The newly formed Karnataka Digital Economy Mission (KDEM) aims to foster a Bengaluru-like startup economy in cities like Mysuru, Mangaluru and Hubli-Dharwad

A Section 8 organisation, KDEM is led by industry stalwarts and works in a closed-loop format with support from industry bodies and government departments

KDEM has taken unique steps to solve issues like startup funding and talent pool availability in new tech clusters, according to chairman BV Naidu

“Karnataka will contribute $1.5 Tn to PM Narendra Modi’s dream of making India a $5 Tn economy by 2025,” – Chief Minister Basavaraj Bommai

An overstatement, one would say, given the unprecedented socio-political turmoil the state is passing through and its disturbing aftermath. But there is the other side of the coin.

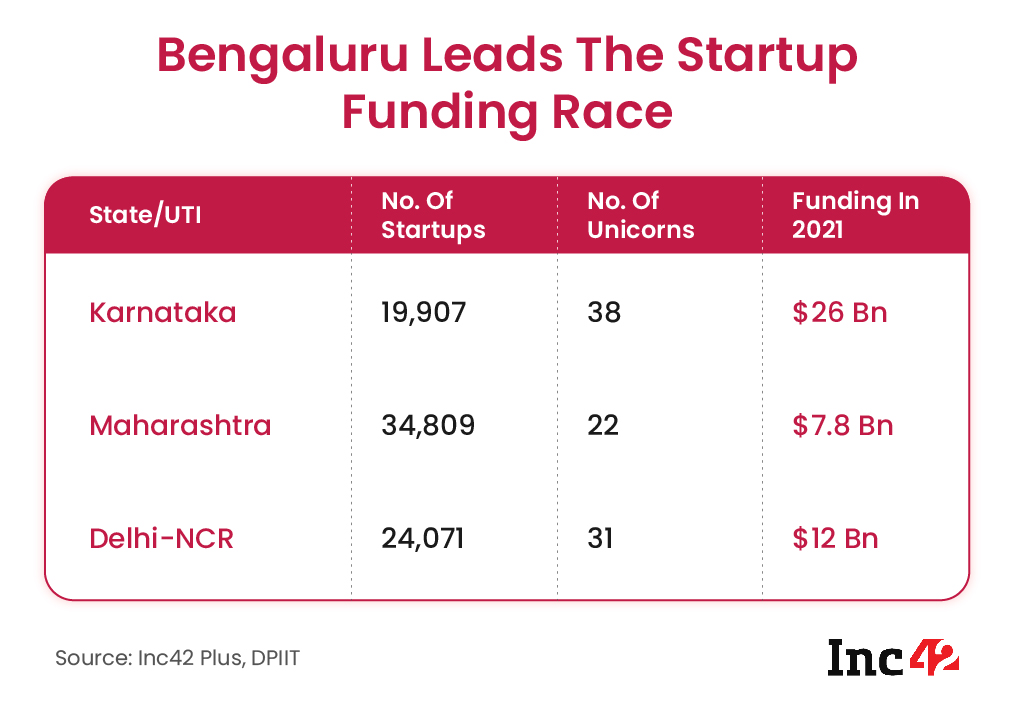

Out of the $41.7 Bn funding raised by the Indian startups in 2021, Bengaluru alone bagged $26 Bn, or 62% of the total amount. The state capital also contributes more than 40% of Karnataka’s GDP. However, Bommai’s grandiose vision is bound to be unrealistic until Karnataka builds multiple Bengalurus with matching achievements.

Of course, the Silicon Valley of India has always been a star performer. It was the fourth richest Indian city in 2021, with an estimated GDP of $110 Bn. Expected to grow at an average annual real GDP growth of 9.9% over 2020-2024, Bengaluru is the fastest growing city in Asia, according to Oxford Economics.

But Karnataka to become a $1.5 Tn economy, the city must grow 3x the current rate, on the back of its preeminent role in the IT/tech industry and the burgeoning startup space. This can be quite difficult as other ‘TecHallis’ from India are bound to give Bengaluru a run for its money.

Consider this. As noted in the Economic Survey 2021, Delhi has now replaced Bengaluru as the country’s startup capital. The National Capital Region added more than 5,000 recognised startups to its kitty compared to the 4,514 in Bengaluru, set up between April 2019 and December 2021.

Experts, however, believe that the state of Karnataka can still offer plenty of development zones and add value to the ecosystem, unlike Maharashtra, which already houses a substantial number of businesses beyond Mumbai. These clusters include Navi Mumbai, Kalyan-Dombivli, Pune, Nagpur, Nashik and many other Tier 2 cities.

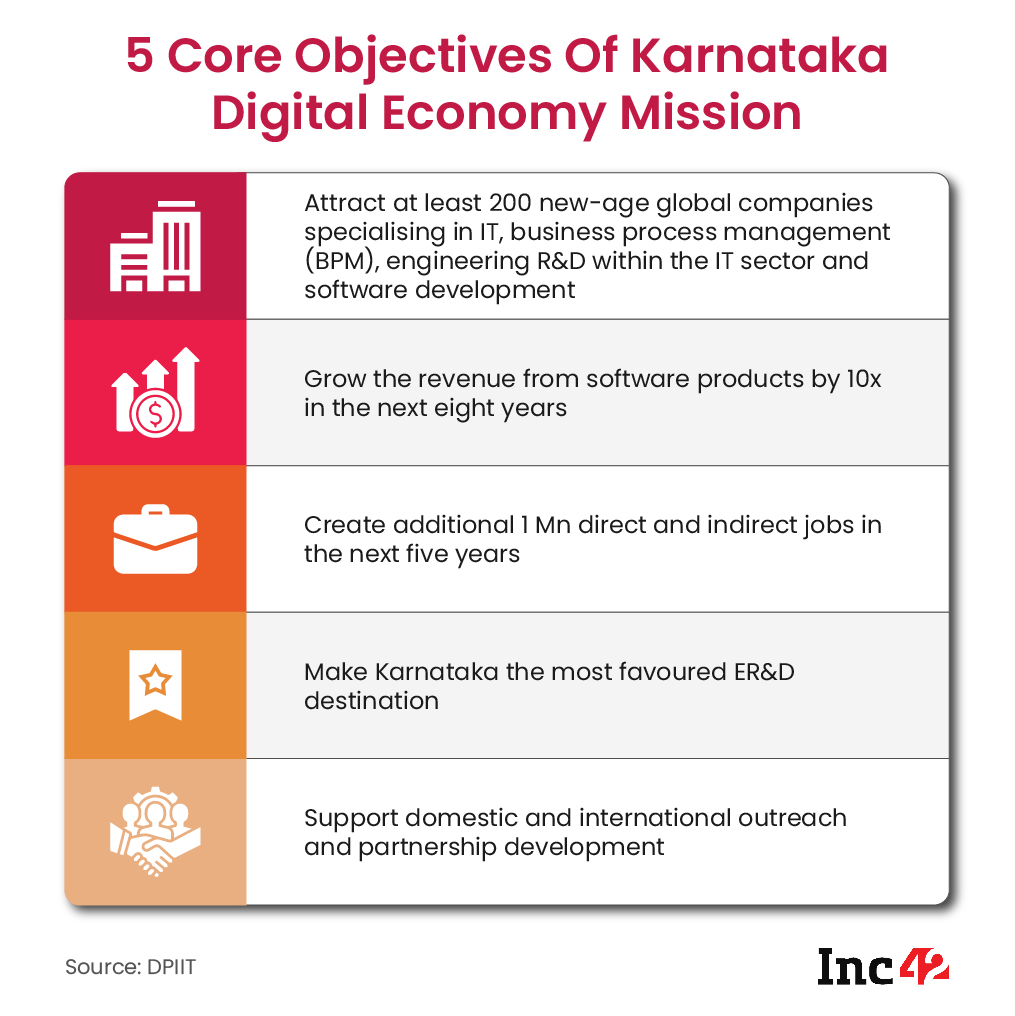

The Karnataka Digital Economy Mission (KDEM) was set up in 2021 to reshape the state’s startup ecosystem in sync with these hyper development trends.

“One thing was clear, though. It must not be another government-controlled body but one led by industry leaders and supported by the state government,” KDEM chairman BV Naidu told Inc42.

“To keep it tuned to our vision, the government’s stake in KDEM is limited to 49%. The remaining 51% is held by industry bodies ASSOCHAM, IESA and NASSCOM. The board includes all additional chief secretaries and the industry representatives,” he said.

Out of $1.5 Tn, KDEM aims Karnataka’s digital economy to hit $300 Bn by 2025.

The idea is to develop tech clusters beyond Bengaluru and across the state. And Naidu is perhaps the best fit to turn this strategic vision of growth into reality.

He played a crucial role in developing the Software Technology Parks of India (STPI) and went on to help implement the National Electronics Policy 2011. Simply put, Naidu has been wearing many hats since his voluntary retirement in 2007 as the director of STPI.

Apart from helming KDEM, he is also a member of Karnataka Chief Minister’s IT task force, the founding member of IIITB (International Institute of Information Technology, Bangalore), the founding director of the Karnataka IT fund, a seed fund launched by the state government, and chairman of the India Semiconductor Association (ISA).

But before we explore how multiple Bengalurus can grow to push a global dream, let us take a quick look at the economic affairs of the state.

The History And The Transformation

The name Karnataka comes from the Kannada word karu+nadu, which means elevated land. Over the centuries, the state had been occupied by the Nanda, Maurya and the Satavahana dynasties and later became a part of the homegrown Vijayanagar empire.

In 1565, it was conquered by the Deccan Sultanate along with Vijayanagar and became a part of the kingdom ruled by Haider Ali and his son Tipu Sultan. Tipu later lost his empire to the Britishers after being defeated in the Fourth Anglo-Mysore War in 1799. After Independence, Karnataka was formally recognised as a separate state on November 1, 1956.

Traditionally, the state has thrived on booming PSUs and made good use of the robust agro, textile, heavy engineering, aerospace and automobile sectors. Dakshina Kannada and Udupi districts are also known as the cradle of Indian banking as seven of the country’s leading banks (Canara Bank, Syndicate Bank, Corporation Bank, Vijaya Bank, Karnataka Bank, Vysya Bank and the State Bank of Mysore) originated there.

Besides, around 60% of the biotechnology companies in India have their base in Karnataka, and 50% of the state’s revenue is generated from this sector.

However, the IT/ITeS industry that made a foray into the state in the 1990s and the decade-old but fast-evolving startup ecosystem have ushered in economic dynamism on a par with global standards, attracting entrepreneurs, investors and industrialists in droves.

Karnataka is the biggest IT hub in India and home to the fourth-largest technology cluster in the world. The state boasts 47 IT/ITeS SEZs (19 operational), five STPIs and dedicated IT investment regions and more than 3,500 IT companies, including industry behemoths like Infosys and Wipro headquartered in Bengaluru.

Understandably, Karnataka jumped from the fourth spot to the first in terms of attracting industrial investment. It witnessed a proposed investment of INR 31,668 Cr in 2014 but topped the list in 2015 and 2016 with a proposed investment of INR 1,54,173 Cr and INR 1,40 683 Cr, respectively.

The momentum continued even during the pandemic. It topped the Indian states with a ticket size of INR 1,54,937 crore in proposed industrial investments in April-December 2020, said Jagadish Shettar, then Karnataka minister for large and medium scale industries.

“We have acquired sufficient land banks for the investors who want to invest in the state. Our chief minister Basavaraj Bommai has presented a people-friendly budget that is a game-changer. The state is home to 400+ R&D centres and 85+ chip design houses and is a key player in the supply chain for the global markets,” said the industries minister Murugesh Nirani at the launch of the Global Investors’ Meet. The event proper will be held on November 2 and 3, 2022.

Mysuru, Mangalore, And Hubli-Dharwad: Focus On More Tech Clusters

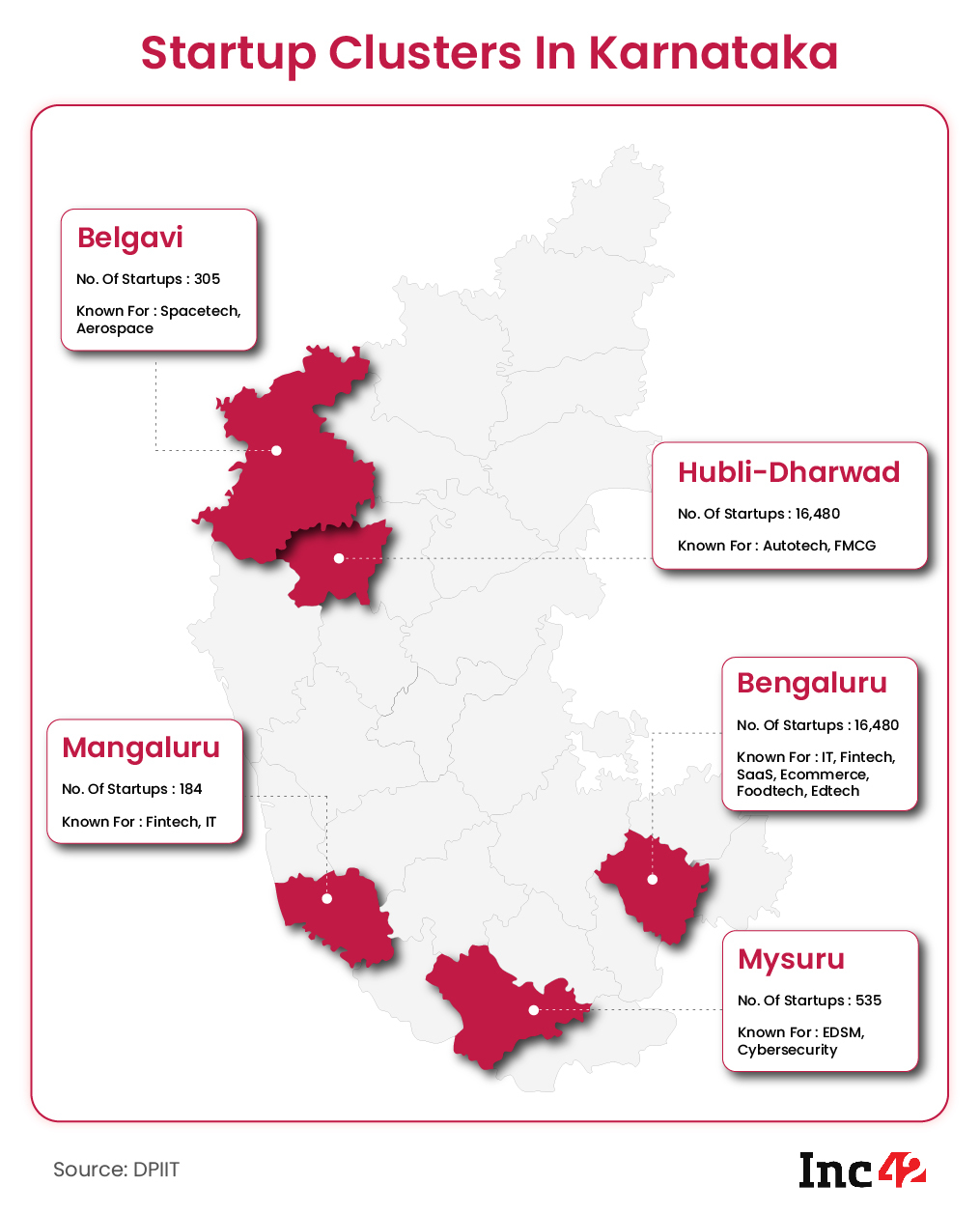

A multipronged development strategy requires sustainable infrastructural growth, resulting in tech clusters with agglomeration benefits. “The idea is to build and promote sector-specific tech ecosystems in different parts of the state,” explained Naidu.

For instance, the city of Mangaluru, already well-known for its banking industry, can host the fintech ecosystem. Similarly, Mysuru is being developed as an ESDM (electronics system design and manufacturing) and cybersecurity cluster. And Hubli-Dharwad is known for its focus on the foundry and the automobile sectors.

“We don’t call them Tier 2 or Tier 3 cities. They are the emerging tech clusters. That is how we want to position these clusters while building the startup ecosystem,” added Naidu.

KDEM is also looking to initiate angel and seed funding for startup businesses and ensure a steady supply of the right tech talent to fulfil their requirements. Overall, there will be four focus areas for infra and business developments beyond Bengaluru. These include:

- IT products and services

- Innovation and startups

- ESDM

- Talent

Simply put, it aims to function as a bridge between the government and the industry, fast-pacing the latter’s requirements in a closed-loop manner.

Industry-Led Task Forces Mapping Development Plans

According to Naidu, different task forces have been set up to lead sector-specific capacity building across these clusters. For instance, Razorpay’s cofounder and CEO, Harshil Mathur, leads the fintech task force in Mangaluru while Jitendar Chaddah, country manager at Intel India, helms a task force handling ESDM.

In addition, an advisory group has been formed for GCC (GNU Compiler Collection) and engineering services. These task forces and the advisory group record the problem statements and help resolve those within a specific time.

Naidu mentioned a use case to detail how things worked. One of the companies stated earlier that the lack of ESDM testing hampered its operations. So, the government built the Lahari testing and certification facility in Mysuru, an advanced unit to help all companies in this space.

The state government has also announced funds for a cleanroom to facilitate high-tech manufacturing. Most manufacturers spend a big chunk of their budget building cleanrooms to protect their products. If states and the central government co-create cleanrooms for ESDM companies, production costs are bound to come down drastically.

“The (Karnataka) government has allocated 40K sq, ft for a cleanroom. This will attract businesses working on EV battery, LED lighting and similar areas,” said Naidu.

And, the plan is working too. Recently, the state government signed a Memorandum of Understanding (MoU) with Israel-based ISMC Analog Fab Pvt Ltd for setting up such a plant in Mysuru with an investment of INR 22,900 Cr. The project is expected to generate 1500 jobs in the city.

KDEM aims to create a talent pool to fulfil the requirements of at least 5000 new startups across these tech clusers. It wants to create 10 lakh employment and reach its goal of $10 Bn worth of exports from these clusters.

Closing Big Gaps In Talent, Funding And Innovation

What other magnets will attract new businesses with excellent earning potential? KDEM has dug deep to raise critical questions regarding talent flow in non-metros, establishing centres of excellence (CoEs) to deal with innovation challenges, and, more importantly, startup funding.

In coordination with the IT industry lobby NASSCOM and other trade bodies, the government is co-developing CoEs across the state. However, Bengaluru has not been included in this drive, given its high density of CoEs and R&D units.

Next comes the talent crunch, and KDEM has already launched a talent accelerator programme to ensure an uninterrupted supply chain.

“We have done mainly three things,” said Naidu. “First, we have identified 3K-4K people in these clusters and ensured they are available for job interviews. The local talent will be happy if they can work locally. Second, we have signed up 72 engineering colleges and asked them to keep the talent pool ready. Third, we will facilitate skilling programmes to make the local talent more job-ready.”

Making funds available to little-known startups is another critical issue. To begin with, KDEM has launched localised funds for each cluster. “We are creating cluster-focussed funds like the Mysuru fund, the Mangaluru fund and the Hubli-Dharwad fund. Interestingly, these venture funds are led by local leaders who invest their money along with the government’s.”

How To Prevent Startup Migration From The State

Shifting base from small towns to metros in pursuit of success is nothing new. It is a common trend among young professionals. And new businesses, especially startups in the early or growth stage that want to foray into global markets, stay close to paying customers and get quick access to potential funders like deep-pocketed international VCs, follow the same route.

Add to that seamless access to infra benefits, cutting-edge technology, supply chain reliability and a burgeoning talent pool. The decision to relocate to Indian metros or overseas startup hubs will make eminent sense.

Interestingly, fintech unicorn Razorpay is a case in point. Initially, the startup was set up in Jaipur but later shifted its base to Bengaluru.

Can KDEM stop this startup exodus after the initial years?

Although the organisation is diligently building the infrastructure, the CoEs and a job-ready talent pool, Naidu thinks that the emergence of cluster-centric funds run by local VCs and angel investors will help prevent untimely startup migration. If the startups are good, their investors will want them to stick to their clusters and attract more businesses. If the first- and the second-level investors do not advise them to move, other investors will not do it either. Later on, these startups can expand to big cities like Bengaluru as part of their expansion plans.

Also, the seed and the angel investors are local in these cases. If the startups do well, early investors’ wealth will grow manifold when they exit, thus strengthening the local capital flow. This will improve capital access in these clusters, and startups will stay on if they get adequate funding.

Consider Saankhya Labs or Robosoft Technologies in this context. Set up in Belagavi, Saankhya Labs became hugely popular for designing microchips and got acquired by the Tata group’s Tejas Networks. Again, Robosoft from Udupi was acquired by Japanese TechnoPro Holdings. Both clusters have seen exciting growth in recent years, and an aerospace SEZ has also been set up in Belagavi.

These developments occurred years ago when the government provided little or no help. Now that the authorities are willing to walk the extra mile to lift the startup ecosystem, local entrepreneurs and businesses will likely see sustainable growth.

Naidu, or KDEM, does not expect Bengaluru startups to migrate to the local clusters. But big corporate houses like Intel, Bosch and IBM or homegrown IT giants like Infosys may set up their offices away from Tier 1 cities in the wake of the pandemic.

After all, many companies are scouting for talent from small-town India to battle the tech talent crunch and skyrocketing salaries. This will further help the local talent hone their skills and get career exposure without shifting to startup hubs like Delhi, Mumbai or Bengaluru.

Meanwhile, KDEM is preparing the runway to help the state take off to Startup 2.0. And Karnataka must not let this opportunity slip away at any cost.

![Read more about the article [Tech50] This startup aims to meet the lifestyle needs of working professionals on a single platform](https://blog.digitalsevaa.com/wp-content/uploads/2021/12/CopyofImageTagsEditorialTeamMaster-3-1638542445110-300x150.jpg)