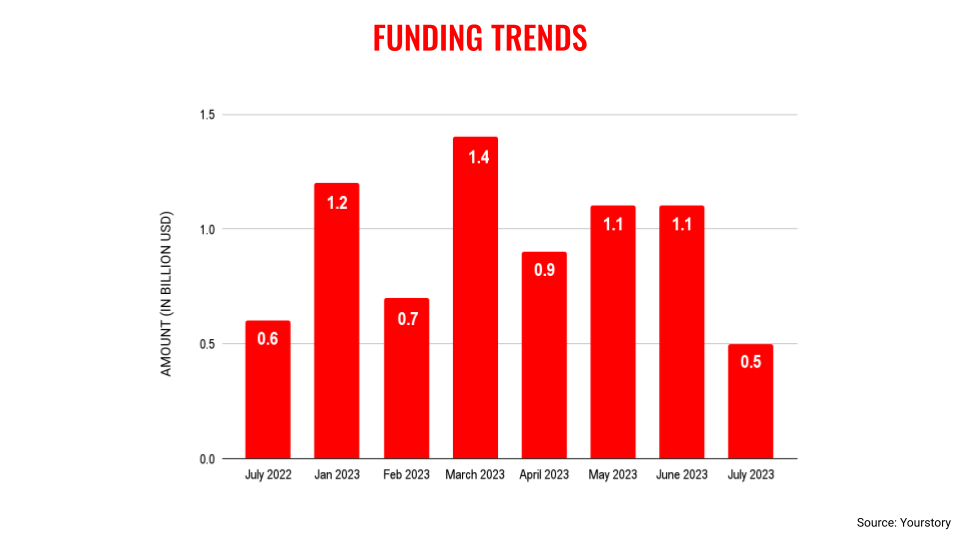

Venture capital (VC) funding into Indian startups touched a new low for the current year as July witnessed $529 million in capital inflow. It is the third time in 2023 that the total capital raised on a monthly basis fell below the $1 billion benchmark.

In February this year, Indian startups received $734 million in funding—the lowest in the first six months of 2023. In April, startups raised a total funding of $971 million. Meanwhile, January, March, May, and June saw over $1 billion in monthly VC funding.

In comparison, startups raised a total of $653 million in funding in July last year—down 19% YoY. It was around the same time when the funding winter began, and the decline reflected the serious challenges faced by the Indian startup ecosystem while raising capital.

These seven months have revealed that it is unlikely the total funding for 2023 will cross the $15 billion mark.

In the first seven months of 2023, startups raised $7.2 billion, 59% less compared to the same period last year, when the total amount stood at $17.7 billion.

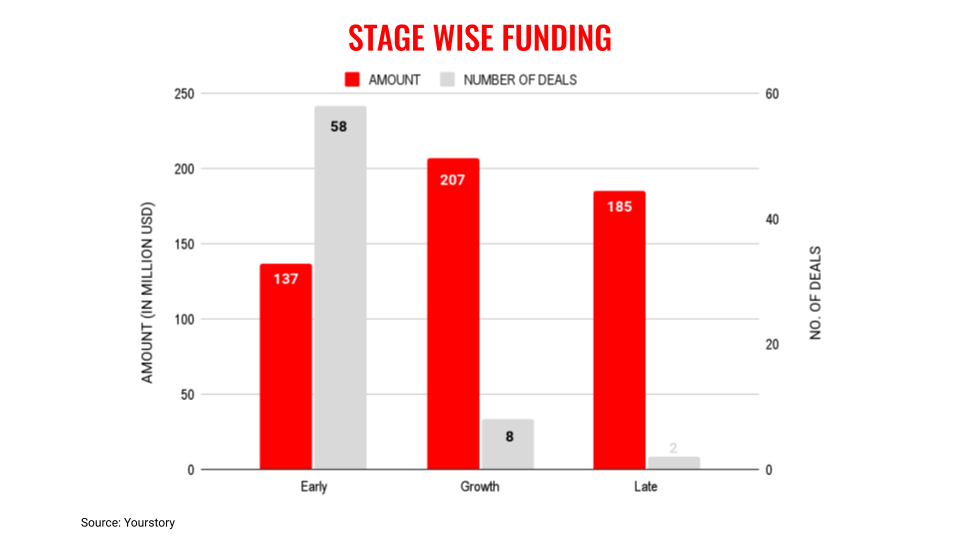

In 2023, $100 million transactions have become a rarity, and large deals come in the range of $30-50 million. Even the unicorns have not raised any significant money this year, with the exception of the likes of Lenskart and PhonePe.

Key transactions in July were from companies, including Kaar Technologies, Battery Smart, Renewbuy, and Veritas Finance, which crossed $100 million, Other large deals during this period were below $50 million.

The growth category received the highest amount at $207 million, cutting across eight deals, followed by the late stage at $185 million (two deals) and the early stage at $137 million (58 deals).

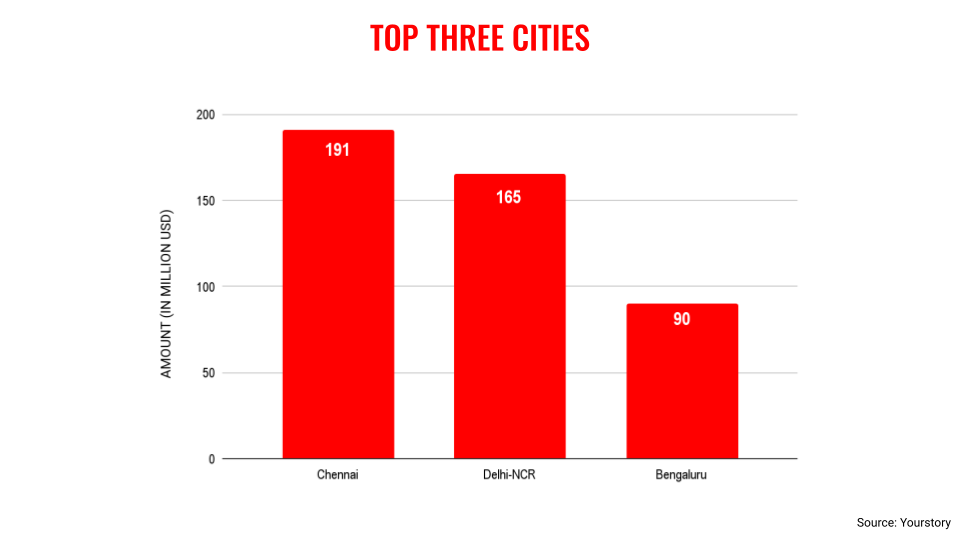

Chennai startups raised the highest amount of VC funding in July at $191 million, followed by Delhi-NCR ($165 million) and Bengaluru ($90 million). Moreover, fintech emerged as the leading segment, followed by electric vehicles and IT services.

July also saw key M&A transactions from companies such as Reliance Retail and Sheela Foam. It is an important development as established corporates are keen to harness the innovative element provided by new-age companies.

The first seven months of venture funding reveal that the Indian startup ecosystem is still caught up in the funding winter, and the hopes of a strong revival later this year are very unlikely.

Edited by Suman Singh