According to a draft red herring prospectus (DRHP) that filed today with the Securities and Exchange Board of India (SEBI), the direct-to-consumer startup says it plans to raise Rs 2,000 crore in its initial public offer via a fresh issue of shares worth Rs 900 crore, and an offer for the sale of shares (OFS) worth Rs 1,100 crore.

Here are some key takeaways from its DRHP:

1. The startup’s founders — Sameer Mehta and Aman Gupta — who own 28.26 percent, each, on a fully diluted basis are the majority shareholders with 56.52 percent stake. South Lake, a venture capital firm based in the Cayman Islands, owns 36.48 percent of the company, and will be selling equity worth Rs 800 crore in the IPO.

2. A material threat to the company’s operations that it flagged in its prospectus includes delays or disruptions in the supply of products and components from its suppliers, including those in Vietnam, India, and China. It further said that political tensions could affect its contracts and arrangements with suppliers in China.

“In the event that China is affected by any adverse conditions that disrupt production and/or deliveries from our contract manufacturers, our ability to deliver our products on a timely basis could be negatively affected, which may adversely affect our business and results of operations,” the prospectus read.

Further, it added that any new trade regulations by India or China could impact its business.

boAt has been heralded as a “Made in India“, “homegrown” D2C brand, but it says in its prospectus that while it plans to continue diversifying and building its supply chain by engaging with new Indian suppliers, it “cannot assure you that we will be able to find suitable suppliers and manufacturers in India and on acceptable terms. Engaging new suppliers may involve setting up additional measures for quality control and vetting. Further, foraying into contract manufacturing in India may also take substantial time and attention of management…”

Aman Gupta (left) and Sameer Mehta, Co-Founders, boAt

3. boAt’s primary sales channels are online marketplaces Flipkart and Amazon. In the six months ended September 30, 2021, while boAt 83.24 percent of its revenue from operations was derived from online marketplaces, a whopping 75.02 percent of its revenue from operations was derived from the top two online marketplaces.

4. For the six months ended September 30, 2021, audio products accounted for nearly 83 percent of its sales. Wearables accounted for 14.05 percent.

5. One of boAt’s chief marketing strategies is social media advertising and word-of-mouth reviews, the startup says, adding deterioration in those relationships may be a material concern for the company.

“Our target consumers may tend to value and believe readily-available information and any negative commentary could drive large-scale social media campaigns and posts against us, our products or brand and sub-brands, whether motivated or otherwise, and result in consumer boycotts, without further investigation and without regard to accuracy of facts.”

6. In the six months ended September 31, 2021, boAt spent Rs 65.7 crore in warranty expenses, far exceeding the previous year’s Rs 52.7 crore (for the full financial year). Its warranty expenses were “primarily relating to the payments made to customers under warranties provided by us for our products“.

Under boAt’s contracts with its distributors, in certain scenarios where there are high numbers of products returned by end-consumers to the distributor, boAt may be required to buy back the remaining quantity of products at the price at which it originally sold the product to the distributor.

“We cannot assure you that the rate and cost of us providing refunds or replacements will not increase in the future. Increases in the rate of product returns may lead to customer dissatisfaction, which may adversely affect our reputation, brand image, business and financial condition.

For the six months ended September 30, 2021, product replacement claims were made on 4.51 percent of its total sales orders, in respect of which 2.97 percent of its total sales orders had products which were replaced.

Also, it spent Rs 46.16 crore on advertisement and promotion over the first half of FY 2022, versus Rs 47.8 crore in the last financial year – which means boAt is ramping up its marketing, sponsorship and advertisement efforts.

“Insufficient investments in marketing and advertisements towards brand building could also erode or impede the development of our brands.”

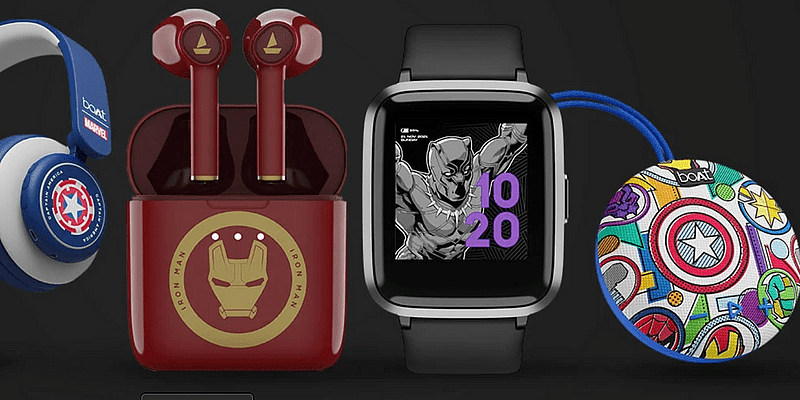

Image source: boAt’s DRHP

7. boAt says it intends to expand into overseas markets such as the UAE, Nepal, and other Southeast Asia regions, which it believes have a large Indian diaspora with similar tastes and preferences as the audience in India. It also plans to “further penetrate” Tier II+ cities in India.

8. In 2020, the startup says it experienced delays and production and logistics for three months; in 2021, for one month. It adds it also “faced interruptions…particularly from sick personnel, leaves, quarantines and limitations in operations.”

9. The startup reported a total income of Rs 1,553.1 crore in the six months ended September 30, 2021. In FY 2021, it recorded Rs 1,320.3 crore in revenue. Total expense in HY ended September 2021 was Rs 1,394.7 crore, versus Rs 1,202.1 crore in FY ended March 31, 2021. boAt reported Rs 118.3 crore in profit for the year for the six months ended September 30, 2021, vs. profit of Rs 86.5 crore for the year ended March 31, 2021.

10. The startup says it intends to use Rs 700 crore of the total net proceeds to repay or pre-pay its loans, and the rest for general corporate purposes.