Unacademy One is a content-focussed acquisition strategy for its core test prep product

Unacademy is lending its full brand weight to these channels and ‘owning’ the channel to a greater extent than its existing channels

Unacademy is looking to emulate what has worked for other startups such as PW, Josh Skills

After months of headlines about layoffs, cost-cutting, poaching, rejigs and more controversies, edtech giant Unacademy looked to turn a new leaf with the launch of Unacademy One, a content-focussed acquisition strategy for its core test prep product.

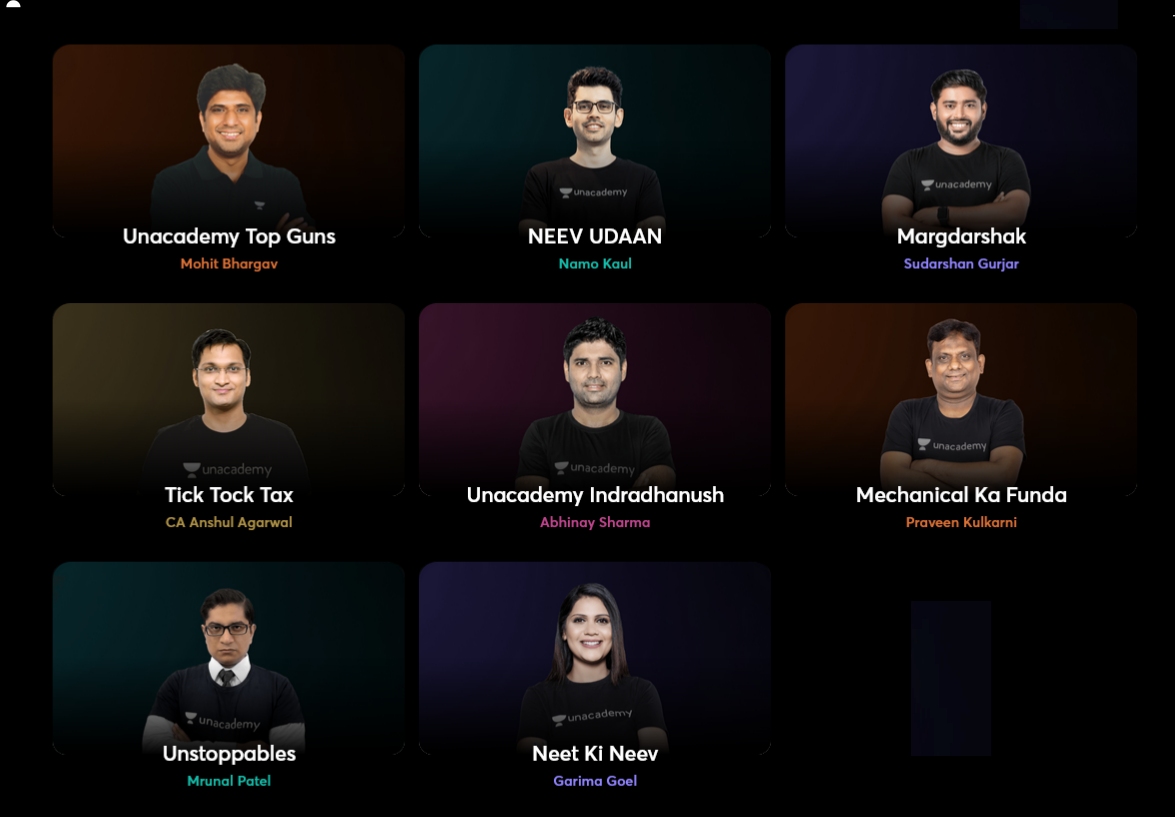

Unacademy One is not a product or platform, but rather seems to be a unified funnel into Unacademy’s various online (and offline) learning products. It’s a collection of 50 YouTube channels built on Unacademy’s existing content buckets for test prep as well as newer categories such as taxation, student life, inspirational stories from learners and top rankers and more.

It must be noted that we could count 26 channels listed on the Unacademy One website, so the other channels may be launched at a later date.

New Funnel Into Unacademy

While Unacademy has always used YouTube to drive acquisition and conversions for its paid learning product, this is the first time that Unacademy has expanded the content universe under its branding.

So far, Unacademy has acquired channels run by educators (Handa Ka Funda, being one example) and let them run under their original banner with links and promo codes bringing learners to the Unacademy app.

But these channels still do not look like Unacademy-owned channels because they seem to be run by the educator and not Unacademy. Now, with this diversified approach, Unacademy is banking on its brand power to reduce the reliance on the educator’s brand — more on this later.

The clearest example of this change is the names of the channels, which are generic in nature rather than being named after educators. For instance, the channels related to NEET UG and JEE tests are named Neev Udaan, JEE QBank, Flash Learn, Life after IIT, which could evolve to be standalone channels with newer educators in the future. Similarly, the UPSC-related channels are named UPSC Unstoppable, Unacademy Margdarshak, EduQuest, IAS Icons, Tick Tock Tax and The 99 Percentile club.

The videos on these channels also differ from a typical edtech video which primarily features the educator. EduQuest, for example, breaks down complex current affairs concepts such as income inequality, online misinformation among others through animated videos and graphics.

Why Unacademy One?

In many ways, Unacademy is lending its full brand weight to these channels and ‘owning’ the channel to a greater extent. The obvious implication of this is that the brand connect and engagement will likely be very strong at the top of the funnel, which could boost conversions to a certain degree.

As for the reasons for this particular approach, the developments at Unacademy this year point to two major factors.

The first is simply streamlining customer acquisition and reducing costs thereof. With 50 new channels, Unacademy is looking to emulate what has worked for rival startups such as PW. The fellow edtech unicorn has around 20 individual YouTube channels, which are all PW branded.

Similarly, Josh Talks and Josh Skills have over a dozen YouTube channels for customer acquisition. As Josh Skills cofounder Supriya Paul told Inc42 in May this year, learning from YouTube content consumption and conversion patterns, allowed the company to reduce the CAC to zero.

The second reason is that Unacademy’s brand is undoubtedly more durable than an individual educator. The poaching controversy in 2022 involving Unacademy and Allen Career Institute is a clear example that banking on teacher brands can prove to be fickle.

While Unacademy has managed to grab some of Allen’s top teachers in Kota and other student hubs, the situation could easily be reversed in a couple of years. The Unacademy One channels do not rely on the brand name and images of the educators. Even though these very educators are responsible for the content, the Unacademy branding is more prominent.

Unacademy’s Profitability Problem

The big question is whether this will solve the challenges related to customer acquisition cost and profitability in the edtech business. While views and watch time can be driven organically once there are enough subscribers, YouTube promotions in the initial days for 50 new channels will involve considerable marketing and promotional spends.

As it looked to restructure, cut expenses and rationalise its operations, Unacademy laid off around 1,000 employees (including teachers) over three phases. While the edtech unicorn is yet to file its FY22 financials, its expenses had shot up significantly in FY21. Overall expenditure rose to INR 2,029.9 Cr with employee benefit expenses growing over 6X to INR 748.4 Cr from INR 119.7 Cr in FY20.

Salaries and wages accounted for INR 196.3 Cr of the employee benefit expenses. Net loss rose 5X to INR 1,537.4 Cr in FY21 from INR 258.6 Cr. The company spent INR 5.1 to earn every rupee in income in FY21, whereas it spent INR 5.96 to earn a single rupee of operating revenue in FY20.

In the past couple of years, Unacademy had increasingly positioned itself as a super app for edtech with a number of offerings. But marketing, driving traction and retaining users in each of these verticals remained a big problem.

Besides this, Unacademy over-leveraged experiments to launch products such as Relevel, Cohesive, Graphy and others, which are not related to test prep. Many of these have their own sets of problems and also require capital to scale up. However, the YouTube-centric approach is certainly less costly to grow and scale up given India’s robust YouTube ecosystem.

Now Unacademy One is once again focussing on its initial proposition and in many ways going back to its YouTube roots. Will this solve the edtech giant’s profitability puzzle?