Just when the mobility business was recovering from the pandemic-induced slowdown that began in March 2020, startups in the space are once again facing headwinds. With the deadly second Covid-19 wave forcing state governments to impose curfews across the country, several thousand drivers have defaulted on their vehicle EMIs.

The financiers ( Banks and NBFCs) who had extended loans to drivers for purchasing these vehicles have now impounded them and are likely to sell in the second-hand vehicle market to recover their cost. The situation is a double whammy for cab aggregators such as Uber and Ola, and shared mobility players including Bounce, VOGO, Yulu, Drivezy, and Zoomcar.

They now will have not just less vehicles on roads but will also find it difficult to attract driver-partners and financiers in future to do business with them.

According to a large second-hand car retailer that Inc42 spoke with more than 30K-35K cabs belonging to both Ola and Uber have been impounded by banks and NBFCs, after drivers defaulted to pay EMI even after financers provided extended moratoriums. The second-hand retailer wanted to remain anonymous as he wasn’t allowed to publicly disclose details of impounded cabs to the media.

Tanveer Pasha, president of the Ola, TaxiForSure and Uber (OTU) Drivers’ Union in Bengaluru told that around 25,000 vehicles belonging to both Ola and Uber in Karnataka purchased via bank and NBFC financing have been impounded by financiers.

Shaik Salauddin, the national general secretary of the Indian Federation of App-Based Transport Workers (IFAT) also confirmed that more than 6,000 cabs in the state of Telangana were impounded by financiers as drivers were unable to pay EMIs in the last 6-7 months. Salauddin also pointed out that around 497 Ola Uber Drivers across the country have tested positive for covid-19, and that around 5 drivers have lost their lives to date, according to IFAT’s official count.

Ola currently operates a standalone leasing unit that allows its drivers to borrow taxis at cheaper interest rates. To avail the facility, drivers are required to make an initial deposit as well as monthly instalments for a period ranging from three to five years. Since its inception in September 2015, Ola had pumped in millions of dollars into the unit to ramp up the supply of vehicles on the road.

Ola’s biggest rival Uber also has a leasing unit in India which was launched in December 2015. Uber drivers have to pay $462-$539 (INR 30,000 – INR 35,000), to be part of the leasing programme and are then required to make monthly lease payments with an option to own the vehicle after three years. Although Uber’s leasing unit is currently operational in India, it had earlier shut down the leasing business in its home market in the US owing to steep losses.

In a response to Inc42’s queries, Uber said that it has announced various healthcare and social security benefits for its drivers. “We announced an INR 18.5 crore ($2.5 Mn) initiative to compensate the first batch of 150,000 Car, Auto and Moto drivers on the platform for time spent in getting their shots. Since the early days of the pandemic, Uber has been providing financial assistance for up to 14 days to drivers who are diagnosed with COVID-19, or have been asked to self-isolate by a public health authority,” said an Uber spokesperson.

During the first quarter (Q1 FY22) earnings, company CEO Dara Khosrowshahi highlighted that Uber’s core-mobility business in India is ‘adversely affected’ due to a steep rise in Covid-19 cases and the company’s priority is to bring back the drivers that have left the platform owing to the lockdown and the safety concerns.

“One of our top priorities is to rebuild the driver base. Our research shows that drivers who left the platform last year primarily did so for two reasons; concerns about safety and concerns about there being enough rider demand,” the chief executive said.

Ola did not respond to an email seeking comments. However, a person close to Ola’s operations told Inc42 that only 2,000 cabs were taken off the roads ever since the lockdown due to “wear and tear” as taxi operators are mandated by regulators to hive-off cabs after six years of usage.

How Bad Can 2021 Get For Mobility Players?

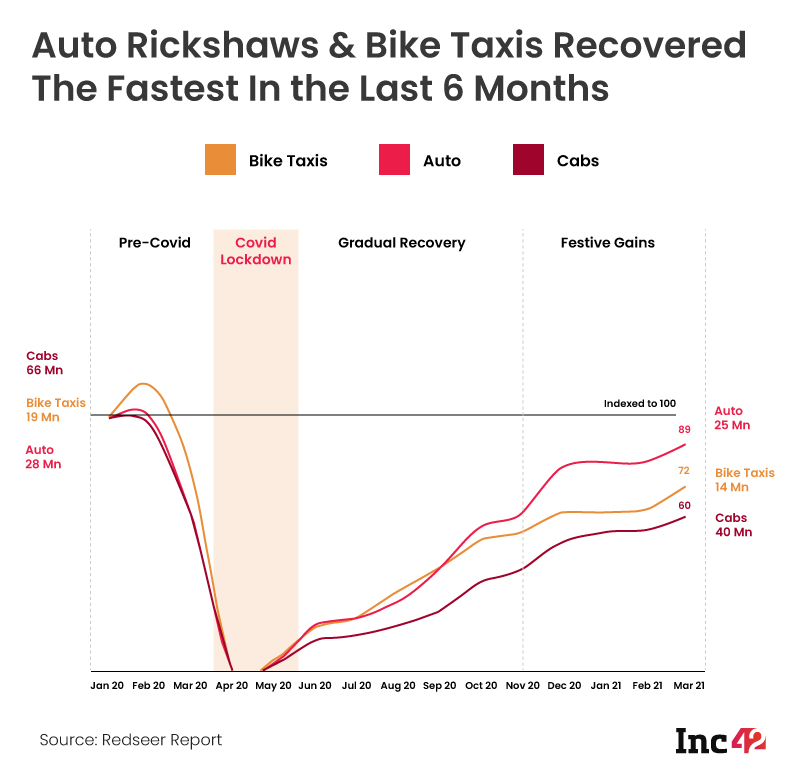

According to estimates from management consulting firm Redseer, mobility startups including app-based aggregators and shared mobility players had a peak demand of around 113 Mn monthly rides as of February 2020, which plummeted drastically to below 10 Mn monthly rides during March, April and May 2020.

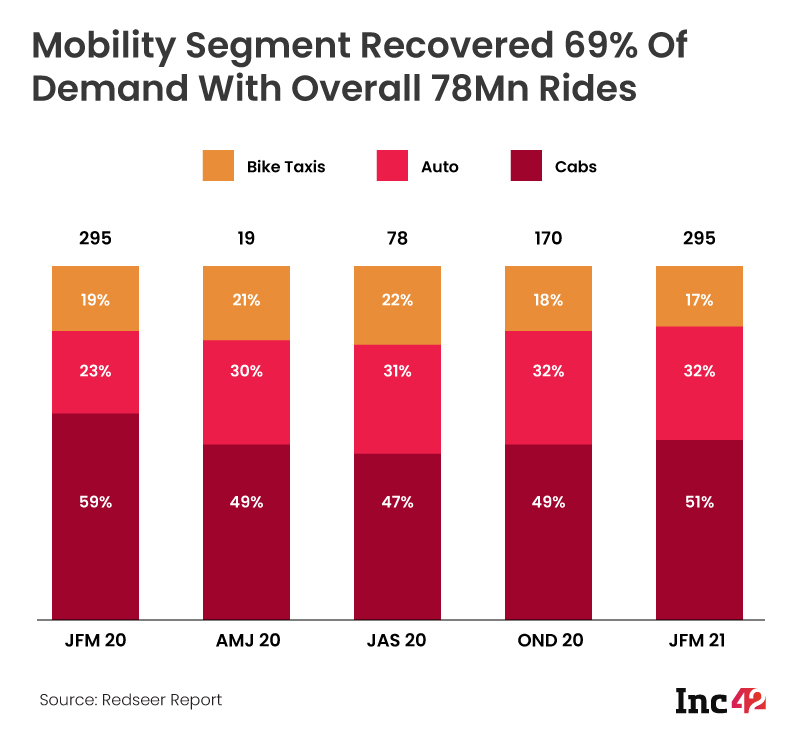

These rides include the demand data aggregated from form factors including Auto Rickshaws, Cabs, and bike taxi platforms. These form factors, however, recovered 69% of the ride demand compared to the pre-covid level with an overall 78 million rides by January 2021. Even though the mobility segment depicted a sharp U-shaped recovery, experts and founders in the space that Inc42 spoke with say that the segment will have to once again prepare for a steep fall in demand.

Redseer’s report shows that although app-based cab rides have recovered significantly to around 40 Mn monthly rides as of March 2021, a downward trajectory is expected in the next few months, as people continue to stay indoors in worst-affected states like Maharashtra, Delhi, UP, Karnataka, and others.

Auto Rickshaws on app-based aggregators such as Ola and Uber, reported the highest ridership (among cab and bike taxis) clocking 25 Mn rides in the reported period. “However, it has still not recovered completely as compared to the pre-Covid days. The trend (of autos recovering ridership) continues as it poses lower risks of contracting the virus,” added Redseer in its report.

Shared Mobility Startups Tread Carefully

Last year, when the Indian government declared a nationwide lockdown in the month of March, leading shared mobility players including Bounce, VOGO, Zoomcar, and Drivezy were forced to sell their vehicles due to a literal zero-revenue crisis. Bike-sharing startups were the worst affected in terms of the number of two-wheelers that they had to liquidate.

In December 2020, Bounce’s chief executive officer Vivekananda Hallekere confirmed with Inc42 that the startup did have over 25,000 vehicles before March 2020, but had to liquidate more than 50% of these vehicles due to diminishing demand. The startup is currently aiming to convert its entire fleet into electric vehicles, which is much cheaper to operate on a shared mobility model when compared to petrol vehicles.

Bounce, which operates on a dockless scooter-sharing model, used to clock around 100,000-120,000 daily rides a day before last year’s nationwide lockdown affected demand. The startup then had to go through two rounds of layoffs, effectively firing close to 50% of its workforce to keep costs in check. Bounce even received all the required regulatory approvals for its retrofitted electric scooter in November 2020. However, it’s unclear how many EVs the startup has currently deployed. Bounce refused to participate in the story and did not respond to a questionnaire seeking comments.

Bounce’s closest competitor VOGO also cut its fleet size last year, although the total number of scooters liquidated wasn’t public. Speaking to Inc42, VOGO’s chief executive officer Anand Ayyadurai said that the impact of the fresh round of lockdowns on its ridership is lower when compared to last year when there were stricter lockdown restrictions. VOGO, which is currently operational in Bengaluru and Hyderabad has seen a 15-20% dip in daily ridership, Ayyadurai said.

“We didn’t see any impact on our two-wheeler rental business until the second week of April in our operational cities. Although there is a 15-20% drop in demand, only in two cities (Bengaluru and Hyderabad), the situation isn’t like last year when demand literally went to zero and we had to rebuild the business from scratch,” explained Ayyadurai.

He also pointed out that food delivery and other gig economy workers currently contribute 30% to the demand for VOGO, which has remained consistent throughout the last year.

Focus On Cutting Down Debt

It is important to note that many startups in the shared mobility space such as Zoomcar, Drivezy, Bounce and VOGO, had earlier taken loans from non-banking financial companies (NBFCs) and private banks to finance procurement of vehicles, prior to 2020. Most of this was classified as debt on their balance sheets. Although a moratorium on these payments (offered by banks and NBFCs) along with the liquidation of vehicles helped mobility startups to meet the debt obligations, firms are still facing tight liquidity.

These startups were well-financed to meet these debt obligations last year, but an extended lockdown in many states due to the ongoing health crisis, coupled with the unpredictability of demand revival is a major cause of concern for these players.

Speaking to Inc42, car-sharing platform Drivezy’s spokesperson Ankur Sengupta said that the startup has now paused adding vehicles financed via debt on its fleet, and has instead moved to a complete franchise model to add supply of vehicles. Under the franchise model, tour and taxi fleet operators, and other vehicle fleet owners attach 4-wheelers with Drivezy on a revenue share basis, allowing the startup to offset the cost of ownership.

“Prior to covid, our outstanding debt on vehicles was at $9 Mn. We have now brought this down almost by 70-80%. We only retained around 20% of these vehicles. Hence currently we have an outstanding debt of just $2Mn -$3Mn left on our books, which had contributed to a major part of the burn rate after the lockdown,” Sengupta added.

He also pointed out that moving to a complete franchise model has helped the startup stay afloat without taking a significant hit on the balance sheet since only 20% of its vehicles are currently owned and operated by Drivezy. However, Drivezy had liquidated a significant number of vehicles to meet debt obligation and other payments.

Prior to last year’s lockdown, Drivezy had more than 14,000 two-wheelers on its shared mobility fleet across 11 cities but had to cut this down to 4,000 bikes, allowing it to keep expenditure under check. Sengupta said that Drivezy also moved some of its vehicles (two and four wheelers) away from metro cities, and distributed them into tier-2, and tier-3 cities such as Hubli, and Mysore where lockdown restrictions are less stricter.

Prior to the ongoing lockdowns in many states, Drivezy used to generate around INR 5,000 per month on an average from a Honda Activa scooter. This number has now reduced to around INR 3,500-4,000 per month, according to Sengupta. On the other hand, 4-wheeler rentals depicted a reverse trend: Prior to the nationwide lockdown last year, a hatchback like Maruti Swift helped Drivezy generate around INR 45,000K-50,000 per month but this went up to INR 75,000-80,000 per cab during the months after reopening of the economy.

“Keeping in mind app-based cab-hailing was unable to operate in many cities even after unlocking, and due to behavioural shift to personal mobility options, we saw a massive increase in customers booking vehicles for a long term — up to 2 to 3 months,” added Sengupta.

Drivezy’s closest competitor Zoomcar had also earlier acquired cars on its platform via debt money but refused to comment on the story regarding how it is managing outstanding debt payable to its lenders. Zoomcar also did not respond to an email seeking comments. Besides, the refund issues of the company on the customer front have been reported multiple times.

While there are talks of a nationwide lockdown to control the second wave, just like 2020, many political leaders are vetoing it to safeguard the economy. Instead, there are demands of targeted lockdowns in containment zones. The state of the mobility sector will depend upon how the lockdown debate pans and how these companies make shifts in business models. Whatever be the case, mobility startups have a tough journey ahead.