Restaurant aggregation and food delivery apps (or foodtech) have not only changed the way we consume but also impacted how the traditional restaurant industry functions at a fundamental level. Currently, Indian consumers place around 2.2-2.5 Mn orders a day, and to service this demand, the restaurant business across the country has undergone a huge transformation.

Prior to the arrival of the food delivery apps in 2012, most people did not opt for restaurant-made and home-delivered food as an alternative to home-cooked food unless one was craving for a gourmet treat. Of course, ordering food on the phone used to be the trend even in those days. A household would either order from the neighbourhood eateries or explore the restaurant catalogues delivered with one’s newspapers before phoning in the choice of cuisines. But with delivery apps such as Zomato and Swiggy in play, ordering food is no longer limited to such simple options. It is more like browsing a Netflix page and picking a show of choice — the options aplenty and the gratification, instant. Consumers ordering on Swiggy or Zomato behave in a similar manner. Now that there is a wide range of options from different restaurants, one would typically spend several minutes (or even hours) scrolling through ratings and dishes before placing the final order.

It seems our emotional connection with food has changed forever.

“Before the aggregators came in, people had an emotional connection with their favourite restaurants. Every household had 20-30 restaurant catalogues. And when you called them, restaurants used to deliver those orders using their own fleets. But now, everything has changed. A hotel guest has become a mere consumer. It is no longer someone whom I used to know very well and who ordered food every week. The person has become a mere order number on my ordering platform,” says Anurag Katiar, the president of the National Restaurant Association of India (NRAI) and the CEO of the Mumbai-based food and beverages company deGustibus Hospitality.

Katiar’s concerns are quite valid. When foodtech / delivery apps initially started operating in India, they promised ‘additional revenue’ to restaurateurs at a low commission of 10% or so per order. But that pitch changed gradually. By 2018, most mid-market restaurants and some big chains saw at least half their revenues coming from Swiggy and Zomato and the latter had more than doubled their commissions to 20-25% per order.

As the Covid-19 pandemic continues to ravage the country and dining-in rarely happens, most of the restaurants (especially those without a dedicated delivery fleet of their own) largely depend on these aggregators for revenue generation. Obviously, the journey from a paltry commission per order to a big percentage of the majority revenue’ has been triggered by the pandemic. But that should not be the sole reason behind the dominance of the delivery platforms. Technically speaking, they are just another sales channel for restaurants alongside dine-in and takeaways. However, that business equation has changed.

Why #OrderDirect Is Gaining Steam

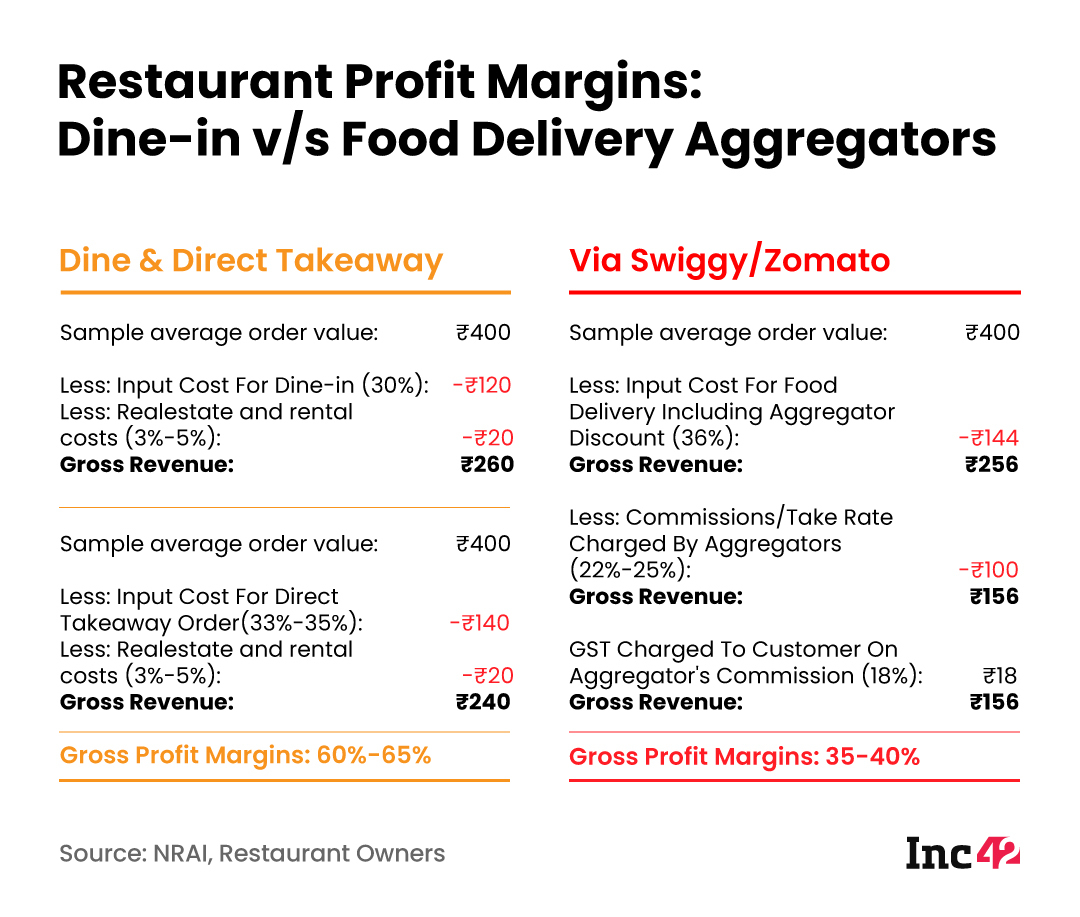

According to multiple restaurant owners who spoke to Inc42, the change in the business equation has affected their profit margins and the ability to keep costs under check. Katiar of the NRAI says that before the mass adoption of food aggregators by customers, restaurants usually had a healthy profit margin of 60-65%. But this number has now dropped to 30-35%. What’s more, this is not the profit margin for online orders but the entire business.

At the unit economics level, 30% of any restaurant’s dine-in order value typically includes expenses (or input cost), such as the cost of raw materials. If it is a takeaway, there will be 3-5% additional expenses for packaging and discount, Katiar points out. Depending on whether a restaurant is using its own real estate or rented space, that, too, is covered in the input cost. Overall, this translates to a gross profit margin of 65%, and this was the basic unit economics of a restaurant business before the arrival of food delivery startups.

“But after the entry of the food aggregation and delivery companies, the input cost may have gone up from 30% to 36% due to direct discount expenses. Add to that the 22-25% commissions charged by the delivery companies and the 18% GST, considered as an expense. So, the gross profit margin dips to anywhere between 35-40%,” Katiar adds.

But the problem is not limited to hefty commissions increasing steadily since the aggregators started working with restaurants in 2014. Given the fact that most mid-market and even premium restaurant/cafe chains currently get the majority of their revenues from Swiggy and Zomato (due to the high rate of user adoption), the bottom line has taken a severe hit.

Siddhant Kamath, the director of Naturals Ice Cream, says that his company was one of the earliest to hop on with food delivery companies way back in 2015. Naturals has been around for the past four decades, and it even had its home delivery business unit with a full-fledged call centre to handle direct orders. Naturals does not sell its products anywhere else except through its direct retail parlours, but after the entry of the aggregators and the spread of the pandemic, the company’s revenue module has witnessed a massive change.

“Primarily, we have been a walk-in brand, and that has always been the major chunk of our business. In the pre-Covid times, around 75% of our sales volume came from walk-ins and takeaways, and 25% was delivered by online aggregators. But after the lockdowns, we saw a big change. Our walk-ins are down to 60%, and online deliveries account for around 40% of our sales,” says Kamath.

Although food aggregators help generate new leads and provide the much-needed online discoverability to restaurant brands, restaurateurs seem to have outsourced the control over their businesses during the past decade or so, going by the fast-changing revenue equation. Now they are trying to regain their control by creating their own food delivery operations and encouraging consumers to ‘order directly’ from their independent ordering portals.

Last-mile logistics firms like Dunzo, Shadowfax and Pidge are now directly delivering food orders from restaurants to consumers, cutting down the intermediary (food delivery aggregator) while SaaS providers such as Thrive Now, DotPe and POSist are helping restaurants build and manage their online menus. These initiatives have gathered steam even before the second Covid wave and are likely to stay here for a long time.

Restaurant owners have told Inc42 that this is, by no means, an ‘anti-aggregator’ movement, but a step towards creating a new sales funnel. But a close look at the ‘order direct’ initiative tends to underline that it is mostly about restaurants trying to rebuild their long-lost engagement with customers who once used to order directly. Now, instead of making a call and getting friendly suggestions on the best fare of the day, customers are expected to browse through an impersonal online catalogue and place orders digitally.

However, the road ahead for creating a new sales funnel or rebuilding customer relationships will be incredibly challenging as consumer preference seems to have shifted to a multi-option aggregation model for a cash-rich but time-poor customer base. And hence, the crucial question: Will the restaurant industry succeed in clawing back some control over their sales funnel, and if it happens, how will it affect foodtech startups?

#OrderDirect Is Not An Anti-Aggregator Movement Against Foodtech

Dhruv Dewan, cofounder of Thrive and Hashtag Loyalty that provides point-of-sale (PoS) and direct ordering software to restaurants, tells Inc42 that the startup has onboarded more than 3,000 restaurant outlets in the past five months. All these outlets have joined the ‘order direct’ initiative. Currently, Thrive is processing 350-400K daily orders, growing at 10-15% a week since November 2020. The Thrive software works by digitizing the offline menu into an interactive online menu wherein each restaurant outlet on Thrive gets their own direct order link.

Thrive also helps in online promotion, and offers third-party logistics integration through tie-ups with Wefast, Dunzo, Pidge, Shadowfax alongside the software offering. Restaurant owners can choose to either pay the delivery cost by themselves or pass it on to the customer.

“We charge a commission of just 3% per order, and we also offer online ordering software for an additional fee on top of this commission. In April this year, the ‘order direct’ movement started to pick up significantly, and we are also solving for customer acquisition,” adds Dewan

Thrive has enabled the ‘order direct’ option for many brands such as Naturals, The Belgian Waffle Co., The Bombay Canteen, Burgerama, Fabcafe, and others. It has recently launched a web marketplace, listing all the outlets it works with. But this marketplace is not the only medium of discovery for these brands.

To gain further momentum, restaurants are also promoting their direct ordering links on social media platforms. When a customer clicks on a specific link, he/she is redirected to a web page that lists the entire menu of the restaurant. Once the order is finalised and paid for, the restaurant sends a person to home-deliver the food. Some restaurants are currently repurposing their existing dine-in staff as delivery staff, while some are using Thrive’s direct partnerships with last-mile delivery startups to deliver direct orders to customers.

However, most companies adopting the direct order channel are premium or gourmet brands with impressive brand appeal and a loyal customer base. Currently, India has 70 lakh branded restaurants, but the bigger market opportunity comes from the 2.3 Cr outlets in the unorganised segment, according to federation of Hotel & Restaurant Associations of India’s (FHRAI) estimates.

Incidentally, eateries across the unorganised segment consider Swiggy and Zomato as an important enabler of their revenue channel as the discoverability they offer to new restaurant entrepreneurs cannot be ignored. So, getting the unorganised segment to adopt the technology and the social media strategy for creating a direct ordering funnel is going to be a challenge and may actually lead to an industry split. Again, the question is: Can B2B enabler startups like Thrive come up with a workable solution for those seeking online discoverability and a wider customer base?

It is going to be difficult, at least in the initial phase. Katiar of NRAI says that for a new player entering the restaurant space, listing on Swiggy or Zomato is a must since the aggregators provide brand discoverability unlike any other medium out there. Even if new restaurant brands lose some money due to the commissions charged by the aggregators, it will create some brand equity.

But when that brand appeal is built, the next important business continuity move will be building a direct connection with customers, and this where customer data plays a crucial role.

Ashish Tulsian, CEO of the cloud-based restaurant technology platform POSist headquartered in New Delhi, tells Inc42 that most brands which are building direct ordering channels are more interested in customer data than the ability to source orders by paying low commissions. POSist is one of the startups currently providing software tools that restaurants are using to build their ordering portals. Earlier, it had launched the POSist app marketplace that allows restaurants to browse and develop online ordering platforms, digital wallets, table reservation platforms and loyalty programmes.

“The (order direct) movement is endorsed by some of the largest brands in the country. Tomorrow, if aggregators decide to give (customer) data, most of the brands in this movement will likely fall out, but hefty commissions will still be a problem. Restaurants have realised that in the case of online orders, their own customers are sold back to them, minus the visibility of who all are ordering,” points out Tulsian.

The Promise Of Customer Data With #OrderDirect

Zomato and Swiggy do not share customer data with most restaurants, and this has created a void for many brands, which have no way of knowing who their loyal customers are. Aggregators, however, share data with big brands like Dominos and McDonald’s for an entirely different reason (more on that later).

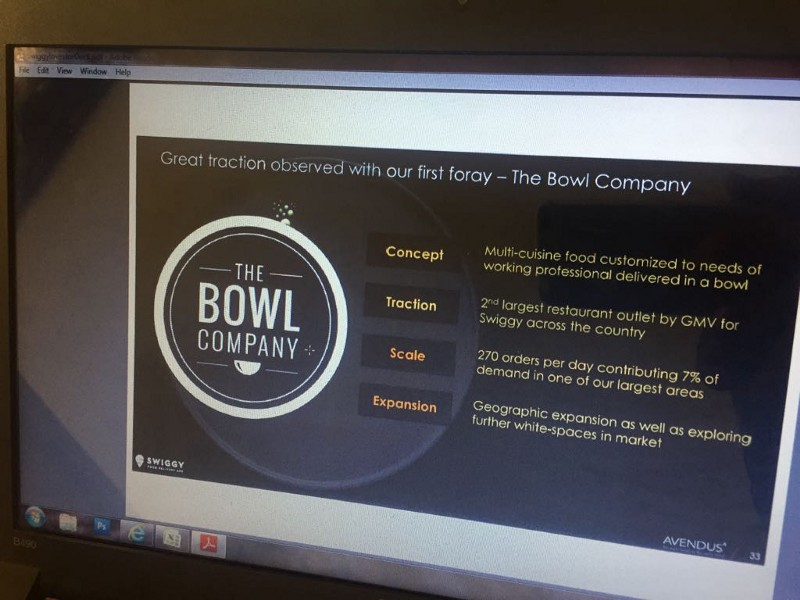

Before the digital ecosystem kicked in, restaurants usually had close ties with their regular customers. But after the foodtech giants took control of the majority of sales volume, restaurants did not pay much attention to acquiring customer data, until the former started using it for discounting and more customer acquisition. Swiggy even launched its private label called the Bowl Company based on the ordering and customer data it had accumulated over the years.

After setting up the Bowl Company, Swiggy was also accused of cannibalising the businesses of its restaurant partners much like how Amazon is accused of cannibalising independent sellers’ revenue by upselling its array of private labels. In July 2017, a Tumblr blog post titled Swiggy, a house of cards (said to be written by the members of Swiggy’s sales team), accused the startup of upselling the Bowl Company brand on its marketplace.

“We (Swiggy) recently took the best business zone in Bangalore and started intentionally routing all the users to order from Bowl Company — our own private label kitchen. The Bowl Company is the top search result in all of Koramangala now. This just directly hits at the heart of restaurants we ‘partnered’ with to grow our business in the first place,” the blog post said.

The blog post has been taken down since, but we could retrieve a copy of it from the Internet archive. Swiggy, however, had maintained that the post was the work of “outsiders” who had mischievous intentions.

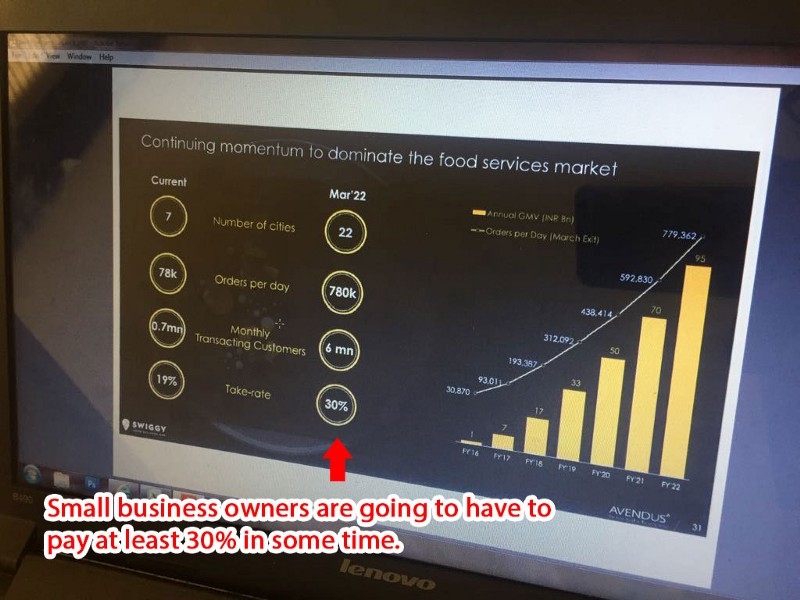

But another piece of crucial information leaked in the 2017 Tumblr blog by the so-called ‘Swiggy employees’ was that the startup wanted to increase its commission (take-rate) to around 30% per order by 2021, which seems to be the direction it is taking. The blog post even attached some slides, claimed to be from Swiggy’s pitch note to investors, which seem to be co-created with the investment banking firm Avendus Capital.

“They (Swiggy management) want the average commission rate to be 30% in 2022. That means that at least some of the restaurants will be paying 40% commission. We know what averages mean. At 40%, restaurants will bleed to death. And most of these businesses which pay 40% will be the small guys, because the big guys will never pay anything more than 20%,” the blog post read.

Katiar of NRAI, Dewan of Thrive and Siddhant of Naturals have confirmed that both Zomato and Swiggy charge different commissions based on the brand recall and the size of the business. Hence, the alleged leak in the Tumblr post seems too difficult to ignore as a similar practice is followed when they share customer data. When it comes to large MNC brands such as Mcdonald’s and Domino’s, the aggregators are willing to share data to keep catering to them.

“When a Swiggy or a Zomato notices when their users are actually searching for an individual brand that is hard to ignore. When users are searching to order a pizza from Domino’s or a burger from Mcdonald’s, they have already made up their mind. In this scenario, the equation is different. The aggregators are willing to share customer data and charge them lower commissions because those are such big brands (with a massive user base of loyal customers),” says a startup founder who sells SaaS products to restaurants and wants to remain anonymous.

But whether a restaurant brand is large, medium or small, when they set up multiple stores and get brand recognition, it becomes essential to access customer data. Branded restaurant chains usually collect phone numbers and email IDs to keep customers posted on deals and discounts and thus get repeat customers. However, most of the order volume is now is skewed towards the aggregators, and restaurants feel the imminent need to create their own ordering channel to figure out crucial customer data for future growth and better monetisation.

This puts us in a dilemma. Foodtech companies worldwide have burnt billions of dollars to build sky-high valuations. But In India, it is still unclear whether Swiggy and Zomato are helping or hindering restaurant brands, especially those which are struggling to stay afloat in the pandemic times as the dine-in revenue channel has taken the worst hit. Of course, the ‘order direct’ movement may fail to take off en masse, but without the brand equity built by restaurants over the years, food delivery startups may fold up. Although cloud kitchens are likely to offer an alternative market opportunity to food delivery startups, an aggregator’s core valuation metrics are still closely linked to their restaurant partners.