Image credits: Rudy and Peter Skitterians/Pixabay

The Polish VC market is accelerating! The market is maturing, the number of transactions is growing, and it is happening faster than ever before, experts say.

Recently, PFR Ventures, in collaboration with Inovo Venture Partners, has published the Q2 report summarising transactions on the Polish venture capital (VC) market.

Recently, the winners of the 2021 Future Hamburg Award were announced.

Here’re the 9 key takeaways from the report!

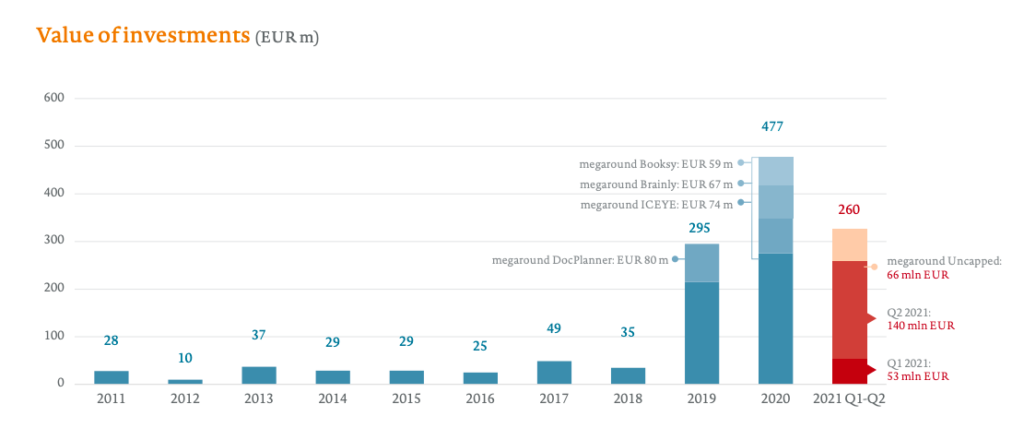

#1 Raised €260M in H1 2021

According to the report, the value of the Polish VC market in Q2 2021 reached €207M. To be specific, 109 funds have been invested in 108 companies, raising a total of €207M.

In the first half of 2021, Polish startups have raised €260M, which is 55 per cent of the total value of the investments in the whole of 2020.

#2 Record-breaking Q2

The biggest deal of Q2 2021 was Uncapped’s megaround. The company raised €66M. Even without taking this into account, the second quarter of 2021 was record-breaking, says the report.

Other Polish companies raised €141M. The previous record-breaking quarter was Q4 2020, with the result of €94M without the outliers.

#3 Largest cash injection from International funds

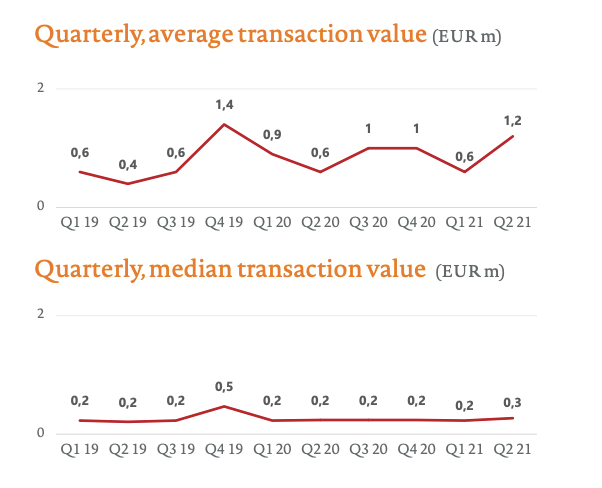

Q2 2021 is a quarter with a large injection of cash from international funds. Compared to Q1 2021, the average increased more than 2-fold to €1.2M.

Aleksander Mokrzycki, vice president at PFR Ventures, says, “In the first half of 2021, the VC market already reached the level of the entire 2019. It seems that the third quarter will be even stronger, which will allow pursuing another record and exceed €477M in transaction value. We already have first signals about the upcoming rounds of a significant value.”

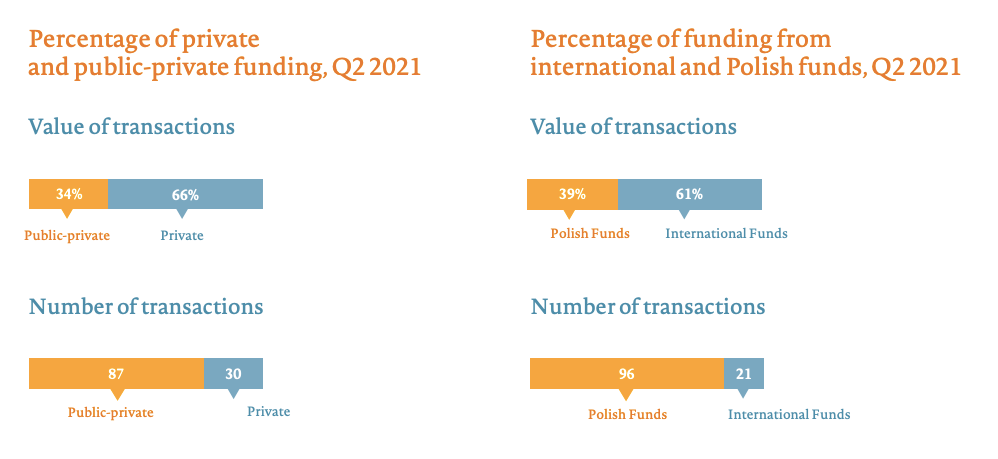

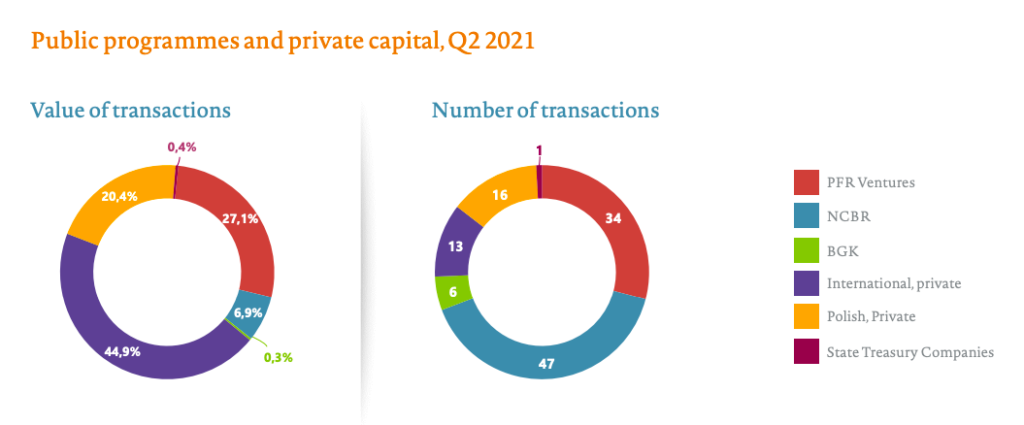

#4 Source of capital

34 per cent of the financing was public-private capital, and the share of international funds in the total value of transactions was 61 per cent. At the same time, 87 out of 117 transactions were based on public-private capital. Polish venture capital funds participated in 96 financing rounds.

#5 Foreign funds

Realising the potential of the Polish market, a lot of foreign funds confirmed that they are increasingly interested in the Polish market in Q2 2021. Notably, over 40 per cent of the capital provided in this quarter came exclusively from international players.

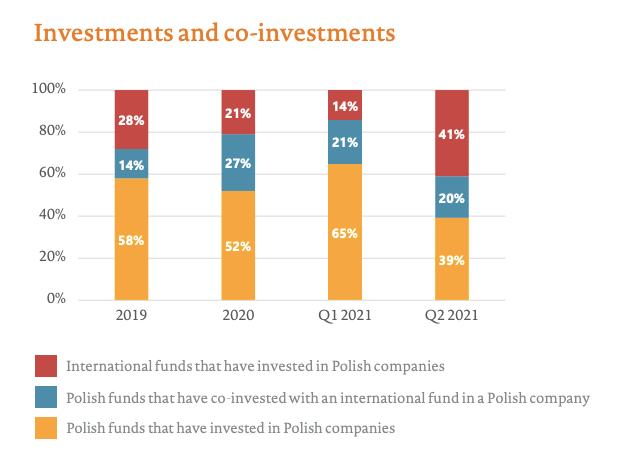

#6 Co-investment

In the last quarter, Polish VC funds, including Inovo, made 20 co-investments in Polish companies with international investors, and their value exceeded 60 per cent of the market value.

#7 Number of transactions increased

The number of transactions compared to the previous quarter increased by over 25 per cent and compared to Q2 2020 by over 103 per cent.

“Despite the increase in the number of transactions made by BRIdgeAlfa funds, from 33 in Q1 to 47 in Q2 2021, the number of which usually determined the median value at around €0.2M, we recorded an increase to €0.3M,” says the report.

#8 Value of transaction

As per the report, the value of the transaction also increased at every stage of companies’ development.

Although the vast majority (approx. 88%) are still the Pre-Seed and Seed rounds, even at this early stage the companies raise more and more capital. The largest rounds resulted in a more than twofold increase in the average value of transactions (from €0.6M to €1.2M).

#9 Poland on CEE map

Poland is one of the largest markets in the CEE region. €207M invested in Q2 in Polish companies accounts for approx. 20 per cent of the value of the CEE startup ecosystem.

Tomasz Swieboda, the partner at Inovo Venture Partners, says, “Polish technology companies are raising more capital and it is happening faster than before. Subsequent rounds are now raised in less than a year from the previous ones, and record holders do it in 4–8 months. A great example is Uncapped. In May, the company raised €66M, just 8 months after the previous round.”#6