In 2021, online travel aggregator Cleartrip became one of COVID-19 pandemic’s many casualties. Travel bans across the world meant OTAs could not find business. In April of that year, ecommerce giant Flipkart acquired the company for an undisclosed amount.

For the financial year 2020-21, when the pandemic had disrupted the travel plans of many, the company’s revenue was at $14.6 million, a steep 67% fall compared with the previous financial year, according to data from Tracxn.

Cut to 2023, more than two years after its acquisition, Cleartrip says it has been recording a 2X growth in business on an annual basis and expects this momentum to continue in the near future as it expands into newer categories.

Its ultimate goal is to become a travel superapp, the company says.

Ever since its acquisition, Cleartrip says it has focused on three areas: customer service, design and technology, and its expanding portfolio.

Cleartrip believes there is much more it can offer to the Indian traveler as there are many of their needs which have not been addressed by the OTA players.

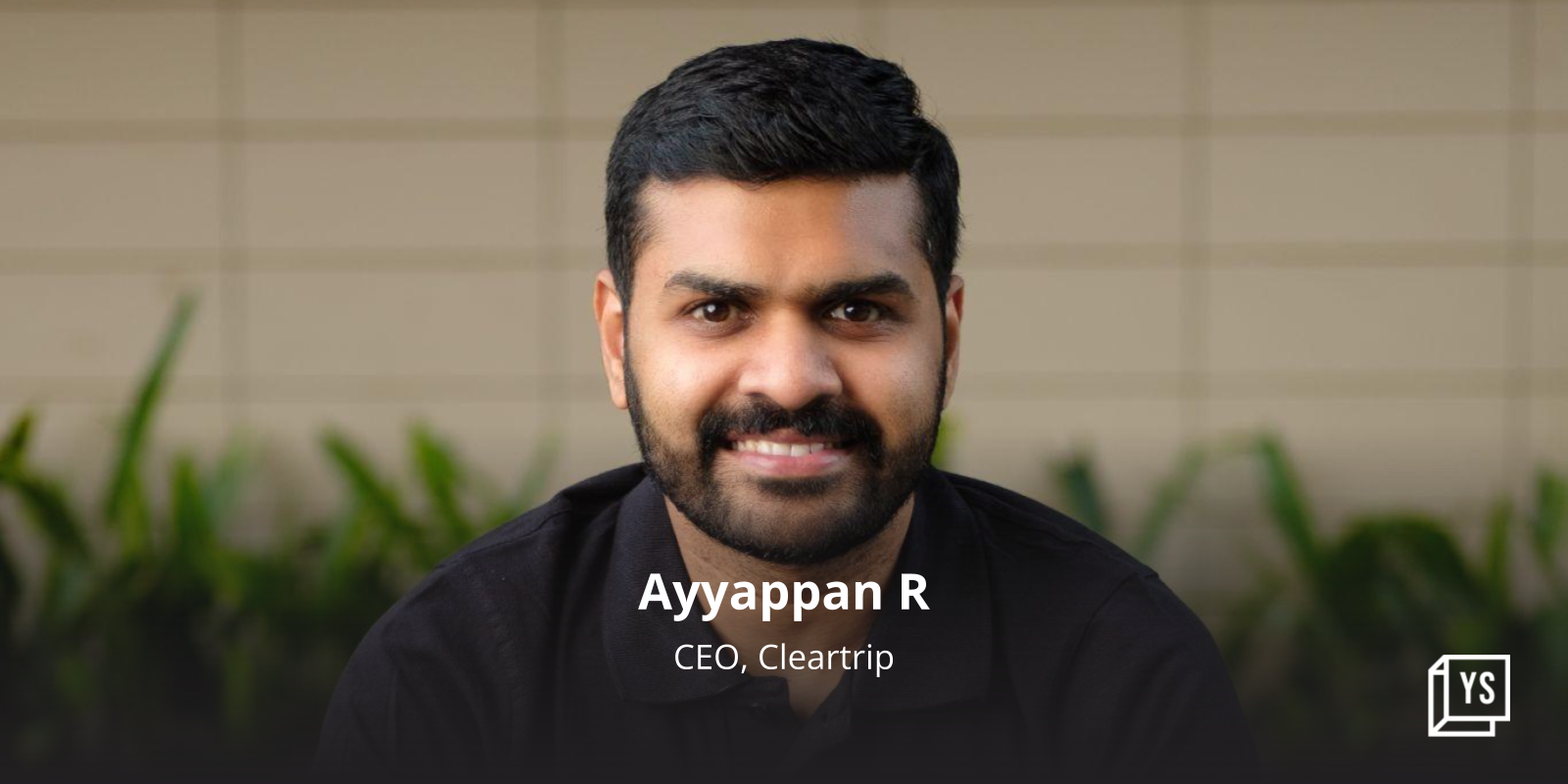

“Existing OTAs have solved for searching and buying but not for browsing and buying and this is a big market,” Cleartrip CEO Ayyappan R told YourStory.

He further explains OTAs are largely transactional in nature where people come online when they have already decided where they want to go and finish their bookings. Cleartrip aims to change this model where it becomes a discovery platform where people can browse for destinations, get content, make their plans, and finally book tickets.

Industry outlook

Fortunately for Cleartrip, the travel industry is expected to get back to the pre-pandemic levels of business by the end of this year.

According to Mordor Intelligence, India’s online travel market size is expected to grow from $15.60 billion in 2023 to $25.69 billion by 2028 growing at a compounded annual growth rate (CAGR) of 10.49% during this period.

A study by the Federation of Indian Chambers of Commerce and Industry says that the Indian travel industry will grow from a size of $70 billion in FY20 to $125 billion in FY27.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

The overall penetration of the online segment in India’s travel market is at around 25%.

Customers in India have an eclectic choice when it comes to making travel arrangements, with online bookings being in demand for certain categories, while not as popular for others.

In the domestic airline market, the industry estimates that the split between online and offline is around 50:50. Interestingly, the difference is wider when it comes to international air travel. Here the online penetration is 25% and 75% is through the offline route.

Online penetration in bus travel is only about 20% compared to 80% of bus bookings conducted offline. However, in the case of train journeys, 80% of the bookings are done online thanks to the government-owned agency—IRCTC.

As far as hotel bookings go, around 75-80% of such transactions are still conducted offline.

Expansion

Given the complex nature of the travel booking market in India, Cleartrip believes it has much more to offer for travelers, especially those in the 18-36 years of age demographic.

According to Ayyappan, this section of the population is much more adventurous about travel and hungry to discover new destinations.

“The needs of this customer group have not been addressed by anybody and we are confident that this is something which can be disrupted,” says Ayyappan.

Over the last two odd years since the acquisition by Flipkart, Cleartrip has brought about several changes in how it operates.

First, the company has sharpened its focus on user experience. “For us. everything else takes second precedence when it comes to customers,” Ayyappan says.

As part of this new strategy, customers are getting refunds in about 24 hours, access to flexible travel itineraries where they can make changes to their plans without worrying about cancellations and better call centre services for a quick resolution to problems.

“We want to make that planning and booking activity such a joyous moment for a customer that they should not worry about anything,” says Ayyappan.

Second, Cleartrip has been constantly innovating its product in an attempt to make it simple and easy to use for the customers. The company says it has invested in bolstering its technology backbone as it has to integrate hundreds of other entities connected with the travel industry to provide a richer experience for the end customer.

“Everything we do one has to work backwards from the angle of what the customer wants,” Aditya Jalan, Senior Director – Product, Cleartrip, says.

Prior to the acquisition by Flipkart, Cleartrip was largely a site for flight bookings and a certain amount of hotel accommodations but now it has been adding newer categories. It has expanded its hotel portfolios and also bought bus bookings on its platforms.

“We want to be across every single travel node and this will be built over a period of time,” Ayyappan says.

For Walmart-backed Flipkart, Cleartrip has helped diversify its services. In Q1FY24, the ecommerce company started offering bus reservations through its Cleartrip platform, a move that has helped its topline.

Value philosophy

Affordability, vital to a price-sensitive market like India, is one of the key business philosophies of Cleartrip.

“Value for us is how can we offer you the same product at a much lower cost or if we are offering a product at the same cost as the market what else can we offer you,” Karthick Prabhu – Head of Strategy, Cleartrip says.

Cleartrip has introduced flexible financing plans for its customers which include installment-based payment or the buy now pay later scheme.

The leadership team at Cleartrip stressed the influence that Flipkart had on its operations. As Ayyappan puts it, “When Flipkart evaluates an industry to enter we look at how there are any needs of the customers that have not been solved as yet.”

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

This would mean providing the largest selection of products or services for the customers which gives better value and experience for them.

The other aspect of Flipkart’s influence is how to build scale within the organisation and target a market opportunity that is very sizeable.

In addition, Cleartrip also wants to tap into the 450 million plus customer base of Flipkart who could possibly look at fulfilling their travel needs through them.

Given that flight booking forms the core of the business, Cleartrip has strengthened its hotel portfolio. It also launched bus services early this year and claims it has an inventory of 10 lakh connections.

“We want to be in every aspect of the travel business and there will be many more launches in the coming quarters,” says Ayyappan.

Growth

Given the growth momentum that Cleartrip has experienced over the last two years, it expects this momentum to continue.

“We do not see this growth tapering and it will be the bare minimum that Cleartrip will be doing if not higher,” says Ayyappan.

Though the company would like to clarify that its growth aspirations will not be just for growth’s sake but an important metric will be the high net promoter score, which is a barometer for customer satisfaction.

“Customers will not come to Cleartrip after deciding where they want to go. People will be coming to us to decide on where they want to go,” says Ayyappan.

Edited by Affirunisa Kankudti