CarTrade may file its DRHP with SEBI this month

It has appointed Citi, Kotak Mahindra Capital and others as investment partners

It has appointed CEO Vinay Sanghi as MD of CarTrade for the next five years

Mumbai based online auto classifieds startup CarTrade.com has converted itself from a private limited company to a public company, ahead of its planned initial public offering (IPO) scheduled for this year. The company’s registered name is now CarTrade Tech Limited.

The company has also approved the appointment of its founder and CEO Vinay Sanghi as managing director (MD) of CarTrade for the next five years. Foodtech giant Zomato, which also filed its DRHP recently, had made a similar move while converting itself into a public limited company, by appointing Deepinder Goyal as the MD of the company for the next five years.

The development comes a week after a media report suggested that CarTrade may file its red herring prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) in the month of May. The IPO will be a mix of a primary and secondary share sale, and investment banks Citi, Nomura, Axis Capital and Kotak Mahindra Capital are advising the company on the IPO as per sources. The development was first reported by Entrackr.

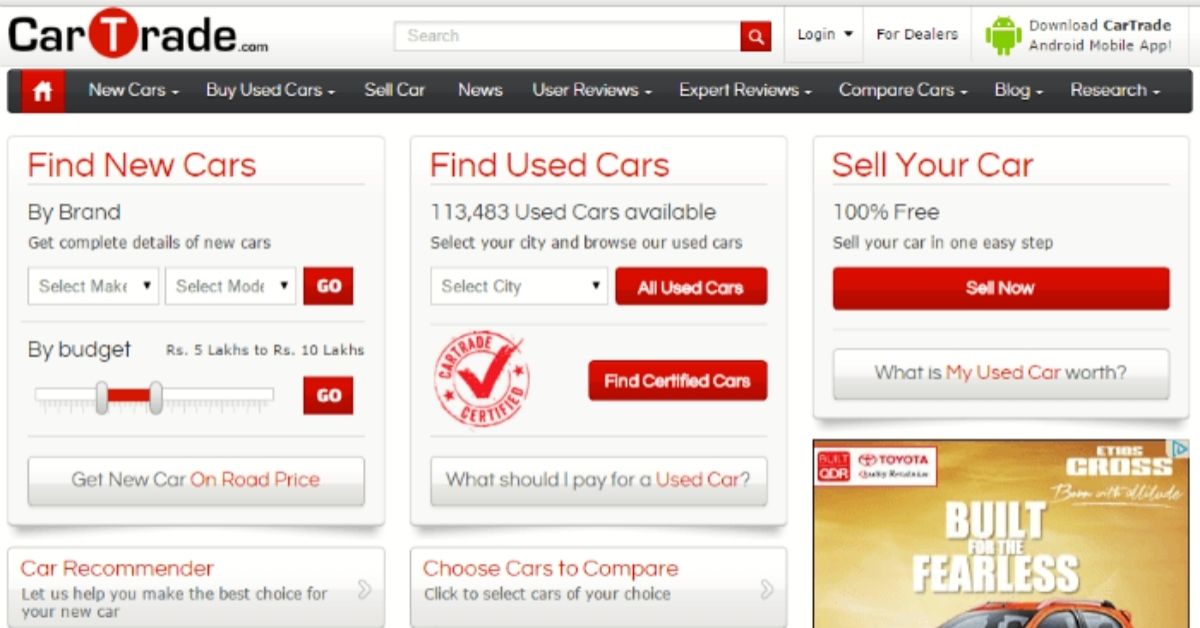

CarTrade is an online automotive market for buyers and sellers of new and used vehicles, founded in 2009 by Vinay Sanghi. The company’s online car auction platform has a presence in over 80 Indian cities. As of last year, it claimed to be selling 1 Mn vehicles a year. More than 40 OEMs and 15,000 plus dealers work with the CarTrade Group and it has over 180 owned or franchisee stores.

In the fiscal year 2019-20, CarTrade’s car auction business formally known as CarTradeExchange saw its revenue increase by 22% year-on-year (YoY), from INR 10.66 Cr to INR 13.08 Cr. The company’s expenses also increased by 22% to INR 11.33 Cr in FY20 from INR 10.66 Cr the previous year. Thus, the company recorded a net profit of INR 1.06 Cr, a 32.5% increase from INR 80 lakh in FY19. Previously, it was reported that CarTrade is planning to go public by 2022 and has also set aside INR 400-450 Cr for acquisitions.

Inc42 had last year picked CarTrade as a soonicorn (startup expected to enter the unicorn club soon). The company’s last funding round was a venture round worth INR 185 Cr ($24.3 Mn) last month, led by IIFL and Malabar Investment Advisors. Before the funding round, CarTrade had a valuation of $936 Mn. The company has raised $307 Mn to date, from marquee investors like Canaan Partners, Epiphany Ventures, Tiger Global Management, Warburg Pincus, Temasek Holdings and March Capital.