Tiger Global-backed neobank reported a sharp rise in its net losses on the back of increased expenses, even as it showed improvement in operating revenue.

In its third year of operation, the fintech’s consolidated net loss ballooned 109% from Rs 156.3 to Rs 327 crore in FY23.

Housed under parent firm Amica Financial Technologies Limited, Jupiter earned Rs 7 crore in operating revenue compared to Rs 42 lakh last year, the company’s filings revealed.

At the same time, the expenses spiked by almost 113% to Rs 383 crore, as processing charges and software and tech expenses almost tripled.

Of the total Rs 383 crore expenses bill, Jupiter spent the majority of the money on employee benefits (Rs 158 crore, a 2X rise), followed by processing and software and technology charges (Rs 108 crore, a 3X rise).

The company increased its advertisement budget by 49% and spent Rs 74.5 crore in FY23, while sales services like customer support and retention cost the firm Rs 15 crore.

Investment pay off

While Jupiter’s earnings from its core business (operating revenue) continue to remain subdued at Rs 7 crore, it managed to clock a total revenue of Rs 56 crore, up from Rs 22 crore last year.

The rationale behind this is the money it made from investments (other income) like interest on fixed deposits with banks and realised gains on quoted mutual funds, which almost doubled to Rs 49 crore.

This was also reflected in a positive cash flow (more incoming cash than outgoing) of Rs 318 crore from investing activities compared to a negative cash flow of Rs 873.7 crore last year.

Meanwhile, its cash flow from operating activities continued to be in red at Rs 381 crore, up from Rs 135.8 crore in FY22.

Its net worth was down to Rs 743 crore from Rs 1046.7 crore.

Credit lines, HRTech, and leadership

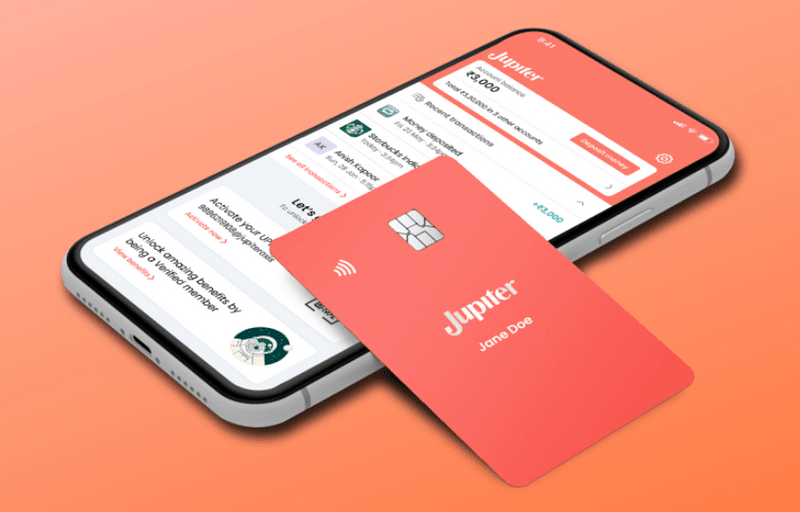

A fairly new concept, neobanks have been trying to gather pace in the country for the last few years. The likes of Jupiter, , , RazorpayX, , and have picked up their respective target segments like SMEs and millennials to offer them digital banking services (savings accounts, wallets, co-branded credit cards, spend management tools, payments, etc.) in partnership with large banks.

However, despite heavy backing from investors, the success rate continues to remain questionable as many contemplate their concrete revenue streams and cross-sell opportunities. Last week, YourStory reported on Fi Money’s widened FY23 loss of Rs 301 crore against an operating revenue of Rs 38 crore.

Among the latest developments, the firm secured an NBFC license from RBI, which would allow it to issue credit lines to customers, the latest ambition among the neobanks to solidify revenue sources.

The NBFC will be housed under the parent firm and operate in parallel with Jupiter.

Founded in 2019 by former PayU India MD Jitendra Gupta, Jupiter has raised over Rs 1360 crore to date from investors like Tiger Global, Peak XV Partners, Matrix Partners, BeeNext, QED Investors, 3One4 Capital, Alteria Capital. The neobank has partnered with Federal Bank to develop a layer-2 neobank, offering financial services to users.

The latest filings also confirmed Jupiter’s acquisition of HRtech startup SumHR in February. The development was first reported by Inc42.

The acquisition was made for a total purchase consideration of Rs 7.5 crore for a 100% stake. The company acquired SumHR to bundle its HRMS software along with the salary account product, it said.

Meanwhile, long-time Swiggy executive Anuj Rathi joined Jupiter last month as chief product and marketing officer to lead product, design, growth and marketing at the neobanking firm.

Edited by Affirunisa Kankudti

![Read more about the article [Funding alert] Edtech startup Knorish raises $1.1M in pre-Series A round](https://blog.digitalsevaa.com/wp-content/uploads/2021/07/Imagezph5-1627299849665-300x150.jpg)