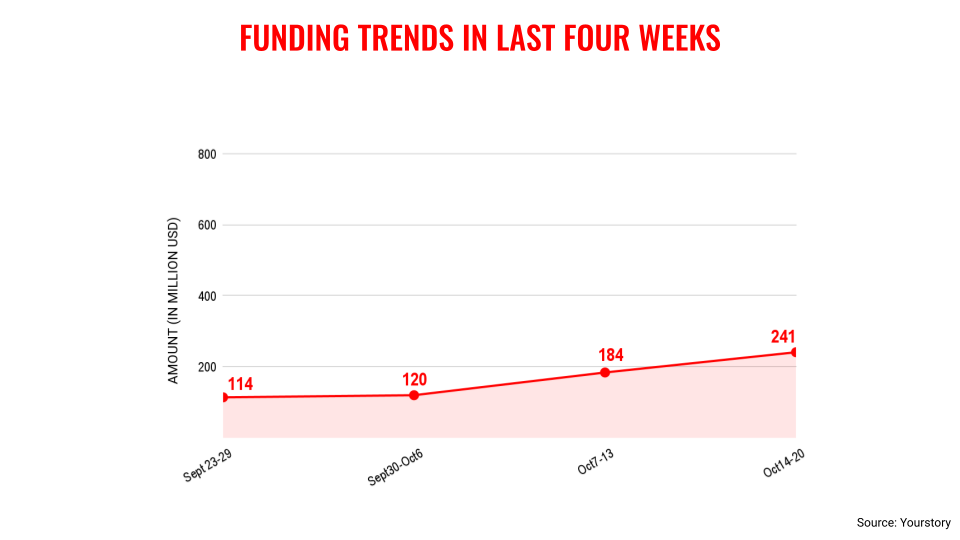

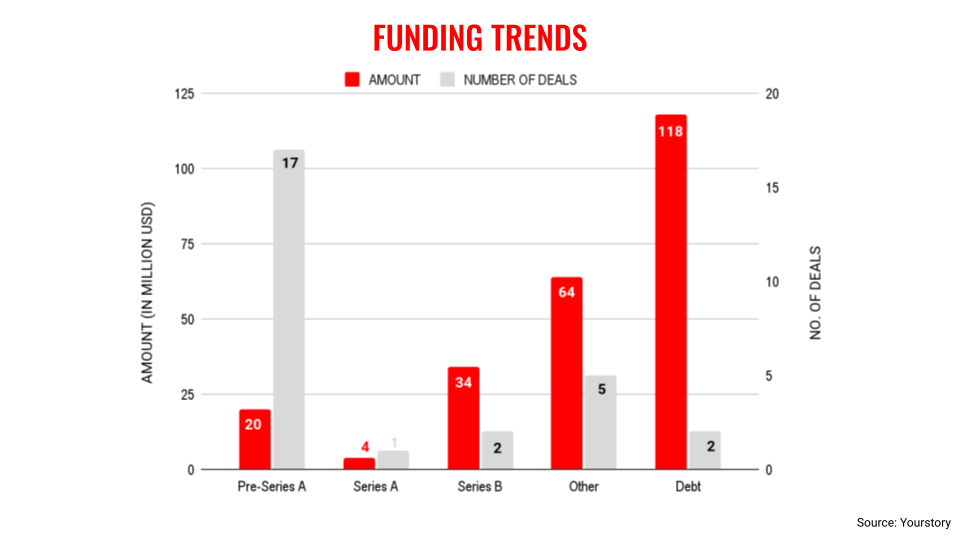

The month of October has turned out to be pleasantly surprising as venture capital inflow into Indian startups saw a steady rise largely due to a few reasonably sized deals that went into double digits.

The third week of October saw total venture capital funding of $241 million cutting across 27 deals. In comparison the previous week saw an inflow of $184 million.

This is the third week in a row that VC funding has shown a consistent rise—which is a breath of fresh air amid the ongoing funding winter as well as a surprise given that the last three months of the year generally witness subdued activity.

However, it remains to be seen if this trend will continue to persist for the remainder of the year.

There were also other positive developments for the Indian startup ecosystem as reports suggest that ecommerce sales during the festive season have picked up pace.

In a similar vein, fintech companies like Paytm and PhonePe have shown steady growth in revenues while reducing their losses.

However, the bottomline remains that the startup ecosystem is still not out of the woods in terms of VC fund flow or seeing growth coming back in full force. The hope is that 2024 turns out to be a better year.

Key transactions

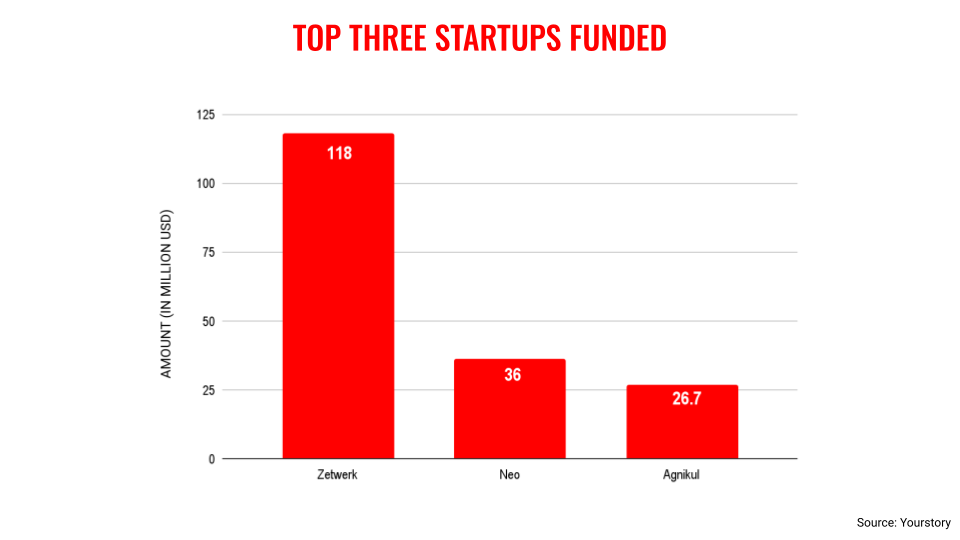

Manufacturing marketplace Zetwerk raised Rs 967 crore ($118 million) from Avenir Growth Capital and Footpath Ventures.

Neo Wealth and Asset Management, a part of Neo Group, on Wednesday said it has raised $35 million (around Rs 300 crore) in a funding round from Peak XV Partners.

Spacetech startup AgniKul Cosmos raised $26.7 million from Celesta Capital, rocketship.vc, Artha Venture Fund, Mayfield India, Pi Ventures, and Speciale Invest.

Logistics startup Freight Tiger raised $18 million from Tata Motors for a nearly 27% stake.

Freyr Energy, a solar energy startup, raised $7 million from EDFI ElectriFI, Schneider Electric Energy Asia Fund, Lotus Capital LLC, Maybright Ventures, and VT Capital.

Showroom B2B raised $6.5 million from Jungle Ventures, Accion Venture Lab, Saison Capital, and ICMG Partners, Strive, Gemba Capital, and Titan Capital.

BharatAgri, an agritech startup, raised $4.3 million from Arkam Ventures, Capria Ventures, India Quotient, 021 Capital, and Omnivore.

Edited by Kanishk Singh

![You are currently viewing [Weekly funding roundup Oct 14-20] Venture inflow shows a steady rise](https://blog.digitalsevaa.com/wp-content/uploads/2023/09/funding-roundup-LEAD-1667575602969-scaled.png)

![Read more about the article [Funding alert] Feminine hygiene products maker Sirona Hygiene raises $3M in Series A from NB Ventures and IA](https://blog.digitalsevaa.com/wp-content/uploads/2021/04/Imageluro-1618896553768-300x150.jpg)