Venture capital funding into Indian startups plummeted to its second lowest level for the year till now amid the continued absence of large-sized deals.

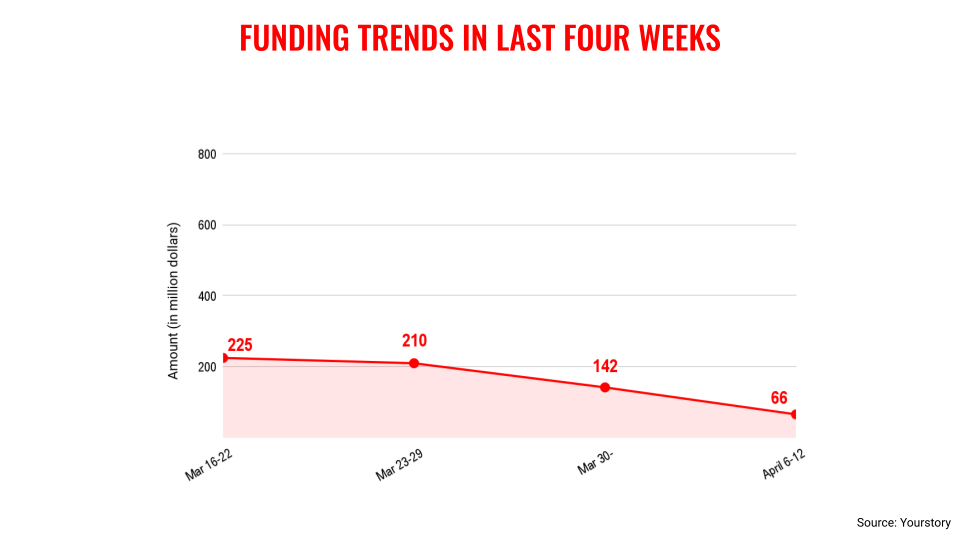

The VC funding for the second week of April stood at $66 million, cutting across 15 deals. In contrast, a total of $142 million was raised in the previous week.

The only time Indian startups raised a lower amount was during the first week of January when the ecosystem secured $61 million. In fact, this is the third time this year that VC funding on a weekly basis has dropped below $100 million.

This turn of events is surprising given that there was a steady increase in capital inflow throughout the month of March. However, April is reversing the trend as the venture funding for the last two weeks has been declining.

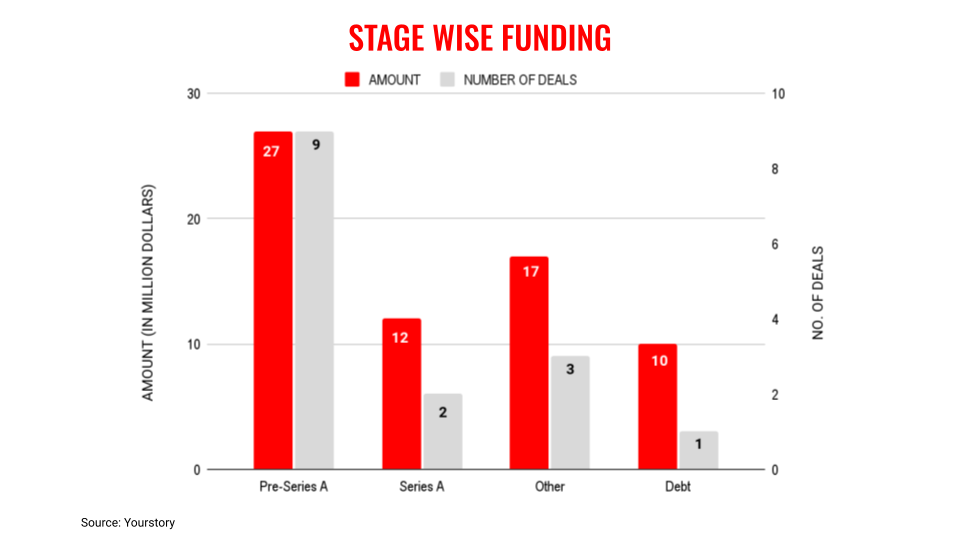

While the sentiment may not be positive, this would not be a big cause of worry as industry observers believe that fundamentals remain strong given the heightened activity in the early-stage funding category. This drop in funding could be seen as an aberration.

At the same time, there are other worrying signals, especially from the US as there are indications that the Federal Reserve is unlikely to effect a rate cut soon given the high inflation rate in the country. The American interest rates have a direct bearing on the inflow of cash into VC funds, which is then further distributed into startups as any increase in interest rates limits the availability of capital.

The positives during the week has been that VC firms continue to raise capital and this is evident from the fundraise of Cornerstone Ventures and Filter Capital.

Key transactions

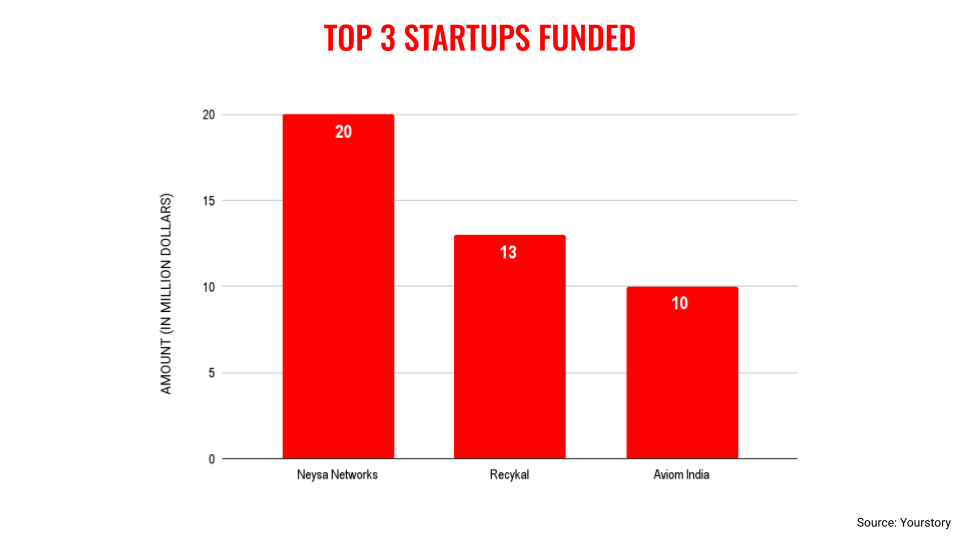

AI startup Neysa raised $20 million from Matrix Partners India, Nexus Venture Partners, Menlo Park, and California-based NTTVC.

Climate tech startup Recykal raised Rs 110 crore (about $13 million) from a Category II scheme led by 360 ONE AssetManagement Limited.

Edited by Kanishk Singh

![You are currently viewing [Weekly funding roundup April 6-12] VC funding plummets amid absence of big deals](https://blog.digitalsevaa.com/wp-content/uploads/2024/04/funding-lead-image-1669386008401-scaled.jpg)

![Read more about the article [Funding alert] Anar Business Community app raises undisclosed investment from Titan Capital](https://blog.digitalsevaa.com/wp-content/uploads/2021/03/funding-1615437662855-300x150.png)