Startups in India still face many challenges while scaling up, but the most common issues are the lack of funding and the absence of smart, data-driven decisions

Velocity’s cofounder and CEO, Abhiroop Medhekar, hosted a session on revenue-based financing and how it can solve these issues for brands as they scale-up

Catch the session and Medhekar’s insights here

The startup ecosystem today is rife with growth opportunities. From implementing an idea to scaling it, the journey has become smoother and faster due to technological advances and the rise of digitalisation. Even then, most startups or small companies have to face some critical business challenges, be it funding or the rapid adoption of smart, data-driven decisions.

“We spoke to a lot of brands and asked what is holding them back. What is not allowing them to grow as fast as they potentially can. And their lack of access to growth capital came up as the biggest growth blocker,” said Abhiroop Medhekar, cofounder and CEO of Velocity, a Bengaluru-based revenue-based financing platform

Speaking at The D2C Summit hosted by Inc42 Plus and Shiprocket in July, he emphasised how fundraising had always been a big challenge for startups. In fact, despite the complicated processes and prerequisites, the traditional way of raising capital from angel investors and venture capitalists has been the only recourse for the ecosystem for the longest time.

Besides, most ecommerce and direct-to-consumer (D2C) brands in the growth stage require funding to improve operational efficiency and develop effective marketing strategies. But these growth expenses are bound to impact revenue growth, often demanded by investors. Fortunately, there are other alternatives to consider and one of them is revenue-based financing.

“The faster you grow, the more capital you will need for inventory. You will need more money to spend on marketing, and it will convert into revenue over time,” explained Medhekar. According to him, this working capital gap keeps widening, which is a major reason why ecommerce brands fail to grow as fast as they should.

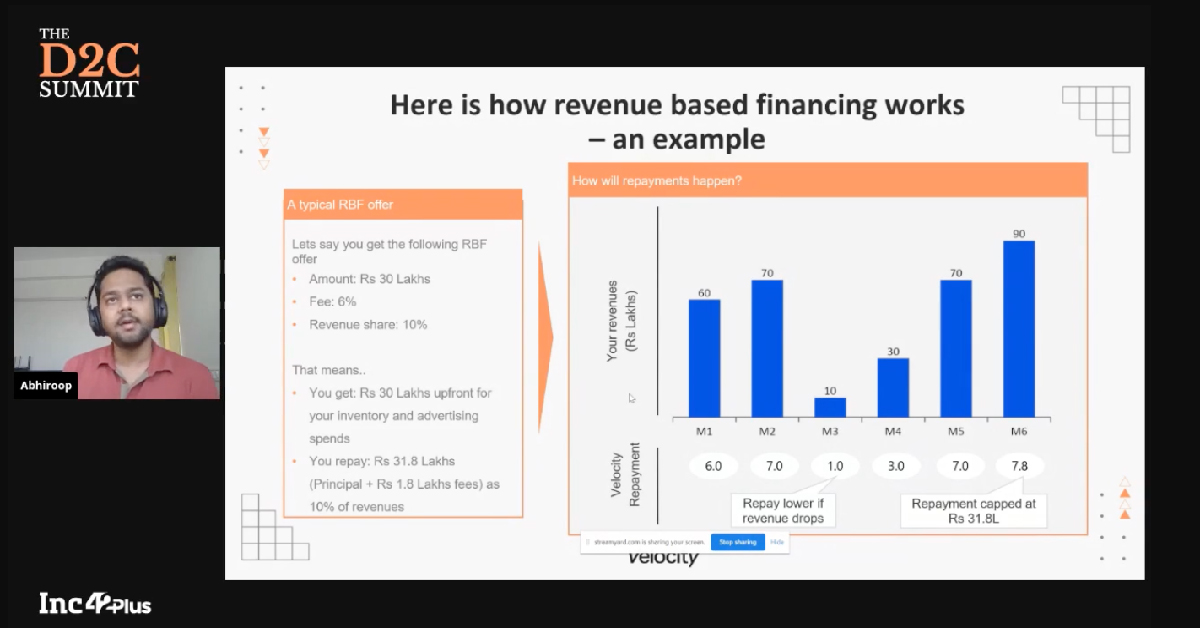

Having built Velocity to bridge this gap and help the D2C and ecommerce startups with revenue-based financing, Medhekar believes that the new format will enable startups to get away from the limiting terms and conditions of traditional funding. This alternative works on the model of loans and allows a company to raise capital against the sales and revenue of the business. The money thus raised can be repaid in instalments based on a proportion of future revenue.

During his session at the two-day summit, Medhekar advised the startup to explore this option for scaling up, given its many advantages.

Watch Abhiroop Medhekar Explain Revenue-Based Financing & Its Scope For D2C Ecosystem, Here:

Velocity And The Workings Of Revenue-Based Financing

Talking about Velocity’s core concept, Medhekar said, “We started with a fundamental question. Why should a business owner pay a fixed EMI irrespective of the cash flow when business revenue fluctuates?”

The revenue-based financing model allows a brand to get its future revenues upfront so that it can be easily deployed for inventory, advertising and other marketing spends. The payment part is also flexible, amounting to a pre-decided percentage of the revenue a company generates month after month.

If the business is healthy, it will have a surplus based on the cash flow generated, which it can keep putting back into the business. Moreover, these finances can work in cycles. When a startup completes the first cycle, including the repayment of the capital raised, it can return to the financier and raise more money.

For instance, Velocity provides INR 10 Lakh-2 Cr to ecommerce and D2C startups without any collateral or equity dilution. A brand with monthly revenue of INR 5 Lakh will be eligible for funding and it will be charged a fixed 4-7% fee against the money raised. Additionally, a monthly revenue share between 5 and 20% will be charged for repayment, as agreed upon upfront.

For transparency and smooth operations, brands must share their financial and marketplace data, which is used to underwrite loans. All data is encrypted in sync with bank-level standards.

“Keeping in mind all these aspects, we believe it is a much better way of financing ecommerce. And I think it is fairly apparent from the way the model has been panning out globally,” said Medhekar.

Catch all the sessions and the insightful conversations from The D2C Summit 2021. The takeaways from the founders, investors and enablers of the D2C ecosystem are right here at The D2C Academy.

![Read more about the article [Funding alert] Nobel Hygiene raises Rs 450 Cr led by Quadria Capital](https://blog.digitalsevaa.com/wp-content/uploads/2021/06/startup-funding-1604990423185-1607520206686-1624433662234-300x150.png)