The first week of the new year has begun on a sedate note for Indian startups with fewer transactions as investors continue to remain cautious.

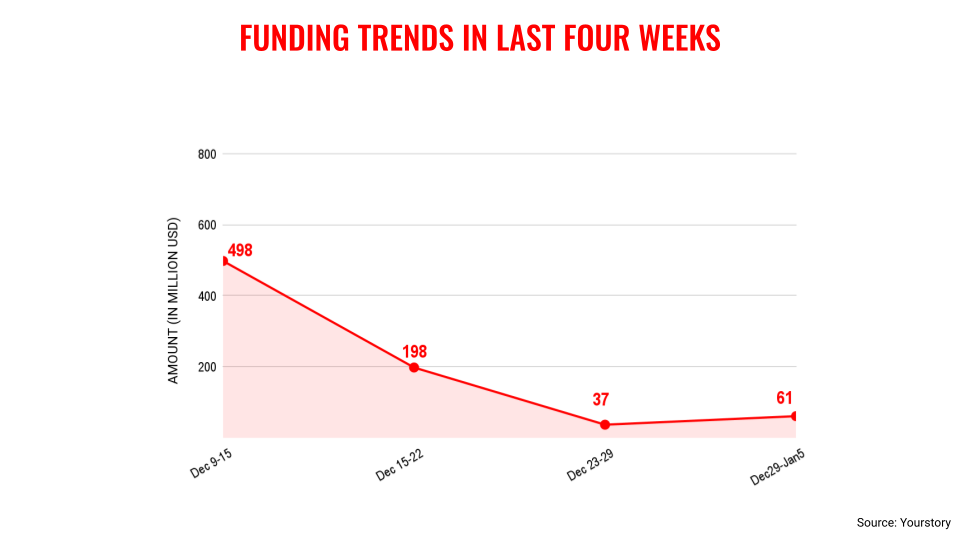

The week saw total venture funding of $61 million across 13 deals. In comparison, the previous week saw a total value of $37.2 million.

This was an expected start in terms of VC funding for startups as 2023 ended on a not-so-bright note. The total funding last year was down 53% as the freeze of the funding winter continues to have a strong grip on the ecosystem and it became even more imperative for Indian startups to focus on building a sustainable business and become profitabile faster.

Now, it remains to be seen whether the VC funding momentum will pick up this year or if it will remain slow for at least one or two quarters as expected. Any pickup is most likely going to happen in the second half of the year.

The macroeconomic uncertainty looms large despite the availability of considerable dry powder among the investor community. The big positive this year is the number of initial public offerings planned by several startups like Ola Electric, FirstCry, and MobiKwik to name a few. Their public debut should give the necessary boost to Indian startups.

Key transactions

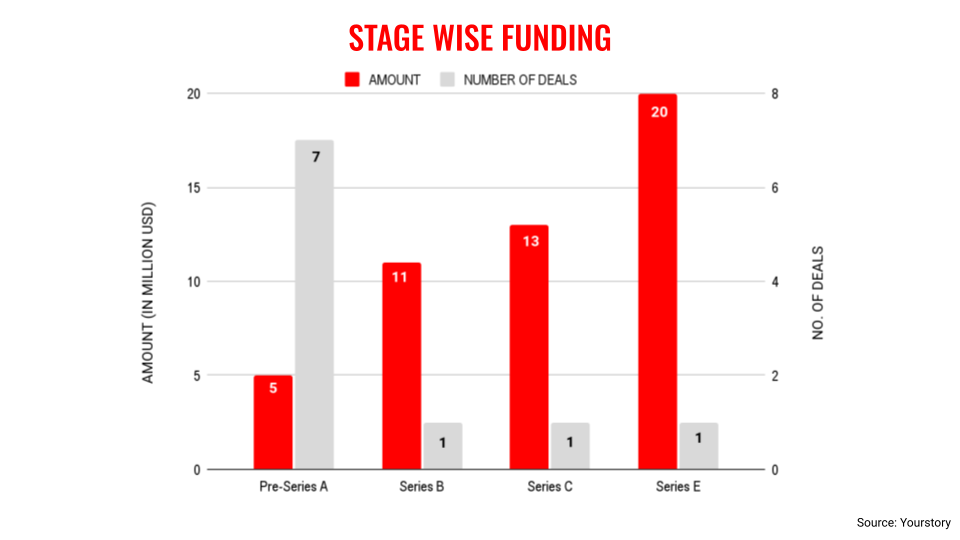

Food and beverage chain VRO Hospitality raised $10 million from Axis Bank, Gruhas, UC Inclusive Credit, NB Ventures and angel investors.

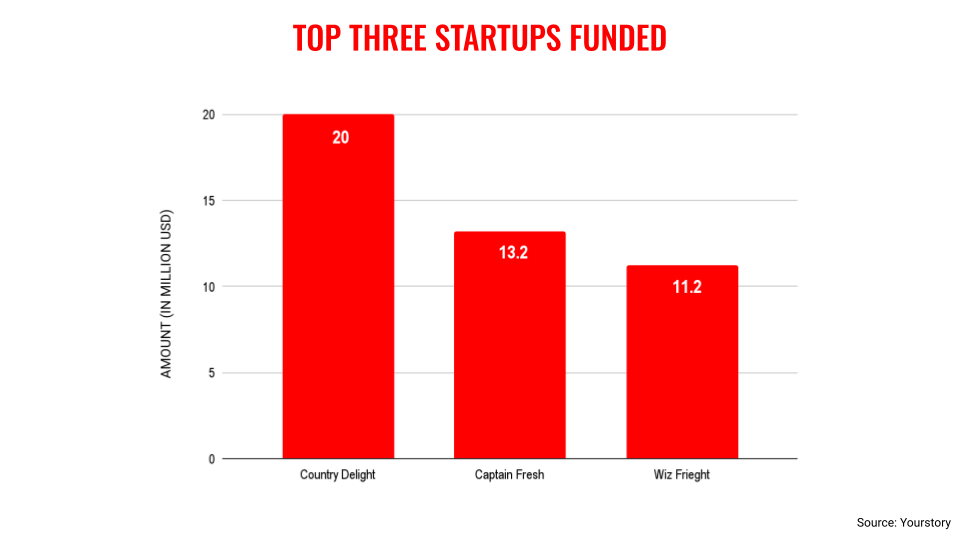

Dairy brand Country Delight raised $20 million from Temasek, Seviora Capital and Venturi Partners. Captain Fresh raised $13.25 million from Nekkanti Sea Foods and Shakti Finvest. Wiz Freight raised $11.24 million from SBI Investments, Tiger Global, Nippon Express Fund, and Axilor Technologies Fund. These developments were reported by Entrackr.

Edited by Kanishk Singh

![You are currently viewing [Weekly funding roundup Dec 30-Jan 5] VC inflow begins on a sedate note](https://blog.digitalsevaa.com/wp-content/uploads/2023/10/funding-lead-image-1669386008401-scaled.jpg)