Amaan AhmedJun 18, 2021 10:42:21 IST

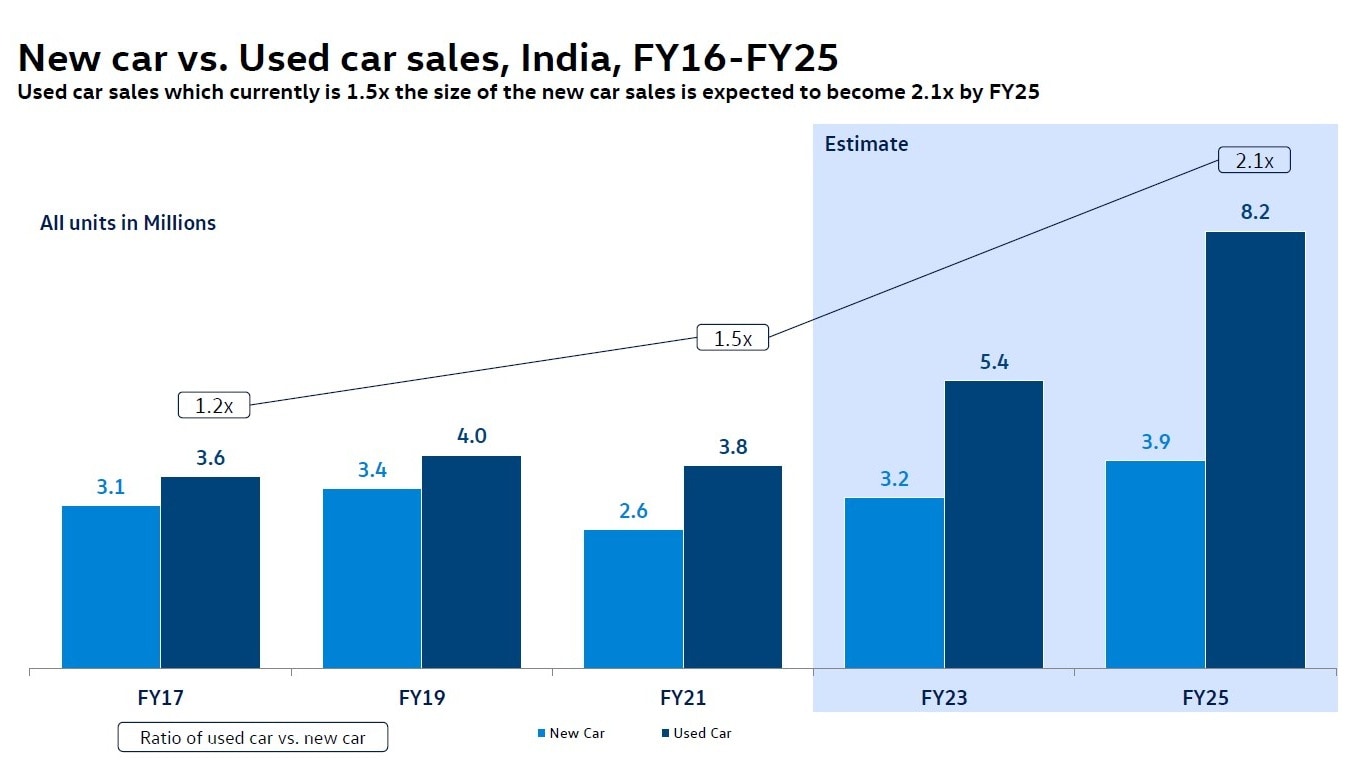

Anticipating a surge in demand for used cars in the coming years, Volkswagen India has teamed up with consulting firm Frost & Sullivan to conduct a detailed study of the pre-owned car market in the country. The report – among other interesting findings – estimates India’s used car market to swell to 8.2 million units by FY2025, which is more than twice the 3.8 million used cars sold in the country in FY2021. That figure is also more than twice the number of new cars estimated to be sold in FY2025, according to the report.

India noted a huge decline in new car sales in FY2021 as the COVID-19 pandemic wreaked havoc across the nation, but the dip in overall used car sales was notably lower. With a paucity of jobs and with a vast majority of the public opting to be more frugal with their spending, used cars suddenly became an even more appealing option as they provide relatively safer personal mobility at a significantly lower cost.

Tier-II and III cities are estimated to account for 70 percent of all used car sales in India by FY2025. Image: Volkswagen

Demand for affordable, used vehicles will only grow further, and Ashish Gupta, Brand Director at Volkswagen Passenger Cars India, said the company’s used car retail business named Das Welt Auto (DWA) is integral to the brand’s growth, as it not only helps make their cars available to people who previously would not have considered them because of their price when new, but also helps the company’s dealers, as margins in the used car business are higher and also open up possibilities in terms of sales of accessories and aftersales support.

Volkswagen sees potential for growth in Tier-II/III cities

Gupta went on to say that demand for used cars will grow majorly in Tier-II and Tier-III cities, and that this study will help Volkswagen shape its strategy to approach those markets accordingly. At this time, Volkswagen has 140 outlets across India, 103 of which are also DWA outlets. DWA is one of the few organised multi-brand used car chains operational at present, with Mahindra’s First Choice and Maruti Suzuki’s True Value outlets making up the largest used car network in the country. DWA sold around 10,000 used cars in the last financial year, according to Gupta.

The report notes that the used car sales split – which sees 55 percent of sales coming from non-metro cities – will balloon to 70 percent in favour of Tier-II cities and rural areas in the next four years. Organised retail chains are estimated to account for 45 percent of used car sales by FY2025, a significant jump over the 25 percent recorded in FY2021. 70 percent of all used cars sold are under the Rs 5 lakh mark, while cars in the Rs 10 lakh bracket make up 90 percent of all used car sales in the country. That said, the report says buyers are increasingly preferring mid- and top-spec variants of used cars, especially in the higher price segments.

India’s used car market is estimated to double to 8.2 million units by FY2025. Image: Volkswagen/Frost & Sullivan survey

While 73 percent of respondents in the survey from metros said price was the prime deciding factor in their purchase, in non-metro cities, just 40 percent of respondents put price as their top priority, demanding a more even mix in terms of maintenance costs, brand value and model recall. More significantly, as many as 22 percent of respondents mentioned safety features as being a key decision-driver, as opposed to just six percent of respondents from metros.

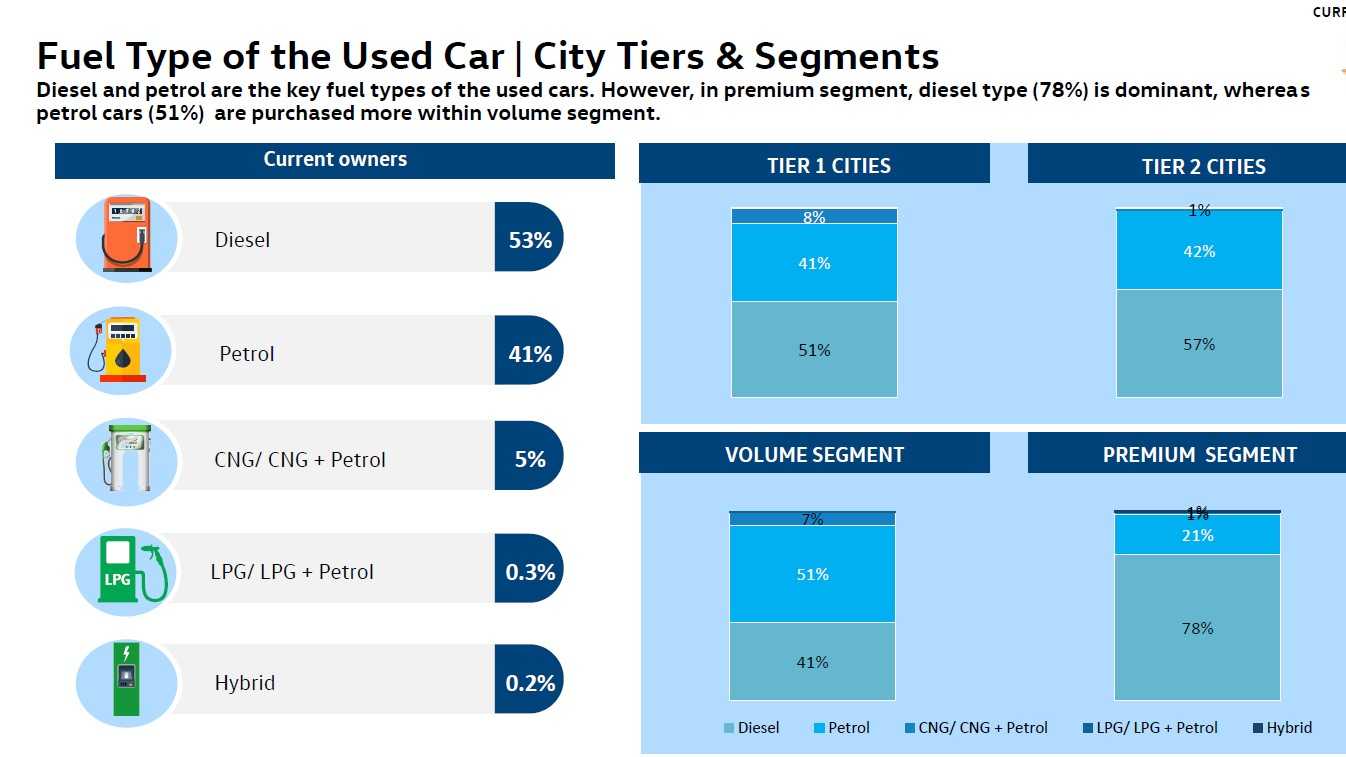

Despite high demand for diesels, Volkswagen firm on petrol prospects

More than half of all used cars sold in India today are diesels, according to the report. 51 percent of sales in Tier-I cities are diesels, and that number rises to 57 percent in Tier-II cities. Remarkably, in the premium segment, 78 percent of sales come from diesel cars. Post the transition to BS6 emission norms, Volkswagen has opted to go the petrol-only way, phasing out diesel engines from its entire portfolio. Right from the entry-level Volkswagen Polo to the seven-seat Volkswagen Tiguan Allspace, all Volkswagen models on sale today only have a petrol engine option. However, Gupta doesn’t see this as a challenge, and says Volkswagen believes the market will switch over from diesels to petrols in the coming years, even in segments where diesel has been the predominant choice. That said, the multi-brand format of DWA means Volkswagen can still cater to customers who want a used diesel car.

“We have taken this decision already – for new cars, we’ll be focusing on petrol and new energy solutions in terms of electrification going forward. If you look at our sales over the years, our car park has almost 55 to 60 percent diesel cars. In fact, the preference of customers in used cars for diesel plays a big role in enhancing our business even further, because 55 to 60 percent of more than five lakh cars that we’ve sold in India are diesel. So, customers coming into DWA looking for a diesel VW car, we have more options to serve them”, said Gupta in response to a query by Tech2.

Explaining the brand’s take on a shift in fuel preferences, Gupta added, “The mix is going to change over the next five years even for used cars. The new car industry is increasingly moving towards petrol. We’ve seen a dramatic shift – three years ago, diesel used to account for 55 percent of sales as compared to 45 percent for petrol. This ratio has now changed to 60:40 in favour of petrol already. Over the next five years, as more and more used cars enter the market, you will see a dramatic shift in the used car mix as well. Even in the premium car segment, where the mix used to be 90:10 in favour of diesel, it has moved to 70:30 already, and this trend will continue.”

Despite diesels making up a large chunk of used car sales, Volkswagen believes buyers will switch over to petrol power in the coming years. Image: Volkswagen/Frost & Sullivan survey

At this point, Gupta says Volkswagen’s own models make up 30 percent of all sales via its DWA outlets. The rest of the sales are accounted for by the major players in the Indian car market, understood to be Maruti Suzuki, Hyundai and Tata Motors.

Used car finance penetration, too, is expected to grow substantially by FY2025, thanks to organised players tying up with full-fledged finance firms. At this time, a majority of used car purchases are made in cash, especially in Tier-II locations, but that is expected to change as more buyers opt for higher-spec versions of premium cars.

“In Tier-II/III cities, the inclination is to go for a cash purchase. It’s a long thought-out process, and not an impulsive buy, which happens mostly in metros. Even in Tier-II/III cities, sales of cars from premium segments are increasing. That means higher ticket values, and a cash purchase may not be possible in all cases. So, in such situations, financing options become attractive. Depending on the vehicle price, the customer chooses between a cash purchase or finance, but we have seen in the upper segment, more expensive vehicles, which include SUVs, are seeing more traction. For such segments, financing is preferred over a cash purchase”, said Kaushik Madhavan, Vice President, Mobility (Automotive & Transportation) Practice, Frost & Sullivan, in response to a query by Tech2.

Adding to Madhavan’s explanation, Gupta said, “In Tier-II cities, we see a proliferation in preference for top-end models compared to metros. When customers in Tier-II/III cities are preferring top end models, that means their budgets may not be adequate for cash transactions. That is where the growth is going to come from, purely because they’re now going for top end models of more premium cars.”