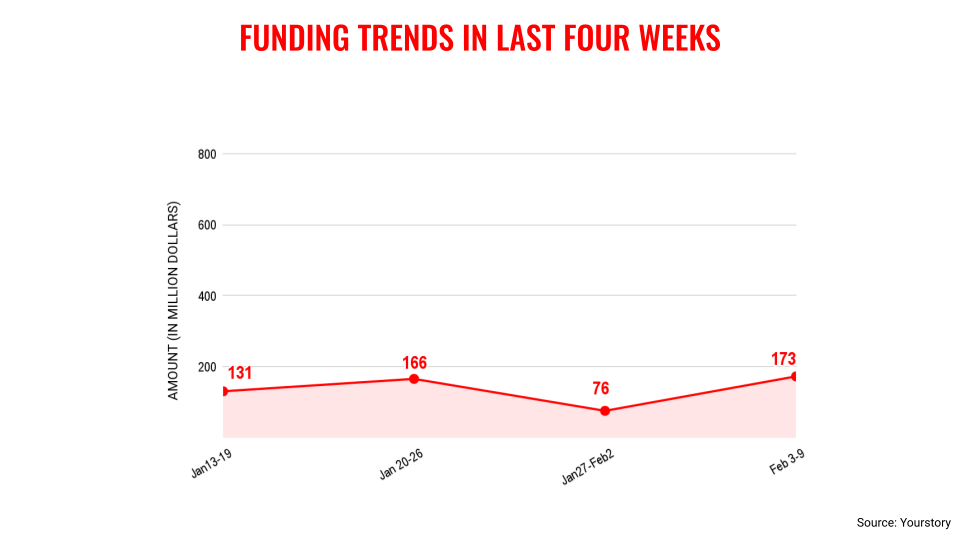

Venture capital (VC) funding into Indian startups sharply recovered in the second week of February, helped by a few reasonably sized transactions, after it dropped below the $100 million mark last week.

Indian startups raised a total of $173 million in VC funding from 29 deals in the second week of February. In comparison, the previous week saw a total funding amount of just $76 million.

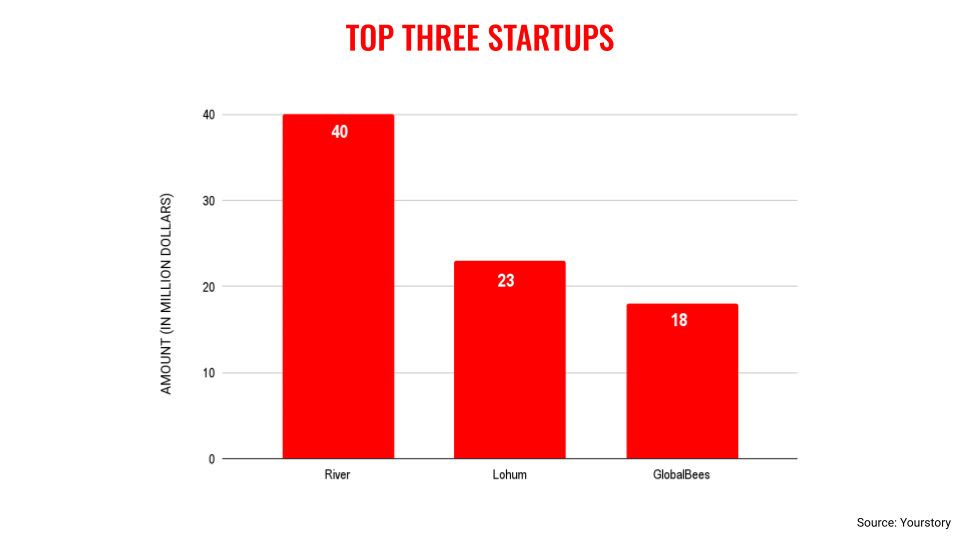

The week also saw a strong dominance of transactions from the electric vehicle (EV) segment.

VC funding came back into the familiar territory of around the $100 million-plus level weekly. In fact, the amount raised this week is the highest amount raised for 2024 till now.

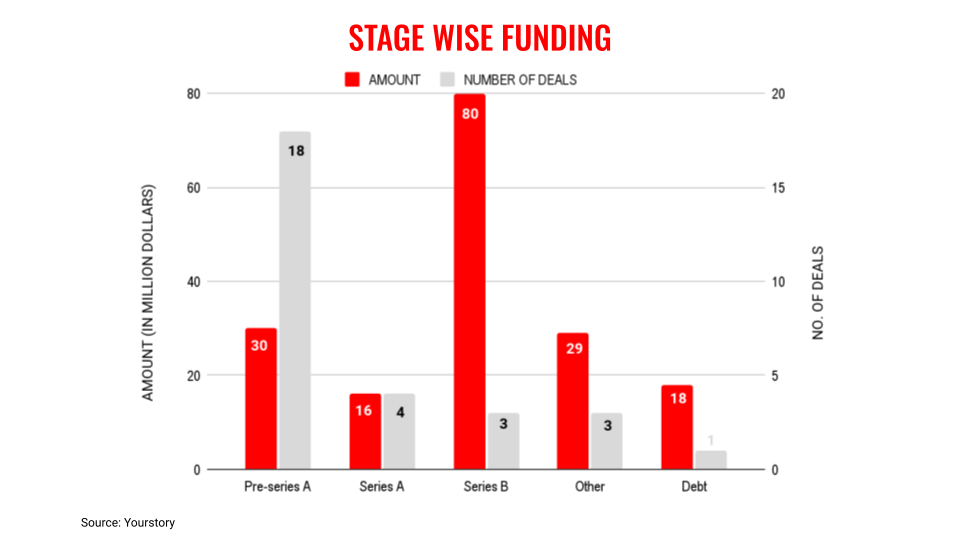

However, this is not a comforting element for the ecosystem as the growth- and late-stage deals are not seeing much traction. A majority of the early-stage deals, valued over $100 million, are providing the much-needed boost during the funding winter.

Any large transactions look unlikely, at least in the near future, as the overall macroeconomic environment remains unstable and central banks are not reducing the interest rates. Any reduction in interest rates will free up capital, and some portion will flow into the startup segment.

On the positive side, Indian startup companies like Zomato, Honasa Consumer, and Nykaa continue to churn out profits—a strong signal to the ecosystem that they are on the right track to building sustainable businesses.

Meanwhile, the troubles at beleaguered Paytm and BYJU’S continue and any positive resolution remains unclear.

Key transactions

EV startup River raised $40 million from Yamaha Motor Co, Al-Futtaim Automotive, Lowercarbon Capital, and Toyota Ventures.

EV-focussed NBFC startup Mufin Green Finance raised Rs 140 crore ($16.8 million) from a group of family offices.

Fintech startup focused on mobility segment OTO Capital raised $10 million from GMO Venture Partners, Turbostart, Prime Venture Partners, Matrix Partners, and 9Unicorns,

Home automation startup Keus Smart Home Automation raised Rs 100 crore ($12 million) led by OAKS Consumer Fund.

Creator-focused platform Wishlink raised $7 million from Fundamentum and Elevation Capital.

Metafin, a cleantech-focused NBFC, raised $5 million from Prime Venture Partners and Varanium Capital.

Edited by Suman Singh

![You are currently viewing [Weekly funding roundup Feb 3-9] EV segment boost startup funding in second week](https://blog.digitalsevaa.com/wp-content/uploads/2024/02/Weekly-funding-roundup-1670592545805.png)