More Indians than ever before (probably) are taking a keen interest in their wealth creation journey. Instead of simply setting a portion of their income aside or in a savings account, we are seeing a huge influx of individuals who are aiming to invest their money prudently.

Investors need to consider a macro approach wherein they are focusing on assessing the industry and then taking prudent well-thought out investments into specific companies. This, of course, is easier said than done! That’s where a business cycles fund comes to the rescue. Simply put, it identifies the right portfolio of companies with the right business cycle tailwinds and invests in them at the right time.

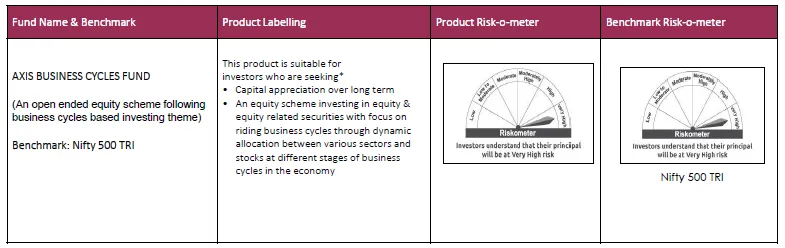

To help investors invest in this fast emerging category, Axis Mutual Fund is launching a new thematic fund, the Axis Business Cycles Fund. It is an open ended equity scheme following business cycles based investing theme. The fund will have a cycle-driven portfolio and the flexibility to be more aggressive in terms of overweight and underweight across sectors. Axis Business Cycles Fund has a bottom up approach and follows the Quality style of investing and offers no market cap bias to investors.

To decode Axis Business Cycles Fund and understand the nuances of leveraging business cycles, we spoke to Ashish Naik, Equity Fund Manager, Axis Mutual Fund. Here are the key takeaways from the conversation.

Why business cycles funds?

India is currently at a promising position, between an expansion and peak phase when looked at through a business cycle lens. Multiple levers are beginning to fall in place for investment cycle pick-up in the country, making this particular investment tool apt for the times.

However, identifying a business cycle is the art of identifying several indicators and then framing an investment opinion from a plethora of data points as well as indicators.

“Our job is to cut through the noise and use only those indicators that best represent both, the health of the economy as well as the underlying investment thesis,” said Ashish.

For example, pharmaceutical companies tend to outperform during recessionary times, while cyclical companies like automakers tend to do well when the economy is expanding rapidly, he said, talking about how certain companies and sectors perform differently in each phase of the economic cycle.

“A typical business cycle fund tries to identify the current phase of the economic cycle, narrows on sectors that can perform in that phase, and then chooses companies within those sectors. The fund, therefore, could provide investors with the opportunity to ride the economic wave by being invested in companies that are expected to take full advantage of the macro environment,” he added.

He also pointed out that these funds look to restructure portfolios once the business cycle plays out. This means the investors can benefit from transitions to new portfolios based on the changing business cycle.

What makes Axis Business Cycles Fund stand out from the rest?

Axis Mutual Fund has a bottom up approach focusing on appreciation potential of individual stocks from a fundamental perspective. It follows the quality style of investing and offers no market cap bias to investors. It will also have the flexibility for a more aggressive stance for over or under-weight sectors.

“In expansionary times, we would focus on building a cyclical sector-based portfolio of companies which would benefit from an impending favourable upcycle,” he said.

“During slowdowns or uncertain times, the portfolio will tend towards counter cyclical themes, companies that are going to be in a better position to navigate tougher times,” he added.

Ashish also spoke about the potential risks associated with a business cycle and how the fund hopes to address it.

“A major risk in investing in a business cycles fund is timing. The phases in the business cycle may change quickly. And in this situation, the fund manager needs to react to these changes and make appropriate investment calls to prevent losses from downsides,” he said.

“When we find an opportunity within a sector, we will try to build a bigger position in that portfolio showing our high conviction. Equally importantly, would be to try to cut our weightages as the investment story plays out, and we move on to the next sector with an eminent business favourable upcycle,” he added.

How can one invest in the fund?

With a minimum application of Rs 5,000 and in multiples of Rs 1/- thereafter, the Axis Business Cycles Fund follows the same process as any other mutual fund.

“The New Fund Offer (NFO) will run from February 2nd to 16th, 2023. Once the allotment is completed, the fund becomes open for regular subscriptions and redemptions on a daily basis,” said Ashish.

“Investors can invest in our scheme with a lump sum investment or via SIP, to give their mutual fund investments a disciplinary approach through systematic investment,” he added.

Source: Axis MF Research as on 31st Dec, 2022

Product Labelling:

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or model portfolio and the same may vary post NFO when actual investments are made.

Axis Business Cycles Fund is not a capital protection or guarantees returns scheme. Please refer to SID for detailed Investment Strategy and other scheme related features.

Please refer SID ,for detail Asset Allocation & Investment strategy of the Scheme uploaded on the website (www.axismf.com)

About Axis AMC: Axis AMC is one of India`s fastest growing assets managers offering a comprehensive bouquet of asset management products across mutual funds, portfolio management services and alternative investments. Visit www.axismf.com for more information.

Disclaimer: This press release represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s).

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

The information set out above is included for general information purposes only and does not constitute legal or tax advice. In view of the individual nature of the tax consequences, each investor is advised to consult his or her own tax consultant with respect to specific tax implications arising out of their participation in the Scheme. Income Tax benefits to the mutual fund & to the unit holder is in accordance with the prevailing tax laws as certified by the mutual funds consultant. Any action taken by you on the basis of the information contained herein is your responsibility alone. Axis Mutual Fund will not be liable in any manner for the consequences of such action taken by you. The information contained herein is not intended as an offer or solicitation for the purchase and sales of any schemes of Axis Mutual Fund.

Past performance may or may not be sustained in the future.

Stock(s) / Issuer(s)/ Sectors mentioned above are for illustration purpose and should not be construed as recommendation.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.