- Digital lending has speeded up documentation and risk assessment at SIDBI

- Digital Prayaas platform gave small loans to 82,000 low-income entrepreneurs last year, 75% of them women

- Loans up to Rs 1 crore fully automated, and paperless now

- SIDBI’s GST Sahay platform boosts lending to GST-filing MSMEs, Udyam Assist boosts lending to non-GST-filing MSMEs

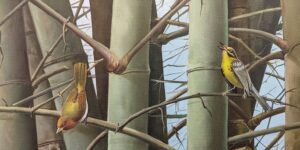

When I walked into the SIDBI office in Mumbai’s Bandra Kurla Complex, it felt like I was walking through an art gallery rather than a traditional financial institution. Various paintings and crafts, made by MSMEs that SIDBI funds, adorned the walls. Each mural and installation spoke to the potential of India’s artists. But despite the museum decor, the offices of SIBDI have this energy that can be best described as entrepreneurial. Driving this renaissance is Sivasubramanian Ramann, the chairman of SIDBI. He is a restless enabler, who wants to create a conducive environment for MSMEs–his prime customers.

Ramann is not the corner-office chairman that I have encountered in the past. He is on the field, his ear on the ground listening to his customers. Under his leadership, SIDBI wants to transform the way MSMEs approach credit. He wants to adopt a digital-first model.

“If you ask me, SIDBI is already a fintech. We are doing all our lending only through fintech,” says Sivasubramanian Ramann in an exclusive interview with YourStory.

Sivasubramanian Ramann, Chairman, SIDBI

Ramann is no stranger to tech-driven administration. Before joining SIDBI in April 2021, he was MD and CEO of the National E-Governance Services (NeSL). With a 1,100 strong workforce, Ramann believes that the best way to do this job is digital.

Direct lending at SIDBI, which makes up 10% of its total lending, stands at Rs 20,000 crore today. These loans help micro, medium and small manufacturers of products, including auto parts, ceramic tiles, and glass lamps access the working capital they urgently need. What is fascinating is that 100% of that direct lending is digital now.

Although MSMEs have been touted as the growth engine of the Indian economy, many still struggle to get access to credit because they are largely informal, lack records to prove creditworthiness, and are not always aware of loan opportunities. SIDBI, as the umbrella body for SME lending, is helping bridge that gap by embracing digital tools. These moves are letting it bring more borrowers in more centres across the country into the formal fold.

For instance, through its Digital Prayaas lending platform, rolled out in 2021, it gives loans typically of Rs 1 lakh-Rs 3 lakh to low-income entrepreneurs at the bottom of the pyramid. Of the 82,000 borrowers in this scheme last year, 75% were women. “As a development financial institute, we are supposed to be taking risks, we are supposed to be going out there and doing different things,” Ramann says, in the exclusive interview.

Faster access to working capital

Even for loans up to Rs 1 crore, SIDBI has now switched to automated appraisal, with a completely paperless process, all the way from application to documentation. “We’ve triangulated the GST, the ITR, and the bank statement, plus we’ve got the credit score from SEBI and the credit bureaus. So put those data points together and we can assess 85% of the risk in less than half an hour.” At the start of the financial year 2023, SIDBI rolled out the service for existing and new customers and Ramann says it has seen a good amount of traction.

The procedure will be further fast-tracked after it adds an account aggregator, which can bring together the bank statement, GST, and other data. In the case of existing customers, loans are already processed faster as the lender knows who the management is and has dealt with them. With new customers, there are additional checks at the facility to confirm the facts presented in the documentation.

Not only that, but SIDBI is also encouraging more MSMEs to get on the books. GST Sahay is one of its brain waves for speeding up working capital loans. The invoice-based financing app lets startups and NBFCs borrow based on unpaid invoices between Rs 10,000 and Rs 3 lakh. This can benefit about 1.5 crore GST-filing MSMEs. Because invoices tend to include GST details of the MSME’s suppliers, SIDBI is able to quickly assess those transactions and disburse loans.

Formalising the informal

The lender is also making use of the data gathered by its partners on the ground — including microfinance institutions (MFIs), non-banking financial companies (NBFCs), and banking correspondents (BCs) — to inform its own lending decisions.

SIDBI’s partners on the ground are also using data gathering and analytics to bring more viable loan candidates to light. “We have one digital partner who goes around with a handheld device in places where the businesses are located and puts in the data. There is another company which has mined the national sample survey office (NSSO) data, to say what is roughly the average income in different industries in each pin code.”

Ramann estimates there are between 6 crore and 7 crore non-GST filing MSMEs in India. To help them access credit, SIDBI launched the e-Udyam registration. As part of it, banks and MFIs, which have touched the population of non-GST businesses, are collaborating to connect their data to SIDBI’s system. “We’ve run a programme telling partners to hit our digital system through their digital system, and we will then vet the data. If it is clean, we map it with the requirements of Udyam, push it to the MSME Udyam portal, and get back with the Udyam certificate,” Ramann says.

“This is helping MSMEs get onto the digital system and have valid numbers,” he observes. That goes on to make them better eligible for credit, non-credit subsidies, and schemes. “So you are now really seeing the formalising of previously informal, non-GST entities.”

With these additional digital checks being brought into the system, Ramann says, SIDBI and other lenders can make better decisions.

![Read more about the article [Startup Bharat] Kochi-based Incoff helps businesses and teams connect with coworking spaces](https://blog.digitalsevaa.com/wp-content/uploads/2021/02/imageonline-co-logoadded6-1613452002584-300x150.jpg)