Fundraising is never easy, particularly for first-time founders; pitching to investors and analysing term sheets can be a nightmare.

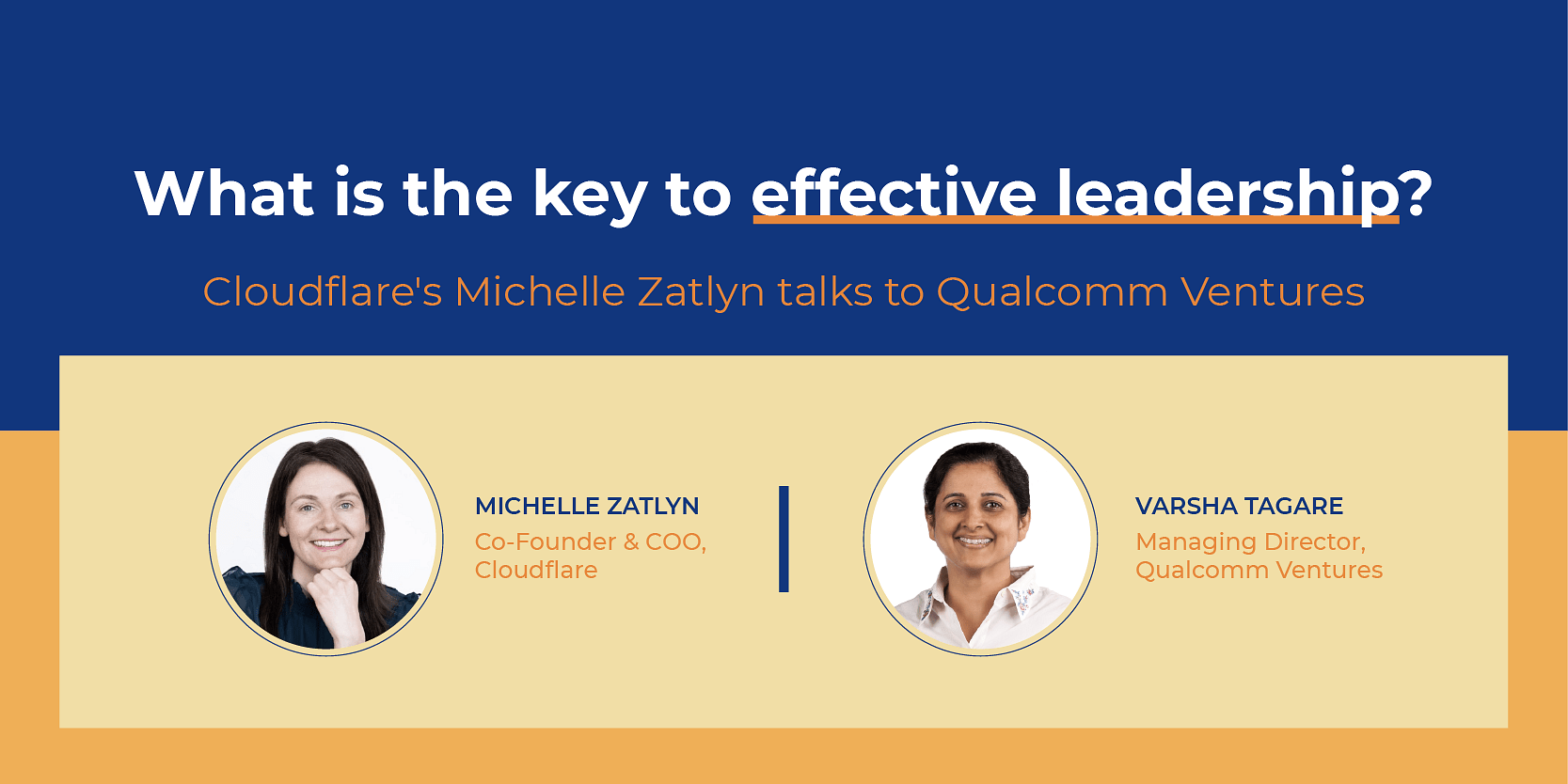

That’s what Michelle Zatlyn, Co-founder and COO of Cloudflare, reiterated in a recent conversation with Qualcomm Ventures while talking about her journey from raising seed round at Harvard University to raising more than $300 million and building a $33 billion IPO company, while also managing sustainable growth over the last 12 years.

A Qualcomm Ventures portfolio company, Cloudflare is a global network designed to provide secure, fast and reliable internet access.

“The internet is a complicated place. These days, everything needs to be faster, secure, and reliable. Cloudflare helps make that happen. We have been able to use technology to help take something very hard and expensive to make it much more accessible and easy for any size of business — from startups to 17 percent of Fortune 1000 companies,” says Michelle.

While sharing her journey, Michelle talks about some key leadership lessons founders can keep in mind while going from seed to IPO stage.

Here’s the edited excerpt:

You don’t have to get everything right always

Before starting up her own venture, Michelle used to work in various roles and projects with multinational companies like Google and Toshiba. She believes that these experiences helped her in learning new things, finding new ideas, and creating something meaningful.

Also, she says that having a breadth of experiences helps founders in making life-changing decisions.

“But, it doesn’t mean you always have to get everything right. It means to learn from it and get better fast. I got better at a high rate of learning, and I’ve held onto it because I think it’s a really huge superpower if you can do that,” she adds.

Who you hire is the most important thing

Having great founders is helpful. But the most important thing, which needs to be identified early on, is “who you hire”.

“Early on, me and Matthew [Co-founder] made a really good family team. But we did not have a lot of industry experience. We wanted to recruit people who would try and complement our skill sets, which is important. Even today, with a 2,000-member team later, we believe that having a diverse team with different skill sets who know the problem area is helpful,” she adds.

Storytelling matters a lot when raising funds

Michelle emphasises that in her experience, sharing a story rather than specific answers during a conversation is much better, especially at early-stage funding rounds.

“Telling a story early on can be really powerful. Initially, we didn’t have many revenue streams. So, I think the story where we’re going and having other metrics to help illustrate that, and the value we were delivering was really powerful, early on.

Value the investment partner more than the investment firm

Many times, the founders prefer to take investment from top-notch VC firms without giving much thought to the investment partners they are getting associated with.

“But, I believe that the person you take money from matters a ton, and so do your diligence on them. Ask people how the partners they invested in were able to help them through a tricky situation. Building a company is hard and at times, you would really want an investor partner who listens,” she adds.

Prefer plain vanilla term sheets over fancy valuations

Fundraising is never easy. As Michelle reminisces, they were really nervous for the first partner meeting while raising their seed round.

“We didn’t have lawyers. We had friends looking at term sheets and I didn’t know how to negotiate clauses. But we are lucky to get Venrock as an investment partner. We got two very clean term sheets — plain vanilla with no bells and whistles. 10 years later, this term still sets the tone of every round we raised since then,” she adds.

Keep the business drama at minimal

Michelle advises founders that at the end of the day, it’s their leadership that can help protect the business. She shared one incident when a really big investor came to offer0 them a billion-dollar valuation at the Series C stage. The firm was well-known and it felt like a validation.

But the more time they spend with the firm and the investors, the more red flags kept cropping up. So, they decided to walk away from the investment. Six months later, they got another investor on board with 10 percent less valuation.

“I actually think that that very hard decision at the moment saved us a lot of headaches down the road. Only you can decide this as a leader, and make decisions along the way that help set you up for success. You’ve got to take this stuff seriously and make choices. And so, try to minimise drama in your business,” she adds.

Listen more to this conversation here.

YourStory’s flagship startup-tech and leadership conference will return virtually for its 13th edition on October 25-30, 2021. Sign up for updates on TechSparks or to express your interest in partnerships and speaker opportunities here.

For more on TechSparks 2021, click here.

Applications are now open for Tech30 2021, a list of 30 most promising tech startups from India. Apply or nominate an early-stage startup to become a Tech30 2021 startup here.

![Read more about the article [Weekly funding roundup Sept 9-15] Venture capital inflow continues to rise](https://blog.digitalsevaa.com/wp-content/uploads/2023/08/funding-roundup-LEAD-1667575602969-300x150.png)