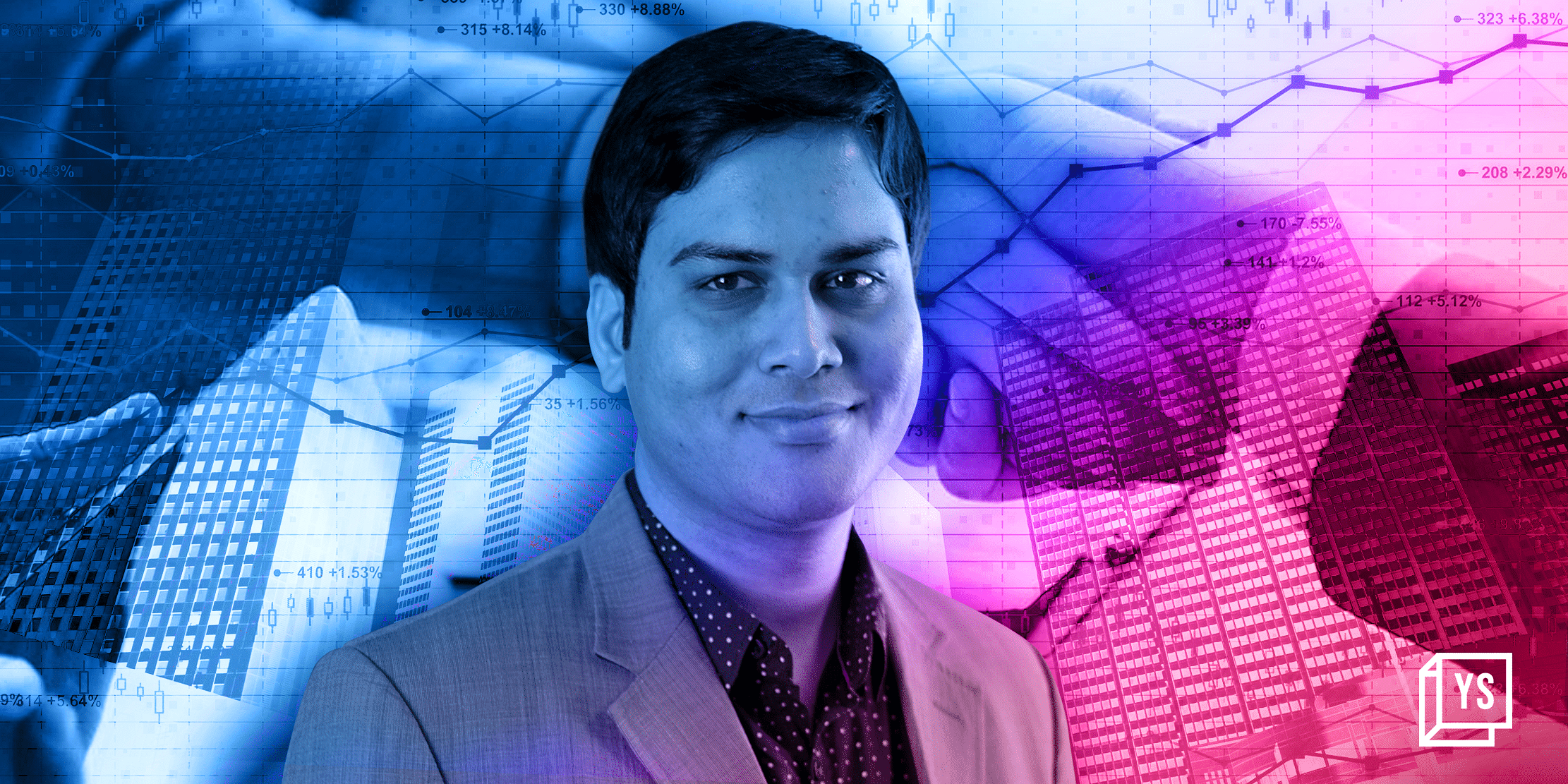

The past three years have been busy for .

Founded by Harshvardhan Lunia and Mukul Sachin in 2014, the MSME-focused lending platform had long been providing short-term working capital loans and other financial products to SME borrowers through its NBFC arm, Lendingkart Finance Limited. Now, it has positioned itself for a complete overhaul by focusing on co-lending and becoming the technology partner of large financial institutions.

The move has coincided with the co-lending spring in the fintech industry, particularly post-pandemic. Instead of taking full exposure on the books, co-lending allows new-age NBFCs and fintechs to partner with banks to help them deploy their funds and extend loans to the underserved. An estimated 80% of the capital comes from banks which have greater access to cheaper loans (demand deposits), while the NBFCs (along with tech partners) become the consumer-facing entities and take care of the sourcing, underwriting, product innovation, and correspondence for the consumer.

This creates a win-win situation, as banks are able to have a greater reach while the NBFC player is able to extend loans at lesser rates, mitigate risk exposure, and hence, reduce losses on loans.

Lendingkart is now building its core business model around co-lending, which has come a long way from merely being just a buzzword, especially after being recognised by the Reserve Bank of India (RBI), which recently put guidelines in place for digital lending. Startups and banks have been partnering for lending in niche segments to create tech-powered innovative products and increase loan books.

YS spoke with Harshvardhan Lunia, Co-founder and CEO at Lendingkart, to understand the current order of business, challenges, IPO plans, and its positioning in the market.

Edited excerpts:

YS [YS]: How do you look at the RBI’s latest digital lending guidelines?

Harshvardhan Lunia [HL]: The regulator (RBI) had to set up the ecosystem for the long term for digital lending. Any ecosystem getting built will have people who get some liberties and some who don’t. So, the RBI has clearly defined the roles and responsibilities.

They (guidelines) came as a surprise but work had been going on since last year, with the working group taking in all the recommendations from the industry. There are a few open points which are still being worked out, and I feel that the guidelines are quite progressive and good for the ecosystem.

[YS]: Would digital lending platforms or apps have to bear heavy costs to adhere to these mandates?

[HL]: If you look at the regulated entities, they have been doing everything that is being asked while working with other regulated partners, banks, financial institutions, and so on. For them, including Lendingkart, it won’t increase any cost.

However, if you look at the non-regulated entities or service providers, they have been working with the partners, but without a framework. With the new guidelines, many banks would now do deeper due diligence before forging a partnership.

Secondly, data storage was the major moat of the majority of lending platforms, which provide a critical service to the banks in underwriting loans. With the new guidelines, if they are not supposed to store the data of the consumer, how will they provide their services? And once the data is gone, what’ll be their moat? Will they be able to build a business with the efficient-enough services that they provide to the banks?

All of that might increase their costs.

[YS]: Lendingkart has been shifting its core business model from direct lending to co-lending. How are things progressing there? Have you slimmed down your loan book?

[HL]: The co-lending business has been a work in progress for us for a long time. When we started Lendingkart, the clear idea was to serve the underserved segment and give loans to micro and small businesses. We always wanted to build the ‘capabilities’—like distribution, algorithm-driven underwriting, and then, collection—to reach out to them (MSMEs), but at the same time, we also knew that we would have ‘constraints’ in terms of deploying that money.

The money happens to be that of the depositors lodged in all the banks. We always wanted to become a platform that would help these institutions reach out to the smallest consumers through our platform.

We started our co-lending platform in November 2020. Post the second COVID-19 wave, the business took off substantially as the term collaboration came into play in a massive form.

During October-November 2021, we were doing almost 30-40% of our business around co-lending, and now, almost 90% of the business goes into the same. This year, we will be disbursing over Rs 4,000 crore worth of loans. We have 16 live partners on the platform, including private sector banks and NBFCs, and seven in the pipeline.

Our business over the next 12 months is already pre-sold to the pipelines.

[YS]: Won’t the co-lending model reduce business margins (commission vs interest) or limit the scope of the business for Lendingkart?

[HL]: It is more important that the customer benefits from lower interest rates. It may seem that lower interest rates will reduce our income, but the drop in our costs further improves profitability. So, it is a win-win—customers get better rates and our partners get access to a larger customer base through our platform.

All this happens while we remain profitable. As a matter of fact, we have recorded a third straight profitable quarter, with growth in both top and bottom lines. And, we have only scratched the surface. A huge number of MSMEs are yet to discover these benefits.

[YS]: Besides distribution/co-lending, would you be looking at the infrastructure side of things, like embedded finance?

[HL]: We are working on platforming our services. We have launched our 2gthr and xlr8 platforms, and our partners have already started benefitting from them. There is so much that we can do for the entire industry. We have learnt a lot and built tech for ourselves, and now, for our partners. There is no reason we cannot take our platform to a wider audience.

[YS]: Any plan to get into BNPL as well?

[HL]: BNPL is a consumer segment. Overall, we have not built anything in this segment and have been focused on MSMEs, and will continue to do so. It will be our bread and butter. We’ve been one of the rare fintechs who have continued to build in the MSME segment only and didn’t dwell on other segments. This segment has done wonderfully well for us, and we will continue to focus on this.

[YS]: What are the plans for IPO?

[HL]: We plan to go for an IPO in the next six to eight quarters. We have been profitable for the last three quarters, and recorded Rs 50 crore profit last year at the group level.

Our credit lines are healthy. Our requirement for the entire FY23 is already assured. In terms of products, we are very keen on having more people experience our platforms. The financial ecosystem is ripe for collaboration. We want to play a big role with our platform products.