Over the years, banking has gone through some mighty changes which have left a big mark on the fragmented SME industry. However, many small businesses don’t have the latest technology and are hesitant about going digital or making any changes.

So, what will new-age banking be like for the startups and small businesses that are so important to India’s economy?

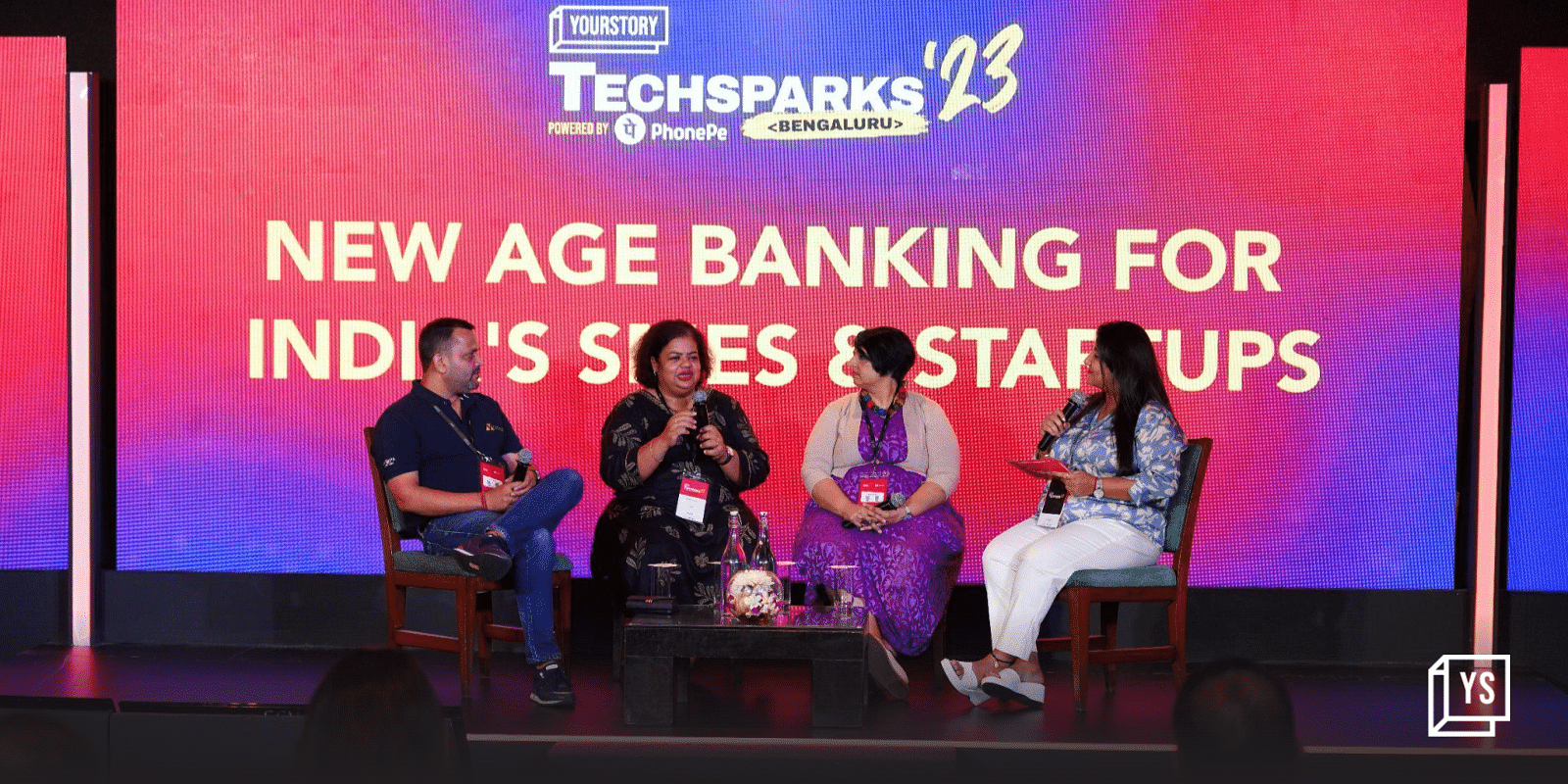

At TechSparks 2022, Mabel Chacko, Co-founder and COO of Open; Hardika Shah, Founder and CEO of Kinara Capital; and Kumar Amit, Co-founder and COO of Castler discussed modern banking and its impact on India’s small and medium enterprises (SMEs) and startups.

Kumar highlighted that new-age bankers, especially fintechs, have leapfrogged in the past few years. This has led to the banking ecosystem pivoting.

“The new age banking is thriving in the Indian banking system and the way by which it can continue its growth in the future is through good governance and responsible execution,” Kumar added.

Kinara Capital caters to primarily micro enterprises and Shah said that new-age banking has different kinds of risks than traditional banks. “We understand that small businesses do not have the capacity and technical know-how but they are running profitable businesses. We understand customers beyond formal documentation and this truly differentiates us from traditional banks.”

However, she emphasised that fintech entrepreneurs, who are mostly first generation, really need to get comfortable with technology and use services from a business value perspective, and that’s the challenge that SMEs and startups do not trust many new-age banking systems.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

According to a report by Razorpay on SMEs in India, 41% of enterprises are unsure whether to spend more on IT and digital solutions, whereas 36% are uncertain of their business outcomes from digital solutions. For digital solutions, 35% perceive that they have inadequate knowledge and training for adoption and 30% did not find immediate returns from previously investing in digital solutions.

So, how can new-age banking solutions help in bringing more SMEs into the formal banking system?

Chacko underscored that financial inclusion is very important.

“A lot of businesses came online during COVID-19, even freelancers or solo entrepreneurs like gym instructors, etc, came into more formal business systems and opened current accounts, this shows that more SMEs came into the formal banking ecosystem,” she noted.

Formalisation opens more avenues to use various business tools and services that enhance business perspectives. Chacko said that the biggest challenge is working capital and through formalisation, the chances to access credit also increase.

Kumar also pointed out that escrow accounts are also coming to the rescue of SMEs where there is a trust gap between parties. “The world is very digitised, transactions happening across countries so solutions like escrow are also helping businesses to mitigate risks,” he added.

Discussing the future trends in the modern banking world for small businesses and startups, the panellists mentioned that there will be more growth in the near future due to increased regulatory frameworks, embedded financing, and improved financial inclusion.

Shah said that the biggest beneficiaries of digitisation are people from various backgrounds who require a wide range of financial services. This will propel our nation to achieve its goal of becoming a $5 trillion economy.

Edited by Kanishk Singh