The world’s largest asset manager is finally entering India — and it’s doing so in a partnership with India’s richest man. Jio Financial Services and BlackRock said Wednesday they have agreed to form a joint venture, called Jio BlackRock, as the Indian conglomerate Reliance’s finance unit enters the asset management industry in the South Asian market.

The 50:50 joint venture — in which the parties are together targeting to invest $300 million — will seek to offer tech-enabled access to “affordable, innovative” investment solutions for millions of investors in India, they said.

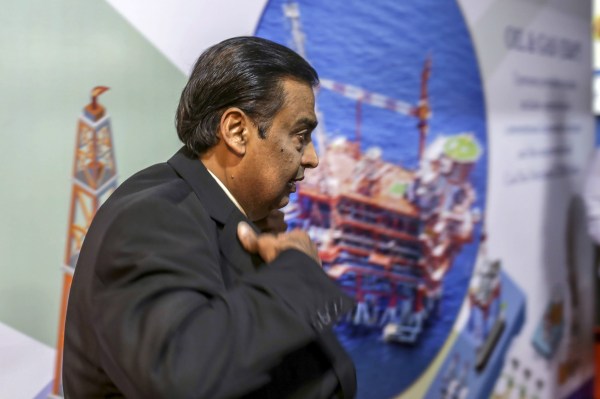

The joint venture gives a peek into the financial services ambitions of billionaire Mukesh Ambani. Jio Financial Services, an oil-to-telecom giant Reliance’s spinoff, was valued at about $20 billion in a special session conducted by Indian exchanges last week. In a surprising move last year, Ambani announced the demerger of Reliance strategic Investments and Holdings and its listing as Jio Financial.

“This is an exciting partnership between JFS and BlackRock, one of the largest and most respected asset management companies globally,” said Hitesh Sethia, President and CEO of Jio Financial Services, in a statement.

“The partnership will leverage BlackRock’s deep expertise in investment and risk management along with the technology capability and deep market expertise of JFS to drive digital delivery of products. Jio BlackRock will be a truly transformational, customer centric and digital-first enterprise with the vision to democratise access to financial investment solutions and deliver financial well-being to the doorstep of every Indian.”

More to follow.