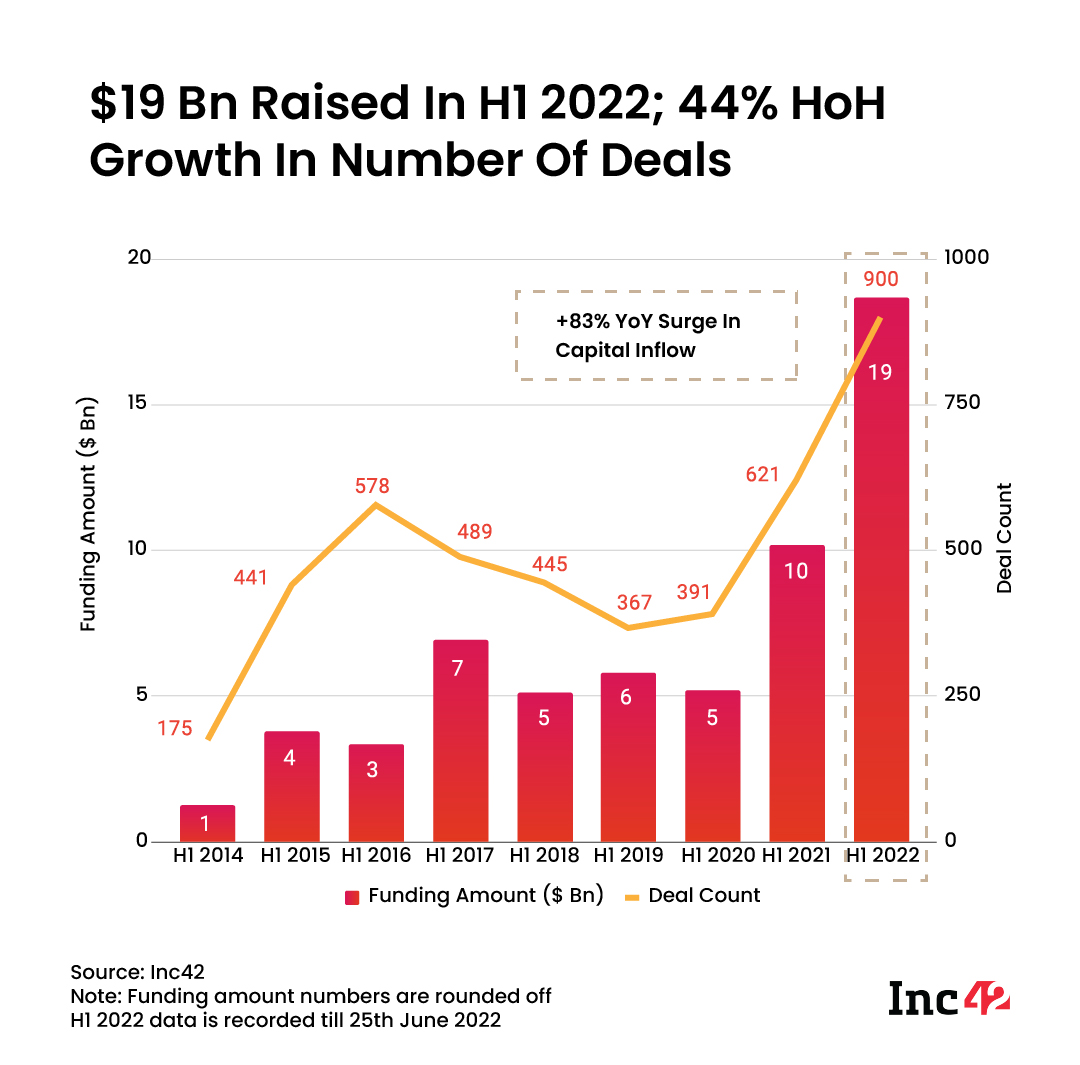

With $19 Bn raised in H1 2022, half-yearly funding saw major spike compared to the previous six months, but the quarter-on-quarter decline became worse in Q2 2022

Month-on-month inflow of both the funding amount and deal count is on a negative trend with growth rate for both being -4% and -8% respectively

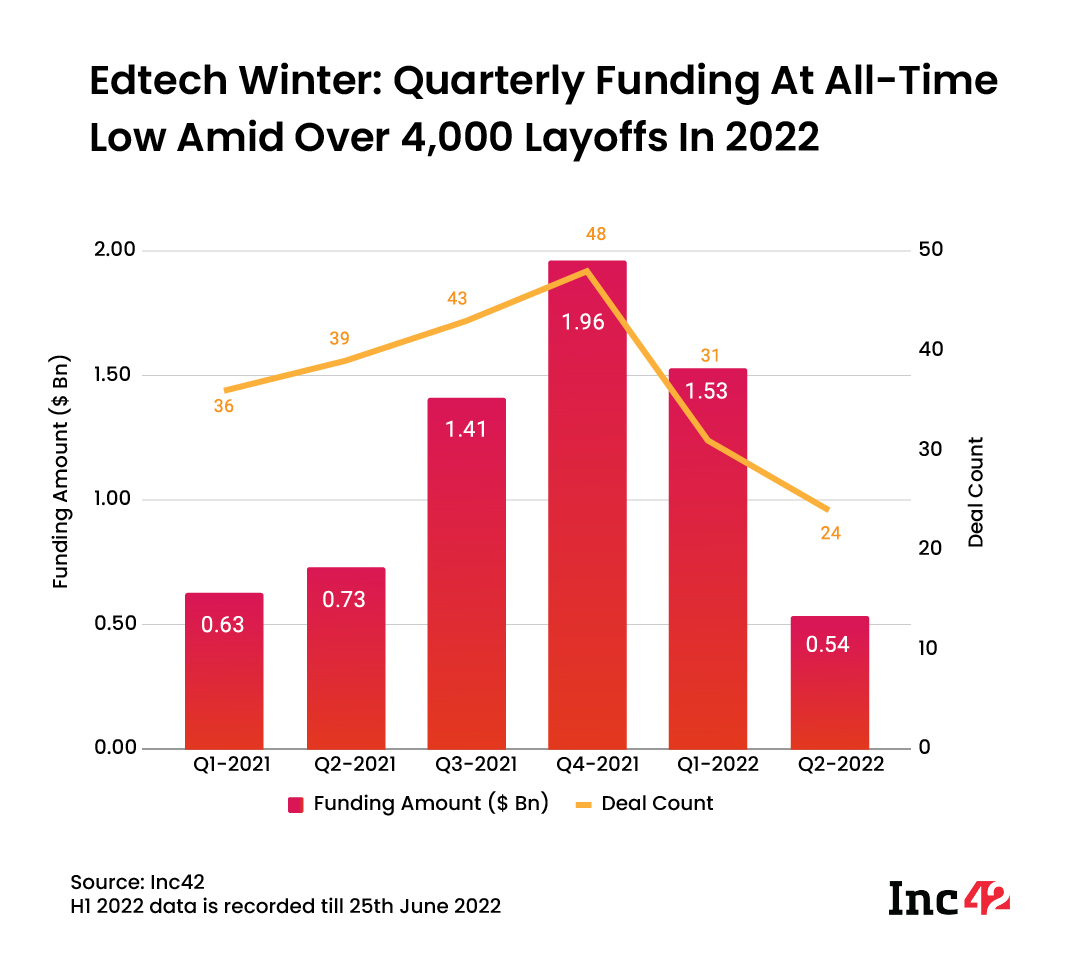

The funding decline is more evident in sectors such as edtech, where the outlook is more uncertain given the layoffs and restructuring at the largest edtech companies

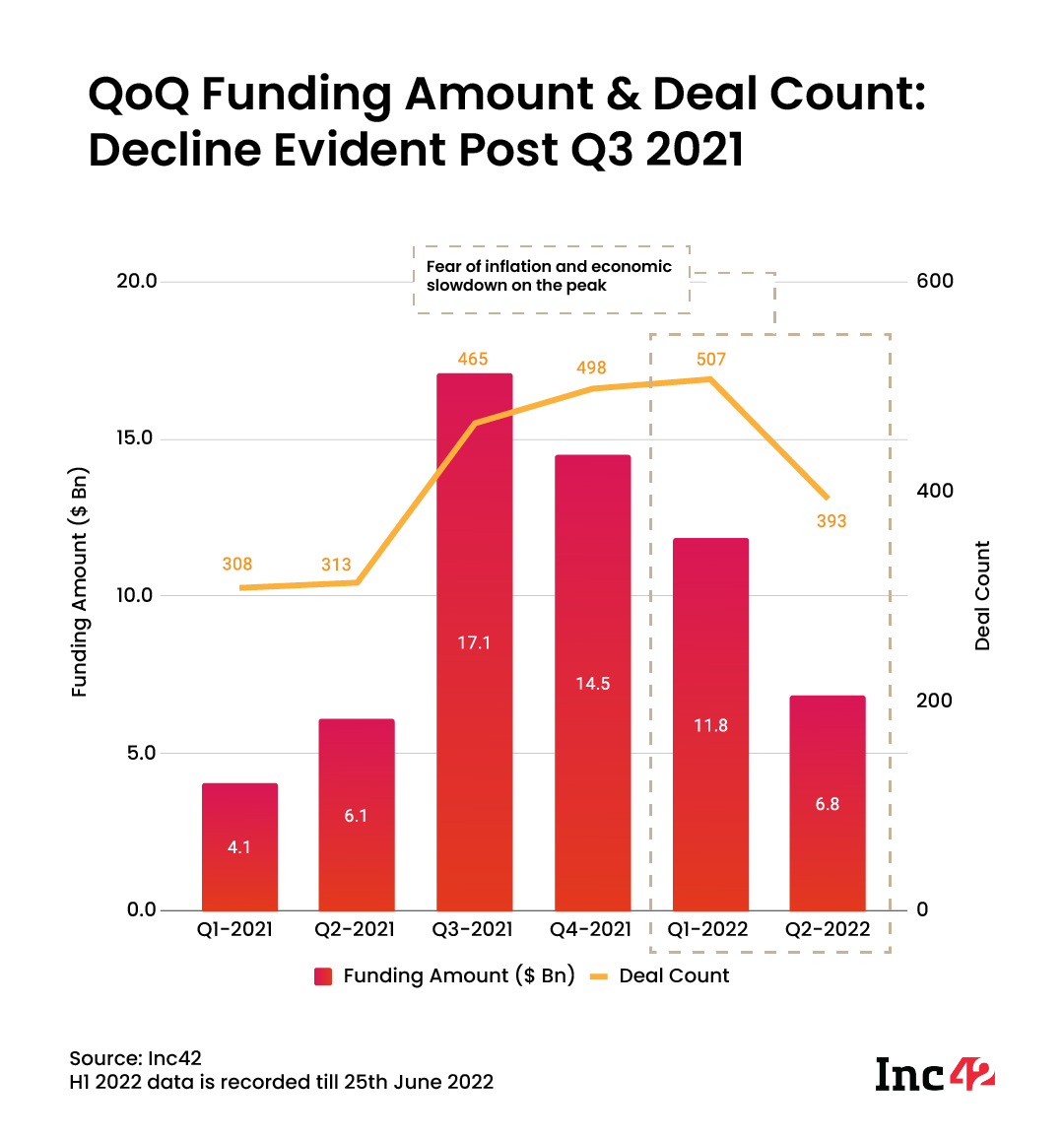

Amid a funding winter, the Indian startup funding picture makes for a bleak viewing, with much of the highs of the past year all but forgotten. Even though the six-month funding data at the halfway stage of 2022 (H1 2022) indicates a big jump in startup funding in comparison to the previous six months, the quarter on quarter decline is rather evident.

Overall, H1 2022 saw Indian startups raise over $19 Bn in funding across 900 deals, but on a quarterly basis, Q1 2022 contributed over $11.7 Bn out of this total. With $7.3 Bn in Q2 2022 as per data till June 25, the quarterly funding amount is the lowest in the past year i.e since Q2 2021 when about $6 Bn was raised.

37% QoQ Decline In Startup Funding

The third quarter of 2021 (Q3 2021) was an outlier but since then the quarter-on-quarter (QoQ) funding has declined each quarter. While $7.3 Bn does not seem like a small amount — and it is not — the QoQ decline indicates that the startup ecosystem is slipping into the much-talked about funding winter.

The quarterly decline trend has so far been 15% between Q3 2021 and Q4 2021, 18% between Q4 2021 and Q1 2022 and then a massive 37% decline in funding in the most recent quarters. This clearly shows that the funding winter has had a major chilling effect on the fundraising prospects of startups.

While both the funding amount and deal count in H1 2022 have touched historical high. the month-on-month inflow of both the funding amount and deal count is on a negative trend with MoM growth rate for both being -4% and -8% respectively.

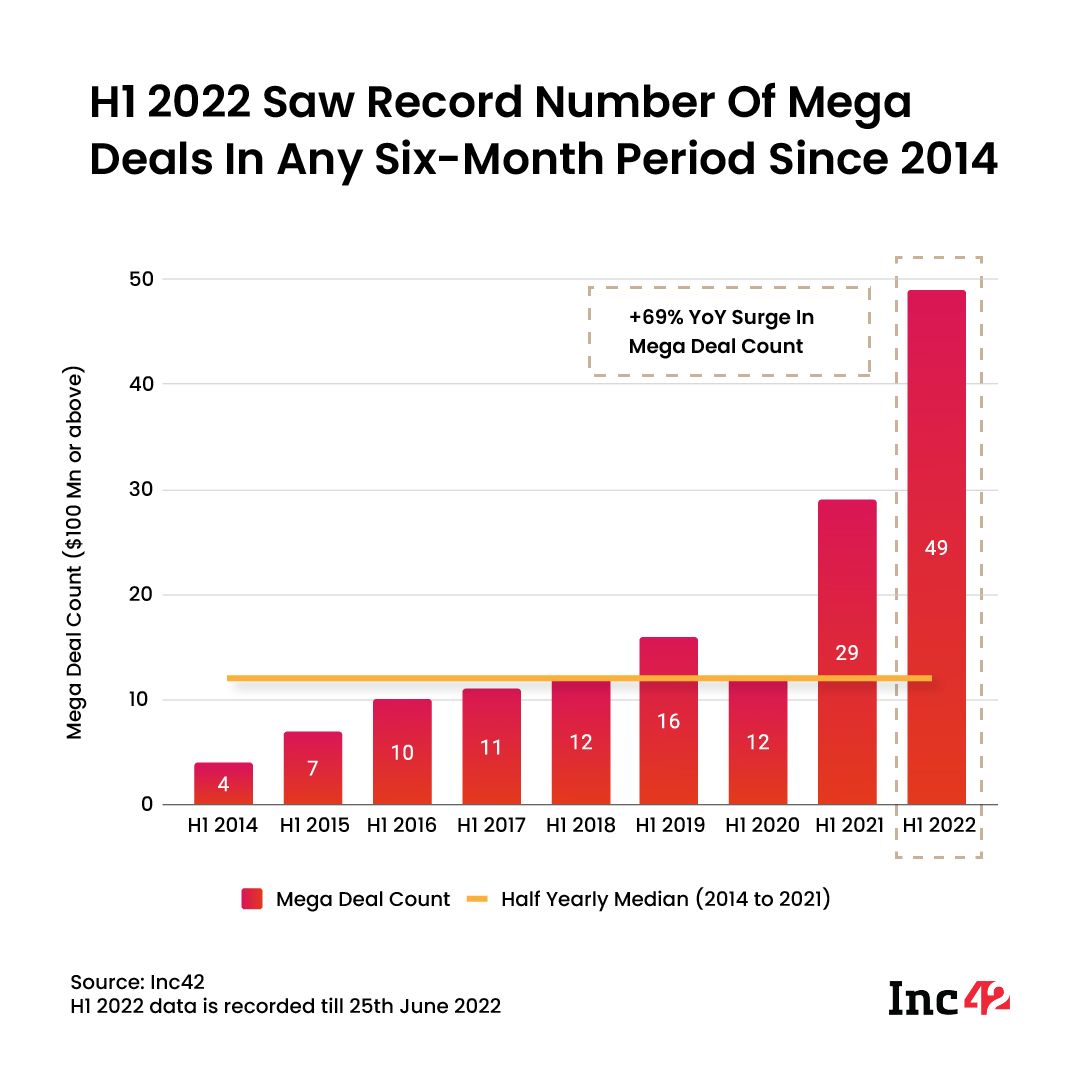

Mega Deals Boom In H1 2022

Another major indicator of that fact data can often be misleading is the number of mega deals that make up the funding amount in H1 2022

Mega deals or rounds over $100 Mn rose largely dominated the landscape which makes the decline look less steep.

To put that in the context of data, H1 2022 saw 49 deals over $100 Mn, which is 69% higher than the previous six-month period. The total funding contributed by mega deals in 2022 so far is a whopping $10.6 Bn or 55% of the total funding raised in the first six months.

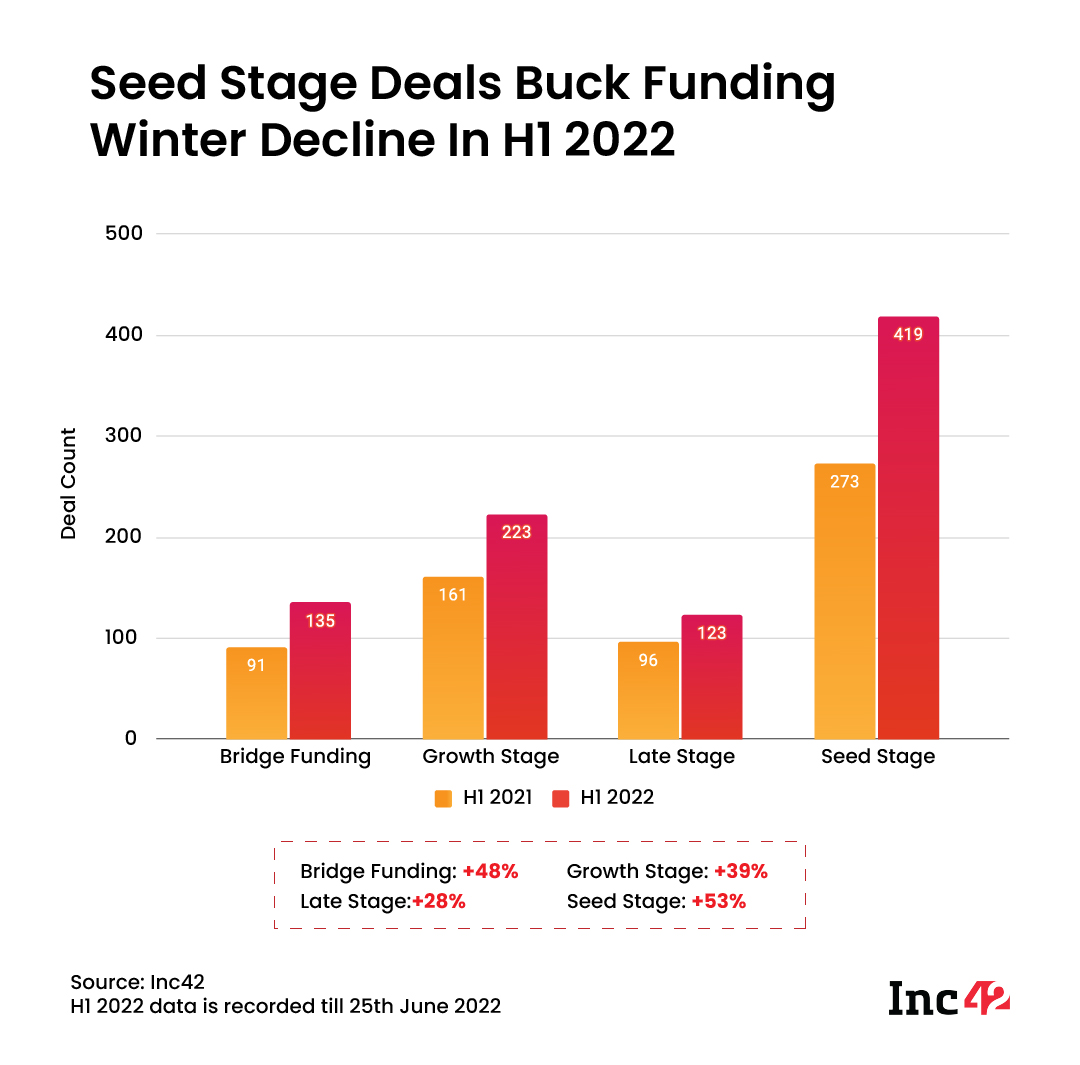

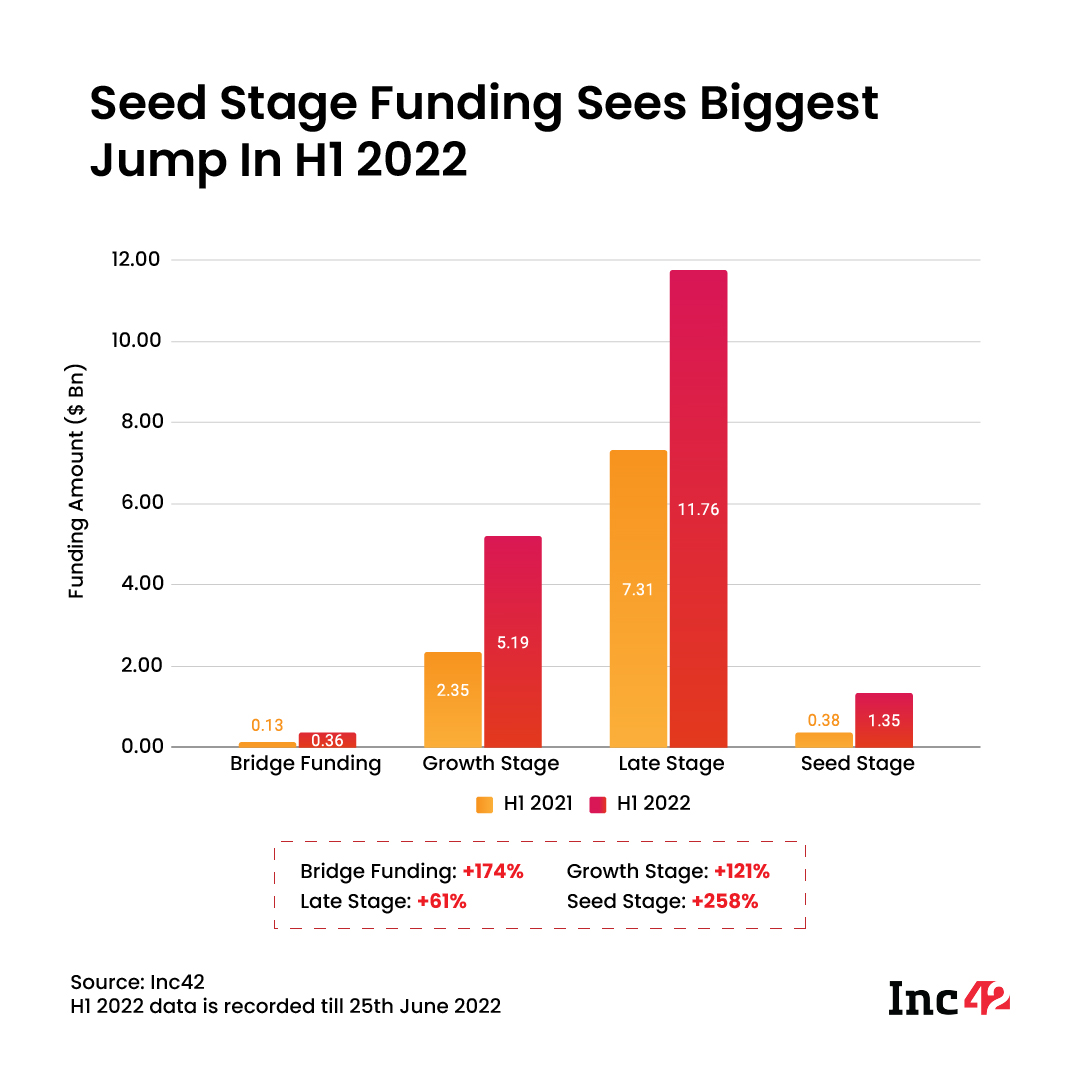

Seed Stage Booms Amid Funding Winter

While the number of mega deals points to a bias towards late-stage funding in startups and sectors where the market prospects seem much brighter in 2022. Seed funding saw the highest growth in terms of deals and funding — breaching the $1 Bn mark in H1 2022.

This is significant because of two reasons — the seed funding trend shows that this stage is bucking the overall slowdown in funding, while the deal count in seed stage was more than growth stage and late stage combined.

Edtech’s Massive Slump

Ecommerce, enterprise tech and fintech were the top-funded sectors in terms of deal count, and the same three sectors featured among the sectors with the most funding as well, and media and entertainment are two sectors that continued to garner funding.

The funding decline is more evident in sectors such as edtech, where the outlook is more uncertain given the layoffs and restructuring at the largest edtech companies such as BYJU’S, Unacademy, Vedantu and others.

From 75 deals in H1 2021 and the fourth position on the sector-wise funding charts, edtech has slipped to 8th place in H1 2022 with 55 deals. That’s just over 6% of all deals, in comparison to 12% in H1 2021. On a quarterly basis, the funding in edtech has plummeted from $1.4 Bn in Q1 to $537 Mn in Q2 2022, a massive drop of 61% for edtech funding.

Gender Diversity, Other Major Trends

One area that is typically not covered in funding reports is gender diversity and the funding attracted by startups with female founders. Of the $19 Bn invested in Indian startups in H1 2022, 13% or $2.4 Bn went to startups with at least one female cofounder.

A third of the funded startups with at least one female founder are from the ecommerce sector, but only 17% of the total 849 unique funded startups had at least one female cofounder.

With 165 M&A deals in H1 2022, the total deal count in the mergers and acquisitions space saw a 126% YoY surge and the total tally is significantly higher than the median half-yearly count of 59. Ecommerce saw the most number of M&As with house of brand and roll-up-led acquisitions driving this growth. Surprisingly, Mumbai was the startup hub which saw the most number of acquisitions.

Due diligence and corporate governance have become burning topics in the startup ecosystem in 2022 with a spate of controversies such as BharatPe, Zilingo, Trell, Infra,Market among other startups. As per an Inc42 survey, up to 40% of the investors in India are looking to ramp up their due diligence given the focus and scrutiny on this aspect.

What Does Rest Of 2022 Hold For Indian Startups?

Amid a crunch in global liquidity, rising cost of capital given fiscal policies in India and the US, the overall funding outlook for Indian startups is looking bleak for the rest of 2022. And data also indicates that the decline is likely to last until the end of the year, particularly given that most VCs have asked their portfolio companies to cut costs, revise and revisit their budgets, projections and other metrics to survive and adapt to the winter.

BEENEXT, Sequoia, Redpoint, Y Combinator wrote to their portfolio companies in the past couple of months urging them to buckle up for the bumpy ride and extend their runways as much as possible.

What VCs are now saying is that this is a graver situation than the initial Covid lockdowns in 2020, since the recovery then was boosted by fiscal policies, whereas now conservatism is the name of the game as far as policy is concerned. Given these factors, it is very likely that the bearish climate will lead to further slowdown in Indian startup funding in 2022.