Nandini YadavMay 21, 2021 12:51:54 IST

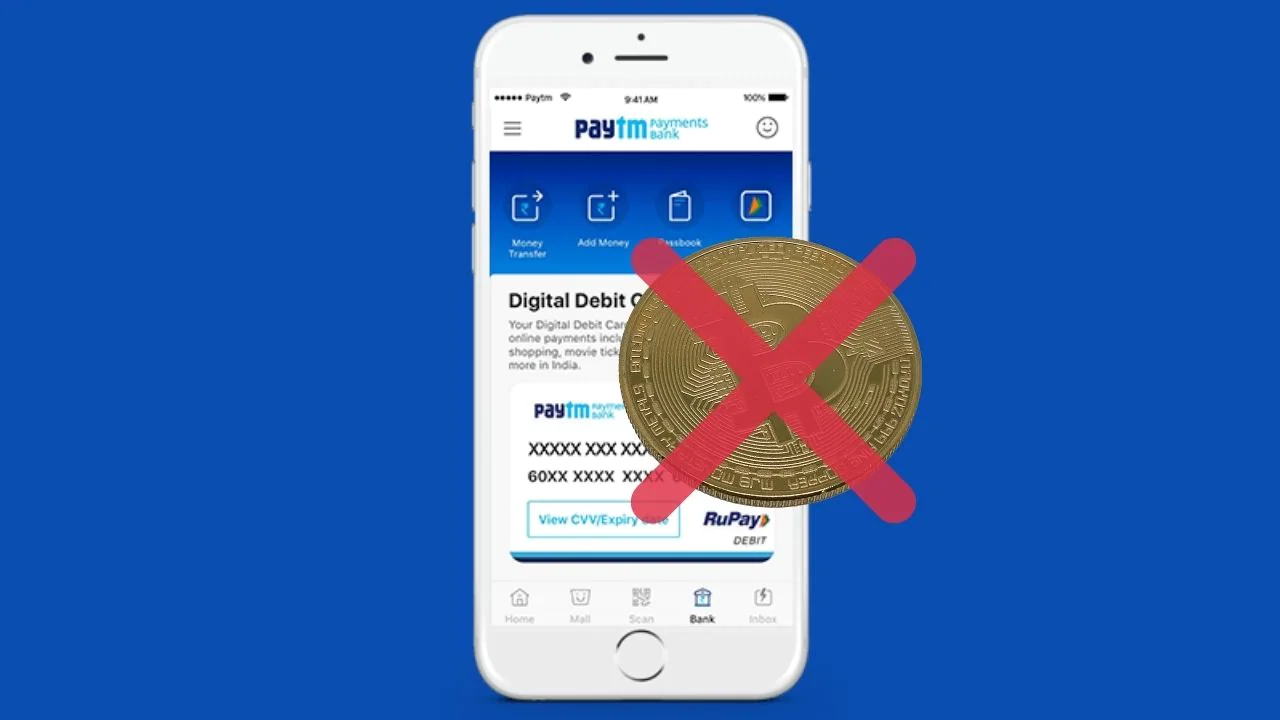

Paytm Payments Bank Ltd no longer permits users to purchase or sell cryptocurrency assets via its platform. This was further confirmed in a tweet by WazirX, a Bitcoin and cryptocurrency exchange, which announced on Thursday that it “will not accept INR deposits to Paytm Bank account from 11.59 pm IST tonight, 20 May 2021.” This comes after several other banks such as Yes Bank and ICICI Bank also ended association with cryptocurrency exchanges (such as WazirX and BuyUCoin) earlier this week.

While we work with our partners to add more INR deposit options, we recommend you to use WazirX P2P to buy/sell USDT with INR.

Thank you for your support! 🙏

NOTE: INR withdrawals will remain unaffected.

— WazirX: Bitcoin & Cryptocurrency Exchange in India (@WazirXIndia) May 20, 2021

Paytm Payments Bank has not officially announced the end of support for cryptocurrency exchange on its platform yet. It has also not clarified the reason for its stance. We reached out to Paytm, and have not yet received a response on the same.

In April 2018, the Reserve Bank of India (RBI) directed all regulated entities including banks not to provide services to businesses dealing in virtual currencies like Bitcoin, so as to protect consumer interest and check money laundering. The ban led to plummeting trade volumes and exchanges shutting their businesses.

However, in March 2020, the Supreme Court quashed the RBI ban and allowed banks to handle cryptocurrency transactions from exchanges and traders.

We reached out to WazirX co-founder Siddharth Menon, who said, “Some banks are still holding on to the old circular or don’t have any idea of how crypto works. This resistance is only from their compliance team. We have been reaching out to banks and educating them; we are making progress and hope things will be more positive in the coming weeks.”

“It’s unfortunate that India being in the forefront of fintech is restricting the crypto industry. WazirX is going to enable few more options to deposit starting today,” Menon added.

The Indian government is already working on the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, which is believed to bring a ban on all private digital currencies (cryptocurrencies) and promote regulatory framework to launch its own official Central Bank Digital Currency (CBDC) backed by the RBI. Reports suggest the CBDC will be named Laxmi Coin.

The Bill was to be tabled in Parliament’s Budget Session, but was deferred as the government continues to talk to stakeholders in the space.

In March this year, Union Finance Minister Nirmala Sitharaman had said the government will not “shut off all windows” for cryptocurrency. “We will allow a certain amount of windows for people to experiment on blockchain and Bitcoin,” she said.

(Also read: WazirX trading platform deals with outages as cryptocurrencies dip; opens floodgates for memes on Twitter)