WazirX has filed petitions against the ED’s summons in the Delhi High Court And the Karnataka High Court, which will hear the case on August 16 and on August 24, respectively

Binance was never involved with any day-to-day decision-making; the responsibilities were always with the managing team and whoever they recruited, a senior WazirX employee said

In the case of FDI/ acquisition of an Indian entity by a foreign entity, the mode of payment can not be in crypto, according to FEMA regulations, said Supreme Court lawyer Vijay Pal Dalmia

“You are the owner. I am just the operator”

“No, No. Not us, you never handed over the control to me. So, you are the owner.”

When was the last time you saw founders fighting on Twitter to give away their ownership in a startup?

We have seen BharatPe cofounder Ashneer Grover, Zilingo’s Ankiti Bose, ShopClues’ Sandeep Aggarwal and many others fighting for the ownership of their companies. However, what happened between the founders of WazirX and Binance was unusual.

With over $14 Bn of daily trading volume, which is 7X of Coinbase (the second largest crypto exchange by trading volume), Binance is currently the largest crypto startup globally. WazirX, with a user base of over 10 Mn, has been one of the top three crypto entities in India.

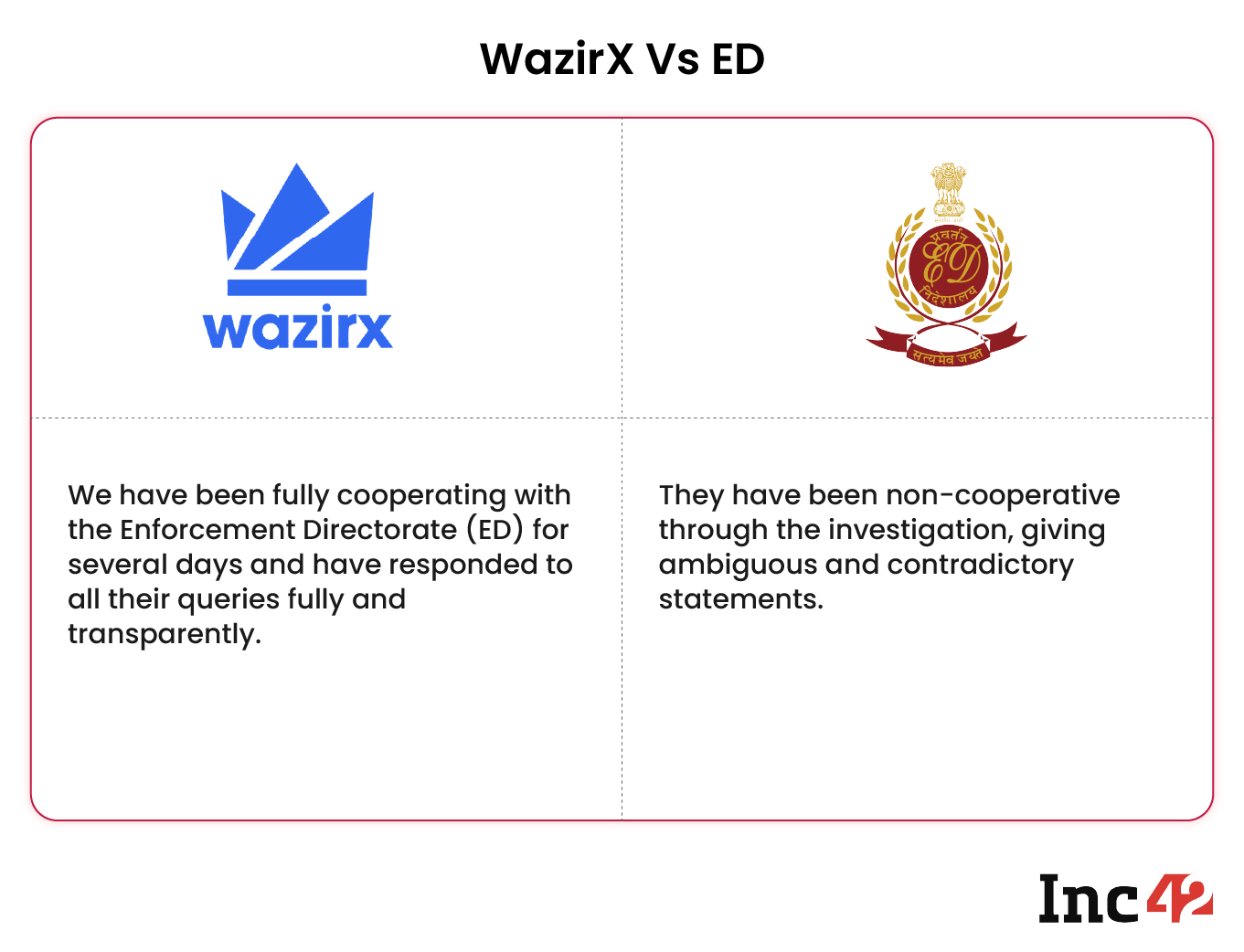

The sudden spat between Binance founder and CEO Changpeng Zhou and WazirX founder and CEO Nischal Shetty started after the Enforcement Directorate (ED), in a statement on August 5, 2022, stated that WazirX was giving contradictory and ambiguous answers to evade oversight by Indian regulatory agencies.

“Despite giving repeated opportunities, WazirX failed to give the crypto transactions of the suspect fintech APP companies and reveal the KYC of the wallets. Most of the transactions are not recorded on the blockchain also,” the ED said in the statement.

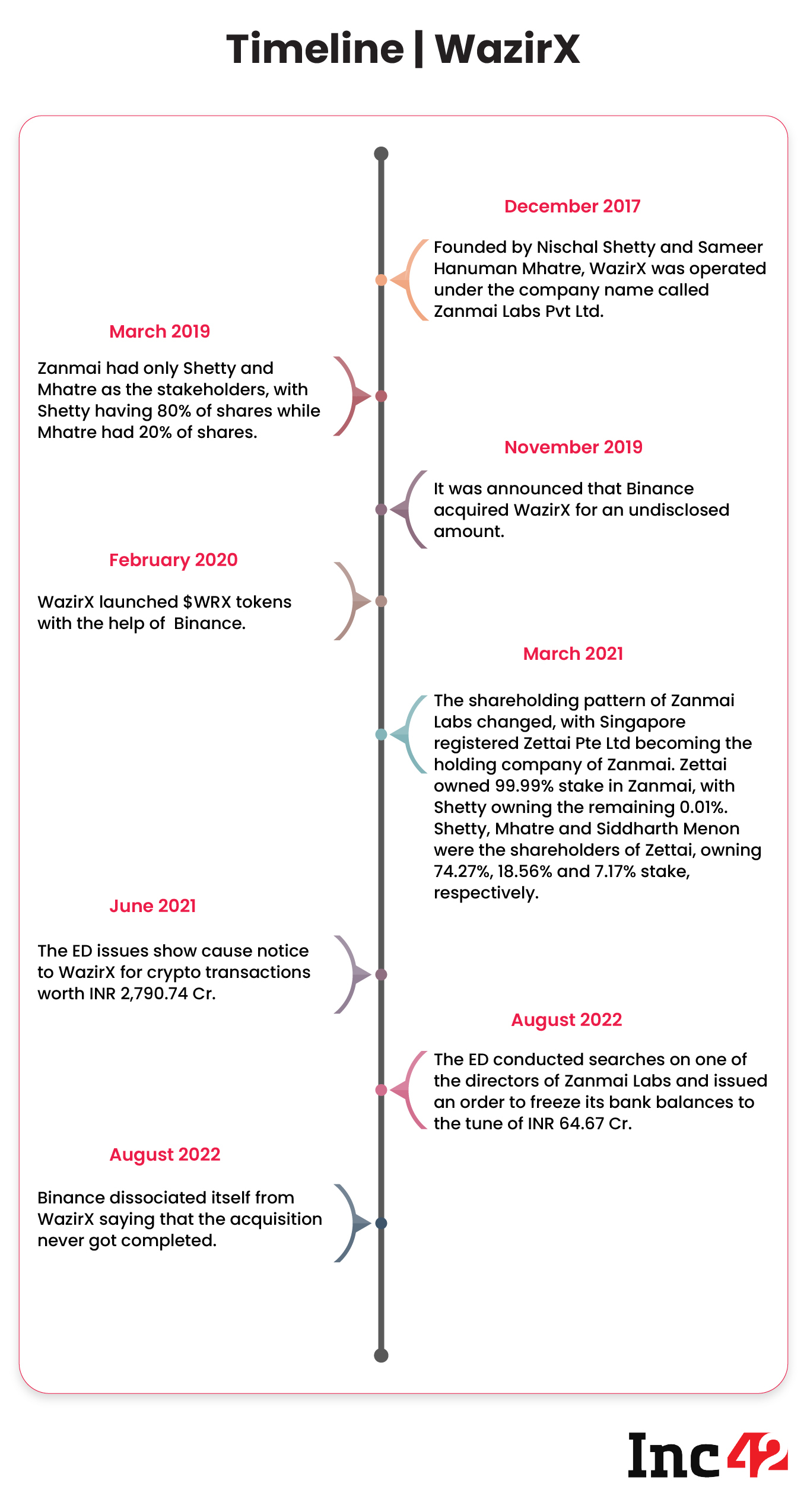

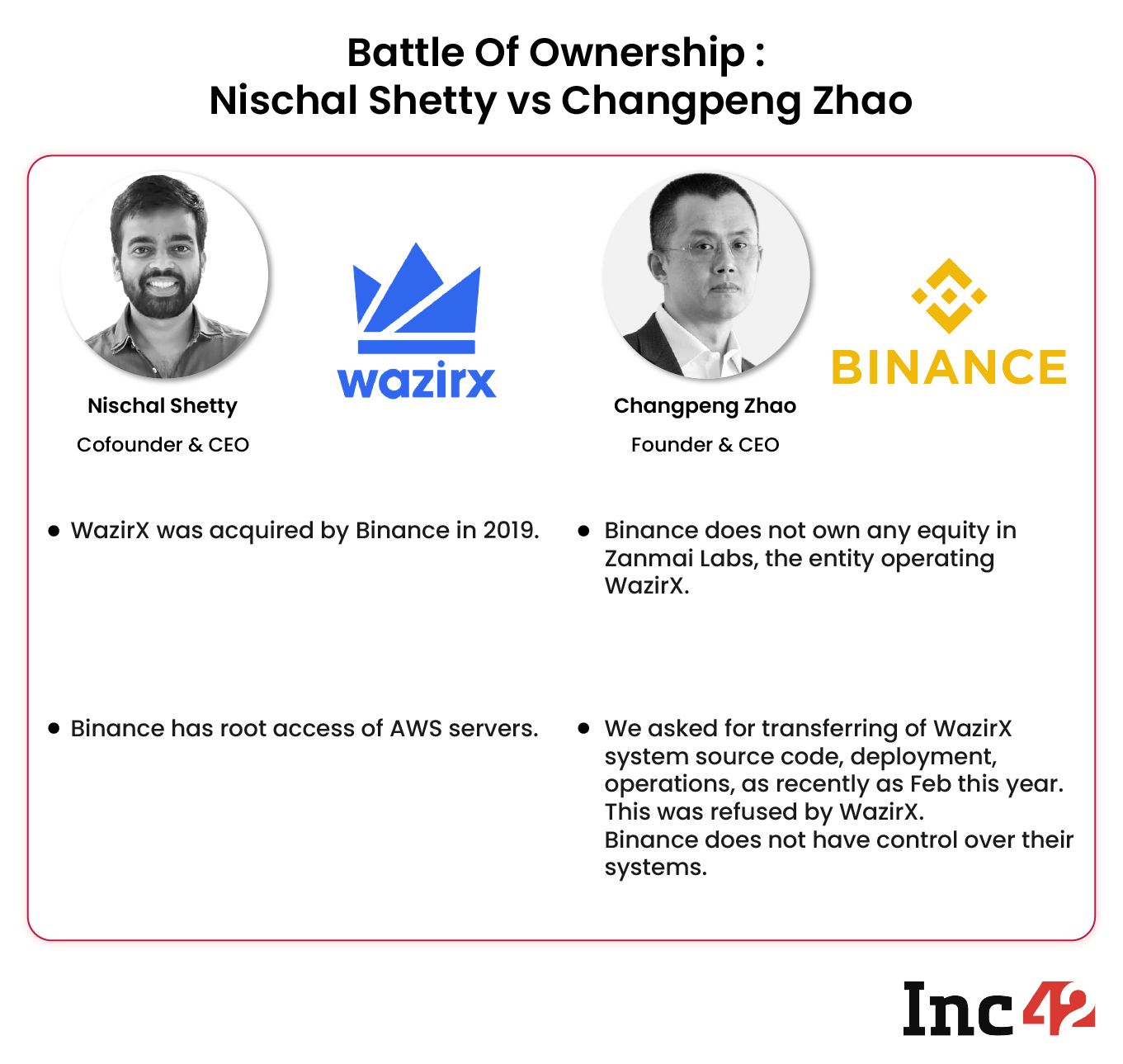

Almost two years ago, in November 2019, Binance had announced that it had acquired WazirX. No further statement on the matter from either Binance or WazirX post the acquisition announcement led to the general assumption that Binance had indeed acquired WazirX. Zhao even tweeted links that referred WazirX as ‘Binance-owned Indian crypto exchange.’

However, last week, Zhao, in a tweet, distanced Binance from WazirX stating, “Binance does not own any equity in Zanmai Labs, the entity operating WazirX and established by the original founders…This transaction (Acquisition) was never completed. Binance has never – at any point – owned any shares of Zanmai Labs, the entity operating WazirX.”

While we will get into who said what, and the legal understanding of this, it’s important to look at the facts that we have with us.

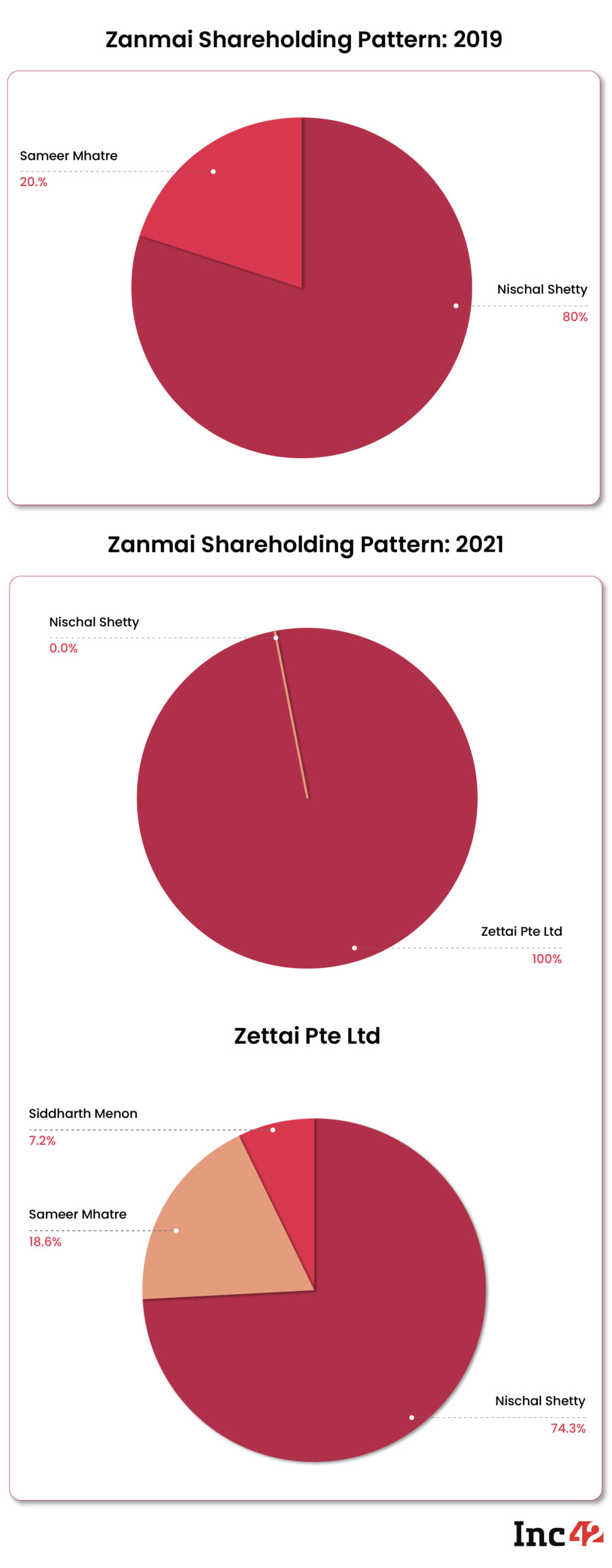

Binance Does Not Own Any Stake In Zanmai

Inc42 accessed the filings of India entity Zanmai with the Ministry of Corporate Affairs (MCA) and observed that there was a change in the shareholding pattern. Further, according to the Accounting and Corporate Regulatory Authority (ACRA) filings of Singapore-based Zettai Pte Ltd, the holding company of Zanmai Labs, Shetty, Mhatre and Menon are the only stakeholders.

Clearly, there was a change in the shareholding pattern of Zanmai. However, it was not Binance who acquired the stake.

Speaking on the acquisition norms in the country, Vijay Pal Dalmia, a Supreme Court lawyer and partner, Vaish Associates, said that there are certain steps required for an investment or foreign acquisition to be complete. This includes:

- Identifying the appropriate structure to invest through

- Taking Central government approval (if required)

- Inflow of funds via eligible capital instruments

- Complying with the reporting requirements of the Reserve Bank of India

Further, the Securities and Exchange Board of India’s (SEBI’) regulations are not applicable as WazirX is not a listed company. Companies that receive foreign direct investment (FDI) are required to file a Single Master Form to comply with the RBI’s reporting requirements and register with an entity master.

Entity master is a one-stop portal for foreign investment reporting which has been introduced with the objective of obtaining data on foreign investment in Indian entities. The entities who do not comply with the above registration will not be able to receive FDI under FEMA regulations and shall be marked as non-compliant.

Dalmia further asserted that the mode of the transaction cannot be in crypto as the RBI asserts that the amount of consideration shall be paid as inward remittance from abroad through banking channels or out of funds held in NRE/ FCNR(B)/ Escrow account maintained in accordance with the Foreign Exchange Management (Deposit) Regulations, 2016.

Acquisition Or Partnership?

In 2018, when INR-Crypto was cut off due to the RBI’s indirect ban on crypto, which led to many Indian crypto companies shutting down one after the other, WazirX became a peer-to-peer (P2P) crypto exchange.

Hence, in 2019, when Binance announced its acquisition, it acquired WazirX’s P2P business. However, it continued to be operated by Shetty and the founding team in India.

Currently, both Zanmai and Binance have access to the WazirX AWS login. As per Shetty, while Zanmai continued to operate INR-Crypto under license from Binance, the P2P business was controlled by Binance.

According to Zhao, Binance does not have control on operations including “user sign-up, KYC, trading and initiating withdrawals”, and WazirX’s founding team controls this. Shetty has not contradicted these claims yet.

Speaking to Inc42, a crypto M&A analyst, who did not wish to be named due to his past linkage with WazirX, said, “Such a circumstance where the acquirer does not have even operational control, can’t fall under acquisition definition. This best fits into the category where Binance acquired WazirX technology while it remains operated by Zanmai.”

Since none of them complained until the ED highlighted the rot within, it seems that they worked more like partners offering smooth off-chain transactions between one another, he added.

Meanwhile, Patrick Hillmann, chief communications officer of Binance, issued a statement saying, “It has come to our attention that some users were given to believe that funds deposited in WazirX were managed by Binance. This is not the case.”

“In order to provide clarity and protection for users, we are removing the off-chain fund transfer channel between WazirX and Binance. Effective from 2022-08-11 03:00 (UTC), Binance will cease to support off-chain fund transfers between WazirX Exchange and Binance via the “Login with Binance” option. Users will still be able to deposit and withdraw balances via the standard withdrawal and deposit process between Binance and WazirX,” he added.

One of the senior employees of WazirX, who worked directly with the founders, told Inc42, “Actually, Binance was never involved with any day-to-day decision making… The responsibilities were always with the managing team and whoever they recruited.”

WazirX Vs ED: Did ED’s Investigation Trigger Founders To Move Away From WazirX?

In June 2021, the ED served a show cause notice to WazirX for allegedly violating the Foreign Exchange Management Act, 1999 in transactions involving cryptocurrencies worth INR 2,790.74 Cr.

The central agency then issued a statement saying, “It was seen that the accused Chinese nationals had laundered proceeds of crime worth about INR 57 Cr by converting Indian Rupee (INR) deposits into cryptocurrency Tether (USDT) and then transferred it to Binance (exchange registered in the Cayman Islands) Wallets based on instructions received from abroad.”

After a year, the ED conducted searches on one of the directors of Zanmai Labs and issued an order to freeze Zanmai’s bank balances to the tune of INR 64.67 Cr.

The ED further said that Sameer Mhatre has complete remote access to the database of WazirX, but despite that, he is not providing the details of the transactions relating to the crypto assets purchased from the proceeds of crime of Instant Loan APP fraud.

The lax KYC norms, loose regulatory control of transactions between WazirX & Binance, non-recording of transactions on blockchains to save costs and non-recording of KYC of opposite wallets has ensured that WazirX is not able to give any account for the missing crypto assets. It has made no efforts to trace these crypto assets.

By encouraging obscurity and having lax anti-money laundering (AML) norms, it has actively assisted around 16 accused fintech companies in laundering the proceeds of crime using the crypto route. Therefore, equivalent movable assets to the extent of INR 64.67 Cr lying with WazirX were frozen under PMLA, 2002, the agency said.

Meanwhile, Zanmai filed a writ petition against the Indian government and the ED in Bengaluru High Court in June 2022, challenging the summons served by the ED under Section 37(1) and (3) of FEMA, Section 131(1) of the Income Tax Act, and Section 30 of the Code of Civil Procedure, 1908.

In its petition, it further alleged that various zones of ED were harassing the company by issuing similar summons one after the other. For instance, ED Chennai issued a summons similar to the one issued by ED Hyderabad to which Zanmai had already responded.

Earlier in January 2022, WazirX had filed a similar petition in Delhi High Court seeking to set aside the ED proceedings with regards to the show cause notice it earlier served to Zanmai.

While the Delhi High Court will now hear the case on August 16, the Karnataka High Court is likely to hear the case on August 24.

With WazirX’s Future In Doldrums, Founders Move On Separate Paths

In January, the ED summoned the directors of Zanmai to appear before it. On February 1, 2022, Shetty launched a separate L1 blockchain project called Shardeum. Another cofounder and COO Siddharth Menon launched a Web3 gaming project Tegro.

A senior employee of WazirX told Inc42 that much before this, the cofounders had hired directors or promoted existing employees into leadership positions to lead and operate their teams on a daily basis.

Founders started taking decisions behind closed doors, unlike how they handled the entire team earlier.

Further, Binance asked WazirX users to move to WazirX, while it stopped the WRX token conversions. WazirX has already stopped withdrawal features and with the ED having frozen its accounts worth INR 64 Cr, there’s a high probability that the users will face more issues on WazirX platform.

While Shetty’s Shardeum is said to be raising funds at a valuation of $200 Mn, WazirX is left in the lurch with hardly anyone caring about the customers’ interests.

While neither Binance nor the founding team of WazirX ever issued any clarification regarding the nature of their relationship with each other, it is the customers who are likely to face the brunt of this confusion and uncertainty.

The entire episode has fueled further doubts about crypto companies and the way they operate.

Can a centralised entity claim to offer true decentralised benefits of crypto? There remain a plethora of issues until crypto and web3 startups get their houses in order.