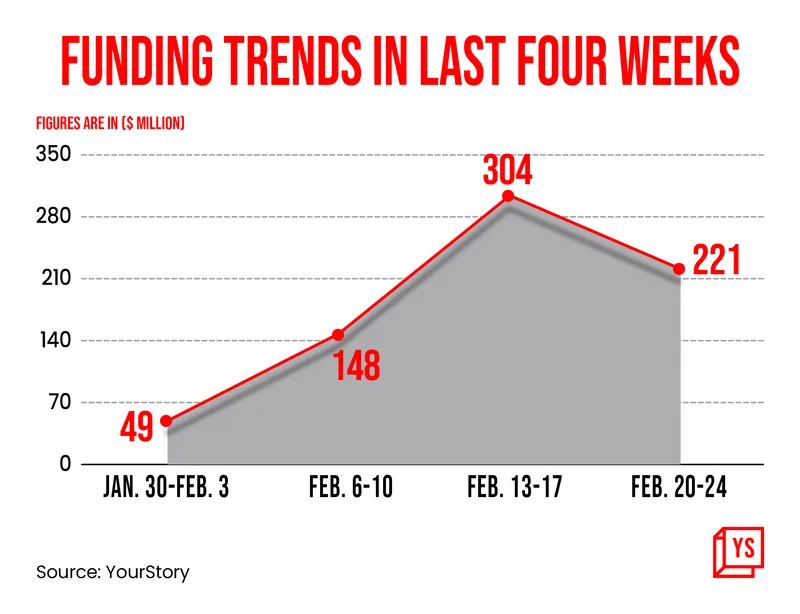

The last week of February saw a drop in venture funding as the absence of many large deals didn’t fuel any uptick in the capital inflow.

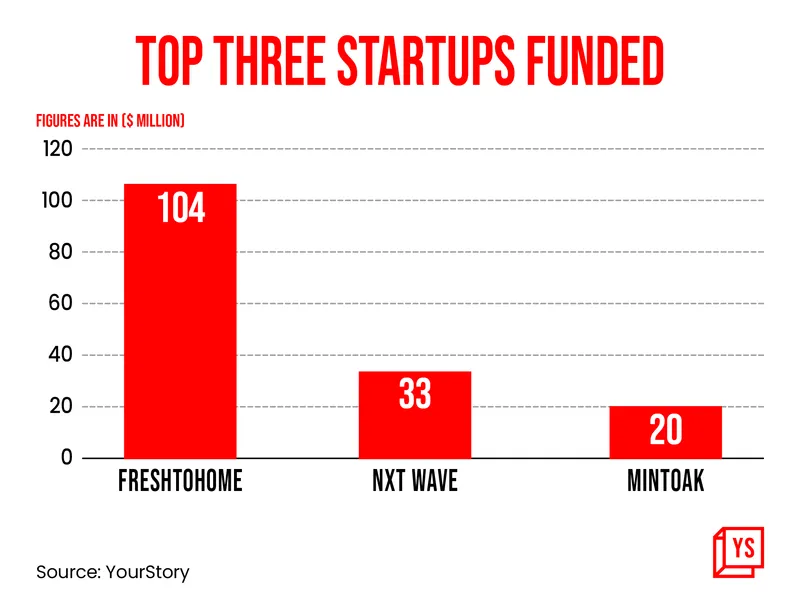

This week, the total venture funding stood at $221 million, boosted by the single deal of $104 million from the Bengaluru-based online fish and meat retailer FreshToHome. In comparison, the previous week saw venture funding of $304 million.

In the present funding environment, only category leaders or the top three startups in a segment are able to raise a substantial amount of capital. Companies including PhonePe and InsuranceDekho were also able to raise capital in excess of $100 million.

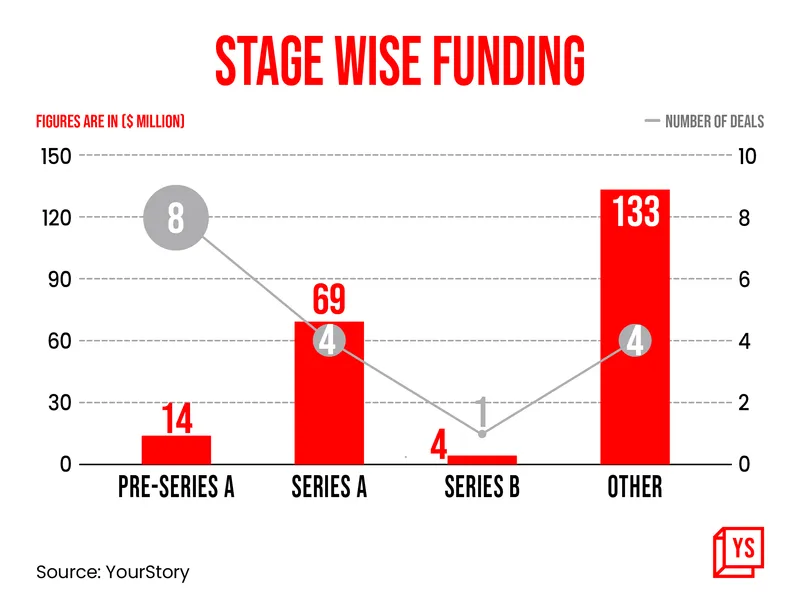

In the present funding environment, the early-stage category of investment is getting the maximum traction with small ticket deals. The situation is unlikely to change anytime soon as the macroeconomic indicators have not shown any sign of stability.

A report by Preqin showed that fundraising by venture capital firms hit a nine-year low in the fourth quarter of 2022. Investors put their money into 226 venture capital funds as compared to 620 funds in a similar period a year ago.

This is an indication of the tough times ahead for the startup ecosystem and the only option would be the path towards sustainable growth without burning too much cash.

Key transactions

FreshToHome, the fish and meat retailer, raised $104 million from Amazon Smbhav Venture Fund, E20 Investment, Mount Judi Ventures, and Dallah Albaraka.

Upskilling platform NxtWave raised $33 million from Greater Pacific Capital (GPC) and Orios Venture Partners.

Fintech startup Mintoak Innovation raised $20 million from PayPal Ventures, British International Investment, HDFC Bank, and Pravega Ventures.

Digital Twin solutions provider Intangles raised $10 million in a Series A round from Baring Private Equity Partners India.

Tech startup Scrut Automation raised $7.5 million from MassMutual Ventures, Lightspeed and Endiya Partners.

Web3 gaming startup Kartos Studios raised Rs 160 crore ($7.2 million) from Accel Partners, Prosus Ventures, Nexus Venture and Courtside Ventures.

Edtech startup AdmitKard raised Rs 50 crore ($6 million) from GSV Ventures and other investors.

![You are currently viewing [Weekly funding roundup Feb 20-24] Venture capital inflow declines in absence of large deals](https://blog.digitalsevaa.com/wp-content/uploads/2022/11/funding-lead-image-1669386008401-scaled.jpg)