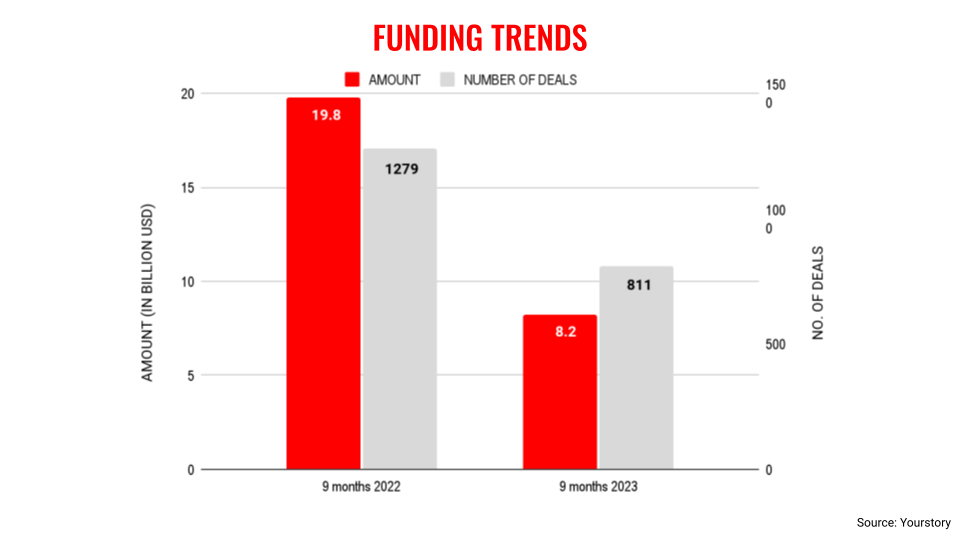

Venture capital (VC) funding into Indian startups declined by 59% for the nine months of 2023 compared to the same period in 2022, indicating the severe slowness in the flow of capital into the ecosystem.

The total funding raised by Indian startups in the nine months of 2023 stood at $8.2 billion while it was $19.8 billion in 2022. The number of deals during this period also declined by 37% as the total count for 2023 was 811 as compared to 1,279 in 2022, according to YourStory Data.

Going by these trends, the total funding for the year 2023 will not come anywhere close to 2022 and would probably be just half that number. In 2022, the Indian startup ecosystem raised $24 billion.

As of now, the capital inflow into Indian startups–be it early, growth, or late–has considerably slowed down. In fact, the slowdown in funding started in the second half of 2022 and its grip further tightened this year.

One stark example of the funding winter environment comes from the unicorn category, i.e., companies that are valued at $1 billion and above. In the nine months of 2023, only one startup, Zepto, got into this coveted zone, compared to the emergence of 23 unicorns in 2022.

It is very unlikely that the remainder of the year will see the emergence of any unicorn as the October to December period are generally lean months of business activity.

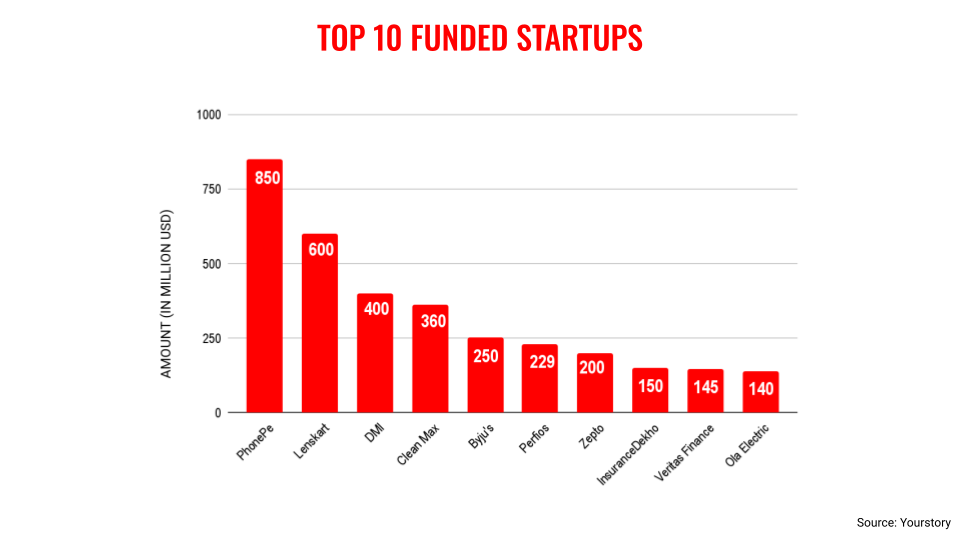

In fact, in the nine months of 2023, only 15 startups raised over $100 million in funding. Leading this list was fintech unicorn PhonePe, which cumulatively raised $850 million across tranches. This was followed by eyewear brand Lenskart, which raised $600 million.

It is actually these large deals which provide the boost to the overall funding amount and this category of investments has been quite tepid during the course of this year till now. In fact, if one takes into account the transactions whose value come in the range of $40 million and above but below $100 million, the number stands at just 13.

During this period, companies such as Atomberg, Drools, BluSmart, Credgenics, Wakefit among others who raised funding in excess of $40 million.

Despite this depressing scenario, there is hope. Neha Singh, Co-founder of data platform Tracxn, said, “Despite facing the challenges of a funding winter, India ranks as the fifth highest funded country in Q3 2023 and maintains fourth-place in terms of total funding for the year to date (YTD). It underscores the resilience of India’s tech startups and their ability to adapt to changing market conditions.”

In its Geo Quarterly Report India Tech – Q3, 2023, Tracxn noted that the India Tech space is seeing a decline in funding every quarter, with a third consecutive drop in funding in Q3 2023, making it the least funded quarter in 2023 and also the least funded quarter in the last five years.

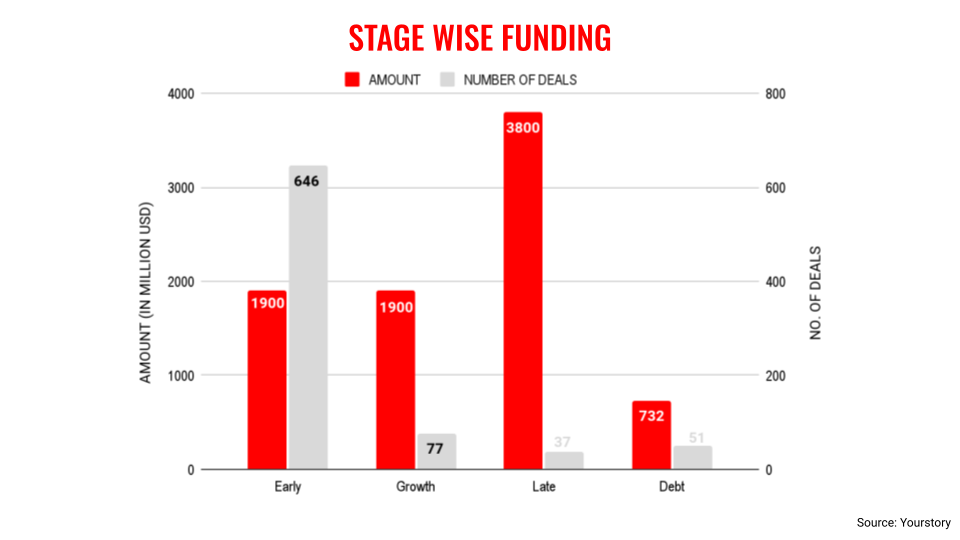

In terms of stages of funding, every segment–be it early, growth, and late categories–saw a decline in funding in the nine months of 2023 when compared to the similar period of 2022.

However, there was one category which actually saw an increase in funding in the nine months of 2023 when compared to 2022, i.e., debt. This category saw total funding of $732 million in 2023 as compared to $344 million in 2022. There has been an increased reliance on debt by Indian startups as funding through the equity route is not very forthcoming. Further, it also helps them in retaining their valuation.

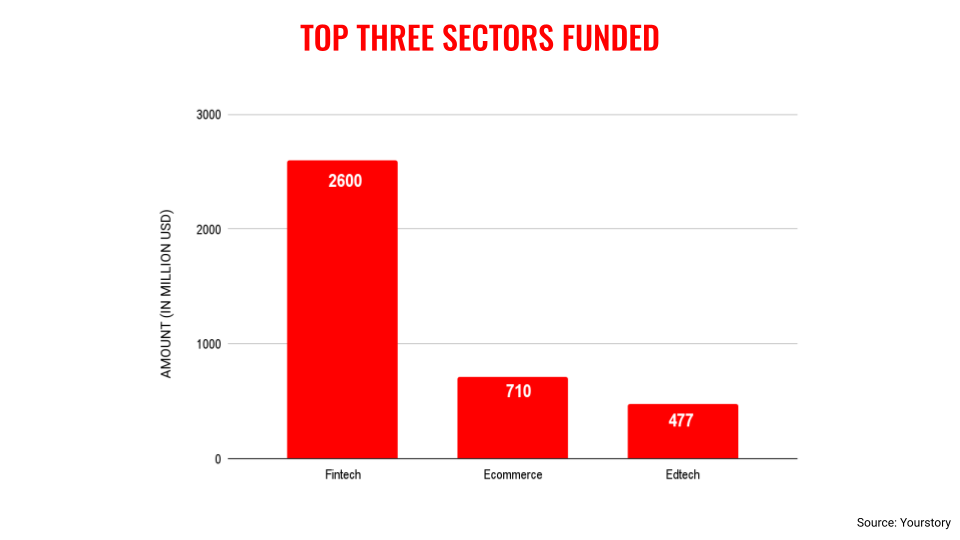

The sectors which raised the amount of funding during this nine-month period of 2023 in the top four includes fintech, ecommerce, edtech, and electric vehicles. The one common theme between 2022 and 2023 has been the top position occupied by the fintech segment, which continues to generate interest among investors.

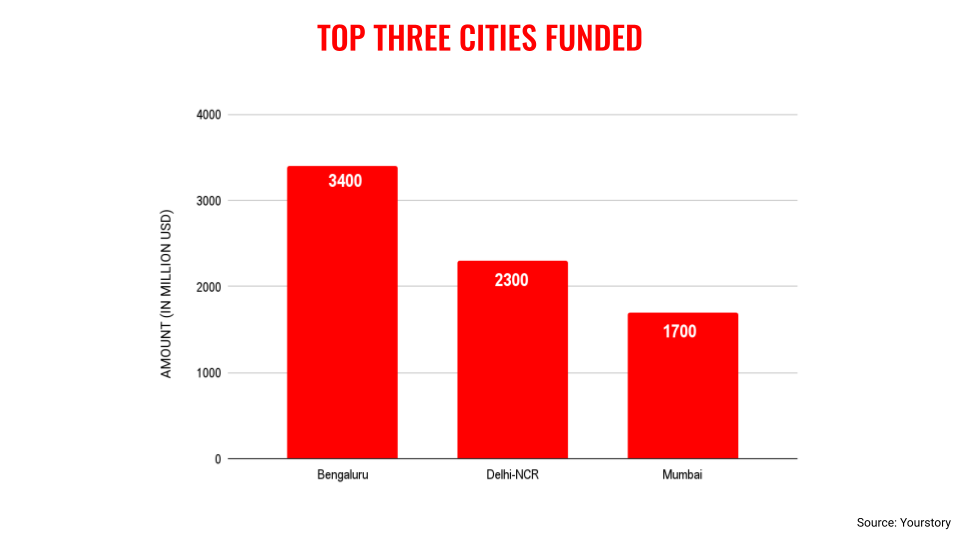

In terms of cities, the trend has remained unchanged in terms of the top three, which include Bengaluru at the top spot followed by Delhi-NCR and then Mumbai. However, the quantum of funding into these cities has considerably reduced. While Bengaluru raised $9.7 billion in the nine months of 2022, it has raised just $3.4 billion in first nine months of 2023.

Given the performance of funding into Indian startups for the first nine months of 2023, it looks like it will be a year that was not positive for the ecosystem as a whole. The hope now rests on 2023 where the expectation is that capital will start to flow much more vigorously back into the ecosystem.

Edited by Megha Reddy

![Read more about the article [Funding alert] Coralogix raises $55M in Series C round led by Greenfield Partners](https://blog.digitalsevaa.com/wp-content/uploads/2021/07/coralogix-founders-p-1627550052257-300x150.png)