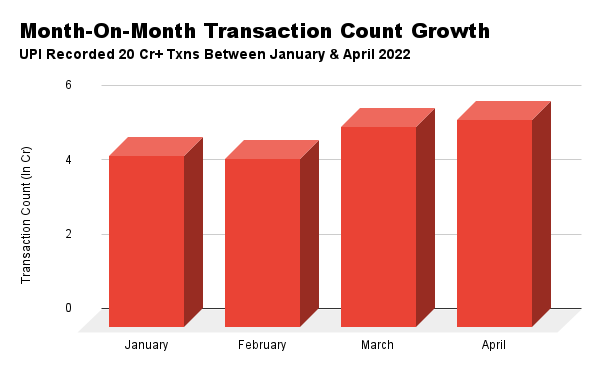

UPI recorded 540 Cr transactions in March 2022 as opposed to 452 Cr transactions in February 2022 – recording a month-on-month (MoM) growth of 19%

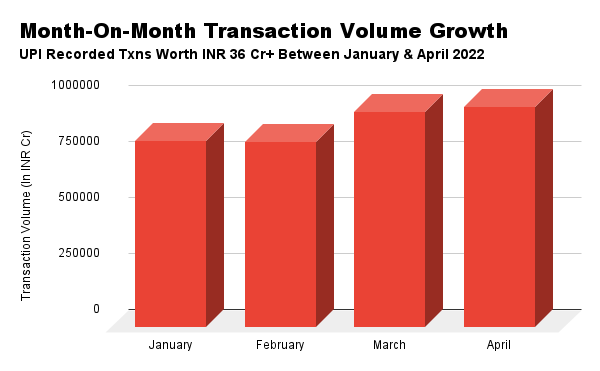

In April 2022, the transaction volume increased by 2.36% while the transaction count increased by 3.22% MoM

The decline in growth comes despite the introduction of UPI on features phones via text and missed call facility

UPI recorded 558 Cr transactions in April 2022, which is almost 3% month-on-month (MoM) growth from March 2022 when it registered the 540 Cr transactions. The transaction volume also increased by 2% from INR 9.6 Lakh Cr to INR 9.8 Lakh Cr ($128.5 Bn).

In March 2022, UPI recorded 540 Cr transactions worth INR 9.6 Lakh Cr ($111.2 Bn). Up by 19% from February 2022 when it recorded 452 Cr transactions worth INR 8.26 Lakh Cr, the financial year had ended with digital payments at its highest.

While the growth has declined to single digits in the past month, UPI is currently the most popular digital payments system in India, with more than 314 banks linked to it. The State Bank of India (SBI) was leading the segment by processing about 148 Cr transactions, as of March 2022. It was followed by HDFC Bank with 47.7 Cr transactions, Bank Of Baroda with 35 Cr, Union Bank with 32.6 Cr, ICICI Bank with 30.67 Cr and Paytm Payments Bank with 31.4 Cr transactions.

The contactless digital payment service UPI continues to gain market momentum even after the conditions brought by the Covid-19 pandemic in 2020 begin to subside. Compared to April 2021 when UPI transactions were at a mere 264 Cr worth INR 4.93 Lakh Cr, April 2022 witnessed a 2X year-on-year (YoY) jump.

The UPI payments space in the country is currently dominated by two players – PhonePe and Google Pay. Together, the two command a little over 84% of the UPI market in terms of transaction volume in March 2022. The space also includes other big fintech names such as Paytm, Amazon Pay and WhatsApp Pay.

While individual UPI app-wise numbers for March 2022 are out, the National Payments Corporation of India (NPCI), an organisation accountable for managing and controlling UPI payments in India, is yet to disclose app-wise April 2022 numbers.

UPI’s Growth – A Contributing Factor To India’s Payment Ecosystem

The ever increasing UPI transactions are also a huge contributor to India’s payment ecosystem. Only last month, ACI Worldwide’s report on real-time payments across the world reported that India led the world in real-time payment transactions in 2021. According to the report, India reported 48.6 Bn transactions, representing more than 40% of the global transactions emerging from the country.

The number of real-time transactions in India was almost 2.6X higher than that of China (18 Bn transactions) and almost seven times higher than the combined real-time payments volume of the US, Canada, the UK, France and Germany (7.5 Bn), the report had said.

Interestingly, UPI alone recorded 38.75 Bn transactions worth over INR 73 Lakh Cr (approx $970 Bn) in CY21 — a year-on-year rise of over 110% as opposed to CY20. UPI constituted almost 80% of real-time transactions in 2021.

Testament to its increasing usage, recently, SEBI finally brought its plans to bring UPI into the fold for IPOs. SEBI will now allow people who either apply for the share allocation or are eventually allocated the shares to pay using UPI.

Is Crypto Facing Bottlenecks Due To NPCI?

UPI is part of the payment culture in India. And that is why it has been and is going to be the key instrument for crypto exchanges to deepen their presence in India. If there’s no UPI, it will be extremely difficult for crypto exchanges to bring in non-serious Indian users who have been accustomed to making payments via UPI.

UPI has also been a go-to feature for several crypto exchanges, seeing an exponential rise in terms of users as well as the volume of transactions. With zero MDR on UPI, users were able to buy crypto at cheaper prices and in smaller volumes. However, NPCI issued a statement highlighting that it is not aware of any crypto exchange using UPI, leading to a major fall out of the payment system from crypto exchanges and de-incentivising crypto in India.

This has led to crypto exchanges facing a huge issue in terms of bank partners and payment gateways, with NPCI yet to formalise the usage of UPI by Indian crypto exchanges.