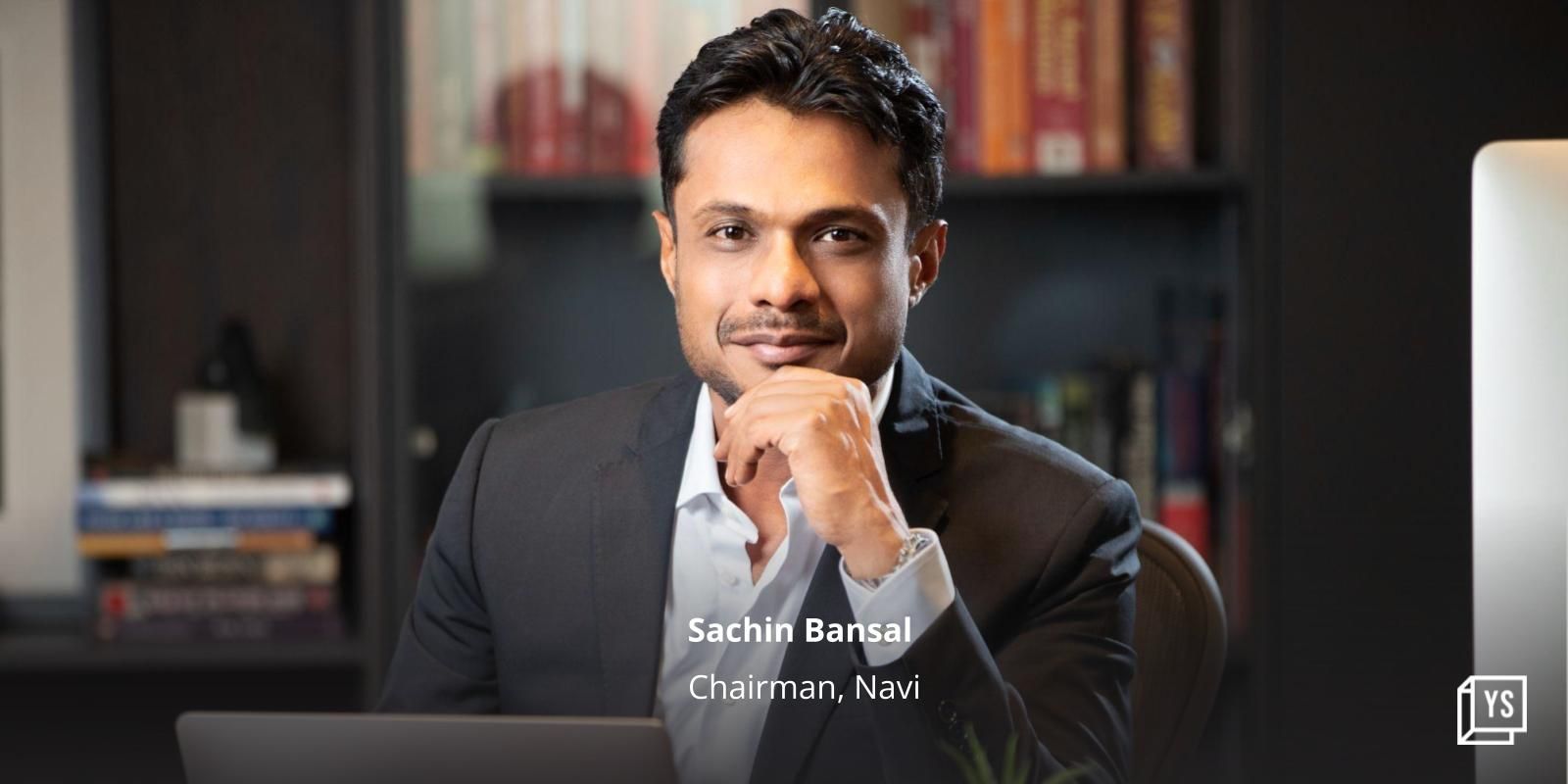

The Reserve Bank of India (RBI) has lifted the restrictions imposed on Navi Finserv Limited, allowing the non-banking financial company (NBFC) to resume its loan sanction and disbursal activities.

The central bank had initially imposed the restrictions on October 21, 2024, citing concerns over the Navi’s and three other NBFC’s pricing policies and other regulatory non-compliance issues.

The RBI’s decision to lift the restrictions follows a series of interactions with Navi Finserv, during which the NBFC committed to implementing revamped processes and systems to ensure adherence to regulatory guidelines. The central bank expressed satisfaction with the company’s remedial actions, particularly in addressing the concerns of fair loan pricing and other regulatory requirements.

“Subsequently, RBI had several rounds of interaction with the company for rectification of deficiencies. Now, having satisfied itself based on company’s submissions, and in view of adoption of revamped processes, systems, and the company’s commitment to ensure adherence to the Regulatory Guidelines on an ongoing basis, especially for ensuring fairness in the loan pricing, the Reserve Bank has decided to lift the afore-mentioned restrictions placed on Navi Finserv Limited, with immediate effect,” RBI said in a statement.

The RBI’s initial action against Navi Finserv was part of a broader crackdown on NBFCs found to be charging excessive interest rates and engaging in other unfair practices. The central bank had also imposed similar restrictions on three other NBFCs, including Asirvad Micro Finance Limited, Arohan Financial Services Limited, and DMI Finance Private Limited.

Navi Finserv had to pull the plug on a bond sale slated for an October 21 bidding session amid orders to pause lending operations. Navi Finserv had planned to raise Rs 100 crore through bonds maturing in 2.25 years, offering quarterly payments at 10.40% interest, according to a Reuters report.

“Navi Finserv maintains a healthy liquidity position, and after careful consideration, we determined that there was no immediate need for external funding at this point, leading to this development,” Shobhit Agarwal, Head of Lending, Navi Finserv said in a statement to YourStory.

![Read more about the article [Funding roundup] SuperBottoms, GeoIQ, and Qwikskills raise early-stage deals](https://blog.digitalsevaa.com/wp-content/uploads/2022/03/Image5wy1-1630828923435-300x150.jpg)