For financial services firms, establishing a robust and trustworthy brand image is pivotal for sustained success. However, the stringent regulatory environment often poses a challenge, dissuading many institutions from fully embracing employee advocacy. Unlike other industries, the financial sector operates under the watchful eye of regulatory bodies such as FINRA, SEC, IIROC, FCA, and PRA, imposing strict guidelines on communication and transparency. Consequently, the fear of non-compliance and the potential repercussions has led to a certain reluctance among financial institutions to fully leverage the power of employee advocacy.

Nonetheless, in this era of heightened digital engagement, a well-crafted strategy coupled with the right tools can empower financial institutions to reap the manifold benefits of employee advocacy while effectively managing associated risks. By integrating compliant and strategic employee advocacy initiatives, your financial institution can not only expand its client base but also foster lasting relationships, enhance credibility, and position itself as a reputable industry leader.

Jump Ahead:

Why Launch an Employee Advocacy Program?

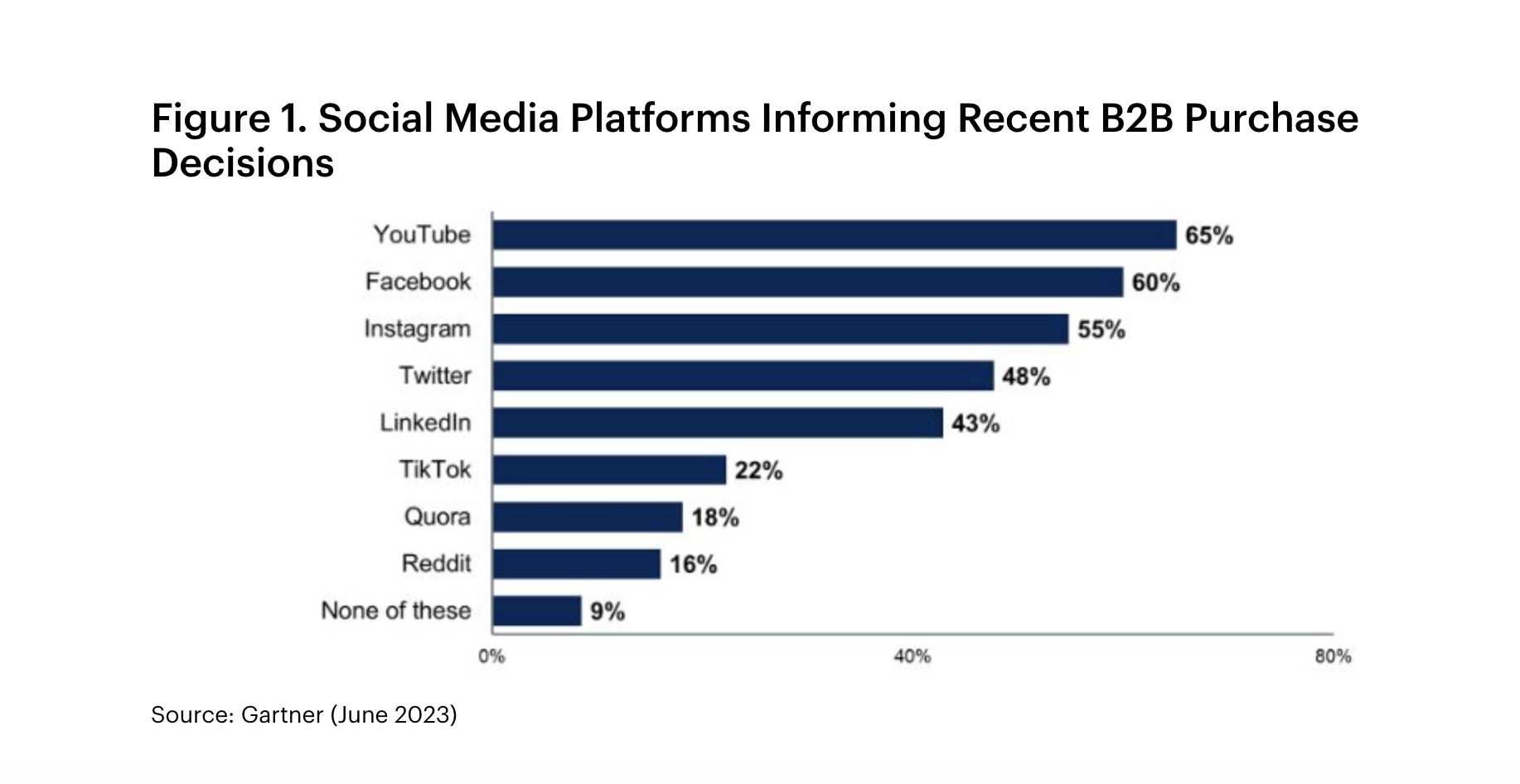

You may be wondering why financial institutions need to participate in employee advocacy to begin with. Gartner research indicates that a significant portion of B2B buyers use social media to inform their purchasing decisions, with the top channels being YouTube (65%), Facebook (60%), Instagram (55%), X (48%), and Linkedin (43%).

Considering your audience’s reliance on social networks for making purchasing decisions, neglecting to equip them with valuable insights and advice on these platforms will undoubtedly provide your competitors with a significant advantage. And because customers tend to trust individuals over brands, employee advocacy is the best way to connect with your potential clients and build your reputation as a reliable financial expert.

Financial service providers who engage in employee advocacy programs have benefited in the following ways:

They Win More Clients and Empower Sellers

In the competitive landscape of the financial services industry, where trust and relationships play a crucial role, empowering employees to serve as advocates can be a game-changer. In fact, 81% of socially engaged sellers in the financial services industry report increased business prospects. By enabling employees to communicate the institution’s value proposition through their personal networks, financial institutions can expand their reach and tap into previously inaccessible markets.

It’s a numbers game. Your employees have an average of 10x more followers than your corporate pages. These followers may be former colleagues, people they know from university, neighbors, family, or friends. Many of these individuals could be ideal clients for your institution, but if you post on your corporate channels alone, your message is unlikely to reach them. By using employee advocacy, you not only reach these individuals, but you gain their trust through their connection with your employees. This strategy allows for a more personalized approach, fostering stronger client connections and increasing the likelihood of securing new business.

They Create Genuine Connections with Clients

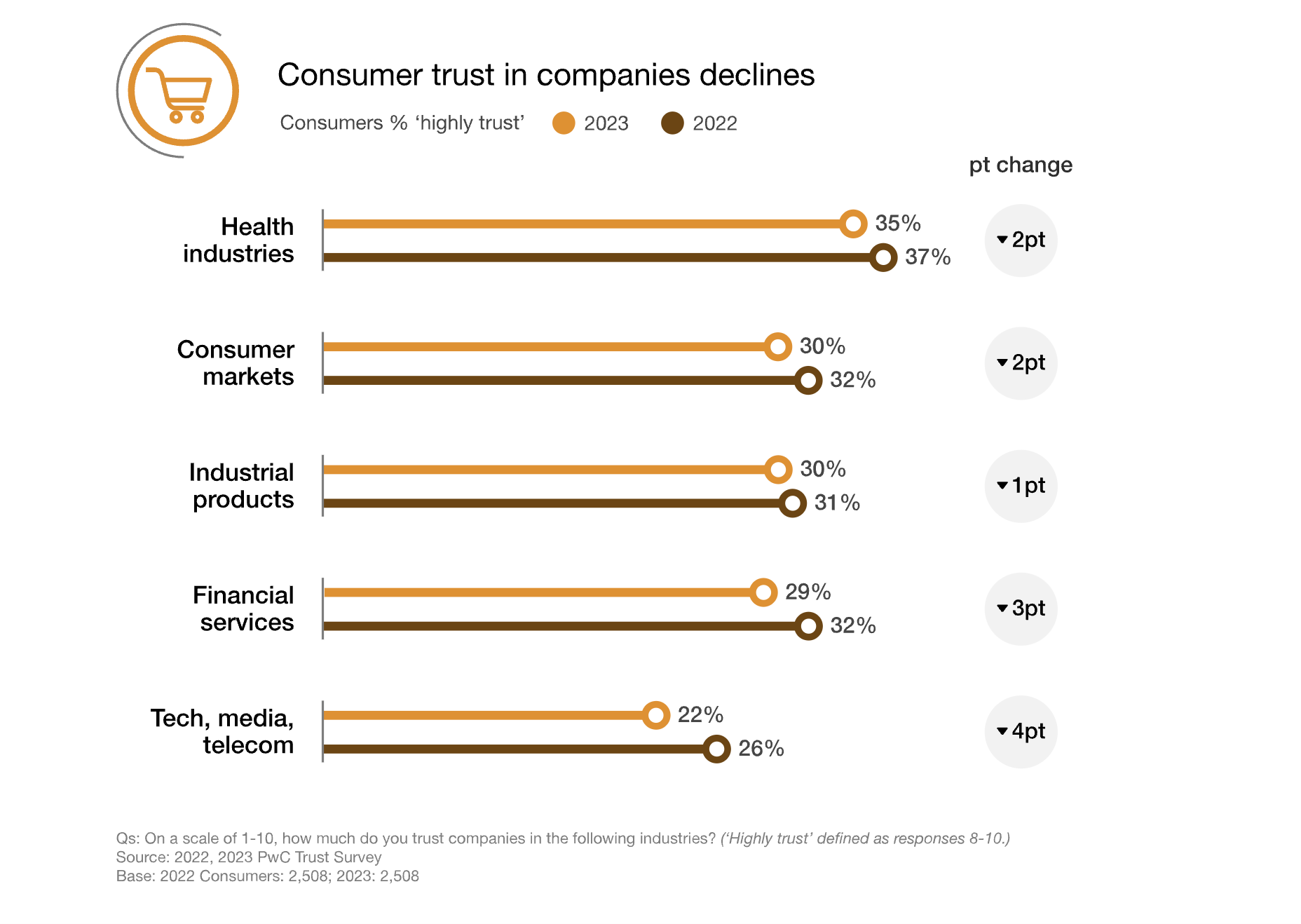

According to PwC’s 2023 Trust Survey, only 29% of consumers trust financial services institutions, falling back three points since 2022.

Fortunately, employee advocacy can rectify the situation, providing a human touch to your brand. By encouraging employees to share their insights, experiences, and industry knowledge, your employees are perceived as experts in the field who seek to share their knowledge with their network.

This humanizes your institution and establishes a deeper level of trust and rapport with clients, fostering a stronger sense of credibility and reliability. By providing employees with the tools and support to share pre-approved, thought-provoking content, institutions can engage clients on a more personal and relatable level, enhancing overall client satisfaction and retention.

They Position Their Brand as a Reputable Financial Authority

In an industry heavily reliant on expertise and credibility, building a strong reputation as a reliable and knowledgeable financial authority is paramount. Employee advocacy enables financial institutions to showcase their in-depth industry insights and thought leadership, positioning the brand as a go-to source for reliable financial information and advice.

By consistently sharing insightful content, such as market analyses, investment strategies, and regulatory updates, institutions can solidify their position as a trusted and influential voice within the financial services landscape, attracting new clients and retaining existing ones.

4 Steps to Developing Your Employee Advocacy Strategy

Now that we’ve established why your financial institution should consider employee advocacy, let’s talk about how.

An effective employee advocacy program requires careful planning and execution. To maximize the impact of such initiatives, financial institutions should focus on several key factors.

1. Authenticity is Key

Fostering authentic and engaging communication is pivotal. While it’s vital to oversee your employees’ written communications to ensure they adhere to your institution’s guidelines, it’s equally important that the content resonates with their authentic voice. In an era where audiences seek genuine connections and personalized interactions, avoiding generic messaging that clearly appears to be ‘copy-paste’ is essential.

Instead, employees should use their voice to build meaningful connections with their audience by addressing their concerns, and queries, and providing personalized advice. By humanizing the brand and establishing an emotional connection with the audience, financial institutions can cultivate a loyal and engaged customer base, fostering long-term relationships built on trust and mutual understanding.

2. Make Sure Content is Educational and Informative

Striking a delicate balance between promotional and informative content is paramount. While it’s imperative to promote the institution’s products and services, an exclusive focus on promotional content might lead to a drop in engagement and appear spammy. This defeats the purpose of your employee advocacy program.

Incorporating thought leadership pieces and industry insights that go beyond mere promotion can significantly enhance your institution’s authority and credibility. By providing valuable, educational content that transcends product promotion, financial institutions can position themselves as thought leaders within the industry, attracting a wider audience and fostering a stronger sense of trust and reliability.

3. Implement Stringent Approval Processes

All shared content should undergo a pre-approval process that aligns seamlessly with the institution’s overarching brand identity and values. This meticulous alignment not only fosters a consistent and coherent brand image but also reinforces the institution’s core values and mission across diverse communication channels.

Most importantly, it also helps your institution stay compliant with industry regulations. By having a thorough approval process where all regulations are factored in, financial institutions can build a unified narrative that resonates with their audience and reinforces their brand’s credibility and reliability.

4. Put Compliance at the Heart of Your Employee Advocacy Program

Navigating social media regulations is vital for financial services organizations, given the potential legal and financial implications of non-compliance. Key regulatory bodies like FINRA, FTC, FCA, and others enforce rules spanning areas such as records, supervision, and fair communications. Compliance challenges for financial institutions include managing reputational risks from viral content, navigating complex legal implications, overseeing numerous third-party interactions, and mitigating risks from malicious actors.

So how can your institution leverage employee advocacy without being open to these risks?

Understand the Requirements

Compliance with B2B social media entails navigating an intricate framework of rules and regulations, frequently updated to keep pace with technological advancements. Ensure thorough awareness and understanding of the latest laws and regulations within your team.

Recognize your Scope of Operation

Engaging in social media necessitates maintaining multiple accounts across various platforms. Continuously map out your organization’s social media presence to monitor the activities conducted by your staff across these platforms.

Perform Risk Evaluations

According to FFIEC guidance, establishing a risk management program is crucial for identifying, measuring, monitoring, and controlling social media-related risks. This program should encompass a governance structure, comprehensive policies, risk management processes for third-party relationships, employee training, oversight protocols, and robust audit and compliance functions.

Develop Policies and Delegate Responsibilities

Once you’ve comprehended the risks and compliance obligations, create clear and comprehensive content-use policies aligned with relevant laws and regulations. Ensure that all employees understand their roles and responsibilities in maintaining social media compliance.

Monitor and Regulate

Consistently monitor and supervise your activities across all social media accounts to ensure ongoing compliance. Conduct regular audits and leverage B2B social media platforms with tailored features for financial institutions to facilitate effective monitoring and risk mitigation.

Prioritize Engagement with Stakeholders

The dynamic nature of social media entails continuous content generation by employees, customers, peers, and partners. Utilize this content to identify potential compliance risks and employ it as a tool for monitoring and addressing any emerging issues.

Employ Advanced Technological Solutions

Enhance your social media governance by utilizing specialized central governance platforms designed specifically for B2B social media activities, including compliance management, to effectively mitigate the risks associated with social media usage.

Hold Training Sessions for Employees

As regulations continue to evolve, it’s crucial to keep your employee advocates well-informed about the latest rules and regulations within the financial services sector. Conduct regular training sessions focusing on regulatory compliance, equipping them with comprehensive knowledge and protocols to effectively utilize employee advocacy while safeguarding your firm from potential risks.

Overcoming Regulatory Hurdles with Oktopost

The stringent regulatory requirements enforced by financial authorities have often deterred institutions from fully embracing employee advocacy. However, Oktopost’s robust platform offers a comprehensive solution to address these concerns. With its approval workflows and banned words feature, you can ensure that all content shared by employees complies with industry regulations and organizational guidelines. The platform also features governance roles and permissions, enabling your business to limit who has access to which social media data. Most importantly, Oktopost makes data security its top priority, enabling you to rest assured that your data won’t reach malicious hands.

By allowing institutions to maintain strict control over the content being disseminated, Oktopost minimizes the risk of non-compliance and safeguards the institution’s reputation and standing within the industry.

Summing it up

As financial institutions navigate the intricacies of the digital landscape, the integration of a well-thought-out employee advocacy strategy, complemented by advanced tools like Oktopost, can serve as a catalyst for overcoming regulatory challenges and enhancing the institution’s overall brand presence, credibility, and client relationships. By prioritizing genuine connections, establishing the brand as an industry authority, and ensuring strict compliance with regulatory standards, financial institutions can leverage employee advocacy to not only drive growth but also build a solid competitive advantage within the ever-evolving financial services sector. Learn more about how Oktopost can help take your financial institution’s employee advocacy efforts to the next level.

![Read more about the article [Funding alert] EV startup REVOS raises $4M Series A investment, aims to be ‘Android for EVs’](https://blog.digitalsevaa.com/wp-content/uploads/2021/09/Imagec3n0-1630510577586-300x150.jpg)