The year 2021 has been a spectacular year for initial public offerings (IPOs), with Rs 1.03 lakh crore ($13.9 billion) raised over 51 issues until end-November. Among these, a sizeable number of Indian tech startups have also hit the capital market with IPOs.

Starting with Zomato, the list includes top startups like – CarDekho, PolicyBazaar, Nykaa, Paytm, and Freshworks (though listed on NASDAQ), while healthtech unicorn Pharmeasy and logistics tech unicorn Delhivery have filed the regulatory draft red herring prospectus (DRHP) which means that they would be hitting the stock exchanges soon.

On the bright side, these rising IPOs play a significant role towards creating wealth for the said startups, its employees, investors, and host of other stakeholders.

As Ajay Thakur, Head of BSE SME and Startups, at the Bombay Stock Exchange (BSE) says, “The listing of Nykaa and Policybazaar is a very encouraging sign. We are seeing the risk appetite of investors increasing and if the market has to grow, it has to be with old and new economy together. Many startups which have turned into bigger companies will try to explore the mainboard of the exchange.”

He also adds that startups getting listed with oversubscribed IPOs, and that are trading at a premium will also motivate other peers in the startup ecosystem.

However, all this means that now there are a slew of startup founders turned CEOs who no longer run a privately funded companies, but a publicly listed one. And this means these founders as well as the organisations need to undergo several shifts to play in their new avatars.

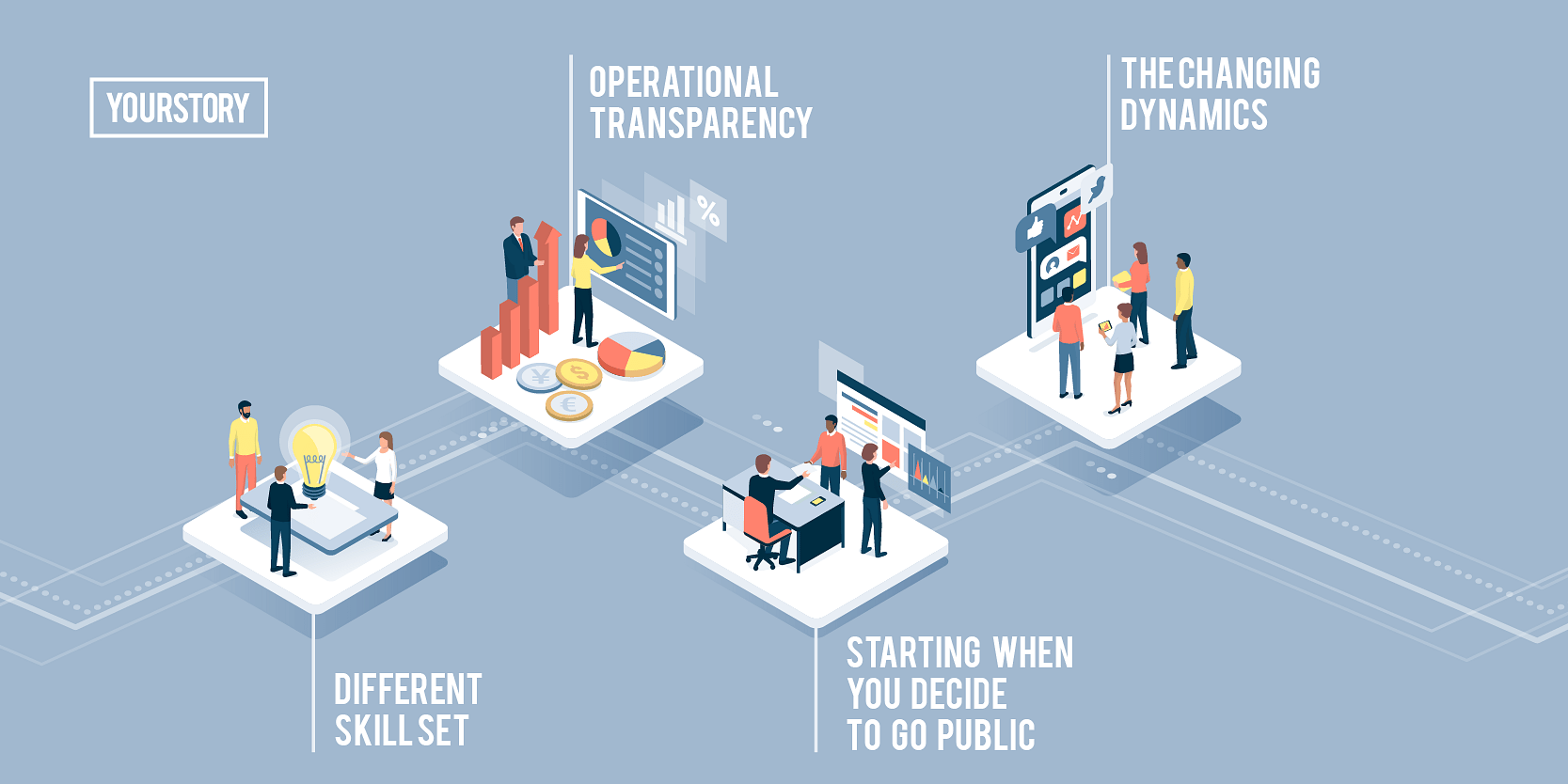

Different skill sets

Ronnie Screwvala, Co-founder of edtech unicorn UpGrad, and founder of media conglomerate UTV Group, explains, “When you take money from a private investor, there is a very different agenda and that shifts when you become a public company. You need to be ready for that. This doesn’t mean you just need to be ready for quarter-on-quarter results, but also become a very good communicator. It is a public company, and it is onerous for you to necessarily communicate that. This becomes important.”

The thumb rule for running any publicly-listed company is to understand that they will be held to significantly greater regulatory scrutiny than ever before. The autonomy that startups have when they are privately held significantly drop. This also means that now there needs to be a stronger focus on corporate governances, increased financial disclosures, better financial reporting, deeper investor relations, and robust functions.

Ronnie Screwvala, Co-founder and Chairman, UpGrad

Operational transparency

Speaking about his own experience pre and post-IPO, is Prashant Pitti, Co-founder and Executive Director, Easy Trip Planners which operates EaseMyTrip. The online travel company kicked off its IPO in May this year, which was oversubscribed by 159 times.

“We have successfully transitioned from a privately held company to a public listed entity, and the biggest difference we noticed while running our operations is a greater sense of being responsible, trustworthy, and transparent.”

Prashant adds that it is important to keep in mind the impact and value the company is now going to create, and how it impacts its stakeholders in return.

“We need to adhere to mandatory compliances and ensure we follow them every time. We now have industry veterans as independent directors to counsel and for approvals related to all activities that make business decisions more inclusive and future-ready,” says Prashant.

He explains there is an increased focus on external activities apart from internal checks as well, like engaging with a larger set-up that includes investors, equity analysts, media, industry and regulatory bodies.

“It helped us to achieve greater growth by maximising our potential, financially and operationally,” explains Prashant.

Starting when you decide to go public

For any company with its eye on the bourses, the journey towards going public begins much before filing of the DRHP. While founders and key managerial personnel engage with investors to complete the legalities, the stage is further set to shortlist and appoint merchant (investment) bankers, legal counsels, and other domain experts to set the IPO sailing.

Also, the metrics that worked for the organisation earlier doesn’t really aid the company as it traverses towards its public listing.

Prashant explains another important factor that is bringing in 100 percent clarity towards the ultimate goal of the company, and the process of how it can be achieved as a team.

“Let everyone understand the importance of their roles and being a team player towards achieving that objective. As an organisation, we are fortunate to have this strong synergy and harmony across levers since the beginning, where we managed to scale up our business exponentially and become the second-largest online travel company in India. We believe this is one of the main reasons that helped us in the transition and achieving the status of a successful listed company,” says Prashant.

It also is important to always believe in growing your revenue while maintaining a healthy bottom line.

“This is something we have imbibed since the beginning and with our persistent efforts, managed to remain profitable to date. While we continue to focus on increasing our top line, achieving profitability, and growing our market share, equal efforts have been made to enhance operational efficiency as well. Further, we continue to build an efficient and robust infrastructure and generate greater value for our stakeholders. This is how we believe one can set new benchmarks in terms of revenue generation with real growth,” he adds.

The changing dynamics

While the dynamics of running a publicly listed company are significantly different from that of a private one, the change in the investor pool is a big one too. Explaining the changing dynamics of the IPO landscape, Ronnie says the sectors that have gone IPO, it is about getting normal retail investors curious about new sectors, there is a curiosity dynamic.

“Many people today ask how can a company that is profitable can be valued in the same way as a loss making one. Now, if you look at it in the old economy with a manufacturing focus, everything went to your balance sheet, but in the service economy, it goes through the P&L. There is no justification and no fine line. The point is who gets to the finishing post,” says Ronnie.

BSE’s Ajay adds, there are various advantages as one gets pure equity funding with the balance sheet getting stronger.

“Also, one gets a lot of exposure besides providing employee stock option plans (ESOPs) to their best employees. Funding is very much an essential part of any business ecosystem, and the (stock exchange) is one place where maximum wealth creation happens,” Ajay adds.

Ronnie also adds that today, people are trying to deduce which of these new age tech companies companies are going to emerge stronger in the next four years.

“When you put in this quarter’s results, the work for it had started two years before these results. This means you need to ask and see how things will look eight quarters from now. Today, the companies that are hitting the market have a balanced view on this,” explains Ronnie.

His advice for companies that are listing today? Leave a lot on the table, and whatever you are doing, plan for six quarters in advance.

It also means that IPO valuations have to be reasonable so that the growth after listing would generate value for a larger set of shareholders, rather than founders and early investors taking the maximum extractable value away at the time of going public.