The IPO will contain a fresh issue worth INR 1,250 Cr and an offer for sale of 109.45 Mn shares from existing shareholders

Digit Insurance’s loss after tax remained at INR 295.86 Cr, up 141% from the INR 122.76 Cr it reported the previous fiscal year

Digit also reported INR 6,095.24 Cr in premiums received in FY22, up 68% from FY21

Virat Kohli-backed Insurtech unicorn Digit Insurance has filed the draft red herring prospectus (DRHP) for an initial public offer (IPO) with the Securities and Exchanges Board of India (SEBI).

The IPO will contain a fresh issue worth INR 1,250 Cr and an offer for sale (OFS) of 109.45 Mn shares from existing shareholders. The total offer size will be made clear in the subsequent filings with the market regulator, it seems.

ICICI Securities, Morgan Stanley, Axis Capital, Edelweiss, HDFC Bank and IIFL Securities are the bookrunners for the IPO.

Speculation around the insurtech major’s IPO was rife for the past few months, with media reports in May suggesting that the startup might go public in a $500 Mn IPO, looking at a valuation of $4.5-5 Bn. Media reports had suggested that Digit Insurance would file the DRHP by September and go public in January 2023.

The insurance regulator Insurance Regulatory and Development Authority (IRDAI) mandates insurtech companies to be at least five years old before going public. Looking at this, Digit Insurance would not have been eligible for going public before October 2022, as it was founded in October 2017.

While the startup has not clarified the IPO dates in the draft prospectus, it is likely that the IPO will open after October 2022.

The public offer makes Digit Insurance the second insurtech startup to go public after Policybazaar did so last year. In 2021, it raised INR 121 Cr in a funding round which took its valuation to $4 Bn. The insurtech major, therefore, is looking to hit a higher valuation on the bourses.

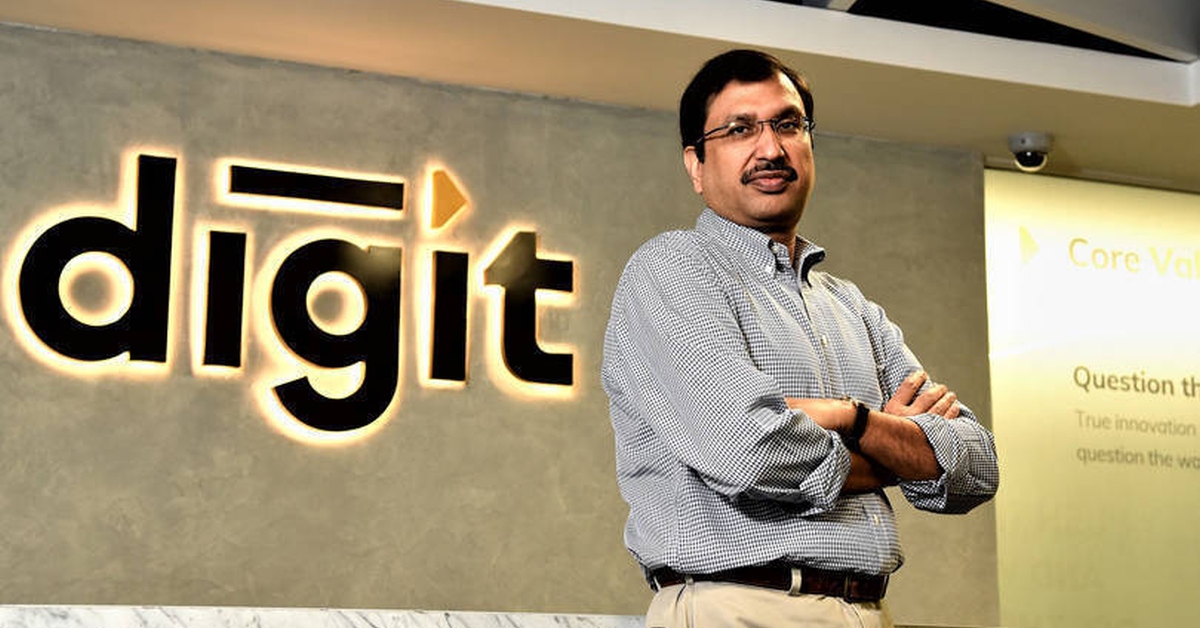

Founded in 2017 by Kamesh Goyal, Digit Insurance offers insurance policies in multiple verticals. Digit has served more than 20 Mn customers across car, bike, health and travel insurance segments, per its website.

According to its FY22 financial report, Digit Insurance booked an operating loss of INR 375.15 Cr across its insurance businesses, up 102% from the INR 185.49 Cr it recorded for FY21. Similarly, the startup’s loss after tax remained at INR 295.86 Cr, up 141% from the INR 122.76 Cr it reported the previous fiscal year.

Digit Insurance also reported INR 6,095.24 Cr in premiums received in FY22, which includes advance receipts. The insurtech startup had recorded INR 3,616.79 Cr in premiums received in FY21. Therefore, Digit recorded a 68% increase in its received premiums.

![Read more about the article [World Autism Awareness Day] Gurugram-based CogniAble is ensuring a better quality of life for children with](https://blog.digitalsevaa.com/wp-content/uploads/2021/04/collage-1-1602139134167-300x150.png)