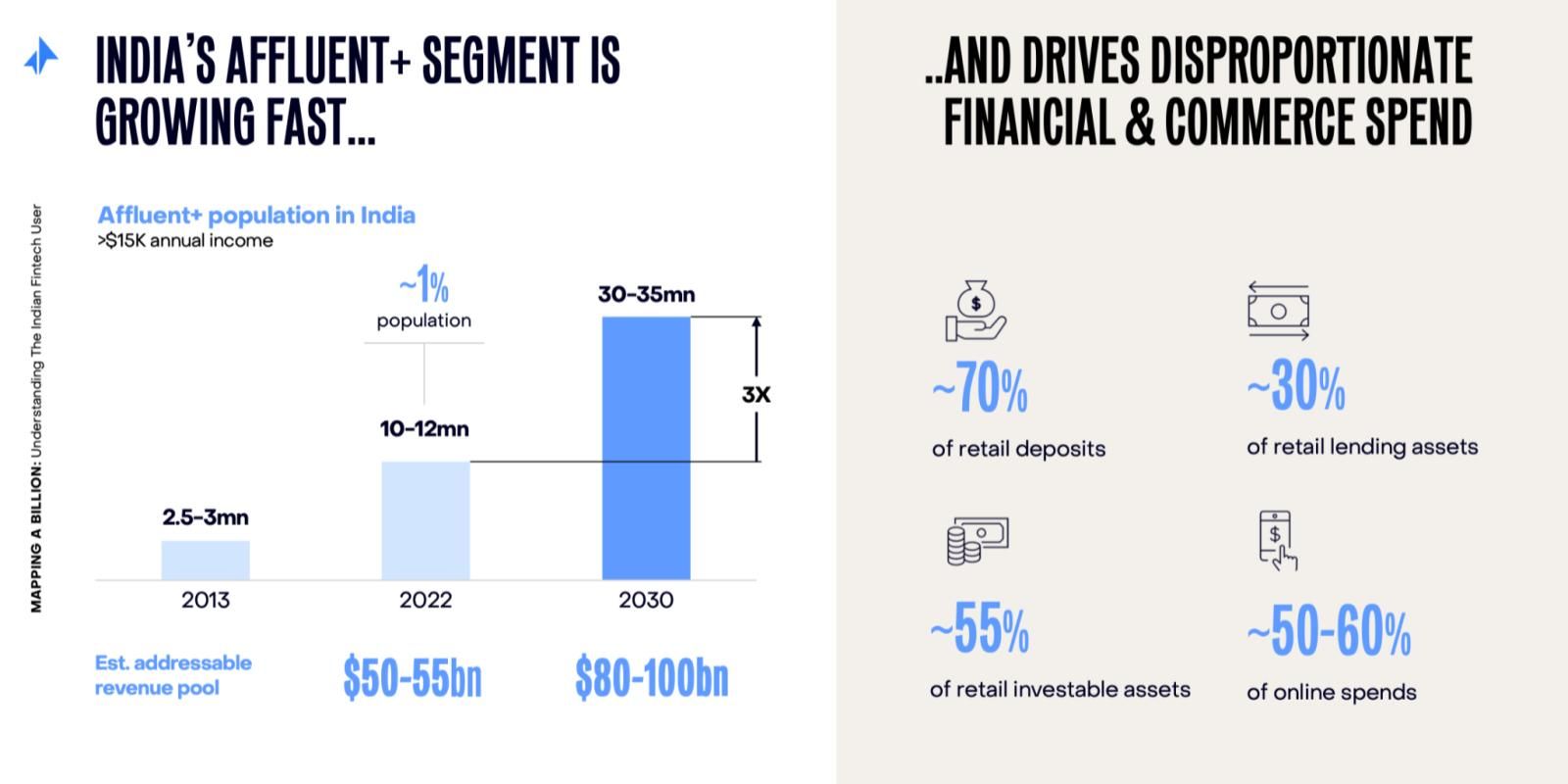

Early-stage VC firm sees an additional $80-100 billion annual revenue pool to be unlocked by India’s growing ‘Affluent+’ customers by 2030, presenting a massive opportunity for fintechs building for the same, according to a report titled ‘Mapping A Billion’ by Elevation Capital.

People with nuanced needs in the ‘affluent+’ or ’emerging affluent’ category hold an annual income of about $15,000-25,000, and strong aspirations with a growing discretionary income. The individuals want superior end-to-end digital experiences and require access to differentiated new products.

They fall below High Net-worth Individuals (HNIs) but aspire to have financial products and services reserved for them.

As of now, there are about 10-12 million customers, forming about 1% population which falls under this segment. This is expected to rise 3X by 2030 to 30-35 million presenting an estimated addressable revenue pool of $80-100 billion for fintechs and financial service companies, the report noted.

The report is based on the VC firm’s thesis on opportunities for fintechs across different user segments in India, including Affluent+.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

Catch them ‘rich’

In the past few years, many startups have emerged to serve this category across premium cards, alternative investment and wealth advisory. As many as 30 fintechs have Affluent+ as their core strategy, as per the report.

Some of the prominent names, as noted by the VC firm, are , , , , , , , and , among others.

Interestingly, 54% of players the surveyor spoke with consider placing this segment in their core/dominant business strategy with “contextual offerings to meet specific needs”.

The report cited case studies of players like CRED and OneCard which started out with simplifying process to pay bills and earn rewards, and a co-branded metallic credit card with never-expiring rewards points, respectively.

Later on, the duo tapped cross-sell opportunities across loans, ecommerce, BNPL, and rent payments.

Similarly, in the wealth management space, platforms like Dezerv and Strata have strategised to offer products (alternative assets classes) to the Affluent+ segment which were earlier accessible to HNIs.

A business head of a private sector bank noted in the report that the affluent segment has a high customer lifetime value. “Despite the higher acquisition cost, the LTV/CAC ratio is still favourable compared to other segments,” they added.

Up against incumbents

As many new and established players come forth to serve this emerging customer base, they also face competition from legacy players, especially banks and prominent wealth advisories.

Banks like HDFC, Axis, IDFC, SBI etc are increasingly looking to target the affluent segment by bundling premium offers and services such as concierge, locker services, and medical assist, with core products like credit cards and saving accounts, a business head of a foreign bank notes in the report.

“There is a huge opportunity for fintechs to provide active wealth management support to India’s growing affluent class, which is currently underserved by banks, who are focussed on lending and deposits, as well as legacy wealth management firms who target mid-tier clients,” a Dezerv founder noted.

Large revenue pool of teens, NRIs, blue-collar workers

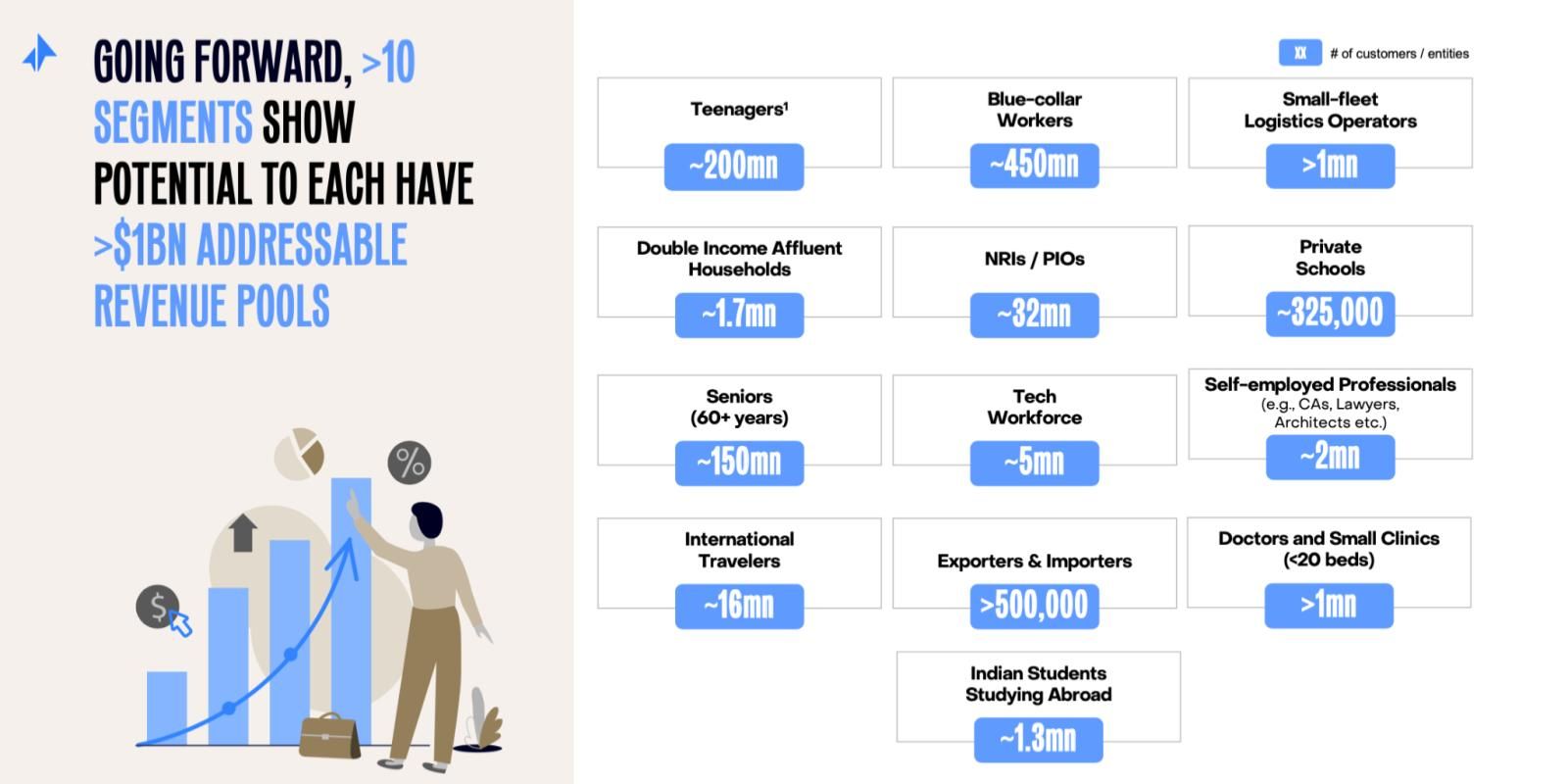

The VC firm has further identified 10 other segments, besides Affluent+, where fintechs can capture a $1 billion+ revenue pool, as they increasingly move away from a product-led approach to a user segment-led focus.

This includes teens/young adults, NRIs, importers/exporters, self-employed professionals, and international travellers, among others.

“We have been big believers in the verticalisation of financial services. While Phase 1 of India’s fintechs journey saw companies unbundle banks, we think the next decade will be about fintechs re-bundling banks and financial services for a targeted homogeneous group of users,” said Vaas Bhaskar, Principal, Elevation Capital.

The VC firm’s portfolio boasts fintech names like Paytm, Axio, Acko, Fampay, and Jodo as well as traditional financial institutions like NSE, Vidhi Home Finance, and Edelweiss Financial Services.

He further added, “Incumbent cost structures and lack of focus on some of these segments have created a white space for fintechs to serve the needs of these users uniquely.”

Another big opportunity that the VC firm identifies is—protection and wealth—which is likely to reach $30-40 billion in revenue by FY30.

While a large chunk of fintechs today revolve around payments and credit products, penetration of products like protection and wealth, which are more challenging to sell, remains low.

However, the latter now stands to gain more traction as regulators push for transparency, products become affordable, people become comfortable with digital purchases, and digital marketplaces become efficient with end-to-end sales.

Mridul Arora, Partner, Elevation Capital, said, “India is a large country with 1 billion+ addressable fintech users—these are heterogenous users with nuanced needs and contexts. Serving a segment successfully needs understanding where they are in their adoption curve and building towards their specific pain points.”

Edited by Kanishk Singh

![Read more about the article [Weekly Funding Roundup Dec 25-31] Strong ending for 2021 raises expectations for 2022](https://blog.digitalsevaa.com/wp-content/uploads/2021/12/weekly-funding-roundup-1640354161359-300x150.png)