In November last year, NPCI had mandated that starting January 2021, UPI apps would not be allowed to process more than 30% of the total volume of transactions on the UPI network

In its SOP, NPCI has stated that the total volume of UPI transactions, of which no more than 30% can be processed by a single app, will be calculated on a rolling three-month basis

Existing TPAPs that were exceeding the 30% cap as of December 31, 2020, will be given a period of two years to comply with the new rules in a phased manner

The National Payments Corporation of India (NPCI), on Friday, issued the standard operating procedure (SOP) for the implementation of a 30% market share cap on third-party application providers (TPAPs) facilitating UPI transactions.

In November last year, NPCI had mandated that starting January 2021, each of the TPAPs such as Google Pay, PhonePe and Paytm, would not be allowed to process more than 30% of the total volume of transactions on the Unified Payments Interface or UPI network. NPCI had said that the market share cap would ensure that India’s digital payments landscape does not become an oligopoly, while also preventing risks of overload of the UPI infrastructure.

In its SOP, NPCI has stated that the total volume of UPI transactions, of which no more than 30% can be processed by a single app, will be calculated on a rolling three-month basis. Existing TPAPs that exceeded the 30% cap as of December 31, 2020 have been given a period of two years to comply with the new rules in a phased manner.

The SOP states that the design principle to be used to control the volume of UPI transactions through each TPAP is user onboarding onto the UPI app.

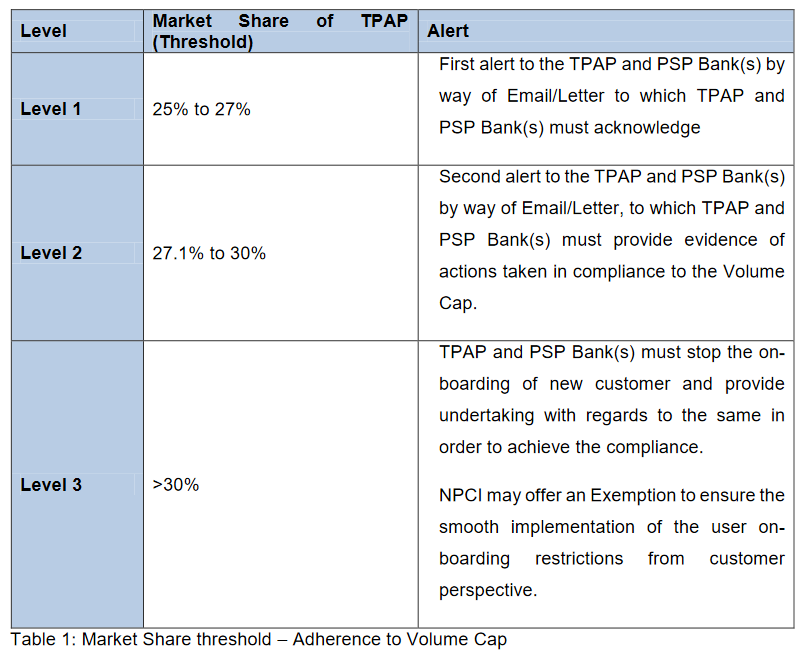

“There will be a provision to exempt the players to some extent when the volume cap is reached so that it does not create sudden disruption in the market. Such exemption may be for a limited time period of up to six months basis the request by TPAP through their PSP Bank upon breach of certain thresholds,” says the SOP document.

It is worth mentioning that currently, the UPI ecosystem is dominated by Google Pay and PhonePe, both together accounting for over 85% of UPI transactions.

A UPI app that has reached between 25%-27% market share will receive an alert from NPCI which it will have to acknowledge. If the app’s market share increases by over 27%, it will receive a second alert and will have to provide evidence of steps being taken to ensure adherence with the market share cap.

If an app breaches the market share cap, it would have to stop new user on-boarding. In such an event, UPI apps would be required to send prospective new users the following message: “Dear user, as per NPCI rules any UPI app with more than 30% market share cannot onboard new customers until their market share goes down. Currently, the UPI market share is % so unfortunately, you’ll have to wait a while before you can access our UPI services. We apologize for the inconvenience and promise to notify you as soon as NPCI allows us to onboard you again!”

Amid the Covid-19 pandemic, the number of transactions through the UPI interface has grown manifold since April last year, when physical distancing protocols necessitated enhanced adoption of digital payments.

The usage of this payments interface had increased by 11.8%, from 1.61 Bn in August to 1.80 Bn in September 2020. Then, grew a good 15% to 2.07 Bn in October 2020. Since then, the growth rate was 7% to 2.21 Bn in November and 0.9% to 2.23 Bn in December.

In January, the total number of transactions reached 2.30 Bn but declined marginally to 2.29 Bn in February.

“With over 500 Mn smartphones, 1.2 Bn Aadhaar users and 1 Bn mobile phones, it is possible to increase the UPI user base 5x in the next three to five years, aspiring to achieve a billion transactions a day on this fully interoperable platform that UPI is. Truly, UPI has the potential to be one of the first of its kind with the fully interoperable systems, and with the participation of the banks and fintech companies collaborating together,” reads the NPCI SOP.