An overpowering doubt precedes every product purchase when it comes to skincare: Will it work for me? For the longest time, brands, too, have spent vast amounts on R&D and struggled to find a one-product-serves-all kind of elixir to address skincare issues at large. But much like fingerprints, skin types are different, and nothing less than customised products can help individuals.

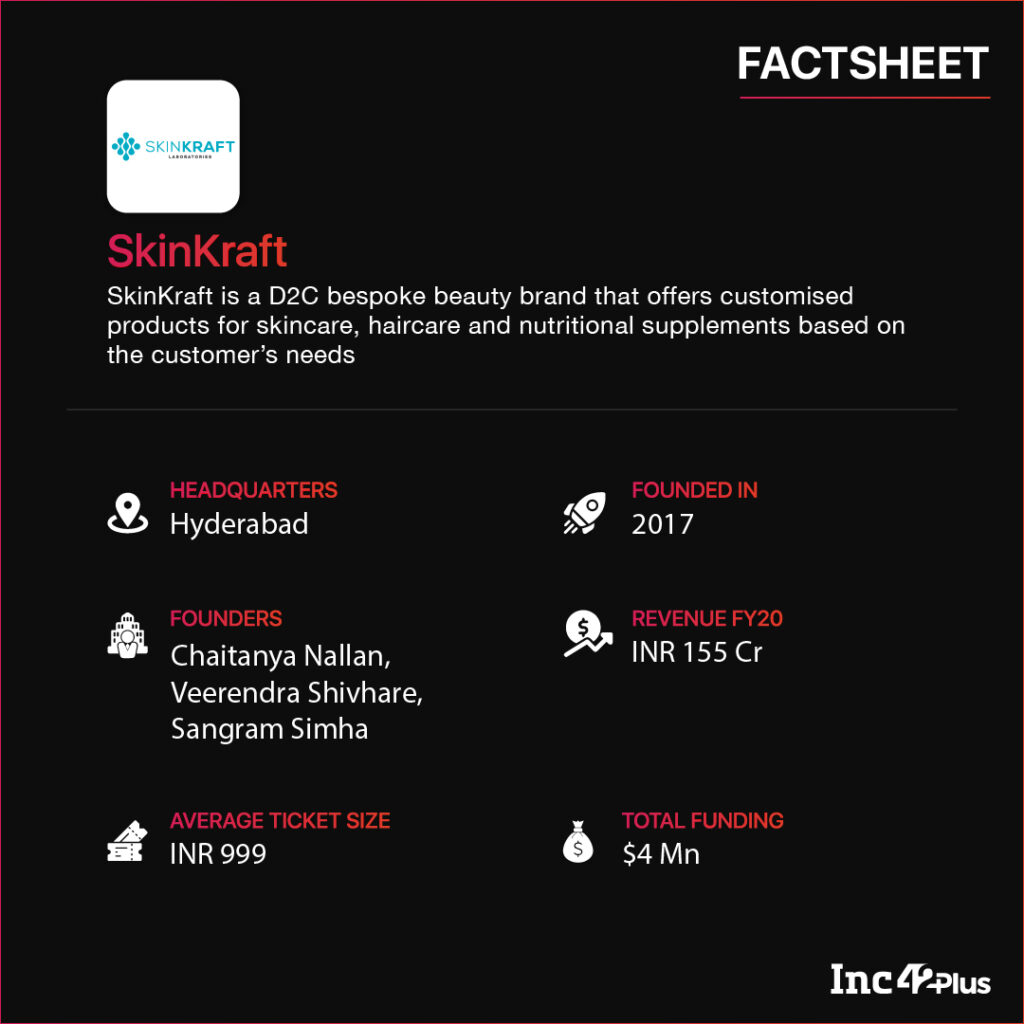

Powered by new-age technology, a handful of digital-first, direct-to-customer (D2C) brands specialising in ‘bespoke beauty’ are on a mission to provide fully customised formulations tailor-made for every user. In the process, they do away with harmful chemicals and shock pricing while some brands like SkinKraft offer AI-enabled skin profiling and product recommendation, further refined based on user feedback.

Bespoke beauty is booming worldwide (Tokyo-based Ubuna Beauty, Melbourne’s Bespoke Beauty Australia and Curology from San Francisco, to name a few), and the trend has started picking up in India too. A couple of key players in this space include Gurugram-based Bare Anatomy and Hyderabad-based SkinKraft and Vedix, owned by IncNut Digital.

From Content To Manufacturing, A Leap Of Faith

SkinKraft and Vedix are similar in company culture but widely different when it comes to product offerings. But it has been an intriguing journey all along. Sangram Simha (CMO), a marketing specialist and an IMT-Ghaziabad alumnus, set up IncNut Digital in 2011. After working together at Infosys and advertising company mGinger, Chaitanya Nallan (CEO) and Veerendra Shivhare (CTO) joined Simha in 2012.

For about half a decade, IncNut operated as a digital content company and launched two women-centric websites. Launched in 2011, Stylecraze focussed on beauty, fashion and wellness while Momjunction, started in 2013, revolved around motherhood. The company claims that on average, the websites see combined monthly traffic of more than 50 Mn.

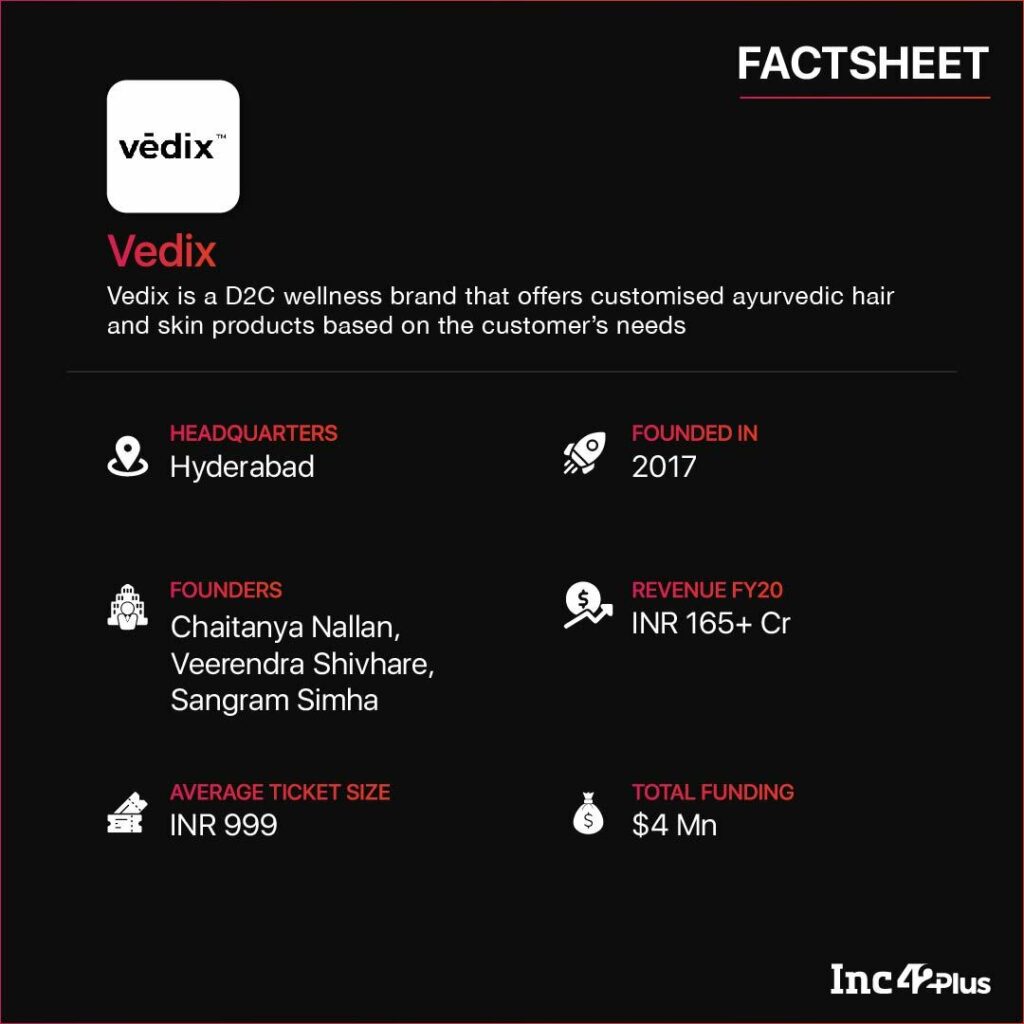

Inspired by the success, the trio wanted to delve deeper into the beauty and wellness segment and launched SkinKraft and Vedix in 2017 as wholly-owned subsidiaries of IncNut. While SkinKraft offers skin and hair care formulations using Western science, Vedix explores ayurvedic knowledge and techniques for a fresh range of beauty products.

As part of their bespoke beauty offerings, both brands ask their users multiple questions regarding their skin types and the issues they face. The entire knowledge-gathering process is curated by a team of dermatologists, ayurvedic doctors and data scientists, and users are provided customised products based on their responses and requirements.

Commenting on the two-pronged approach that captured the best of both modern science and ageless wisdom, Nallan said, “We started with an unfair advantage as we had a full-fledged team of beauty writers and communicators who understood the pain points of consumers and the gaps left by existing brands. We wanted to put this knowledge to good use and offer solutions that cater to their needs.”

SkinKraft’s Bespoke Beauty Solutions

The parent company’s three pillars of strength included the power of content (for an in-depth understanding of the segment and effective touch-basing with consumers), data science expertise (for building a strong recommendation engine capable of classifying user profiles) and a captive target audience (for increasing sales).

Unlike many D2C peers that struggled with brand visibility and building a sound customer base, IncNut’s journey of more than half a decade had already strengthened its presence as a knowledge marketer. So, manufacturing through its subsidiaries was the next logical step to service its customers.

SkinKraft puts a heavy emphasis on research and development that works on two fronts. First, the profiling, and second, the classification. The company’s R&D helps curate and set up the right questions required to build a user profile.

After gathering the data, the person’s skin type is profiled by using a combination of algorithms (based on dermatological principles). Next comes the classification part, done by comparing the skin type with hundreds of pre-generated profiles that the company has already built.

Post the classification, the firm’s AI-powered recommendation engine suggests three best-matching products from the list of formulations. These include a cleanser, a moisturiser and an active agent that will address basic skin problems.

SkinKraft makes the formulations in-house and has partnered with five manufacturers in Noida (Uttar Pradesh) and Baddi (Himachal Pradesh) for rolling out the end products. As of now, around 14 Lakh units are manufactured per month. The company also procures the ingredients and says that the materials used are certified by the Drug and Cosmetic Administration for topical products. The ingestible are certified by the Food Safety and Standard Authority of India

Post-manufacturing, its products are tested for toxins, allergens and safety standards by an Australian agency that adheres to FSANZ (Food Standard Australia and New Zealand) benchmarks. It also claims not to use phthalates, paraben, sodium lauryl sulfate (SLS) or formaldehyde, common preservatives and harsh active agents usually found in many skin and hair care products.

Going into 2020, the bespoke beauty brand diversified its product line and started offering customised haircare and skincare solutions for men.

Its latest product launch includes a wide range of customised nutrition supplements for which the company has obtained Halal and Kosher certifications. In line with its beauty offerings, the brand recommends vitamins, minerals and micronutrients that may be missing from a consumer’s diet.

SkinKraft has adopted a subscription model starting from INR 999, and customers can opt for monthly, three-month or six-month packages. The company claimed that the number of annual subscriptions reached 1.8 Lakh in FY20, and it clocked INR 155 Cr in revenue that year, growing at 15% MoM. Also, repeat subscriptions accounted for 40% of the total annual subscriptions, the company said.

In August this year, SkinKraft launched its best-selling products on Amazon India so that new customers can purchase these outright. The one-off buying with no (subscription) strings attached is a practical way to create brand awareness faster, while the product quality is likely to drive people to the subscription funnel. The company has recently made its products available on other marketplaces like Purplle, Flipkart and Myntra.

Currently, 5% of SkinKraft’s revenue comes from marketplaces, but the company expects it to grow to 30-35% by FY22.

Exploring The Goodness Of Ayurveda Through Vedix

India’s ageless wellness culture stems from the ancient science of ayurveda. In fact, a large part of the Indian population still uses ayurvedic products for skincare and holistic nourishment. Realising the potential of this traditional wellness genre in the modern context, IncNut launched Vedix in 2017. It operates along the lines of SkinKraft and has a similar subscription model, but only ayurvedic processes are followed for assessment and the customised skin regimen.

For instance, Vedix does a dosha analysis (in Sanskrit, faults or imbalances that may cause health issues), and a consumer has to answer 30 questions regarding wellness before the user profile is created. It is then matched with existing categories with the help of ayurvedic doctors, and the recommendation engine comes up with customised products.

The ayurvedic brand currently offers products under four categories — skincare, haircare, detox and health supplements.

Vedix follows the same regimen as SkinKraft when it comes to procurement, production and quality checking. Its ingredients come from certified organic farms, and the company has an AYUSH licence (the Ministry of AYUSH is the regulatory body for maintaining the quality standards of ayurvedic products) for developing its formulations.

Its products also undergo quality checks by the Australian agency that monitors SkinKraft. The brand claims that its products are free from soy, gluten and dairy, and they are cruelty-free.

Vedix claims to have clocked more than INR 165 Cr in revenue in FY20, a 100% jump compared to the previous financial year. The company says it has a monthly average of close to 1 Lakh subscriptions, with a repeat subscription rate of 65%. The brand is aiming to enter the US, the Middle East and the Southeast Asian markets by the end of FY22.

Although bespoke beauty is a niche segment, India’s online beauty and personal care market has grown exponentially even during the pandemic. It was valued at $22.9 Bn in 2020, making it the fourth-largest market in the world (after the US, China and Japan), according to an Inc42 Plus report. And this market is expected to grow at a CAGR of 5.48% to reach $29.9 Bn by 2025. Add to that people’s increasing awareness of wellness and clean beauty as part of a holistic lifestyle, and this segment will only get better.

Experts also believe that the rise in content and social commerce across the country will further drive this segment’s growth as this model’s success lies in consumer awareness and better engagement through timely and relevant content. Global brands like San Francisco-based Curology and New York-based Atolla have already implemented such content strategies as they run blogs on their websites and post about the benefits of their solutions on social media.

In India, lifestyle products still thrive on influencer marketing. But the new breed of ‘woke’ consumers care deeply about quality and product provenance as part of beauty and wellness needs. Hence, brands like SkinKraft and Vedix are likely to see a strong market for sustainable growth.