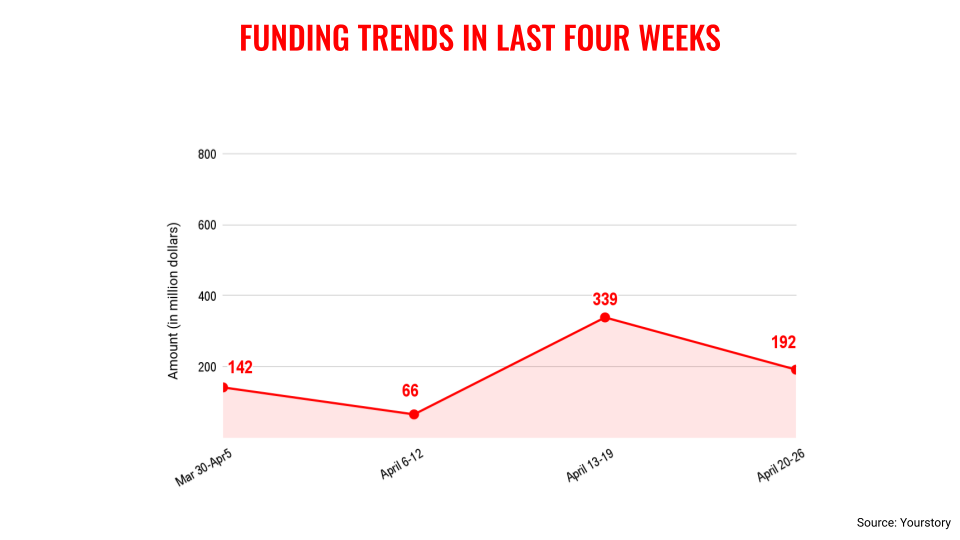

Venture capital (VC) funding into Indian startups declined in the last week of April as the deal momentum fizzled out and more startups took to the debt route.

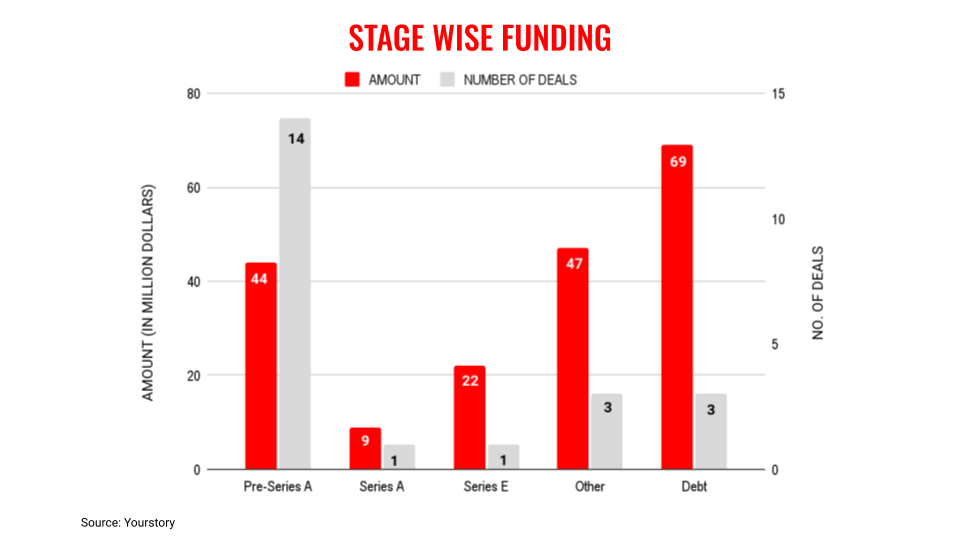

VC funding for the week totalled $192 million, cutting across 21 deals. In contrast, the previous week saw a total fundraise of $339 million—the highest the Indian startup ecosystem has raised this year till now.

During this week, the debt component saw strong traction, receiving $69 million from a total of $192 million. However, it underlines that startups continue to face challenges in raising equity capital, with the only financing option available to them being the debt route. It also helps startups maintain their valuations.

The funding scenario remains challenging for the Indian startup ecosystem. The conflicting signals from the world’s largest economy, the US, have led to further uncertainty. A lot depends on what the US Federal Reserve will do in terms of interest rates. VC inflow may only increase if there is a cut in interest rates.

The Indian startup ecosystem saw both positive and negative news during the last week of April.

FirstCry withdrew its IPO papers as the market regulator sought some more information on business metrics and is expected to refile soon. On the other hand, food tech unicorn Swiggy will soon file for its $1.2 billion IPO.

Meanwhile, the social media platform Koo continues to face funding challenges and has stopped paying salaries to its employees.

However, VC firms continue to raise fresh capital, with the latest being Norwest Venture Partners, and are expected to fund startups in the near future.

Key transactions

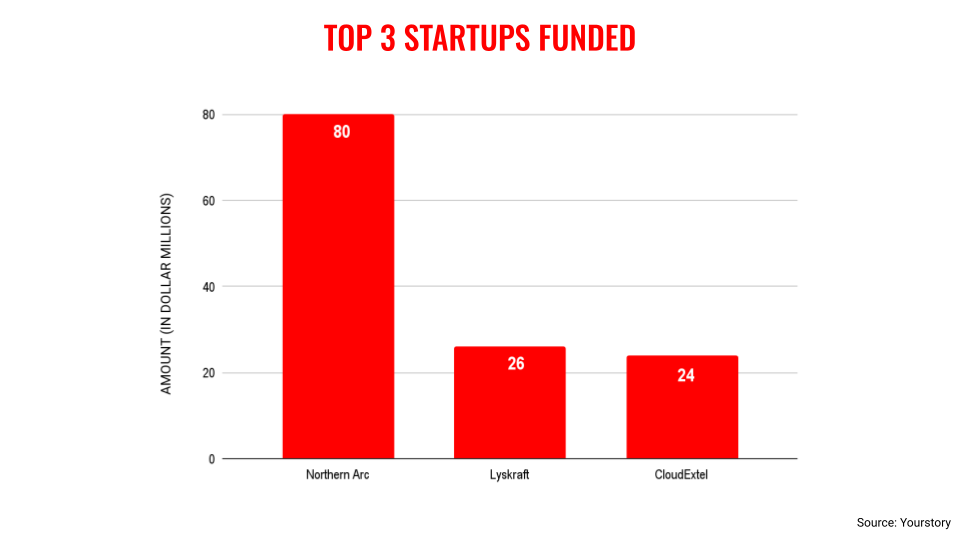

NBFC Northern Arc raised $80 million from the International Finance Corporation (IFC), a member of the World Bank Group.

Fashion retailer Lyskraft raised $26 million from Peak XV Partners, Prosus, Sofina, and Partners of DST Global along with other startup founders.

Networking tech startup CloudExtel raised Rs 200 crore ($24 million approx) from NIIF Infrastructure Finance Limited and Aditya Birla Finance Limited.

EV aggregator LetsTransport raised $22 million from Bertelsmann India Investments (BII), Rebright Partners, NB Ventures, ALES Global, Stride Ventures, and CAC Capital.

Sustainability startup Accacia raised $6.5 million from Illuminate Financial, AC Ventures, Accel, and B Capital.

Agri finance company Samunnati raised $5 million from Enabling Qapital.

Edited by Kanishk Singh

![You are currently viewing [Weekly funding roundup April 20-26] VC investment dips as startups resort to debt capital](https://blog.digitalsevaa.com/wp-content/uploads/2024/04/funding-lead-image-1669386008401-scaled.jpg)