IT Minister asks bankers to create a platform like UPI for MSMEs

Minister for Railways, Communications, Electronics & Information Technology, Ashwini Vaishnaw, on Sunday urged the banking industry to create an innovative digital platform – as powerful, seamless and robust as UPI (Unified Payments Interface) – for providing quick and easy credit to MSMEs, small businessmen, and those at the bottom of pyramid.

The building blocks required to create such a platform are already available, given the strong ecosystem of Aadhaar, mobile phones, UPI platform and digilocker, he said asking the banking industry to come up with innovative ideas and solutions in three months.

MCapital appoints Rohit Agrawal as new CEO

Mcapital, the lending arm of Mswipe, has announced the appointment of Rohit Agrawal as Chief Executive Officer.

Rohit, who has more than 15 years of experience in financial services and lending, will spearhead Mcapital to achieve Rs 1,000 crore AUM by March 2024

In his new role, Rohit will expand Mswipe’s core payments business by building a robust merchant financing and small loans vertical through Mcapital. He will also oversee the adaptation of innovative technology in creating new credit products for SMEs.

Rohit, a CA by profession, joined Kotak Mahindra Bank in 2006. Since then, he has worn many hats including working for the bank’s mid-market business and heading its ecommerce and new-age business.

Mswipe CEO Ketan Patel said, “I look forward to working with him in developing cost-effective and consumer-friendly solutions for small merchants and expanding our lending business.”

About his new role, Rohit Agrawal said, “I am excited about my appointment as CEO of Mcapital and I look forward to building a sizeable, profitable and risk-efficient lending business. Together, we are committed to strengthening the merchant ecosystem in India and making SMEs our preferred partners.”

Funding

Sense raises $50 M led by SoftBank Vision Fund 2

Sense, the San Francisco headquartered HR tech startup, which has an office in Bengaluru, has raised $50 million in a Series D round of funding led by SoftBank Vision Fund 2.

Until now, Sense has secured $90 million in funding with other investors being Accel, Avataar Venture Partners, GV, Khosla Ventures, and Signia Ventures.

Founded in 2015 by Anil Dharni, Ram Gudavalli, Pankaj Jindal, and Alex Rosen, Sense will use this funding round to drive global expansion and product development.

CHARGE+ZONE raises $10M bridge round from Venture Catalysts, others

Integrated incubator and accelerator Venture Catalysts and others have invested a cumulative $10 million bridge round in Charge+Zone, an electric vehicle (EV) charging startup.

The funding will assist CHARGE+ZONE in amping up its already existing charging network of over 1,000 points across 19-cities largely for electric buses and cars, the startup said in a statement.

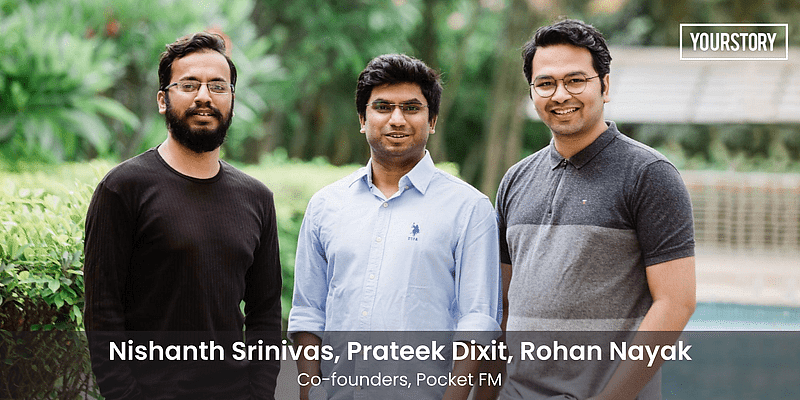

Audio OTT startup Pocket FM raises $22.4M in Series B; targets 100M users in next 6 months

Audio OTT app Pocket FM on Monday said it has raised $22.4 million in a Series B funding round led by Lightspeed, Times Group and Tanglin Venture Partners, among others.

The startup said it will use the funding to scale up its operations, increase its presence across geographies, invest in tech, and build a community of content creators.

Pocket FM had earlier raised $5.6 million in its Series A round from Tencent.

Solethreads raises Rs 2.5 crore in venture debt from Alteria Capital

Solethreads, a footwear brand founded in 2019, has raised Rs 2.5 crore in venture debt from Alteria Capital and the startup aims to use this capital for R&D, product portfolio as well as market expansion of its flip flops product.

On the funding received, Sumant Kakaria, the CEO and Co-founder, said, “This exciting partnership with Alteria Capital will support us in widening our pipeline of sustainable innovation to reach out to a broader base of customers.”

Early last year, Solethreads had raised Rs 13 crore in a Series A round of funding from DSG Consumer Partners and Saama Capital. Their products are present in both online and offline channels.

This footwear brand has also started new product recycling and reuse initiative – The Solester Reuse progamme. This initiative allows anyone to exchange their flip flops and slippers, for reward points, which can be used to purchase the brand’s products. The footwear that the company receives through this initiative is in turn recycled and used to create new Solethreads eco-friendly flip flops.

Solethreads was co-founded by Gaurav Chopra, Sumant Kakaria, Aprajit Kathuria, and Vikram Iyer.

Gaurav Chopra, Co-founder, Solethreads

Doss Games raises Rs 2.5 crore in led by Titan Capital

Doss Games has raised Rs 2.5 crore in a pre-seed round of funding led by Titan Capital, with participation from angel investors such as Maninder Gulati – Global Chief Strategy Officer, OYO; Varun Alagh, CEO, Mamaearth; Abhinav Sinha – Global COO, OYO; and others.

Doss Games will use this capital to strengthen their product, design and blockchain capabilities. For the next few months, the startup will focus on AI-powered creation technology for users to create metaverses for smartphones.

Founded in 2021, Doss Games helps creators mint their own social tokens, build metaverses, conduct real-time virtual events, build and play personalised games and much more with the power of AI-assisted creation.

This startup also plans to invest in the community of developers and 3D voxel artists from design hubs around the world like Japan, Istanbul, Poland, etc who will build assets to integrate into the metaverse ecosystem.

On funding received, Mukul Sharma, CEO, Doss Games, said, “We believe that Web 3.0 metaverse is a powerhouse of opportunity for creator economy. The initial money is helping us to achieve the product-market fit fast.”

AI Health Highway raises seed round from Venture Catalysts, The Chennai Angels

AI Health Highway, a medtech startup incubated at Society for Innovation & Development of IISC, has raised an undisclosed seed round of funding from Venture Catalysts and The Chennai Angels.

AI Health Highway would use this capital for expansion and product development.

Dr (Maj) Satish Jeevannavar, Founder, AI Health Highway, said, “We are working towards screening, early detection and prediction of Heart and Lung Disorders and the seed funding would fast-track our vision to reduce 25 percent of premature deaths due to NCDs by 2025. Our easy-to-use device, AISteth, has been developed in a manner that even the elderly patients can use this at their homes to monitor heart/lung functions which will be a big boost for home health and telemedicine partners.”

According to this startup, non-communicable disorders (NCDs) kill 41 million people every year globally and cardiovascular disorders account for the majority of the NCD deaths i.e., 17.9 million deaths annually.

Apoorva Ranjan Sharma, President, and Co-founder, Venture Catalysts, said, “One-third of NCD deaths occur in the low and middle-income countries (in India 5.8 million deaths), clearly indicating the pressing need to diagnose and prevent them occurring. We are excited to back the value proposition of Ai Health Highway that leverages device, data and intelligence.”

LoanKuber raises Rs 13 crore led by Lets Venture

Fintech startup LoanKuber has raised a pre-Series A round of funding of Rs 13 crore led by Lets Venture with participation from Inflection Point Ventures and other investors.

LoanKuber will use the proceeds towards building and expanding the team, enhancing the existing tech stack and growing its loan book to Rs 75 crore in the next 12 months. It aims to onboard 1,000 MSMEs in the next 12 months as part of its expansion plan.

Founded in 2017 by Saurabh Nagpal, LoanKuber is an automated mortgage platform enabling lending to micro SMEs against owned residential collateral and has a presence across 10 cities.

Mitesh Shah, Co-founder, Inflection Point Ventures said, “LoanKuber is solving a big problem of lending in India. By digitising the entire lending process, they have the ability to bring a large number of loan seekers into a formal credit system and help them build a credit history. We believe MSME lending is still an untapped market and LoanKuber has built the right tech stack to roll out their services for this segment.”

Klassroom Edutech raises $300k led by ah! Ventures

Edtech startup Klassroom Edutech has raised an additional $300,000 in pre-Series A1 round of funding led by ah! Ventures with participation of several angel networks like StartupLanes, Startup Angels Network, Meteor Ventures and Hem Angels.

According to this startup, since its last fundraise of $200,000 in May 2021, its monthly revenue has grown 5X and it claimed that it has reactivated over 120 centres across Mumbai and Delhi ever since the reopening of the economy. It operates on a model of offline and online classes.

Klassroom Edutech conducts classes for standards VI to XII, IIT-JEE, NEET, CA, CS and other competitive exams with plans for new courses every month.

“We are expanding our footprint to two international destinations by March 2022 and are setting up an office in Dubai to cater to the needs of international Indian students,” said Dhruv Javeri, Co-founder, Klassroom Edutech.

Wispr AI raises $4.6M from NEA and 8VC

Wispr AI, a neurotechnology startup founded by Tanay Kothari and Sahaj Garg, has raised $4.6 million in seed funding co-led by New Enterprise Associates and 8VC, with participation from other prominent angel investors.

Wispr AI plans to use the funding to accelerate the development of the functional thought-powered digital interface. The company has a team of neuroscientists, hardware engineers, ML engineers and product engineers.

Founded in 2020, Wispr AI is building a wearable that can convert deliberate thought into action and high-bandwidth digital input. By combining the latest advancements in deep learning, electrical interfaces and neuroscience, the company will allow users to interface with our increasingly immersive digital world in a seamless fashion.

Tanay Kothari, Co-founder and CEO of Wispr AI, said, “As we move away from keyboards and voice, the next generation of interfaces are going to be more natural, seamless and private. Our mission is to bring these interfaces to every single person in India and around the globe.”

KalaGato raises seed round led by 9Unicorns

KalaGato, a mobile app buy-outs company, has raised an undisclosed amount in seed funding led by 9Unicorns and it will use this capital for the acquisition of high growth mobile apps.

KalaGato initially started out as a big data analytics platform before pivoting to a roll-up model wherein it leverages its proprietary data models to identify and acquire rapidly growing, high revenue mobile apps based on internally created data models. Subsequently, the company optimises revenues and expenditures by consolidating costs centrally, optimising inventory and passing on the benefits through enhanced revenue for the apps.

Founded in 2018 by Aman Kumar and Himanshu Dhakar, KalaGato aims to reach a billion users over the next five years by identifying and acquiring undervalued mobile apps.

KalaGato CEO Aman Kumar said, “There are approximately 10 million apps globally, with the market touching $700 billion annually. This is expected to cross $1.2 trillion in the near future, but functions in a disaggregated ecosystem. There are no clear exit opportunities for independent developers but through our data platform we have identified an exceptional opportunity.”

OYCHEF raises Rs 2.5 crore in seed round led by GrowthStories

Private chef service startup based out of Hyderabad OYCHEF has raised Rs 2.5 crore in seed round of funding from GrowthStories and others.

The mobile app startup delivers private chef at home service with a fine dining restaurant and quality cuisine experience. The startup, which has onboarded 45 chefs, has set a target to add an additional 350 chefs and 1,000 freelancers to further expand into Bengaluru, and Goa by 2022.

OYCHEF Service connects foodies and chefs of their choice that is affordable, accessible and easy to book for home and parties, the startup claimed.

GrowthStories founders Sainath Goud Malkapuram and Vinay Kotra said, “What made us commit to OYCHEF is their sustainable business model and the road map to create the largest Personal Chef marketplace on the web and to decentralise the culinary industry, make it accessible to all, help professional chefs grow, and reduce their financial dependence on restaurants.”

M&A

Edtech unicorn upGrad to acquire Talentedge

Higher education unicorn upGrad on Monday announced that it has entered into an exclusive agreement to acquire Talentedge (i.e., Arrina Education Services, the Holding Company of Talentedge Education Ventures Private Limited).

Sources say the deal value is at 3-4X this year’s revenue of Talentedge.

It is expected to be one of the larger consolidations in the Indian Higher education space. Talentedge is slated to do revenue of over Rs 130 crore this year and double its revenue in the coming year.