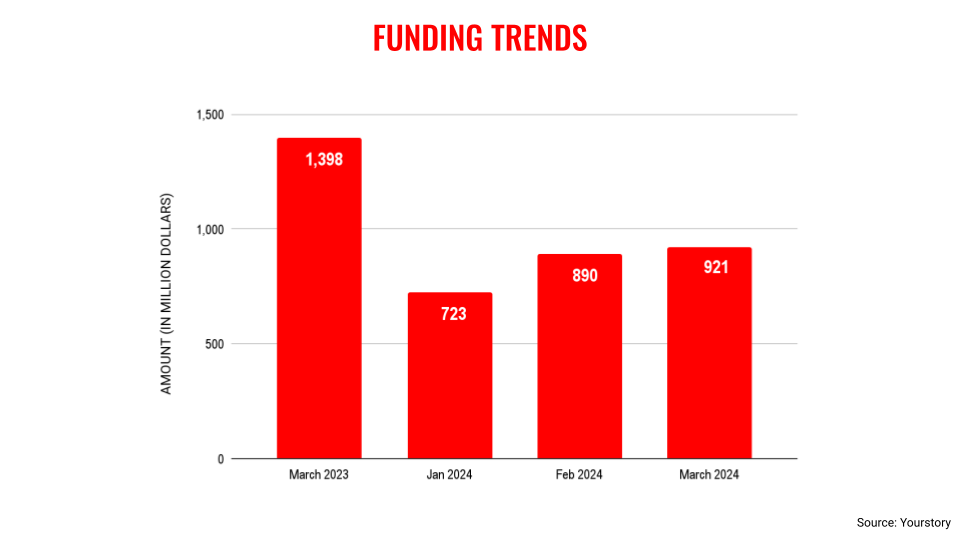

Venture capital (VC) funding into Indian startups for March 2024 saw a 34% decline compared with a similar period a year ago due to the lack of large deals in the ecosystem.

The VC funding for the month stood at $921 million while Indian startups had raised $1.4 billion in March 2023.

However, there is light at the end of the tunnel. The total funding raised in March 2024 was 3.5% higher than in February 2024 when investments worth $890 million were secured, according to YourStory Research.

In fact, there has been a consistent increase in monthly VC funding ever since January this year and this trend is here to stay given that the Indian startup ecosystem has achieved a certain sense of stability and there is a steady inflow of capital.

Another positive element for March 2024 is that the number of deals stood at 86, which is lower than what was recorded in February (114) and January (110) but capital inflow is higher. This shows that the average value per transaction is higher.

This is reflected in the stage-wise funding where the growth category received investments worth $279 million followed by late-stage startups at $255 million and early-stage startups at $234 million. The debt category raised $152 million in the month.

There were just five transactions which received funding above $50 million—Pocket FM, Ambit Finvest, Perfios, mPokket, and Lohum.

.thumbnailWrapper{

width:6.62rem !important;

}

.alsoReadTitleImage{

min-width: 81px !important;

min-height: 81px !important;

}

.alsoReadMainTitleText{

font-size: 14px !important;

line-height: 20px !important;

}

.alsoReadHeadText{

font-size: 24px !important;

line-height: 20px !important;

}

}

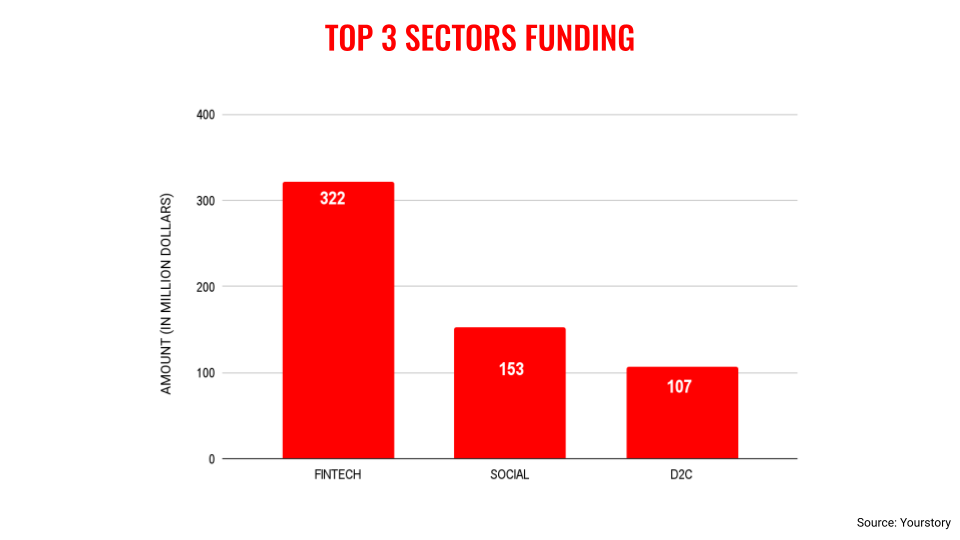

The sectors which received the highest VC funding included fintech at $322 million followed by social networks at $153 million and D2C (direct-to-consumer) at $107 million. Other sectors like EV, foodtech, and healthtech received funding in the $50 million range.

In terms of cities that received the highest amount in March were led by Delhi-NCR at $343 million followed by Bengaluru at $300 million and Mumbai at $166 million. This came as a surprise as Bengaluru startups traditionally receive the most funding.

Given the steady increase in VC funding for the first three months of the year, there is hope that this momentum will continue in the near future as VC funds continue to raise fresh capital and this is going to be deployed back into the ecosystem at some point.

Edited by Kanishk Singh