Finance Minister Nirmala Sitharaman said India has a huge role to play in guiding the world towards sustainable finance, and that the Indian fintech industry should look deeper into green finance to explore innovation opportunities.

Speaking at the Global Fintech Fest 2022, FM Sitharaman said financial regulators have already adopted ‘sustainability’ as a cornerstone of their operation, adding that Budget 2022 had stipulated the government’s plan to issue a green sovereign bond for achieving net carbon neutrality by 2070.

Existing technologies such as UPI (Unified Payments Interface), the Account Aggregator (AA) framework, ONDC (Open Network for Digital Commerce), OCEN (Open Credit Enablement Network), and AEPS (Aadhar-enabled payment systems), among others, have already ensured greater financial inclusion for those on the margins of the formal financial ecosystem, Sitharaman said, adding the next frontier for Indian fintechs is sustainable finance.

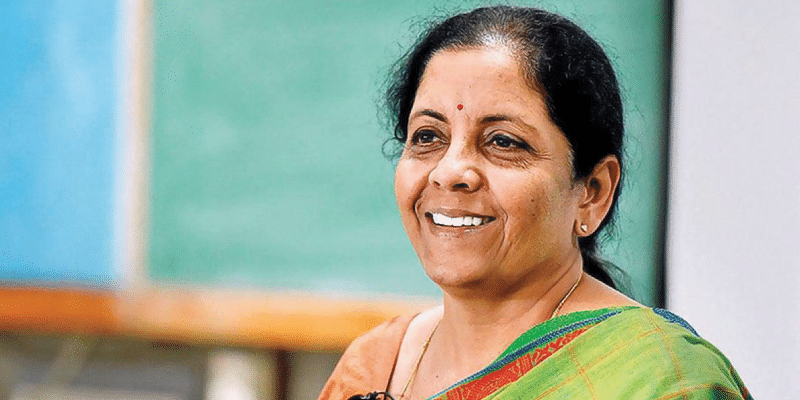

Image source: Facebook

She also emphasised the importance of dialogue between regulatory bodies and industry players, saying it was important all parts of the ecosystem were communicating with each at all times.

“Distance brings distrust, so cut the distance down. Have greater engagement with the government because the greater the engagement, the greater the trust,” she added.

Dr V Anantha Nageswaran, Chief Economic Advisor of India, echoed Sitharaman’s statements, saying the world is looking to India today for innovation in finance.

In another session, Dr Nageswaran seconded Sitharaman’s statements that the country’s fintech revolution was built on technologies cited by her.

“Phase I of financial inclusion was about opening accounts; phase II is about increasing access to financial services such as credit, insurance, investment, etc,” Dr Nageswaran added.

As an example, Dr Nageswaran said the AA system would not only increase Indian citizens’ access to personal credit but also help MSMEs get loans based on their cash flows, which he believes is the next frontier in the loans space.

Dr Anantha Nageswaran in conversation with Shivnath Thukral, Director of Public Policy, WhatsApp India, at the Global Fintech Fest

He pointed out that government portals for financial inclusion, such as the e-SHRAM portal for unorganised workers, are becoming increasingly interoperable, leading to increasing financial access.

“The government is actively pivoting from digital financial inclusion to digital financial empowerment,” Dr Nageswaran added.

![Read more about the article [Funding roundup] BharatX, Bytebeam, Fanztar, EasyRewardz, Revoh Innovations raise early-stage capital](https://blog.digitalsevaa.com/wp-content/uploads/2022/03/Image5wy1-1630828923435-300x150.jpg)