India’s real-time payment system Unified Payments Interface (UPI), and its equivalent network in Singapore, PayNow, are now integrated.

The linkage of the two digital payment systems will allow instant and low-cost transfer of money and cross-border payments/transactions from Singapore to India and vice versa.

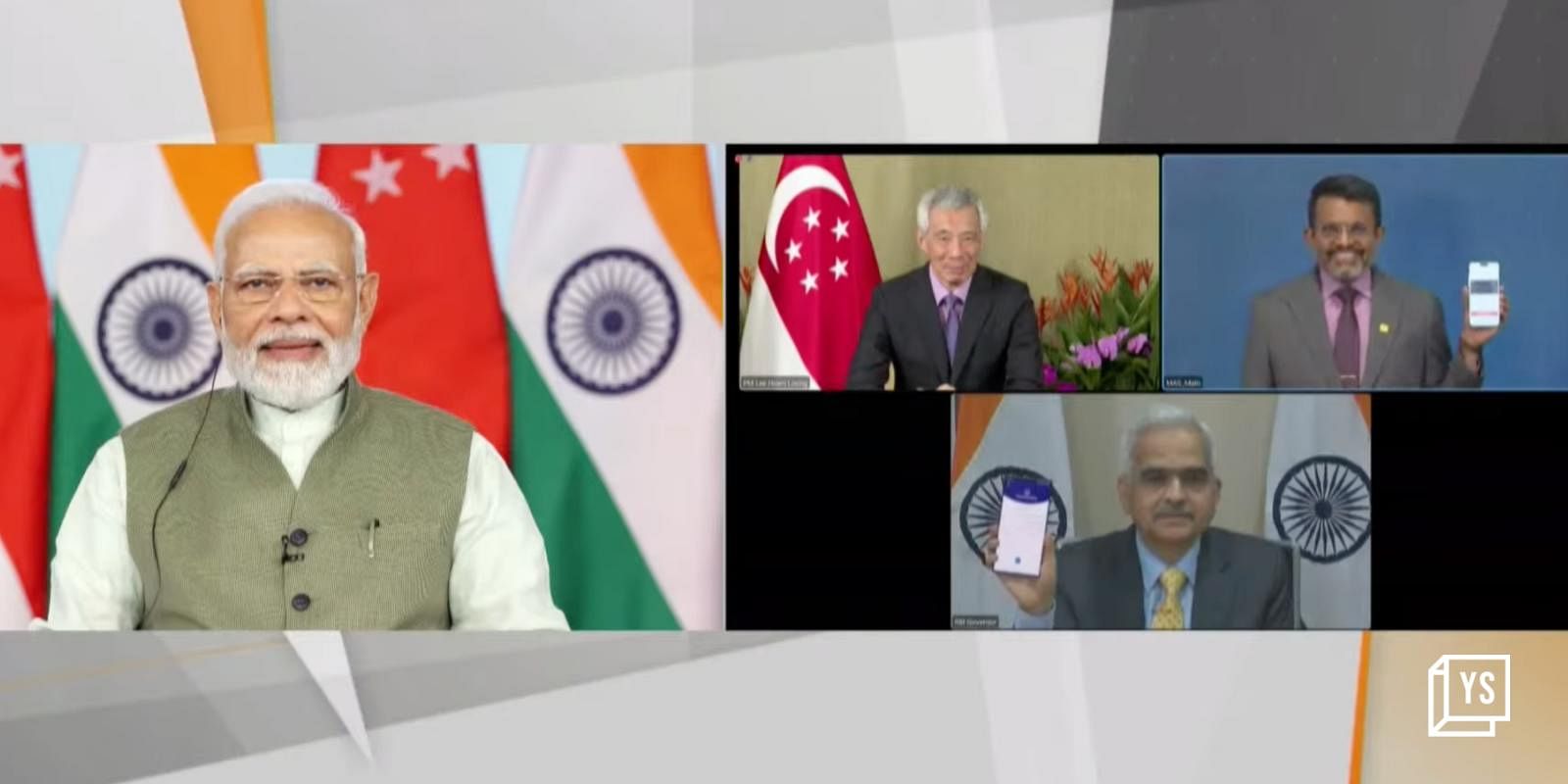

Reserve Bank of India’s Governor Shaktikanta Das and the Monetary Authority of Singapore’s (MAS) Managing Director Ravi Menon launched the new linkage. Prime Minister Narendra Modi and his Singaporean counterpart, Lee Hsien Loong, witnessed the launch via video conferencing.

Governor Das and MAS’s Menon did the first transaction after the launch.

Besides benefiting the vast Indian diaspora in Singapore, the project will help workers, students, and tourists who travel to the country for a brief period and end up paying a heavy bank fee for money transfers.

Further, this payment connectivity comes as an advantage to small businesses and enterprises.

“The launch of the UPI-PayNow linkage (between India and Singapore) is a gift to citizens of the two countries, which they were waiting for eagerly. I congratulate the people of both India and Singapore for this,” the PM said, adding that the linkage is a new milestone in India-Singapore relations.

As per RBI Remittance Survey, 2021, the share of Singapore for the total inward remittances to India in 2020-21 stood at 5.7%.

Digital transactions to exceed cash in India

The PM expressed hope that digital transactions will soon surpass cash as UPI is increasingly becoming the most preferred payment mechanism in the country.

Modi said about 74 billion transactions, amounting to more than Rs 126 trillion, approximately 2 trillion Singapore dollars, were done through UPI in 2022.

“Many experts are estimating that very soon India’s digital wallet transactions are going to overtake cash transactions,” he said.

A large number of transactions via UPI demonstrate that the indigenously designed payment system is very secure, he added.

A key emphasis of the PM has been on ensuring the benefits of UPI are not limited to India only but extend to other countries as well.

“In today’s era, technology connects us in several ways. Fintech is a sector that connects people. Normally, it is confined within the boundaries of one country. But today’s launch has started a new chapter of cross-border fintech connectivity,” the PM said.

(With inputs from PTI)