It is a social platform that enables crypto enthusiasts to make investing decisions and to also share crypto updates and trends

Sahicoin claims to have users and experts from countries including India, the US, Canada, the UK, Singapore, and many others

The Union Government is unlikely to introduce cryptocurrency regulation in the upcoming budget session of parliament

Gurugram-based crypto native social startup, Sahicoin, has raised $1.75 Mn in seed funding. The funding round was led by Alameda Ventures(FTX), Better Capital and a clutch of other investors. It also saw participation from many individual investors including CRED’s CEO Kunal Shah, cricketer Suresh Raina, among others.

The funding will be deployed to grow the startup and also to scale up its team across engineering and product domains.

Sahicoin is a social platform that enables crypto enthusiasts to make investing decisions and to also share crypto updates and trends.

The startup was founded in August last year by IIT Kanpur alumni Amit Nayak, Ankush Rajput, and Melbin Thomas and is, according to the startup, the world’s first such crypto platform. The startup claims to have users and experts from countries including India, the US, Canada, the UK, Singapore, and many others.

Sahicoin CEO and cofounder, Amit Nayak, said, “Since crypto is global by nature, our growth too, is not just limited to India. We plan to partner with key exchanges, DeFi, and NFT players, which will expedite the onboarding of the next billion users onto the crypto ecosystem.”

Echoing the sentiment, FTX’s head of product and ventures, Ramnik Arora, said, “For most people crypto is noisy and inaccessible. We need a product like Sahicoin that helps people make responsible investing decisions.”

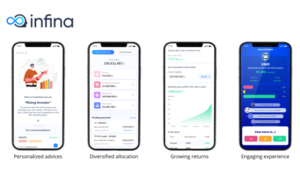

Sahicoin app is available on both Android and iOS and allows users to test the latest investment strategies and earn rewards on the app.

The global cryptocurrency market is expected to surpass the $ 3.4 Bn mark by 2030 growing at a CAGR of 30.32 %. The adoption of virtual currency could spur online knowledge platforms specifically targeted at crypto users.

This comes as Inc42 today reported that the Union Government is unlikely to introduce any cryptocurrency regulation in the upcoming budget session of parliament. This comes amidst growing ambiguity over the taxes levied on the crypto assets.

Earlier this month, India’s tech Industry association had urged the Finance Minister Nirmala Sitharaman to offer clarity on the issue ahead of this year’s Budget. For now, the impasse seems to continue.

The crypto funding has had a great run as investments worth over $638 Mn flowed into the country across 48 funding rounds last year. The momentum is expected to continue but regulatory hurdles could play a big spoilsport for the startups.

While the startup has first mover’s advantage back home, it faces stiff competition from its global contenders, who are more or less involved in the same domain. These include Public.com, Commonstock, and Robinhood.

While there is still no clarity yet on what is in store for the crypto market in India, the investment could spur the sector. The government too should take a favourable view of the situation and ensure a hassle-free business environment for the startups.