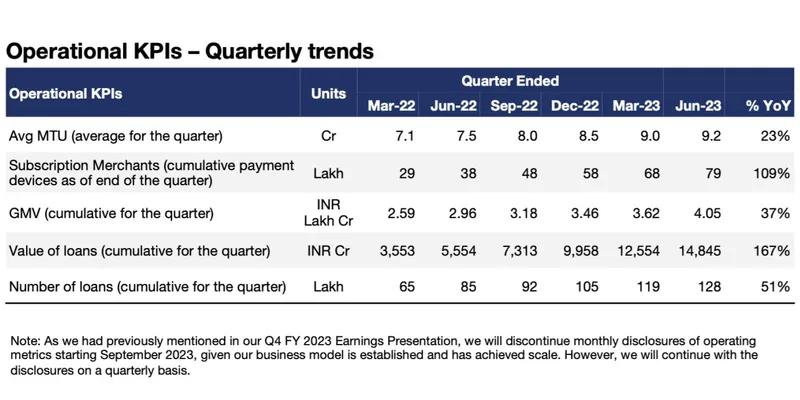

, which owns Paytm, on Wednesday said it disbursed a total of 1.28 crore loans worth Rs 14,845 crore in the first quarter of the financial year ended June 2023 (Q1, FY24).

The company’s loans disbursement was up by 51% y-o-y (year-on-year) in terms of volume, and 167% y-o-y in value.

“MoM (Month-on-Month) loan distribution trend in June reflects the higher disbursal in May, which included pent-up demand for merchant loans from April due to one of our partners not disbursing as they were upgrading their systems,” the company said in an exchange filing.

Currently, Paytm has 7 lending partners through which it distributes loans. It plans to onboard three to four new lenders in the ongoing financial year.

Paytm results

The fintech’s merchant payment volume (GMV) for June quarter jumped 37% y-o-y to Rs 4.05 lakh crore, while 9.2 crore users (average for three months ended June 2023) engaged with the app (Monthly Transacting Users), registered a growth of 23% year-on-year.

Paytm said it is focusing on payment volumes that generate profitability, either through net payments margin or from direct upsell potential.

Offline payments

The financial technology company said 79 lakh merchants are now paying subscription for its payment devices (Soundbox and POS machines), an increase of 11 lakh devices in the said quarter.

Paytm said, with subscription as a service model, the strong adoption of devices is driving subscription revenue and higher payment volumes, while increasing the funnel for merchant loan distribution.

Recently, global brokerage firm BofA Securities raised the target price to Rs 1,020 from Rs 885 earlier, citing momentum in high-margin lending and Soundbox business. On the other hand, Macquarie downgraded the stock to neutral rating, with a target price of Rs 800.

While Paytm’s share price has rallied more than 60% this year on the back of improving business momentum, it is still down from its IPO price of Rs 2,150.

Paytm’s stock was trading at Rs 847.10 on NSE by 10:28 am, up 1.24%.

![Read more about the article [Funding alert] Raintree Family Office, ADB arm, others invest $4.9M in Smart Joules](https://blog.digitalsevaa.com/wp-content/uploads/2021/04/Imageycna-1617945039242-300x150.jpg)