Electric mobility startup has raised Rs 900 crore via a rights issue from its existing shareholders— and Singapore’s .

The company plans to use the funds to launch new products and expand its charging and retail network.

Hero MotoCorp, which currently holds a 33.1% stake in the company, announced earlier on Monday that it will invest Rs 550 crore in the Bengaluru-based electric two-wheeler maker through Series E2 Compulsory Convertible Preference Shares (CCPS).

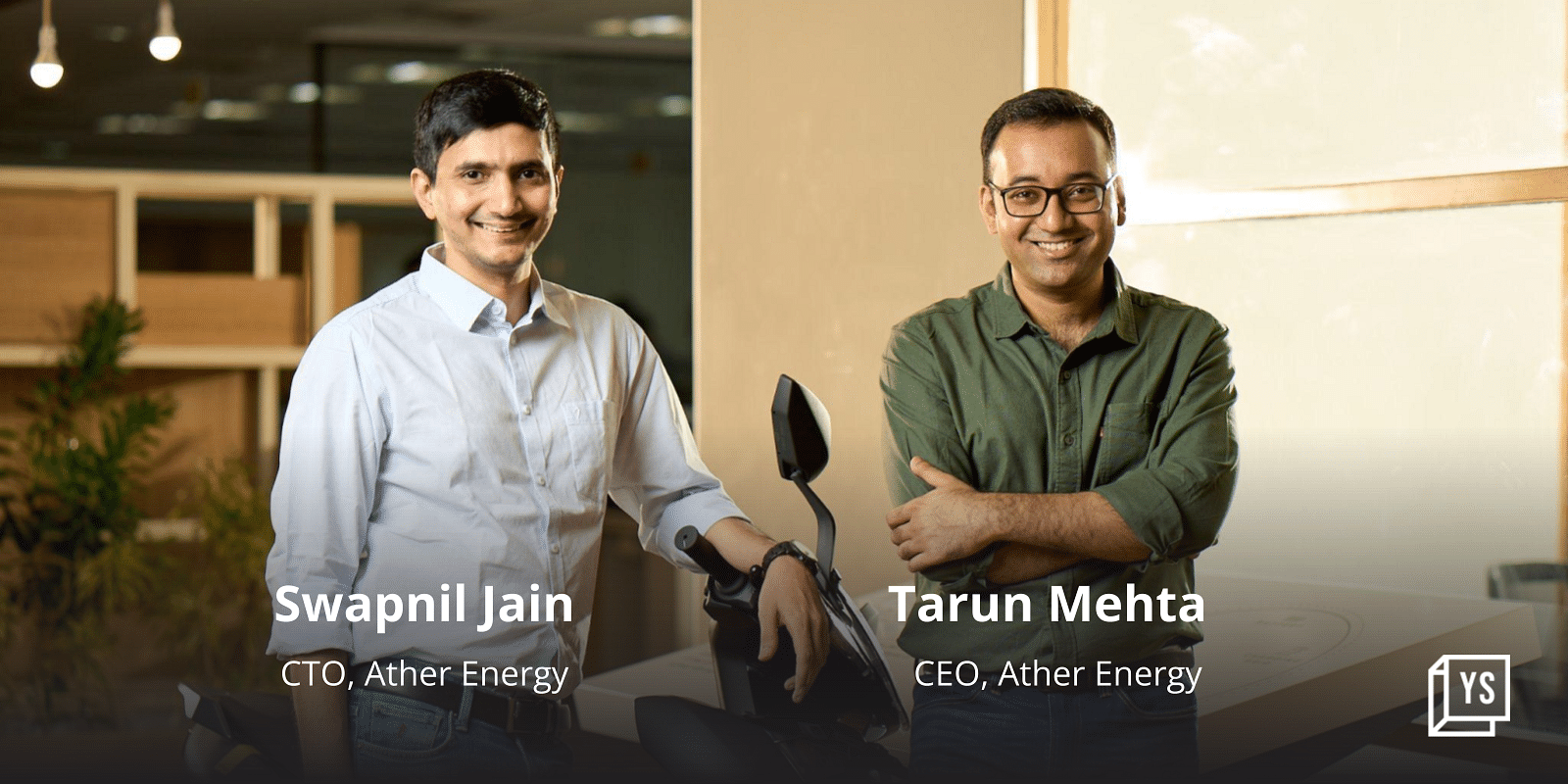

“There was strong support for the rights issue and we are very happy to see the confidence exhibited by shareholders. The last few years have demonstrated just how quick the EV transition in India can be and how it will be led by two-wheelers,” said Tarun Mehta, Co-founder and CEO of Ather Energy, in a press statement.

Ather Energy has experienced significant business growth in the 2022-23 financial year year. Notably, its revenue surged 4.4X—reaching Rs 1,783 crore in FY23 compared to Rs 408 crore just a year ago. The expansion of its retail network has also been remarkable, with the number of stores increasing fourfold to a total of 130.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

While there was a bit of a slowdown in the industry after FAME II concessions were reduced this June, Ather managed to show strong sales: in FY23, the company sold 93,212 units—up 4X from the previous fiscal year. In the first five months of the current financial year, the company has already sold over 41,500 units.

Ather has also been steadily building its charging network and has recently tied up with BPCL to set up more guns across its 21,000 fuel station network.

Ather’s closest rival Ola Electric is currently in the process of preparing for an initial public offering, with the aim of achieving a valuation of $10 billion.

Ola Electric reported revenue of Rs 456.26 crore for the financial year ended March 31, 2022.

Edited by Kanishk Singh