The access to data-driven, digitally-enabled agriculture ecosystems are leading to a revolution in the agri-fintech segment. The use of farm management software, drones, smart irrigation systems, predictive data analytics, integrated warehousing and marketplace platforms are addressing some of the key challenges faced by growers, financers, and governments.

Today, micro-questions of a farmer on what crop to grow, getting a fair price for produce, and seasonal risks are being answered through a macro approach backed by weather and crop patterns, soil content, historical crop cutting methods, among other such parameters.

Actuarially-backed risk-protection methods are enabling smart farming decisions. The convergence of technologies like AI, ML, Analytics, applied to data, are reducing risks, helping institutional agri-finance, planning recovery pipelines, and improving claim settlements.

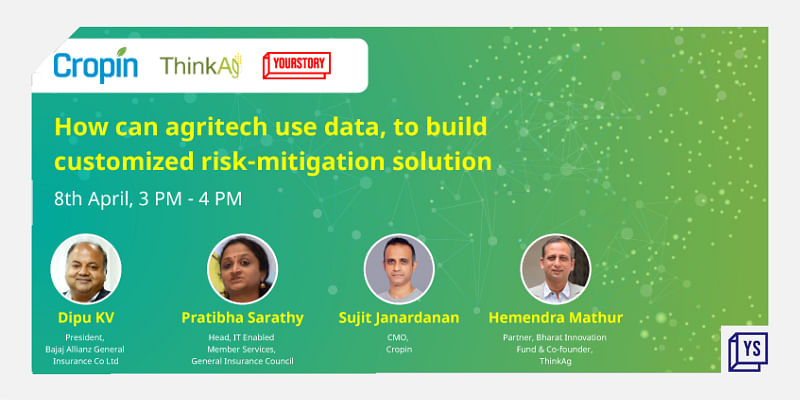

In a roundtable hosted by Cropin, ThinkAg and YourStory, panellists featuring Dipu KV, President, Bajaj Allianz General Insurance; Prathibha Sarathy, Head, IT Enabled Member Services, General Insurance Council; and Sujit Janardanan, CMO, Cropin offered strategic insights on how data can enable financial institutions build risk mitigation solutions for the agriculture sector and drive financial inclusivity in future. The discussion was moderated by Hemendra Mathur, co-founder of ThinkAg, a not-for-profit platform that works towards accelerating adoption of innovation in agriculture.

Edited excerpts from the discussion:

Customised solutions win

In the past two years, agri fintech has come into its own, with participation of mainstream banks that are partnering with agri tech startups to build innovative financing and insurance models for farmers. Today there are localised and climate-based agri-fintech offerings, easier settlement of claims, offering a wide berth for insurance companies to tap into the potential of risk mitigation for the entire farming ecosystem.

As the agri fintech sector evolves, the key differentiator for solutions to be widely acceptable lies in the way data is tuned to offer customised solutions. Dipu offers the example of the Farmitra Mobile App that was launched in 2019, to help farmers with not only crop insurance but also information on weather forecasts, market price of crops, and locators for agriculture inputs.

“The application was launched in various Indian languages for better adoption. A one-stop shop, it offered information on farming-related practices and helped farmers access government portals. The app gained popularity and traction through word of mouth in the farming community,” Dipu said. Owing to its innovation and adoption, the Farmitra app was awarded the Efma Accenture Innovation and Insurance award in 2020 emphasising the fact that leveraging data to offer agile, comprehensive, and customised solutions is the way forward for agri fintech solutions.

Data privacy and security

With farmer digital adoption increasing, the option of evaluating credit scores on the basis of data available, setting up of a federal agri stack, and introduction of the Government launched Pradhan Mantri Fasal Bima Yojna (PMFBY) have been important steps towards the evolution of the insurance landscape. However, accumulation of large-scale data also calls for appropriate privacy and security regulations, which are a work in progress currently in India.

While federal initiatives like the proposed agri stack are a great start to collect farm-related data in one place, the long-term impact also needs to be factored in by agencies and the government working in the agri sector. Prathibha of the General Insurance Council pointed out, “The concept of agri stack from a financial perspective can work well if last mile connectivity is kept in mind. We need to put processes, agencies and intermediaries in place, who can work towards data protection and handhold farmers towards technology adoption. There is also the need to put appropriate regulations in place, so that data collected is not misused by various stakeholders.”

Data models to optimise outcomes

Agriculture being a complex ecosystem, with many variables at play, it becomes imperative for technology intermediaries in the value chain to be able to build solutions that can maximise returns for stakeholders in the sector, whether it be financial institutions, or the farmers.

“The context of using data is very critical to solve problems on the ground for the sector. Data-enabled models should facilitate better decisions for financial institutions. This can be achieved by bringing together data sources and technology in real time for actionable analysis and drive meaningful acceleration of financial inclusion globally,” said Sujit of Cropin, which has digitised over 16 million acres of farmland and touched the lives of over 7 million farmers. Over the last decade, Cropin has built one of the largest farming data insights globally, with the knowledge graph of over 488 crops and 10,000 crop varieties in 56 countries through its AI labs by computing over 0.2 billion acres of farmland in 12 countries covering 34 crops, he added.

The way forward

Considering ag-intelligence and technology adoption in the sector is being enabled by the day, the future of the sector lies in intelligent data analysis that can help risk mitigation for both man-made and natural disasters.

Data analysis can also drive productisation of agri fintech solutions, digital transformation, and scale. In future, risk mitigation can cover the entire lifespan for a rural population that includes not only crop or farm insurance, but also insurance for assets like machinery and transportation, livestock and even insuring the health of a farmer, according to Dipu.

The need of the hour is also a standardised bill or regulation to enable responsible digital transformation of farm data collected, said Prathibha. Among other factors to make the ecosystem a success are respecting farmer rights on data sharing, settling dispute and claim handling processes, and thwarting data frauds, she added.

Partnerships among intermediaries, government bodies, and nonprofits are another important aspect for the success of data-led strategic insights in the agri-fintech sector, said Sujit. Combining a macro and a micro approach towards leveraging land-use data, historical crop patterns, climate-based risks, market pricing, asset risk monitoring can help build agri strategies, enable stakeholders like government bodies, small and medium farm holders, intermediaries like startups and nonprofits to optimise outcomes for the sector.

Setting up partnerships and policy reforms can eventually lead to innovations in the sector, noted Hemendra of ThinkAg. “Digitisation means the coming together of many factors in the agri tech sector. We need multiple startups, intermediaries, and agencies who can build interesting and viable solutions. The penetration of insurance in rural communities is still very low. We need more data, more digitisation, more risk assessment models and delivery channels, which can reach out to farmers efficiently and can deliver those products at an affordable cost,” he added.

![Read more about the article [Startup Bharat] Scared of needles during blood tests? Here’s the world’s first non-invasive solution to check](https://blog.digitalsevaa.com/wp-content/uploads/2021/03/imageonline-co-logoadded18-1616079512706-300x150.jpg)