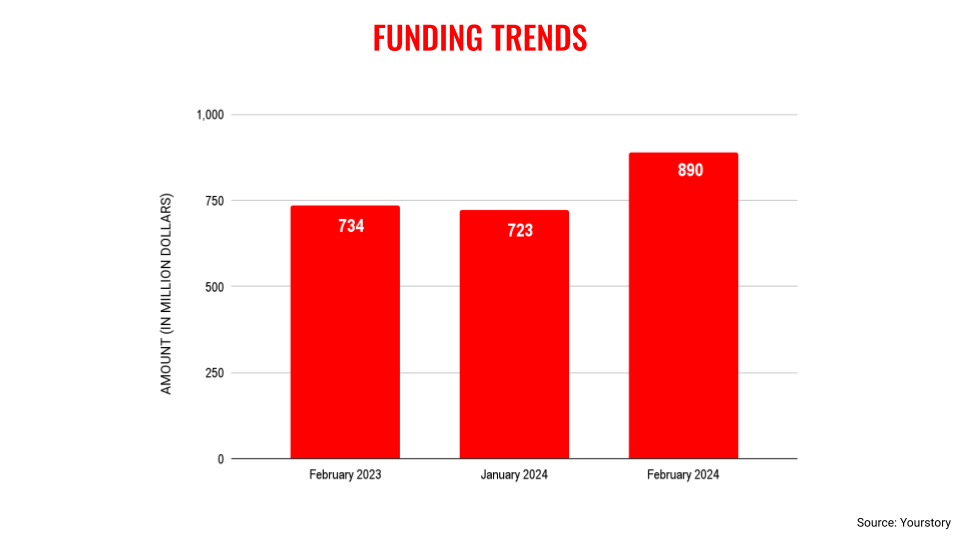

The month of February turned out to be positive for the Indian startup ecosystem as venture capital funding rose by 21% year-on-year due to the steady inflow of deals.

The total VC funding in February 2024 stood at $890 million, cutting across 114 deals. In comparison, Indian startups raised only $734 million in February 2023. Even on the month-on-month comparison, there was a 23% increase in VC inflow as the total funding raised in January 2024 was $723 million.

Even though the total monthly fundraise did not cross the psychologically important mark of $1 billion, the increase in capital inflow despite the challenging macroeconomic environment was encouraging for the Indian startup ecosystem.

Going by the trends, it is likely that monthly VC funding will be above $500 million, if not higher, going forward and this could inject a certain amount of optimism for the ecosystem. The external environment continues to remain unstable as policymakers across the key economies of the US and Europe are battling higher inflation rates by increasing interest rates. This has reduced the funding flow into the Indian startup ecosystem.

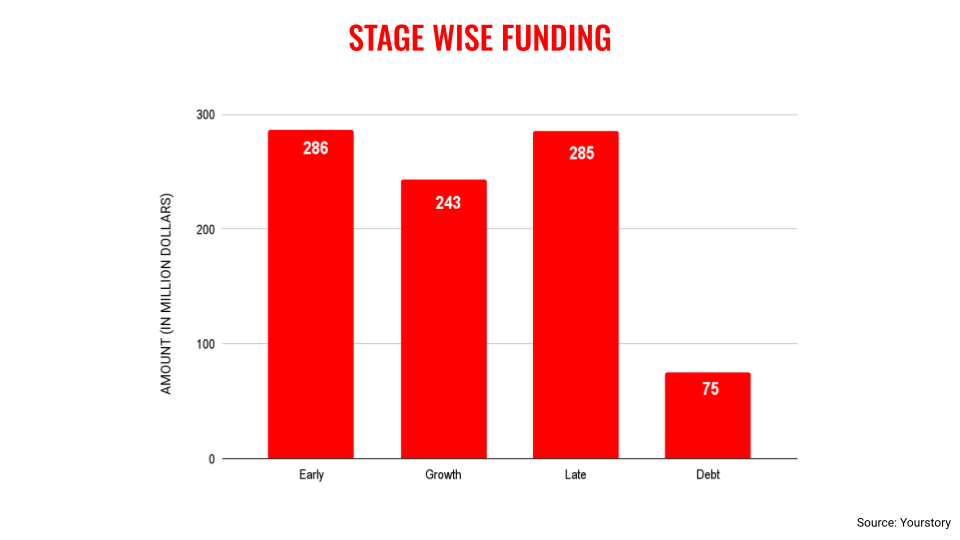

It is very unlikely that there would be any quick turnaround in the present environment and startups cannot expect any major surge of large cheques. Most funding activity is present in the early stage category, however, the quantum of money is low—following the trend since mid-2022.

.thumbnailWrapper{

width:6.62rem !important;

}

.alsoReadTitleImage{

min-width: 81px !important;

min-height: 81px !important;

}

.alsoReadMainTitleText{

font-size: 14px !important;

line-height: 20px !important;

}

.alsoReadHeadText{

font-size: 24px !important;

line-height: 20px !important;

}

}

The month of February witnessed a similar trend when it came to funding raised across all the stages—early, growth and late. Most large deals had a ticket size in the range of $20-40 million.

On a positive note, February is the fourth month over the last year when the total number of deal transactions crossed 100. This shows that there is an increased interest among the investors to put their money into startups, even if in lower amounts.

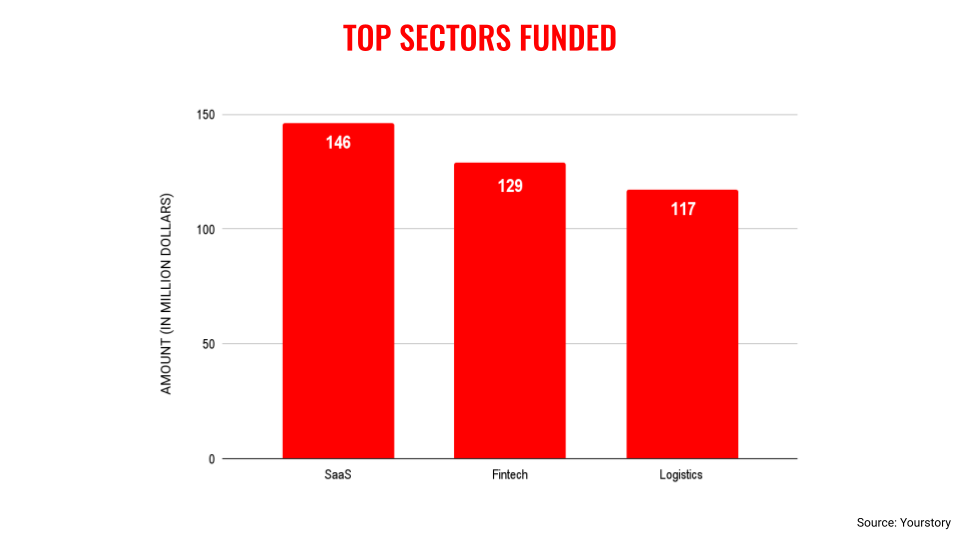

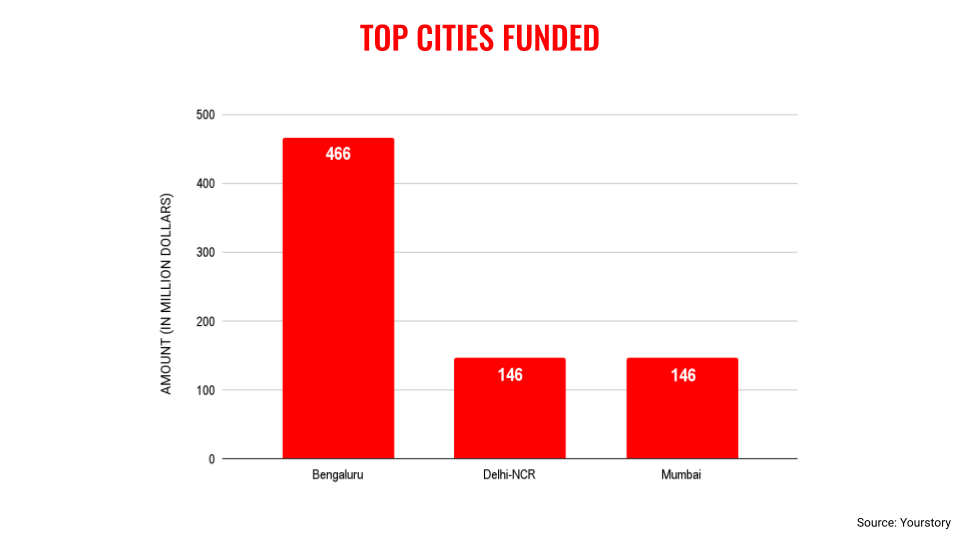

In terms of the segments that raised the highest amount of funding for February, SaaS topped the list followed by fintech and then logistics. When it comes to cities that raised the highest amount of VC funding, there was no change in the top three, which were occupied by Bengaluru, Delhi-NCR, and Mumbai.

An increase in VC inflow will depend on external factors like lower interest rates and the health of the public market. If the US Federal Reserve decides to lower the interest rates, the VC funding tap will open. More importantly, if the stock markets are receptive to initial public offerings (IPOs) of Indian startups, investors would be encouraged to put in a larger quantum of money as there is more clarity on how they would get exits on their investments.

Edited by Kanishk Singh