WhatsApp Pay holds less than half a percent of the UPI market share in the country

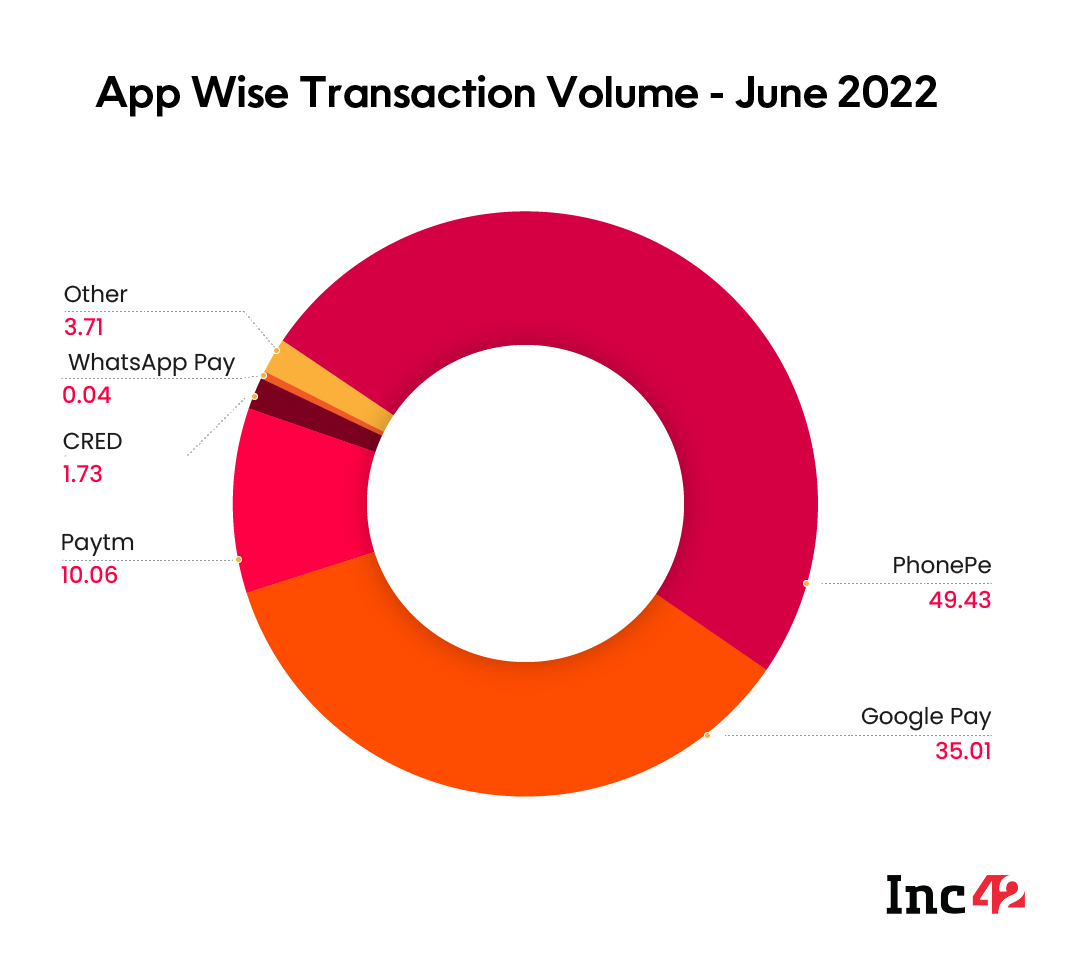

Of the INR 10.14 Lakh Cr worth of transactions that happened in June, PhonePe and Google Pay held over 83% of the total market share

Every month, PhonePe and Google Pay grab the headlines for their duopoly within the UPI segment. But for June 2022, it is WhatsApp Pay that has shown an unprecedented (and a slightly competitive) increase in transaction count and volume from May 2022.

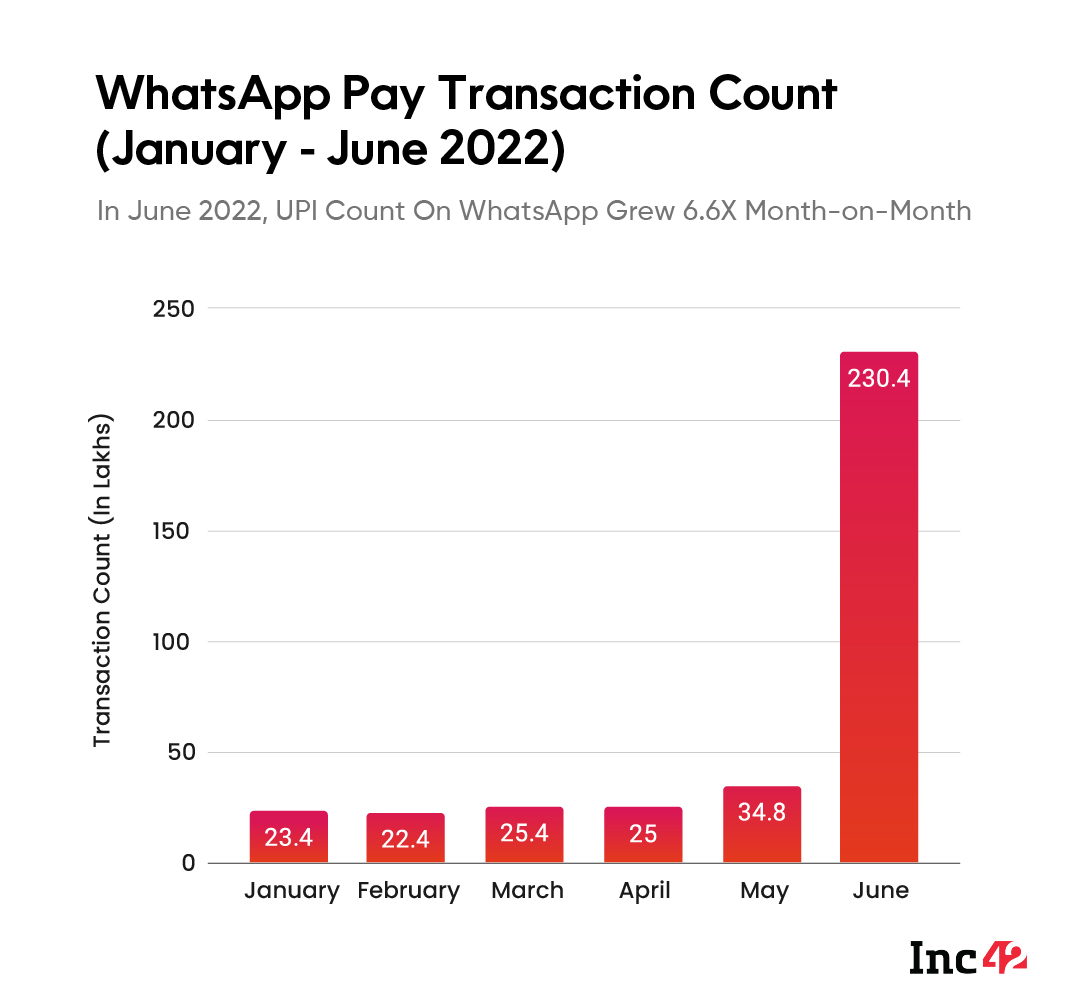

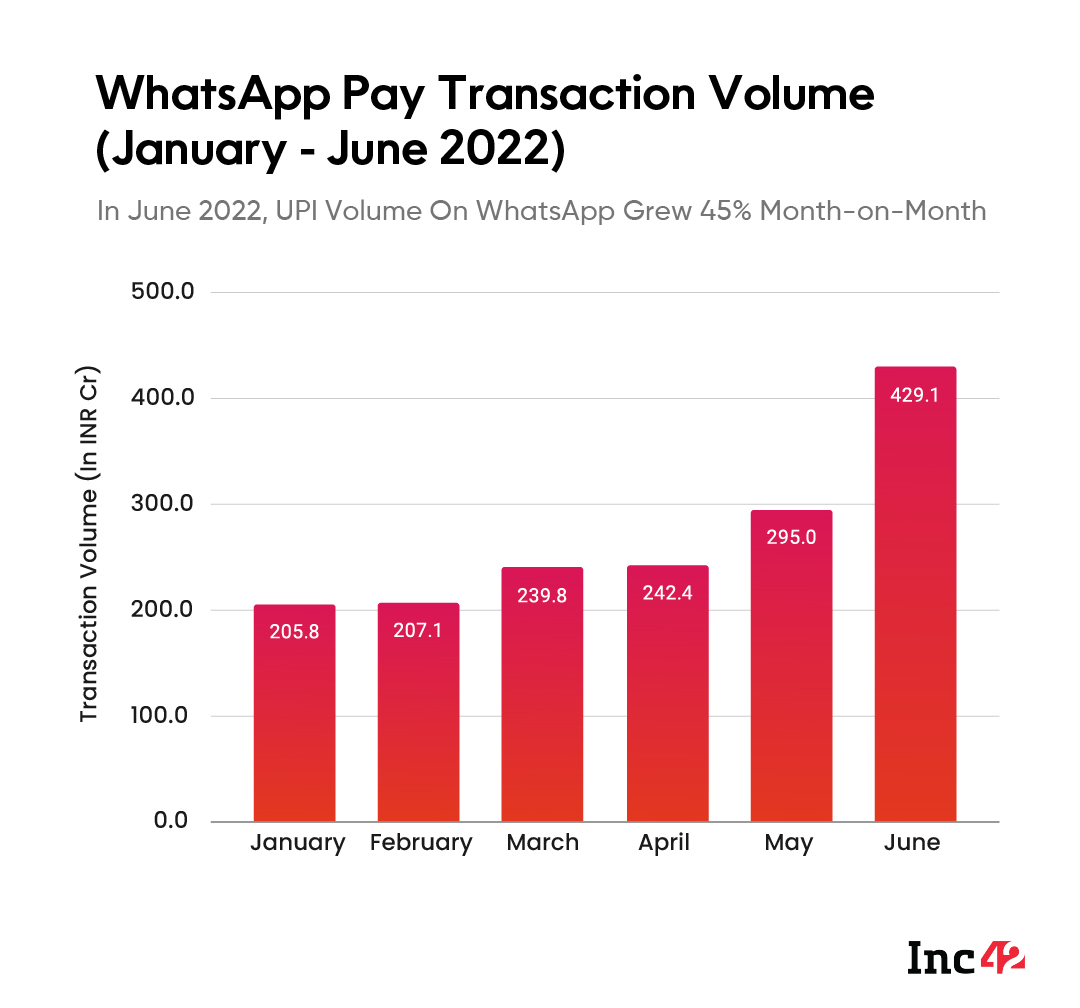

WhatsApp Pay accounted for only 0.4% of the total UPI transactions in June 2022. Yet, the payments arm of the messaging giant recorded 2.3 Cr transactions worth INR 4,290.6 Cr – a 6.6X month-on-month (MoM) jump in transaction count and a 45% MoM jump in transaction volume.

This is a major jump from May 2022, when WhatsApp Pay recorded 34.8 Lakhs transactions worth INR 294.98 Cr.

The sharp increase in the UPI numbers on WhatsApp can be attributed to NPCI permitting the Meta-owned platform to scale to 100 Mn users. But it is also noteworthy that the average size of the transaction on WhatsApp was INR 186.55, signalling that only an incentive drove users to transact using the payments feature of the messaging platforms.

Over the past couple of weeks, WhatsApp started providing aggressive cashback to new as well as existing users. In one such instance, the app was providing a cashback of INR 105 for making three payments to three different contacts with as low as INR 1.

While the idea was to get as many users as possible on WhatsApp Pay, it has resulted in a significant surge in daily transaction numbers whereas the transaction volume did not grow as aggressively.

Competition Tough For WhatsApp Pay

UPI recorded 586 Cr transactions in June 2022 as opposed to 595 Cr in May 2022 – recording a minor MoM decline of 1.5%. Transaction volume, too, fell by 2.5% MoM from INR 10.41 Lakh Cr in May 2022 to INR 10.14 Lakh Cr in June 2022.

Despite the minor setback, the payment processing platform is making splashes across the world, and so are the apps using the interface.

PhonePe processed transactions worth INR 5.01 Lakh Cr in June this year, continuing its dominance as the biggest player in the space.

Google Pay clinched the second spot, processing transactions worth INR 3.55 Lakh Cr in June, while Paytm recorded nearly INR 1.02 Lakh Cr worth of transactions.

WhatsApp Pay, despite a nearly 7X jump in the number of transactions, does not even make it to the top five UPI apps in June.

In June 2022, PhonePe and Google Pay amassed a market share of 46% and 34.5%, leaving 15% with Paytm and almost 1.2% with Amazon Pay.

While the top four UPI apps amassed a total of 96.7%, next in line were the apps of Yes Bank, ICICI Bank, and CRED (only 0.22% share, symbolising higher average ticket size of payments), among others.

As credit spending on ecommerce platforms increases, RBI has announced that RuPay users will be able to link their credit cards with UPI apps. This is likely to increase the overall usage of UPI further, including on banking apps directly, giving another tough hand to WhatsApp’s UPI plans.

![Read more about the article [Techie Tuesday] Meet Erad Fridman, an early product developer at Google who started coding when he was six](https://blog.digitalsevaa.com/wp-content/uploads/2022/02/FinalErad-1644238311461-300x150.jpeg)